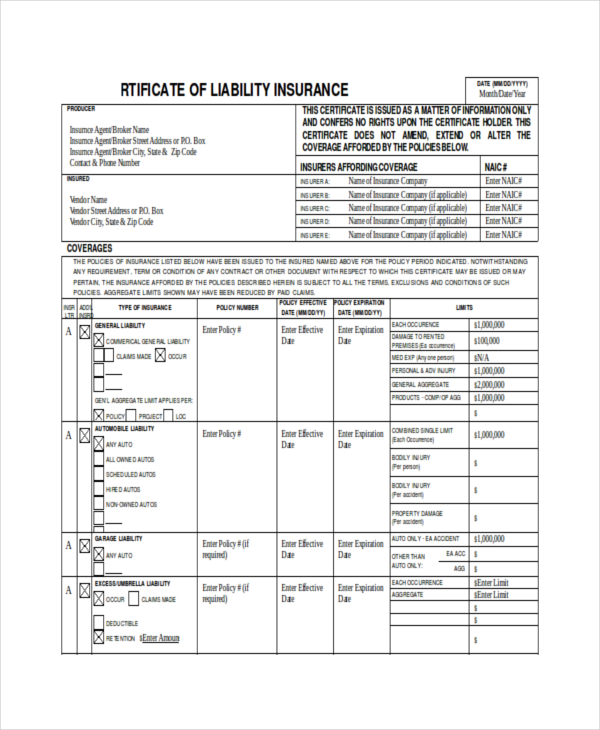

Certificate Of Insurance Liability Form

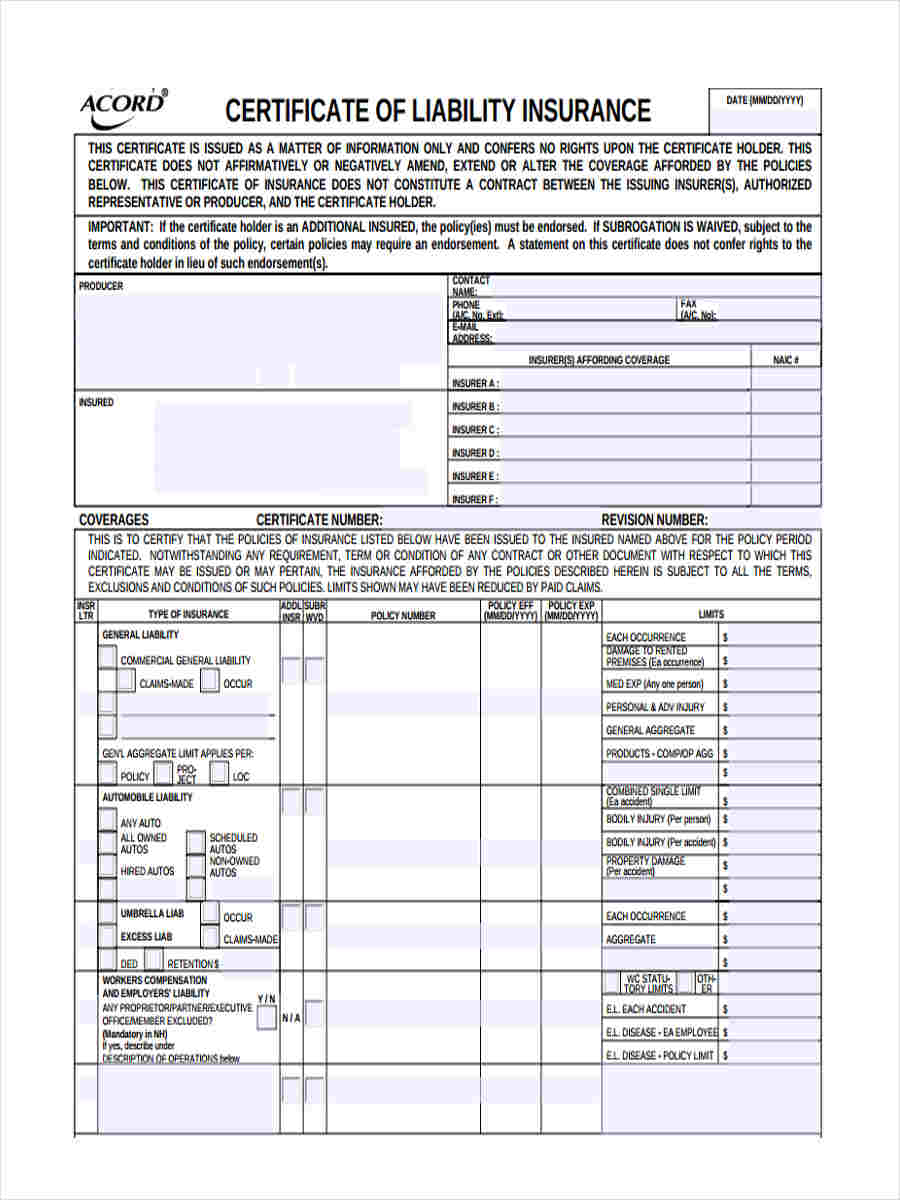

Certificate Of Insurance Liability Form - Web certificate of liability insurance. It lists you or your business as the policyholder or named insured. Web in times of possible lawsuits, a waiver form uses conditions that ensure the business has no legal responsibility of the damage experienced by the customer. Keep it simple when filling out your online certificate of liability insurance and use pdfsimpli. The form can also be used to report workers' compensation insurance coverage. What is proof of liability insurance? Policy number types of insurance coverage issuing insurance company insurance limits named insured policy effective date policy expiration date why do i need an acord certificate of insurance? Web insurance law § 501 (a) defines certificate of insurance as any document or instrument, or addendum thereto no matter how titled or described, prepared or issued by an insurer or insurance producer as evidence of property/casualty insurance coverage. the definition does not include an insurance policy or insurance binder. They’re also known as certificates of liability insurance or proof of insurance. Web a certificate of insurance acord form covers essential information about your business insurance policy, such as:

