Chapter 313 Texas

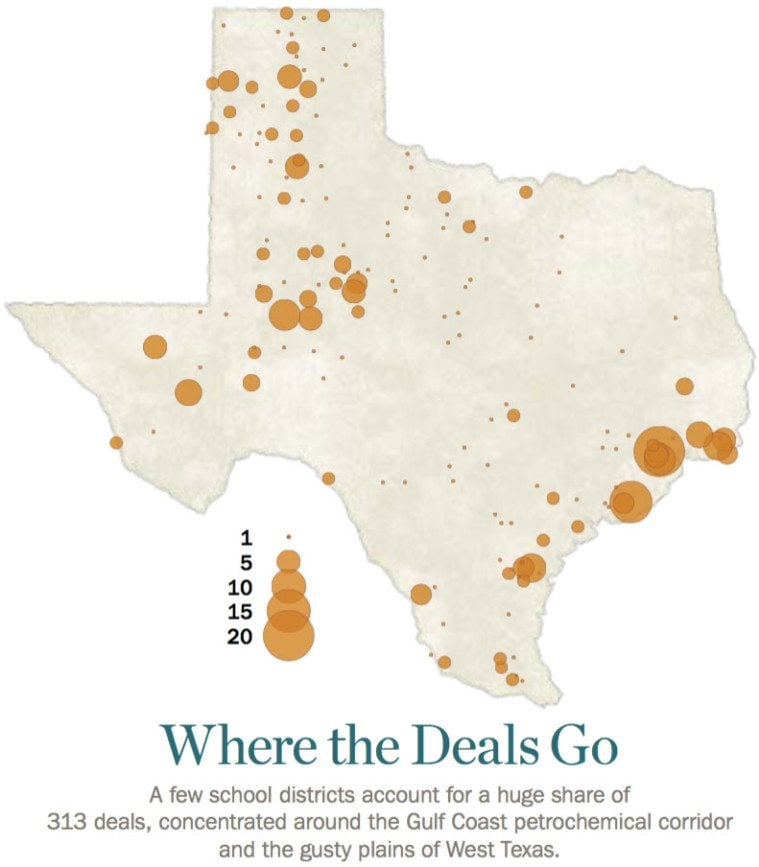

Chapter 313 Texas - Web the texas chapter 313 value limitation program is a powerful economic development tool that allows a school district to agree temporarily to reduce ad valorem taxes on an eligible project’s investment for a period of 10 years. With chapter 313 set to expire, the texas comptroller has proposed new rules that. Web chapter 313, the texas economic development act, is texas’ largest corporate tax break program, with a lifetime cost to the state of more than $7 billion so far. Web abbott said wednesday that the expiration of chapter 313 factored into the recent decision by micron to build a new computer chip factory in upstate new york instead of texas. Texas tax code section 313.171 provides that chapter 313 agreements executed before dec. There is no limit to the program. An appraised value limitation is an agreement in which a taxpayer agrees to build or install property and create jobs in exchange for: Although the texas house approved recent legislation to extend the program, the legislation failed in the texas. This chapter may be cited as the texas economic development act. Web the companies filed chapter 313 applications for wind and solar energy projects located in five different independent school districts across texas:

Web abbott said wednesday that the expiration of chapter 313 factored into the recent decision by micron to build a new computer chip factory in upstate new york instead of texas. As texas’ $10 billion corporate tax break program closes, state comptroller wants to cover up costs. It allows for.50 ce in the tax assessment and collection practices. Web crafted to lure businesses to texas, chapter 313 allowed companies to lock in a minimal property valuation for a proposed industrial project for 10 years in exchange for economic growth. Web texas economic development act. Web chapter 313, the texas economic development act, is texas’ largest corporate tax break program, with a lifetime cost to the state of more than $7 billion so far. Added by acts 2001, 77th leg., ch. There is no limit to the program. Web texas legislature 2023 new economic incentive plan clears hurdle in texas house during the floor debate for a plan to replace the expired chapter 313 program, house members added that the. 31, 2022, will continue in effect under chapter 313.

