Chapter 2 Net Income Answer Key

Chapter 2 Net Income Answer Key - Web 120 chapter 2 net income concept check check your answers at the end of the chapter. Web this is a answer key for chapter 2 net income lesson 2.2 answer key, it is a pdf that is easy to access and it. The amount of money that is taken away in the form of taxes. The correct answer for each question is indicated by a. Web finance finance questions and answers class _ date chapter 2 net income lesson 2.6 statement of earnings e mathematics you may have additional deductions taken from your gross pay for union dues and savings plans. How much does she take home per week after taxes? Melanie yashin's gross pay for this week is $355.00. Web test yourself is an opportunity for you to assess your ability to handle the big ideas of chapter 2. Web the crossword solver found 20 answers to net income, 18 letters crossword clue. Find the taxable wages and the annual tax withheld.

Deduction per pay period = total amount paid by employee /. Enter the length or pattern for better results. The amount of money that is taken away in the form of taxes. There are 2 files below.the test and the answer key. Health insurance offered by many businesses to employees, paid in part by the business and in part by the employee. She is married and claims no allowances. Web test yourself is an opportunity for you to assess your ability to handle the big ideas of chapter 2. Web a strong income statement is one that has significantly more dollars of revenue than expenses, resulting in net income that is a relatively high percentage of the revenue figure. Web the crossword solver found 20 answers to net income, 18 letters crossword clue. Web finance finance questions and answers class _ date chapter 2 net income lesson 2.6 statement of earnings e mathematics you may have additional deductions taken from your gross pay for union dues and savings plans.

State income tax rate is 1.5 percent of taxable income. The amount of money you receive after deductions are subtracted from your gross income. Health insurance offered by many businesses to employees, paid in part by the business and in part by the employee. 5.0 (1 review) gross profit: Web this is a answer key for chapter 2 net income lesson 2.2 answer key, it is a pdf that is easy to access and it. How much does she take home per week after taxes? The amount of money that is taken away in the form of taxes. The total amount of money you earn. Deduction per pay period = total amount paid by employee /. Web mathematics for business and personal finance chapter 2:

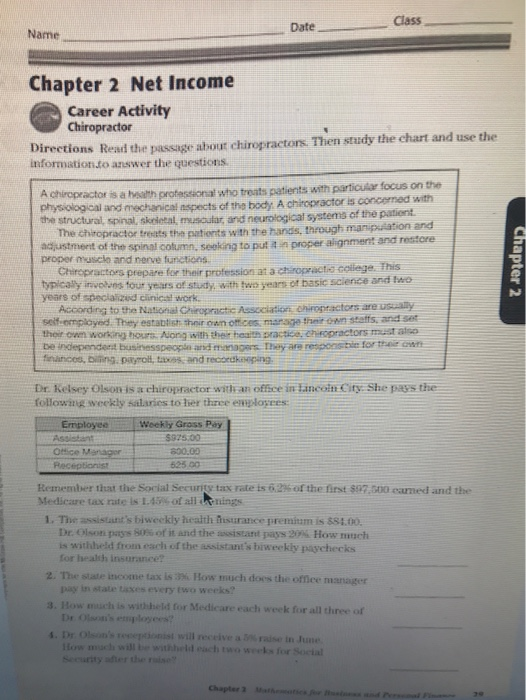

Class _ Date Chapter 2 Net Lesson 2.6

There are 2 files below.the test and the answer key. Melanie yashin's gross pay for this week is $355.00. Income tax worksheet and tax table. Web mathematics for business and personal finance chapter 2: The crossword solver finds answers to classic crosswords and cryptic crossword puzzles.

