Can Two Llcs Form A Partnership

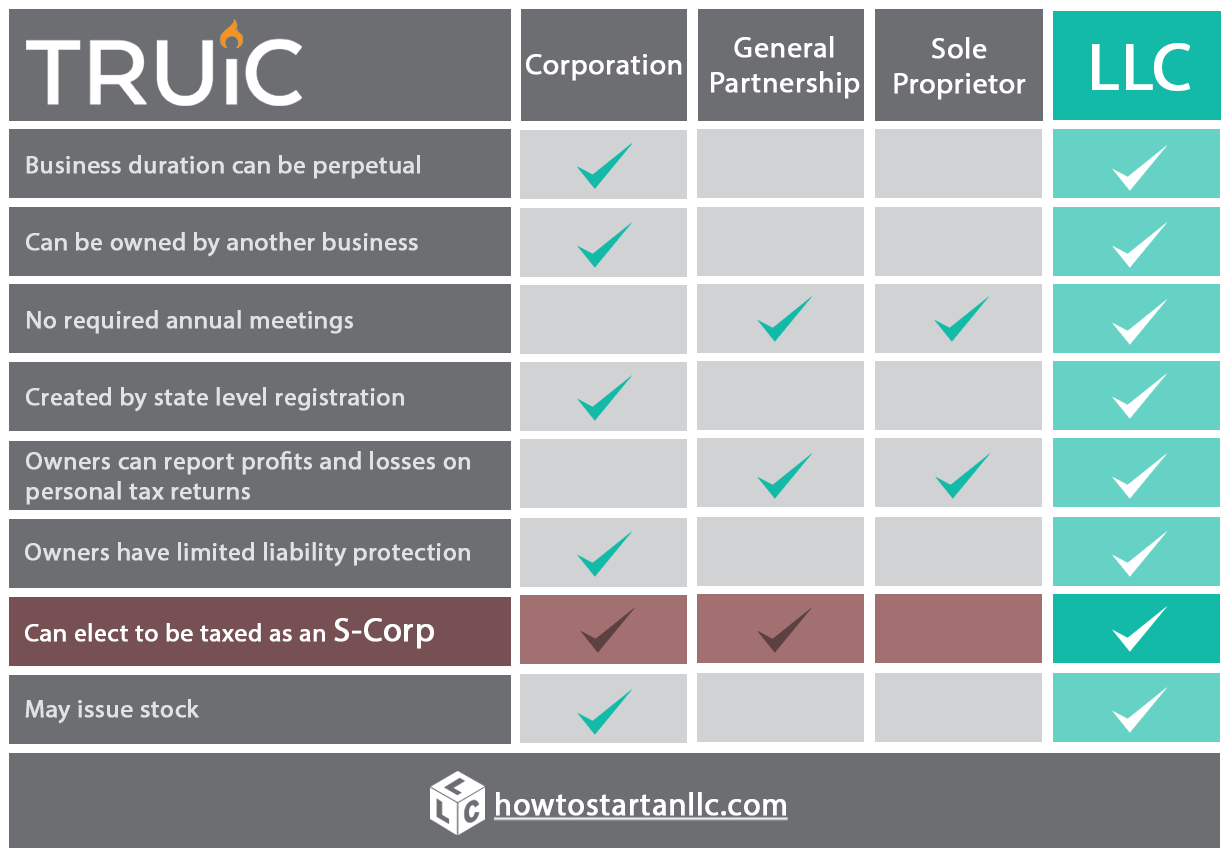

Can Two Llcs Form A Partnership - Web the main difference between an llc vs partnership is that an llc provides limited liability protection. Web remember, a partnership is owned by at least two parties. Therefore, a sole business person may not own a partnership. Web a limited liability company (llc) is a business structure allowed by state statute. Web a limited liability company (llc) is a popular business legal form, and it has many similarities to the partnership legal form. Create an operating agreement specifying each member's role in the company. Web partnerships and limited liability companies (llcs) when two people start a business together, they form an automatic general partnership. Web with bing chat enterprise, user and business data are protected and will not leak outside the organization. This llc partnership article refers to two types of business entities: How they are formed and liability.