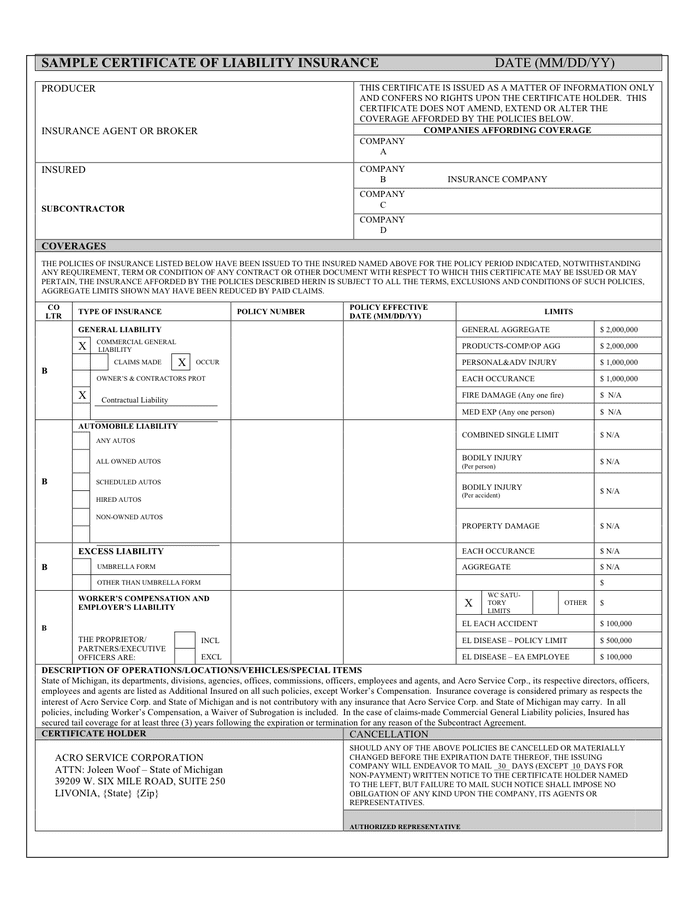

They’re also known as certificates of liability insurance or proof of insurance. A certificate of insurance (coi) form is a document that establishes proof of insurance, most often for a general liability policy. Web this is to certify that the policies of insurance listed below have been issued to the insured named above for the policy period indicated. Web authorized to do business in the state of missouri has issued an insurance policy, which is in accordance with the insurance laws of the state of missouri: It lists you or your business as the policyholder or named insured. Web in times of possible lawsuits, a waiver form uses conditions that ensure the business has no legal responsibility of the damage experienced by the customer. If additional space is needed, add attachment.) name of insurer address ca insurer license number: The form also specifies the type of liability insurance involved, the. What is proof of liability insurance? Web request a certificate complete the following fields to request a certificate from lockton affinity.