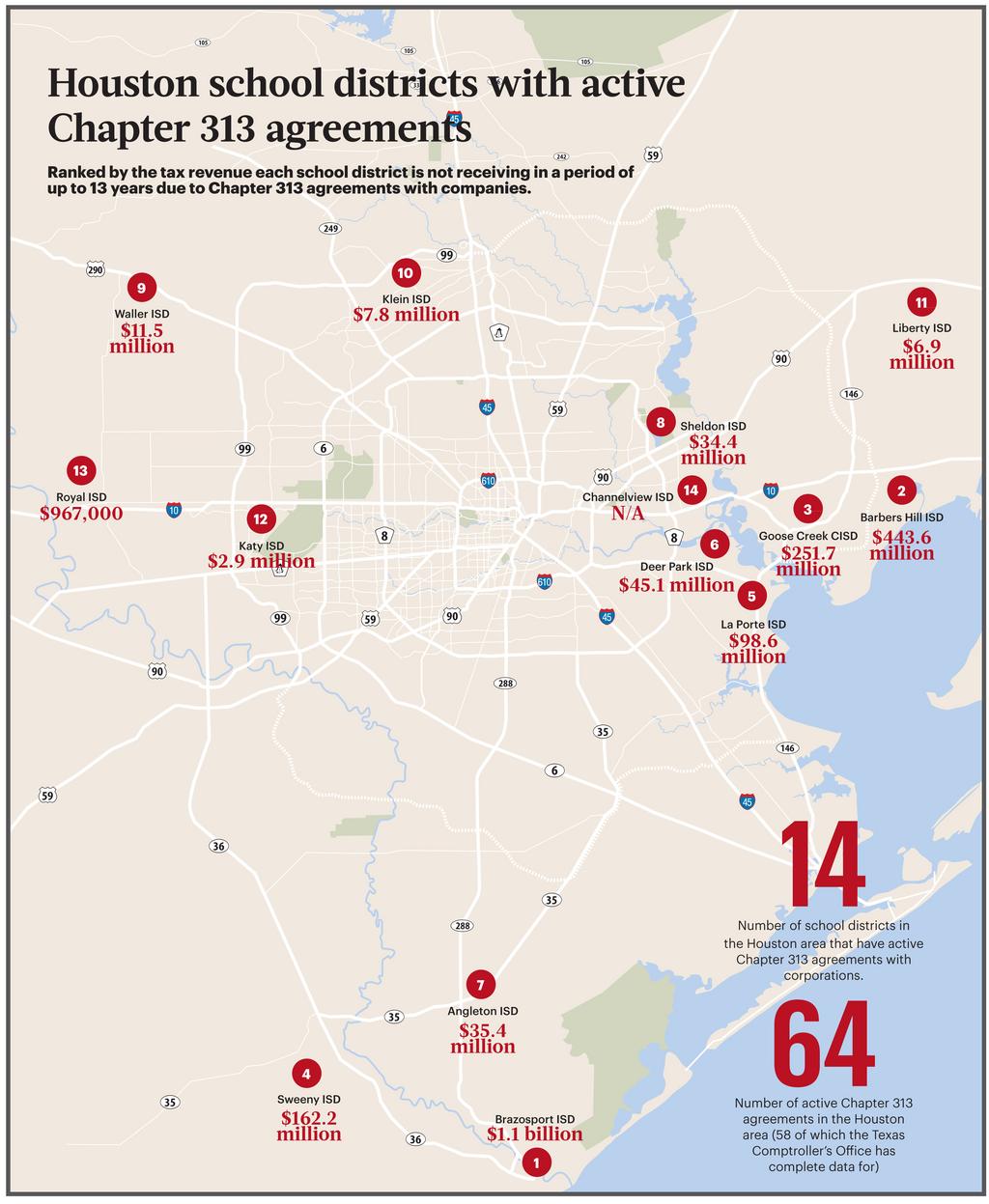

It allows for.50 ce in the tax assessment and collection practices. Web austin, texas — at the end of the year, chapter 313 of the texas tax code will expire. Web the local school district, barbers hill, has granted more chapter 313 tax breaks than any other district in texas. Web texas legislature 2023 new economic incentive plan clears hurdle in texas house during the floor debate for a plan to replace the expired chapter 313 program, house members added that the. Web named for its place in the state tax code, chapter 313 gives texas school districts the ability to cap the taxable value of a property for a portion of school taxes for up to 10 years. Web not dead yet — planning for chapter 313's sunset. Will state officials let it die? Although the texas house approved recent legislation to extend the program, the legislation failed in the texas. But if a developer finalizes a 313. Web abbott said wednesday that the expiration of chapter 313 factored into the recent decision by micron to build a new computer chip factory in upstate new york instead of texas.

Meet Chapter 313, Texas' Largest Corporate Welfare Program

Web chapter 313 of the texas tax code allows school districts to cap the taxable value of a property for a portion of school taxes for up to 10 years, often saving companies tens of millions of dollars. An appraised value limitation is an agreement in which a taxpayer agrees to build or install property and create jobs in exchange.

Chapter 313 Replacement Tax Incentive Program Gets Initial Approval in

Will state officials let it die? Web texas economic development act. 31, 2022, will continue in effect under chapter 313. Web texas legislature 2023 new economic incentive plan clears hurdle in texas house during the floor debate for a plan to replace the expired chapter 313 program, house members added that the. Added by acts 2001, 77th leg., ch.

Texas Has One Week to Save TexasSized Tax Break Connect CRE

Will state officials let it die? Web chapter 313 of the texas tax code allows school districts to cap the taxable value of a property for a portion of school taxes for up to 10 years, often saving companies tens of millions of dollars. Web texas legislature 2023 new economic incentive plan clears hurdle in texas house during the floor.