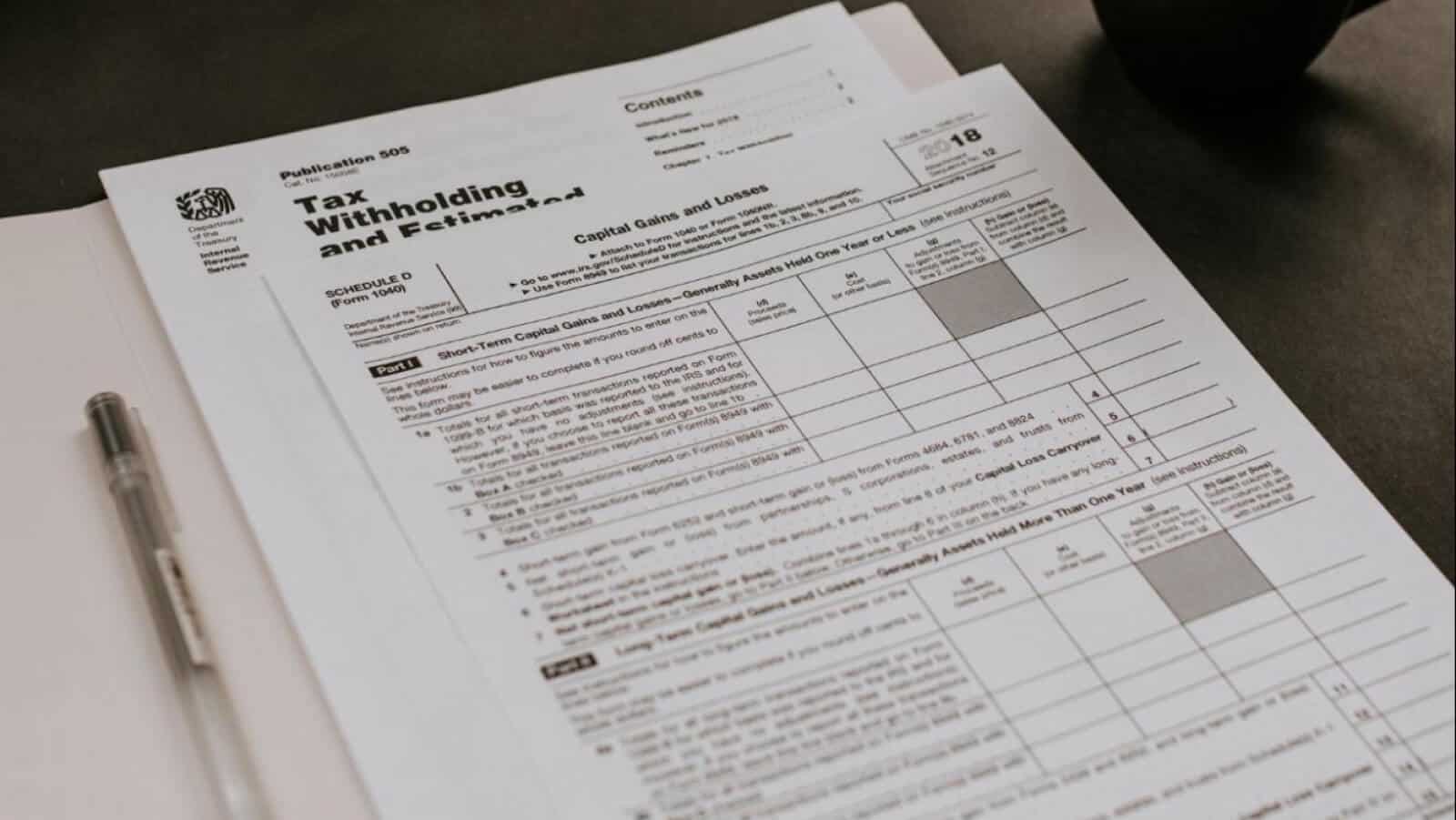

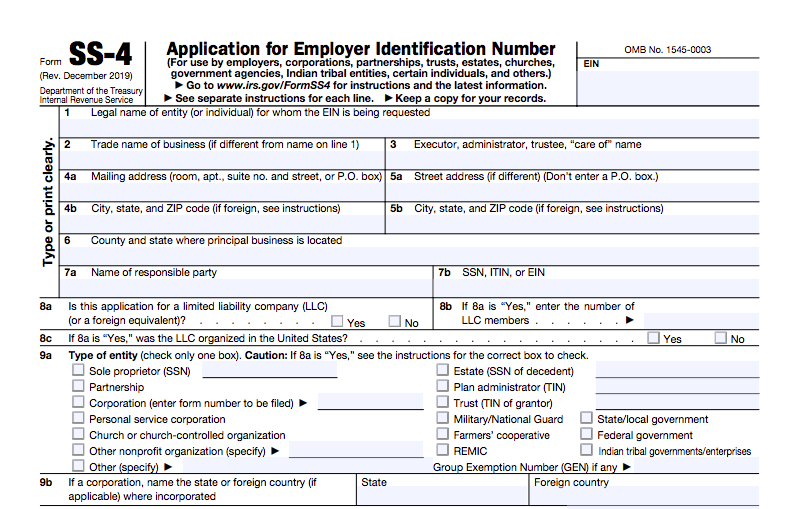

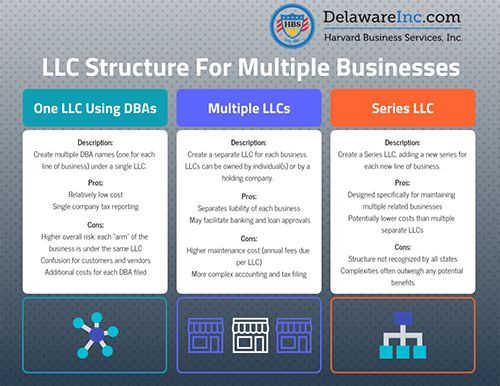

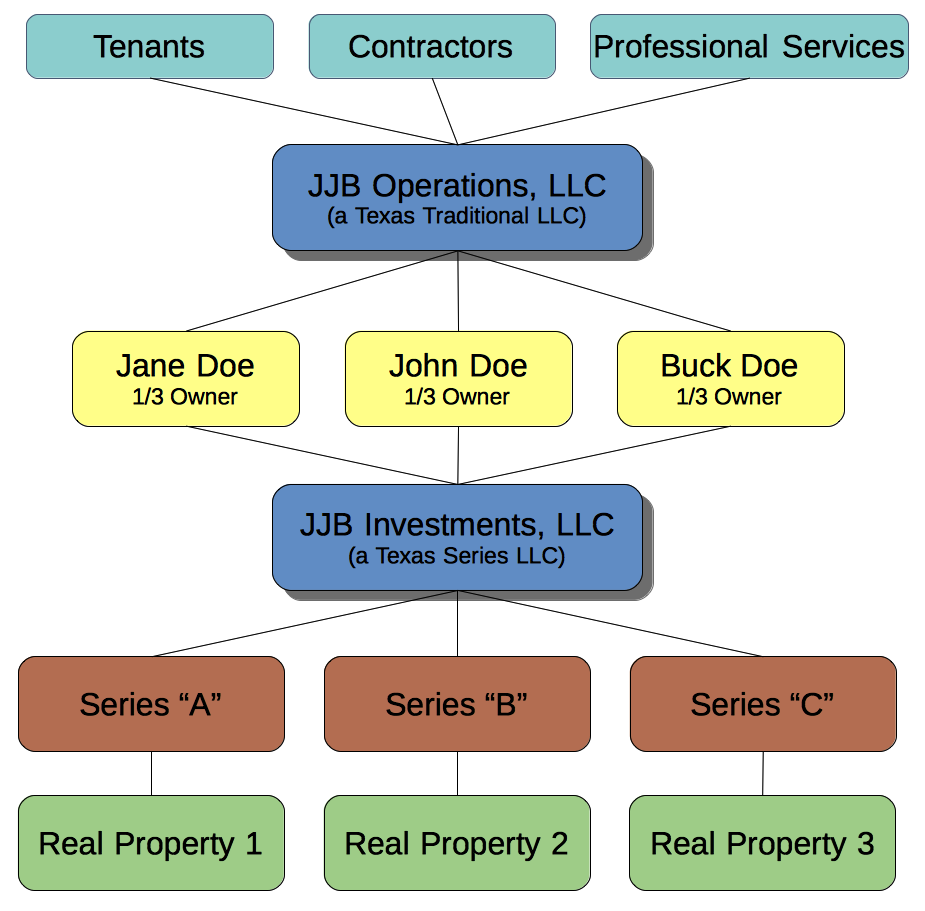

Web can two limited companies form a partnership? If the llcs want to remain separate, they can enter into a joint partnership agreement or simply create a new llc in which each existing llc owns a membership. Therefore, a sole business person may not own a partnership. Web are you considering forming a partnership between two llcs? Easily customize your partnership agreement. What goes in — and comes out — remains protected. Web llc stands for limited liability company. How they are formed and liability. Create an operating agreement specifying each member's role in the company. Web if an llc has at least two members and is classified as a partnership, it generally must file form 1065, u.s.