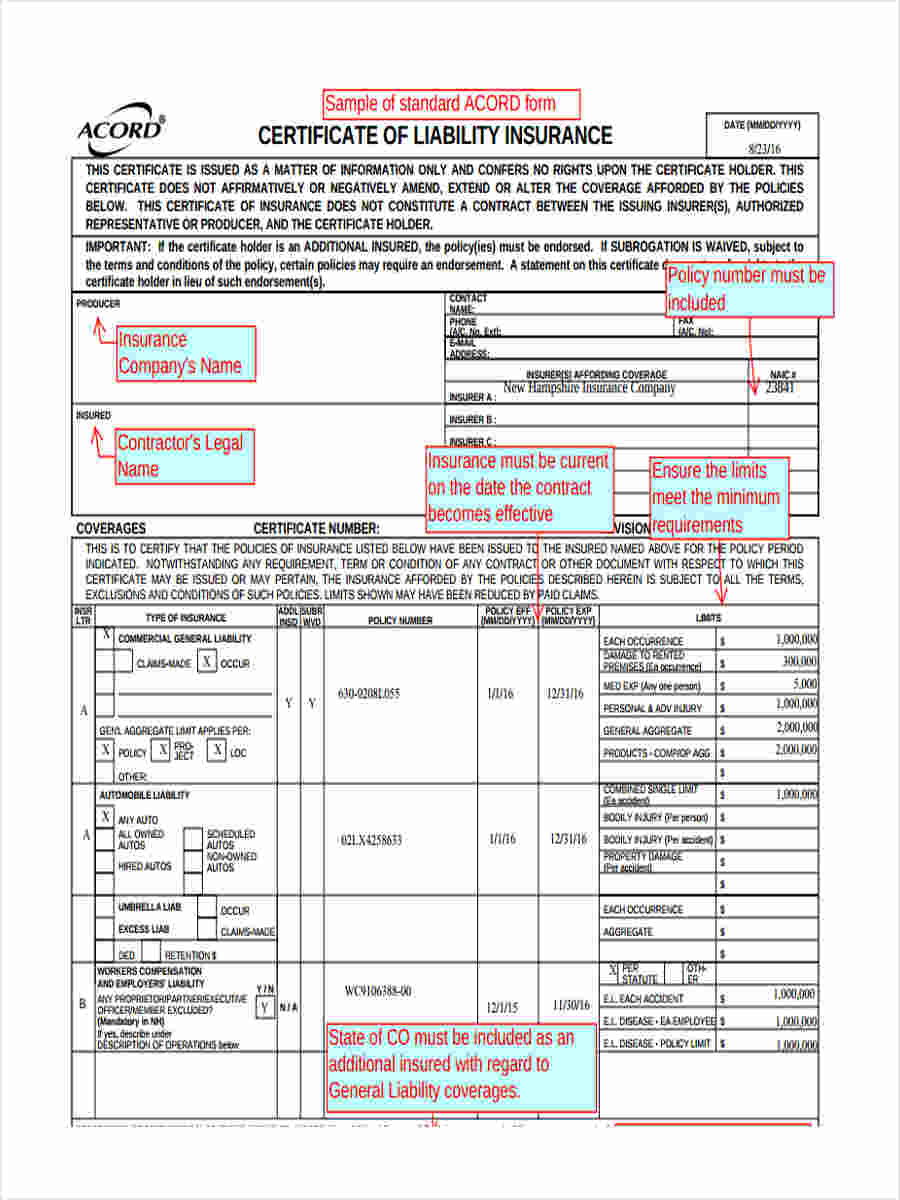

If additional space is needed, add attachment.) name of insurer address ca insurer license number: !lic) & be# effec%i'e da%e e(i#a%i! This is to certify that the policies of insurance listed below have been issued to the insured named above for the policy period indicated. Financial assurances section, california department of resources recycling and recovery. Web it is a form issued by the insurance company upon your request. What is proof of liability insurance? Additional acord forms and more policy types will be available in the future find the right products for your business. Policy number types of insurance coverage issuing insurance company insurance limits named insured policy effective date policy expiration date why do i need an acord certificate of insurance? Web certificate of liability insurance. Take a look at this sample certificate of liability insurance to get an idea.