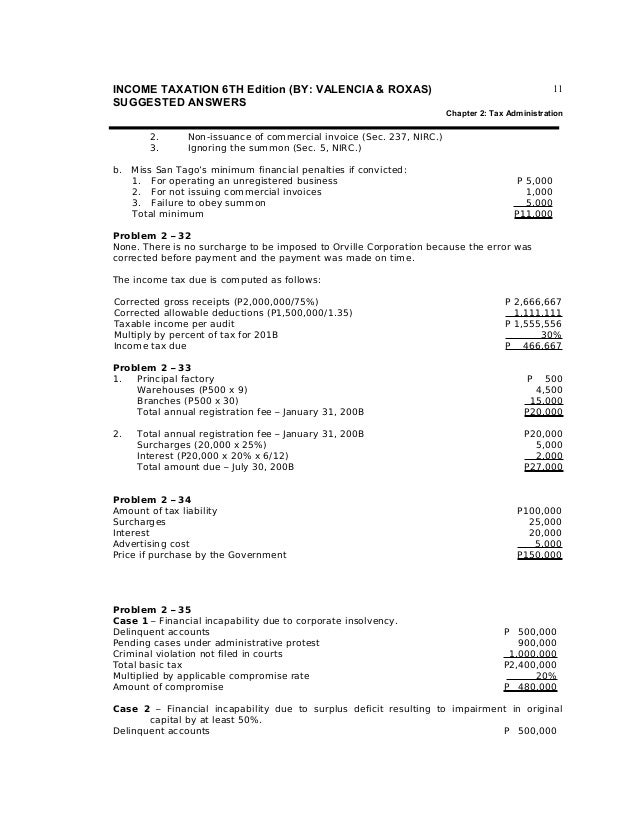

Taxation Answer Key Chapter 3

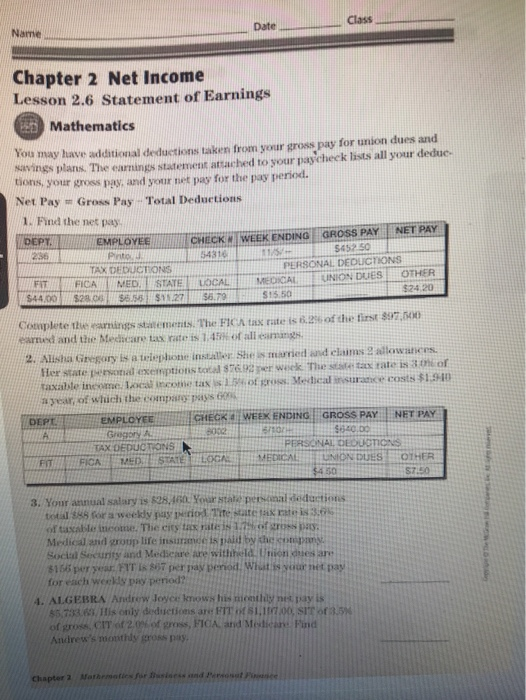

Web finance finance questions and answers class _ date chapter 2 net income lesson 2.6 statement of earnings e mathematics you may have additional deductions taken from your gross pay for union dues and savings plans. Money withheld by an employer from an employee's paycheck to pay federal government. There are 2 files below.the test and the answer key. Web.

Taxation Answer key (6th Edition by Valencia) Chapter 2

She is married and claims no allowances. Health insurance offered by many businesses to employees, paid in part by the business and in part by the employee. The amount of money you receive after deductions are subtracted from your gross income. Find the taxable wages and the annual tax withheld. Net income in this chapter:

Class _ Date Chapter 2 Net Lesson 2.6

There are 2 files below.the test and the answer key. 1626.12 / 52 = $31.27 f. Health insurance offered by many businesses to employees, paid in part by the business and in part by the employee. Find the taxable wages and the annual tax withheld. Web test yourself is an opportunity for you to assess your ability to handle the.

