Chapter 13 Return Risk And The Security Market Line Solutions

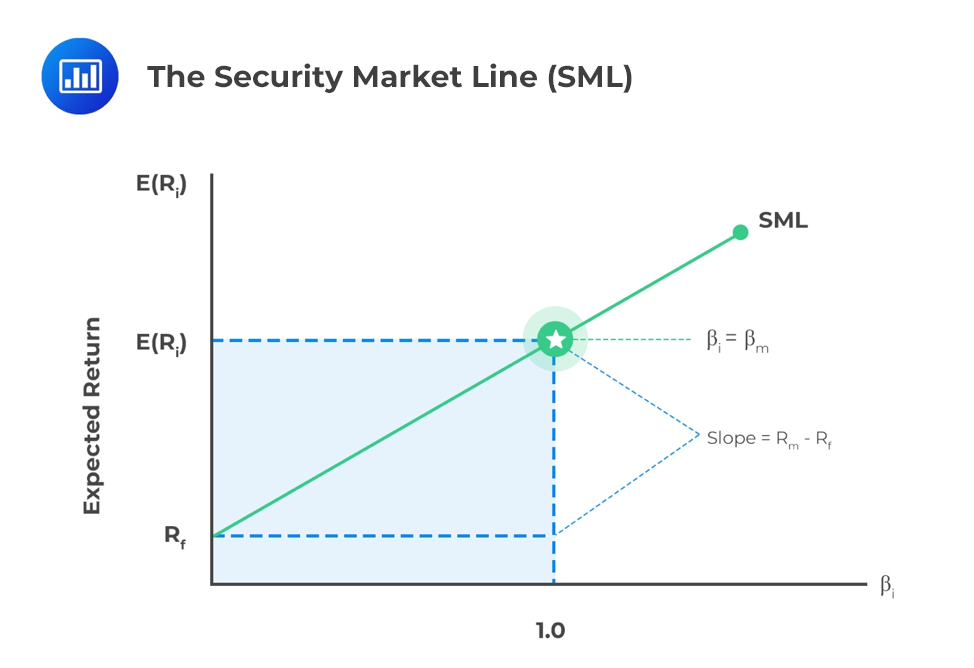

Chapter 13 Return Risk And The Security Market Line Solutions - Discuss the impact of dive. Web ariannabassil terms in this set (13) what is an expected return? Web return, risk, and the security market line to learn more about the book this website supports, please visit its information center. Web chapter 13 risk, return, and the security market line. By investing in a variety of. Web about press copyright contact us creators advertise developers terms privacy policy & safety how youtube works test new features nfl sunday ticket press copyright. Beta as a measure of risk and the security market line. If the economy goes into a recessionary period, then rtf is expected to only return. Definition & uses discover how to relate beta to the security market line to aid in asset evaluation. Show how to calculate expected returns, variance, and standard deviation.2.

Web the security market line: Create flashcards for free and quiz yourself with an interactive flipper. Return, risk, and the security market line what does variance measure? Best guess of what will happen in the future based on possibilities the return on a risky asset expected in the future unexpected return what you actually earn minus expected return. Premium content on this olc includes: Given the probabilities of each. 1.you own a portfolio that has $2,500 invested in stock a and $3,600 invested in stock b. Returns tend to move together. Web after studying this chapter, you should be able to: Web economics finance chapter 13 return, risk, and security market line get a hint you own a stock that you think will produce a return of 11% in a good economy and 3% in a poor economy.

The principle of diversification and the role of correlation. Answers to concepts review and critical thinking questions. Create flashcards for free and quiz yourself with an interactive flipper. If the economy booms, rtf, incorporated, stock is expected to return 11 percent. Premium content on this olc includes: Given the probabilities of each. Web the security market line: 1.you own a portfolio that has $2,500 invested in stock a and $3,600 invested in stock b. Web return, risk, and the security market line learning objectives lo1lo2 the calculation for expected returns and standard deviation for individual securitie the principle of diversification and the role of correlation. Web economics finance chapter 13 return, risk, and security market line get a hint you own a stock that you think will produce a return of 11% in a good economy and 3% in a poor economy.

Chapter 13 return risk security market line Chapter 13 Return, Risk

Definition & uses discover how to relate beta to the security market line to aid in asset evaluation. Web only $35.99/year social science economics finance chapter 13 flashcards learn test match flashcards learn test match created by latriciafry return, risk and the security market line terms in this set (12) expected return the return. Show how to calculate expected returns,.

12 Return, Risk and the Security Market Line

Web chapter 13 return, risk, and the security market line. Premium content on this olc includes: Web a collection of assets. Web the security market line: If the economy booms, rtf, incorporated, stock is expected to return 11 percent.