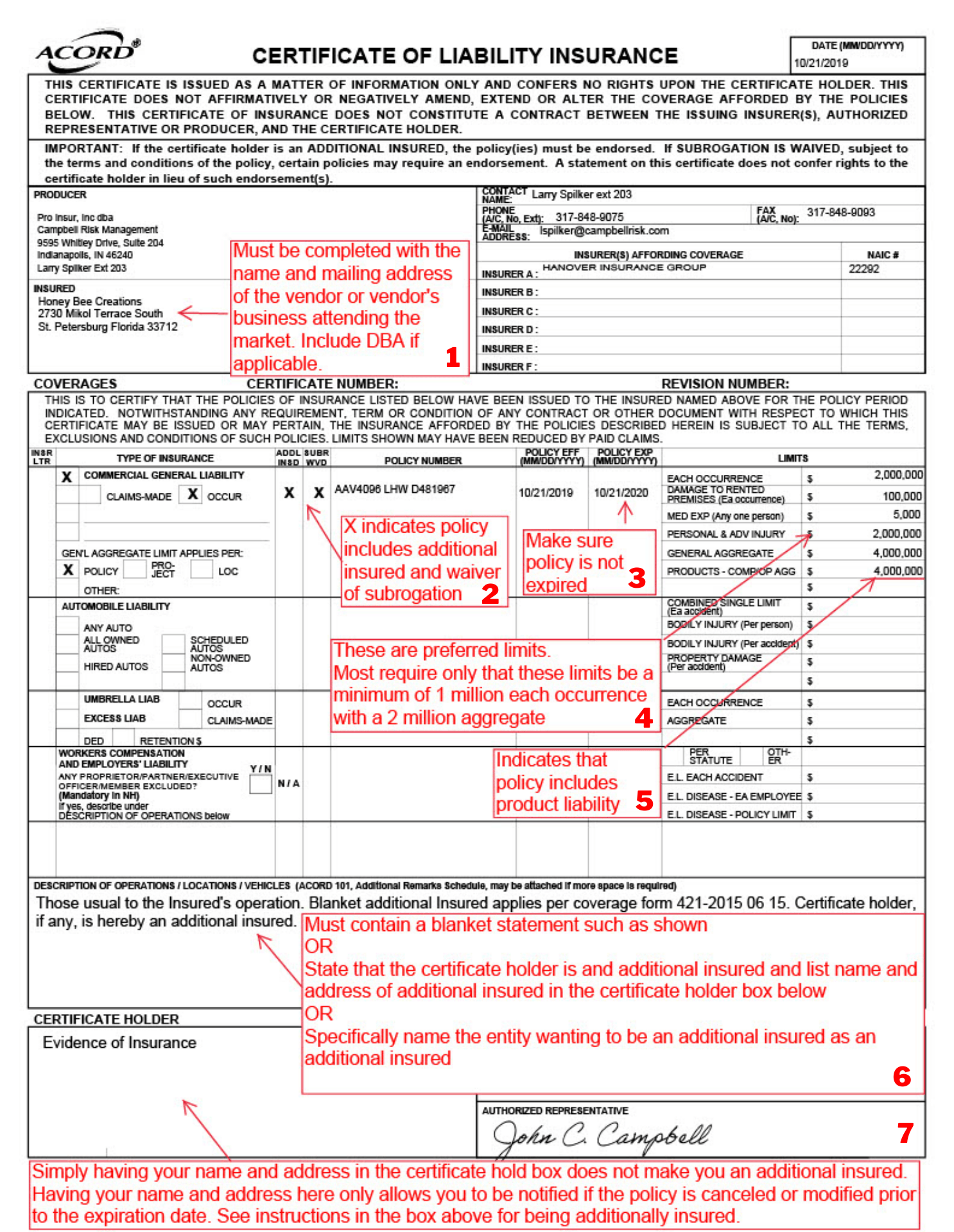

How to Read Your Certificate of Liability Insurance Campbell Risk

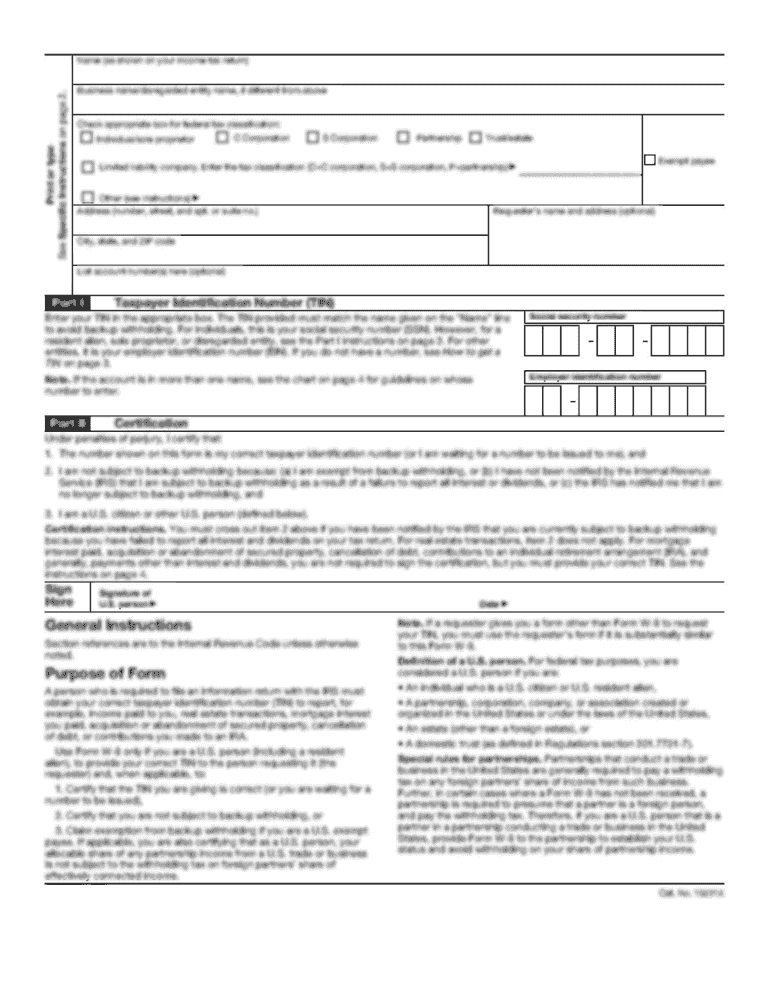

What is proof of liability insurance? The form can also be used to report workers' compensation insurance coverage. Web since our first paper form was released in 1971, acord has provided the standard forms used by the insurance industry. Web a certificate of insurance (coi) is a document from an insurer to show you have business insurance. The form also.

