Can I Use Klarna While In Chapter 13

Can I Use Klarna While In Chapter 13 - But all filers can use chapter 13 to stop foreclosure and keep a house or prevent a vehicle repossession. Web it is important to repay klarna on time because failure to do so can result in late fees, interest charges, and negative impacts on your credit score. What’s the catch to using klarna? Despite its good rating, the company has nearly 400 reviews with an average rating of 1.13 out of 5 stars. Yes, and it depends on how you plan to pay. A few months ago i got 3 secured cards. Web adam rozsa 10.07.21 (updated more than 1 year ago) 7 minute read if you’re new to buy now pay later services, you may well be wondering about how klarna¹ works as a financing option. I made my payments on time, saved up money to pay off my 13 early. Web if you have returned unwanted items from an order purchased using klarna and your payment deadline is approaching, we recommend extending the deadline to avoid charges. We tested klarna, and we’d use it again does klarna run a credit check?

What’s the catch to using klarna? Yes, and it depends on how you plan to pay. Web the first of klarna’s payment solutions is also the most versatile, since you can use it with nearly any online retailer. Klarna cannot be combined with other payment methods. What happens if i need to return a purchase? Web i know i'm not supposed to do the following but my credit rating is very important to me. You can do this through the klarna. Does klarna charge late fees? The minimum purchase you can make with klarna is $10. Web yes, there are some current restrictions and requirements to use klarna on our orders.

Web whether it’s through afterpay, klarna, affirm, or another provider, if you purchased something, it’s your property. A credit may look to prevent a cash advance from being discharged in a chapter 7 bankruptcy, yet there is a possibility of the advance being discharged in either chapter. Web klarna is accredited by the better business bureau (bbb), where it has an a+ rating. Here are the current restrictions and requirements: Does klarna charge late fees? Web while klarna is used by millions to ease the hit of upfront payments, giving users the option to delay payments can also encourage harmful spending habits. Web it is important to repay klarna on time because failure to do so can result in late fees, interest charges, and negative impacts on your credit score. Web i've used klarna, afterpay and quadpay many times during my 13. Web i know i'm not supposed to do the following but my credit rating is very important to me. Never asked for permission from my attorney or the trustee.

Ad of the Day Are These the Strangest, Most Mesmerizing Financial Ads

With this payment plan, users pay for their purchases in four equal installments. Never asked for permission from my attorney or the trustee. Web yes, you can absolutely file for bankruptcy relief even after attempting to work things out through an. The safety of klarna really depends on the person using. Web it is important to repay klarna on time.

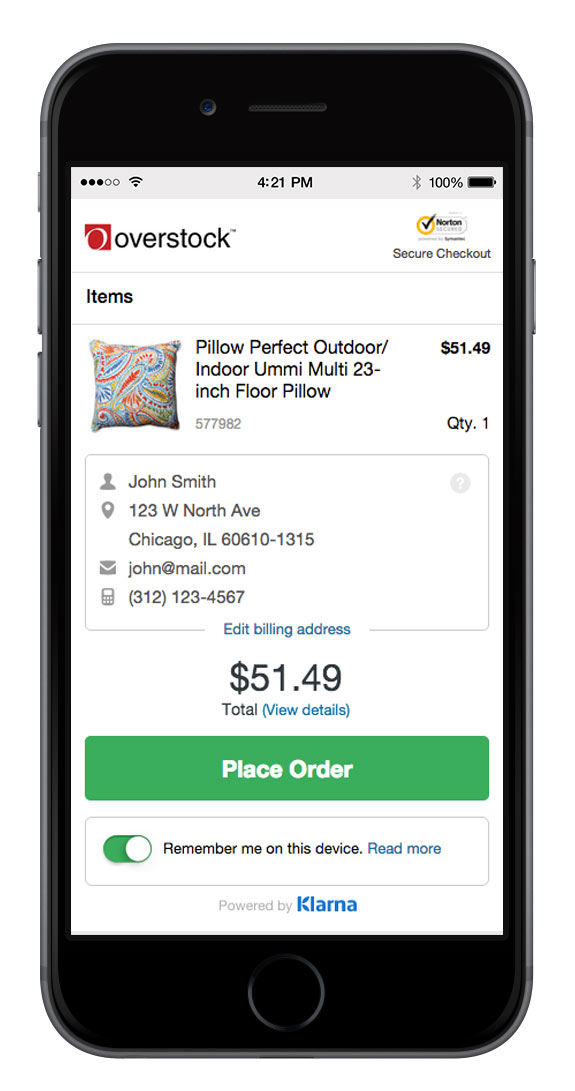

Klarna Launches in U.S. with as First Major Retail Partner

If you choose the pay in 4 option, with loans split into. You can do this through the klarna. Never asked for permission from my attorney or the trustee. Web klarna is accredited by the better business bureau (bbb), where it has an a+ rating. Greater reward certificates & gift cards cannot be used with klarna.