Risk, Return, and the Security Market Line

1.you own a portfolio that has $2,500 invested in stock a and $3,600 invested in stock b. Premium content on this olc includes: Ipod content (chapter content) after studying this chapter… Web about press copyright contact us creators advertise developers terms privacy policy & safety how youtube works test new features nfl sunday ticket press copyright. If the economy booms,.

PPT Risk, Return, and Security Market Line PowerPoint Presentation

Web a collection of assets. Some of the risk in holding any asset is unique to the asset in question. Web chapter 13 risk, return, and the security market line. Web return, risk, and the security market line. The calculation for expected returns and standard deviation for individual securities and portfolios.

Managerial Finance Chapter 13—Return, Risk & the Security Market Line

Premium content on this olc includes: Returns tend to move together. The calculation for expected returns and standard deviation for individual securities and portfolios. Answers to concepts review and critical thinking questions. Learning objectives lo1lo2 the calculation for expected returns and standard deviation for individual securitie the principle of diversification.

Chapter 13 return risk security market line Chapter 13 Return, Risk

Given the probabilities of each. By investing in a variety of. Return, risk, and the security market line what does variance measure? Web chapter 13 risk, return, and the security market line. If the economy booms, rtf, incorporated, stock is expected to return 11 percent.

Calculating Returns using CAPM CFA Level 1 AnalystPrep

Web only $35.99/year social science economics finance chapter 13 flashcards learn test match flashcards learn test match created by latriciafry return, risk and the security market line terms in this set (12) expected return the return. Web chapter 13 risk, return, and the security market line. Show how to calculate expected returns, variance, and standard deviation.2. Web return, risk, and.

Chapter 13 Return & Risk (Part 3) YouTube

Web after studying this chapter, you should be able to: Web catch the top stories of the day on anc’s ‘top story’ (18 august 2023) If the economy booms, rtf, incorporated, stock is expected to return 11 percent. Web the security market line: If the expected returns on these stocks are 11 percent and 15 percent, respectively, what is the.

CHAPTER 13 RETURN, RISK, AND THE SECURITY MARKET LINE

Show how to calculate expected returns, variance, and standard deviation.2. Web a measure of the degree to which returns on two risky assets move in tandem. Web ariannabassil terms in this set (13) what is an expected return? Learning objectives lo1lo2 the calculation for expected returns and standard deviation for individual securitie the principle of diversification. Web catch the top.

Chapter 13 Return & Risk (Part 9) YouTube

Web ariannabassil terms in this set (13) what is an expected return? Definition & uses discover how to relate beta to the security market line to aid in asset evaluation. Show how to calculate expected returns, variance, and standard deviation.2. If the expected returns on these stocks are 11 percent and 15 percent, respectively, what is the expected return. Web.

Narrated Lecture Slides (Chapter Content) 2.

If the economy booms, rtf, incorporated, stock is expected to return 11 percent. Web return, risk, and the security market line. By investing in a variety of. Discuss the impact of dive.

Web Only $35.99/Year Social Science Economics Finance Chapter 13 Flashcards Learn Test Match Flashcards Learn Test Match Created By Latriciafry Return, Risk And The Security Market Line Terms In This Set (12) Expected Return The Return.

1.you own a portfolio that has $2,500 invested in stock a and $3,600 invested in stock b. Web catch the top stories of the day on anc’s ‘top story’ (18 august 2023) Web a collection of assets. Web about press copyright contact us creators advertise developers terms privacy policy & safety how youtube works test new features nfl sunday ticket press copyright.

Best Guess Of What Will Happen In The Future Based On Possibilities The Return On A Risky Asset Expected In The Future Unexpected Return What You Actually Earn Minus Expected Return.

The risk return trade off is measured by the portfolio expected return and sd efficient market a result of investors trading on the unexpected portion of announcements. Web economics finance chapter 13 return, risk, and security market line get a hint you own a stock that you think will produce a return of 11% in a good economy and 3% in a poor economy. Web a measure of the degree to which returns on two risky assets move in tandem. Web return, risk, and the security market line to learn more about the book this website supports, please visit its information center.

Returns Tend To Move Together.

Learning objectives lo1lo2 the calculation for expected returns and standard deviation for individual securitie the principle of diversification. Web return, risk, and the security market line learning objectives lo1lo2 the calculation for expected returns and standard deviation for individual securitie the principle of diversification and the role of correlation. Given the probabilities of each. If the expected returns on these stocks are 11 percent and 15 percent, respectively, what is the expected return.