Web a domestic llc with at least two members is classified as a partnership for federal income tax purposes unless it files form 8832 and elects to be treated as a corporation. What is an llc partnership? After you the employee identification number, or ein, is received, the partnership. Web with bing chat enterprise, user and business data are protected and will not leak outside the organization. Web the main difference between an llc vs partnership is that an llc provides limited liability protection. If the llcs want to remain separate, they can enter into a joint partnership agreement or simply create a new llc in which each existing llc owns a membership. Each state may use different regulations, you should check with your state if you. Llc with more than one member is considered a partnership. This llc partnership article refers to two types of business entities: Web a limited liability company (llc) is a popular business legal form, and it has many similarities to the partnership legal form.

LLC vs. Corporation What is the difference between an LLC and a

What is an llc partnership? Web up to 10% cash back there are two key differences between an llc and a partnership: Web for tax purposes, any u.s. This is an informational return only, as the tax liability will pass to the individual. Web are you considering forming a partnership between two llcs?

How to Choose a Tax Classification for an LLC SimplifyLLC

Partnership owners aren't legally separated from the business. Web up to 10% cash back there are two key differences between an llc and a partnership: It's a common question for business owners looking to expand their operations and pool. Web remember, a partnership is owned by at least two parties. Easily customize your partnership agreement.

LLC Limited liability company JapaneseClass.jp

Web remember, a partnership is owned by at least two parties. Easily customize your partnership agreement. It is a legal entity created for running a business. This is an informational return only, as the tax liability will pass to the individual. Web llc stands for limited liability company.

Learn How to Form a Partnership Using These 10 Steps

After you the employee identification number, or ein, is received, the partnership. Web a limited liability company (llc) is a business structure allowed by state statute. Easily customize your partnership agreement. Web with bing chat enterprise, user and business data are protected and will not leak outside the organization. Aditya deo∗∗∗∗ companies want to come together for strategical advantage.

Understanding the Employer Identification Number EIN Lookup

Llc members can therefore be individuals or business entities such as corporations or other. What is an llc partnership? Web remember, a partnership is owned by at least two parties. Web can two limited companies form a partnership? Create an operating agreement specifying each member's role in the company.

How to Form a LLC (Stepbystep Guide) Community Tax

Therefore, a sole business person may not own a partnership. Web can two limited companies form a partnership? Web are you considering forming a partnership between two llcs? Web a limited liability company (llc) is a popular business legal form, and it has many similarities to the partnership legal form. A partnership is a business where two or.

Multiple Trading Names Under One Company UnBrick.ID

Web llc laws don’t place many restrictions on who can be an llc member. Therefore, a sole business person may not own a partnership. An llc is a sovereign legal being, and. It's a common question for business owners looking to expand their operations and pool. Ad answer simple questions to make a partnership agreement on any device in minutes.

Partnership Tax Services Corporate Tax Return Prep

After you the employee identification number, or ein, is received, the partnership. Web are you considering forming a partnership between two llcs? Partnership owners aren't legally separated from the business. Web llc laws don’t place many restrictions on who can be an llc member. Web a limited liability company (llc) is a popular business legal form, and it has many.

Which Business Is Good For Investment Business Ideas

Each state may use different regulations, you should check with your state if you. Partnership owners aren't legally separated from the business. If the llcs want to remain separate, they can enter into a joint partnership agreement or simply create a new llc in which each existing llc owns a membership. Web updated november 9, 2020: Web if an llc.

What is an LLC?

Web a domestic llc with at least two members is classified as a partnership for federal income tax purposes unless it files form 8832 and elects to be treated as a corporation. This is an informational return only, as the tax liability will pass to the individual. Partnership owners aren't legally separated from the business. Web can two limited companies.

Aditya Deo∗∗∗∗ Companies Want To Come Together For Strategical Advantage.

Web can two limited companies form a partnership? Web remember, a partnership is owned by at least two parties. If the llcs want to remain separate, they can enter into a joint partnership agreement or simply create a new llc in which each existing llc owns a membership. Llc members can therefore be individuals or business entities such as corporations or other.

Web If An Llc Has At Least Two Members And Is Classified As A Partnership, It Generally Must File Form 1065, U.s.

Web llc laws don’t place many restrictions on who can be an llc member. This is an informational return only, as the tax liability will pass to the individual. Ad answer simple questions to make a partnership agreement on any device in minutes. Easily customize your partnership agreement.

Web A Limited Liability Company (Llc) Is A Popular Business Legal Form, And It Has Many Similarities To The Partnership Legal Form.

Llc with more than one member is considered a partnership. Web llc stands for limited liability company. Web for tax purposes, any u.s. Each state may use different regulations, you should check with your state if you.

Partnership Owners Aren't Legally Separated From The Business.

What goes in — and comes out — remains protected. Web answer (1 of 5): Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Web a limited liability company (llc) is a business structure allowed by state statute.