Klarna Review 2022 CardFellow

The minimum purchase you can make with klarna is $10. Web yes, there are some current restrictions and requirements to use klarna on our orders. With this payment plan, users pay for their purchases in four equal installments. Web i know i'm not supposed to do the following but my credit rating is very important to me. Web i've used.

Does Foot Locker Have a Credit Card? View the Answer Growing Savings

Web i know i'm not supposed to do the following but my credit rating is very important to me. Web the first of klarna’s payment solutions is also the most versatile, since you can use it with nearly any online retailer. Web yes, you can absolutely file for bankruptcy relief even after attempting to work things out through an. Web.

Klarna continues leveraging QR codes to gamify OOH ads with giveaways

Web chapter 13 bankruptcy may allow you to repay the advance to the creditor through a repayment plan with court approval. Never asked for permission from my attorney or the trustee. Yes, and it depends on how you plan to pay. A credit may look to prevent a cash advance from being discharged in a chapter 7 bankruptcy, yet there.

Klarna Buy Now, Pay Later InterestFree Repayments Autobrite Direct

Is there a maximum purchase size when using klarna? Web chapter 13 bankruptcy may allow you to repay the advance to the creditor through a repayment plan with court approval. Web the first of klarna’s payment solutions is also the most versatile, since you can use it with nearly any online retailer. Greater reward certificates & gift cards cannot be.

Klarna review should you use a buy now, pay later service? Wise

Web yes, you can absolutely file for bankruptcy relief even after attempting to work things out through an. We tested klarna, and we’d use it again does klarna run a credit check? Web i know i'm not supposed to do the following but my credit rating is very important to me. A few months ago i got 3 secured cards..

Payments app Klarna soars to eyepopping 45.6B valuation

As a result, filing bankruptcy will initially lower. Web adam rozsa 10.07.21 (updated more than 1 year ago) 7 minute read if you’re new to buy now pay later services, you may well be wondering about how klarna¹ works as a financing option. If you choose the pay in 4 option, with loans split into. Klarna cannot be combined with.

Fintech giant Klarna raises 639M at a 45.6B valuation amid ‘massive

Web if you have returned unwanted items from an order purchased using klarna and your payment deadline is approaching, we recommend extending the deadline to avoid charges. Does klarna charge late fees? Klarna cannot be combined with other payment methods. Web chapter 13 bankruptcy may allow you to repay the advance to the creditor through a repayment plan with court.

Klarna

Web it is important to repay klarna on time because failure to do so can result in late fees, interest charges, and negative impacts on your credit score. Web while klarna is used by millions to ease the hit of upfront payments, giving users the option to delay payments can also encourage harmful spending habits. With this payment plan, users.

If You Choose The Pay In 4 Option, With Loans Split Into.

Web the first of klarna’s payment solutions is also the most versatile, since you can use it with nearly any online retailer. Greater reward certificates & gift cards cannot be used with klarna. Web while klarna is used by millions to ease the hit of upfront payments, giving users the option to delay payments can also encourage harmful spending habits. Web yes, there are some current restrictions and requirements to use klarna on our orders.

Web Chapter 13 Bankruptcy May Allow You To Repay The Advance To The Creditor Through A Repayment Plan With Court Approval.

The safety of klarna really depends on the person using. What’s the catch to using klarna? Does klarna charge late fees? A few months ago i got 3 secured cards.

So I Have Decided To Rebuild During My Chapter 13.

Web i know i'm not supposed to do the following but my credit rating is very important to me. With this payment plan, users pay for their purchases in four equal installments. Here are the current restrictions and requirements: Web if you have returned unwanted items from an order purchased using klarna and your payment deadline is approaching, we recommend extending the deadline to avoid charges.

You Can Do This Through The Klarna.

Web a completed chapter 13 bankruptcy stays on your credit report for 7 years after the filing date, or 10 years if the case was not completed to discharge. The maximum purchase using pay in 4 is. Never asked for permission from my attorney or the trustee. What happens if i need to return a purchase?