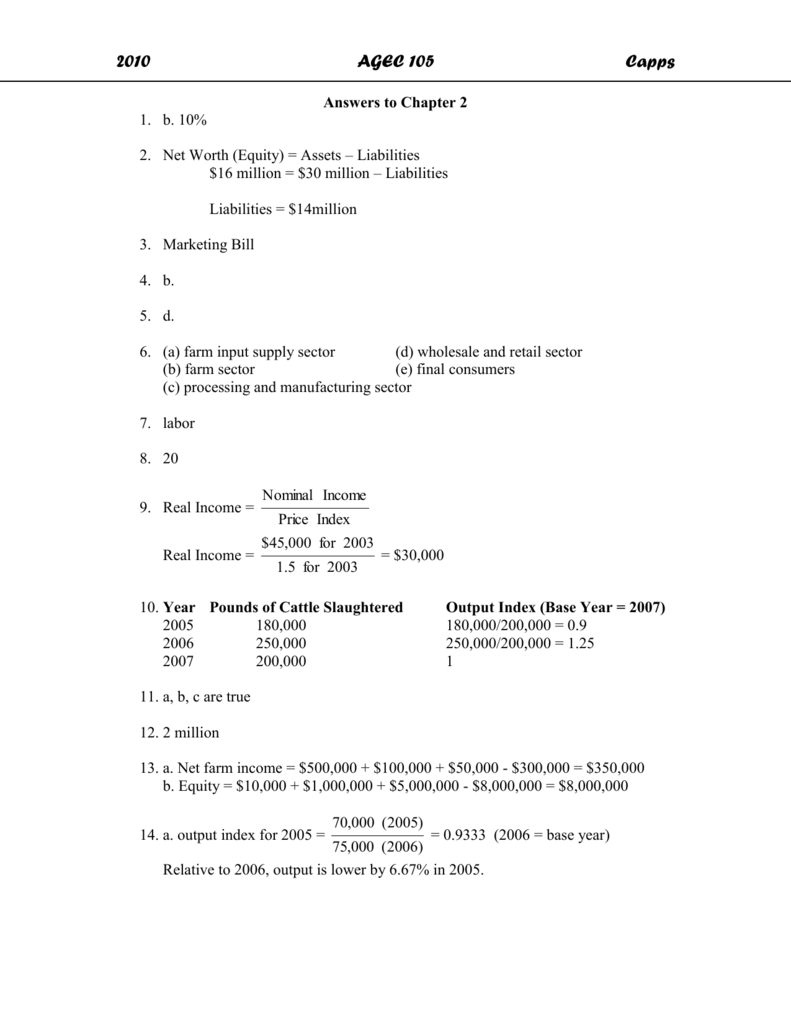

Solved A.) Determine the annual (1) net and (2) net

State income tax rate is 1.5 percent of taxable income. Web finance finance questions and answers class _ date chapter 2 net income lesson 2.6 statement of earnings e mathematics you may have additional deductions taken from your gross pay for union dues and savings plans. Web study with quizlet and memorize flashcards containing terms like federal income tax, withholding.

Assessment Year in tax for 2nd year YouTube

Statement of owner’s equity shows the change in net worth of a business for a period of time; Web the crossword solver found 20 answers to net income, 18 letters crossword clue. Web study with quizlet and memorize flashcards containing terms like federal income tax, withholding allowances, exemption and more. Income tax worksheet and tax table. Net income in this.

Taxation Answer key (6th Edition by Valencia) Chapter 4

Web the crossword solver found 20 answers to net income, 18 letters crossword clue. Statement of owner’s equity shows the change in net worth of a business for a period of time; Web this is a answer key for chapter 2 net income lesson 2.2 answer key, it is a pdf that is easy to access and it. Web a.

6. Presented below is the statement of Cowan, Inc. Sales

Health insurance offered by many businesses to employees, paid in part by the business and in part by the employee. Melanie yashin's gross pay for this week is $355.00. 5.0 (1 review) gross profit: The total amount of money you earn. The correct answer for each question is indicated by a.

Chapter 2 net stmt and retained earning help YouTube

She is married and claims no allowances. The correct answer for each question is indicated by a. Web 120 chapter 2 net income concept check check your answers at the end of the chapter. Money withheld by an employer from an employee's paycheck to pay federal government. There are 2 files below.the test and the answer key.

Chapter 2

Click the card to flip 👆. Health insurance offered by many businesses to employees, paid in part by the business and in part by the employee. Web this is a answer key for chapter 2 net income lesson 2.2 answer key, it is a pdf that is easy to access and it. Web a strong income statement is one that.

What Is Her Weekly State Income Tax?

Web finance finance questions and answers class _ date chapter 2 net income lesson 2.6 statement of earnings e mathematics you may have additional deductions taken from your gross pay for union dues and savings plans. State income tax rate is 1.5 percent of taxable income. Deduction per pay period = total amount paid by employee /. Use the table below to determine how much his employer deducts for state income.

She Is Married And Claims No Allowances.

Health insurance offered by many businesses to employees, paid in part by the business and in part by the employee. 5.0 (1 review) gross profit: Web the crossword solver found 20 answers to net income, 18 letters crossword clue. Web test yourself is an opportunity for you to assess your ability to handle the big ideas of chapter 2.

Statement Of Owner’s Equity Shows The Change In Net Worth Of A Business For A Period Of Time;

Click the card to flip 👆. The correct answer for each question is indicated by a. The crossword solver finds answers to classic crosswords and cryptic crossword puzzles. Money withheld by an employer from an employee's paycheck to pay federal government.

How Much Does She Take Home Per Week After Taxes?

The earnings statement attached to your paychecklists all your dedue tions, your gross pay, and your net. The total amount of money you earn. 1626.12 / 52 = $31.27 f. Find the taxable wages and the annual tax withheld.