Certificate Of Liability Insurance Template

Web 1033 waiver application form. Web a certificate of insurance acord form covers essential information about your business insurance policy, such as: Web a certificate of insurance (coi) is a document from an insurer to show you have business insurance. Web a certificate of liability insurance is a document proving that your business has general liability insurance or other types.

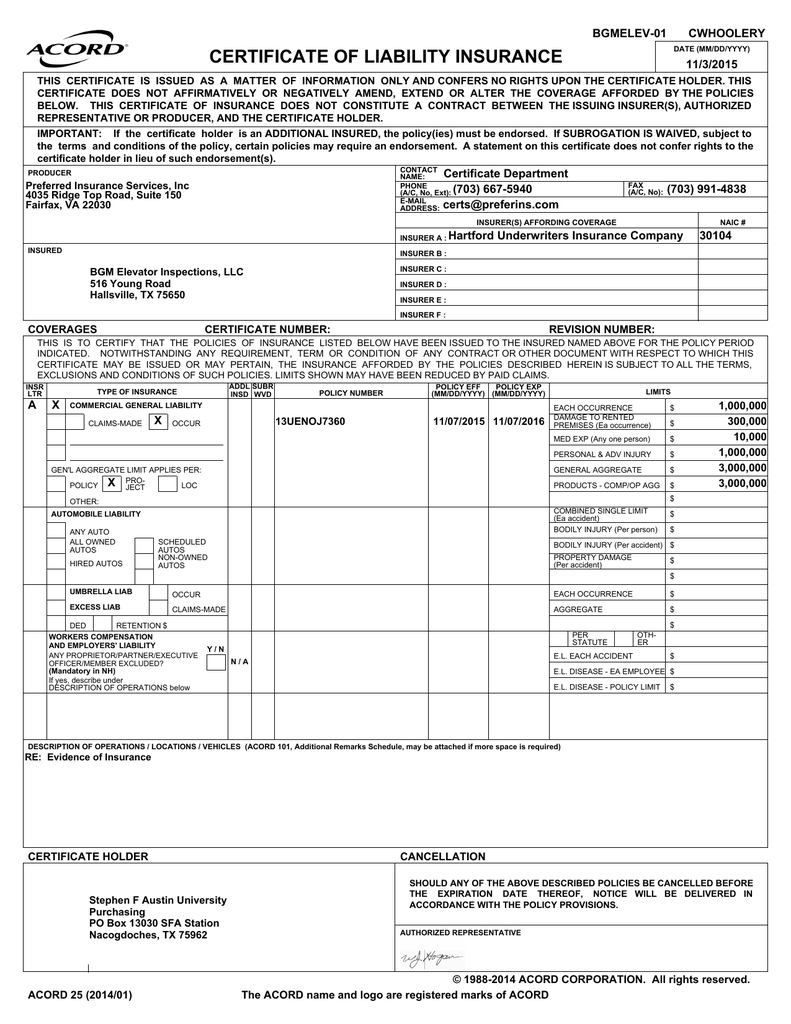

CERTIFICATE OF LIABILITY INSURANCE

With a coi, your clients can make sure you have the right insurance before they start working with you. Web since our first paper form was released in 1971, acord has provided the standard forms used by the insurance industry. Notwithstanding any requirement, term or condition of any contract or other document with respect to which this Using acord's standardized.

Certificate of Liability Insurance (COI) How to Request + Sample

Web this is to certify that the policies of insurance listed below have been issued to the insured named above for the policy period indicated. Notwithstanding any requirement, term or condition of any. Web a certificate of insurance acord form covers essential information about your business insurance policy, such as: We will send your certificate within two business days. Web.

Printable Certificate Template 21+ Free Word, PDF Documents Download

Notwithstanding any requirement, term or condition of any contract or other document with respect to which this They’re also known as certificates of liability insurance or proof of insurance. What is proof of liability insurance? A certificate of insurance (coi) form is a document that establishes proof of insurance, most often for a general liability policy. Acord forms are now.

FREE 7+ Liability Insurance Forms in MS Word PDF

Web a certificate of insurance acord form covers essential information about your business insurance policy, such as: Web this is to certify that the policies of insurance listed below have been issued to the insured named above for the policy period indicated. Notwithstanding any requirement, term or condition of any contract or other document with respect to which this Web.

Liability Insurance Liability Insurance Certificate

Web this is to certify that the policies of insurance listed below have been issued to the insured named above for the policy period indicated. Additional acord forms and more policy types will be available in the future find the right products for your business. Web fill out the online certificate of liability insurance form for free! Web a certificate.

Certificate Of Liability Insurance Template

Notwithstanding any requirement, term or condition of any contract or other document with respect to which this Web certificate of liability insurance. This certificate of liability insurance pdf template provides comprehensive information as proof of coverage for the named insured for the certificate producer's or issuer's use. Web it is a form issued by the insurance company upon your request..

Sample certificate of liability insurance in Word and Pdf formats

Web a certificate of insurance acord form covers essential information about your business insurance policy, such as: Keep it simple when filling out your online certificate of liability insurance and use pdfsimpli. Web this is to certify that the policies of insurance listed below have been issued to the insured named above for the policy period indicated. Artisan and service.

indemnity insurance template The Miracle Of Indemnity

It summarizes the benefits and limits of your general liability insurance policy. Web a certificate of insurance acord form covers essential information about your business insurance policy, such as: It lists you or your business as the policyholder or named insured. Note that some companies also like to issue a liability certificate of insurance with a very simple format, which.

Web Insurance Law § 501 (A) Defines Certificate Of Insurance As Any Document Or Instrument, Or Addendum Thereto No Matter How Titled Or Described, Prepared Or Issued By An Insurer Or Insurance Producer As Evidence Of Property/Casualty Insurance Coverage. The Definition Does Not Include An Insurance Policy Or Insurance Binder.

Web by obtaining a certificate of liability insurance from an insurance company. What is proof of liability insurance? Web in times of possible lawsuits, a waiver form uses conditions that ensure the business has no legal responsibility of the damage experienced by the customer. Web a certificate of liability insurance serves as proof of the insurance coverage of the one insured.

Take A Look At This Sample Certificate Of Liability Insurance To Get An Idea.

Web a certificate of insurance (coi) is a document from an insurer to show you have business insurance. Web a certificate must be submitted with an application form, renewal form, or when updating general liability insurance coverage. If additional space is needed, add attachment.) name of insurer address ca insurer license number: Web a certificate of liability insurance (coi) is a form that provides proof of professional liability insurance for your business.

Learn More From The Hartford.

Policy number types of insurance coverage issuing insurance company insurance limits named insured policy effective date policy expiration date why do i need an acord certificate of insurance? Web a certificate of insurance acord form covers essential information about your business insurance policy, such as: It lists you or your business as the policyholder or named insured. Notwithstanding any requirement, term or condition of any.

Web This Is To Certify That The Policies Of Insurance Listed Below Have Been Issued To The Insured Named Above For The Policy Period Indicated.

Web this is to certify that the policies of insurance listed below have been issued to the insured named above for the policy period indicated. Web a certificate of liability insurance is a document proving that your business has general liability insurance or other types of liability coverage. Web since our first paper form was released in 1971, acord has provided the standard forms used by the insurance industry. A certificate of insurance (coi) form is a document that establishes proof of insurance, most often for a general liability policy.