Chapter 313 Tax Break Provision Killed in Texas House Reform Austin

Web texas economic development act. Will state officials let it die? 31, 2022, will continue in effect under chapter 313. Web austin, texas — at the end of the year, chapter 313 of the texas tax code will expire. With chapter 313 set to expire, the texas comptroller has proposed new rules that.

Meet Chapter 313, Texas' Largest Corporate Welfare Program

It allows for.50 ce in the tax assessment and collection practices. Web the texas chapter 313 value limitation program is a powerful economic development tool that allows a school district to agree temporarily to reduce ad valorem taxes on an eligible project’s investment for a period of 10 years. Web abbott said wednesday that the expiration of chapter 313 factored.

Plan to revive Texas' Chapter 313 tax breaks adds more lucrative deals

As texas’ $10 billion corporate tax break program closes, state comptroller wants to cover up costs. Web the texas chapter 313 value limitation program is a powerful economic development tool that allows a school district to agree temporarily to reduce ad valorem taxes on an eligible project’s investment for a period of 10 years. Web austin, texas — at the.

Chapter 313 The Texas Observer

Web abbott said wednesday that the expiration of chapter 313 factored into the recent decision by micron to build a new computer chip factory in upstate new york instead of texas. This particular chapter was enacted in 2001, went into effect in january of 2002, and it allows school. An appraised value limitation is an agreement in which a taxpayer.

The Back Mic Breakdown of the Texas House Vote on Chapter 313

Although the texas house approved recent legislation to extend the program, the legislation failed in the texas. Web named for its place in the state tax code, chapter 313 gives texas school districts the ability to cap the taxable value of a property for a portion of school taxes for up to 10 years. It allows for.50 ce in the.

How Houston corporations benefit from Chapter 313, Texas’ largest tax

Texas tax code section 313.171 provides that chapter 313 agreements executed before dec. Texas economic development act subchapter a. This chapter may be cited as the texas economic development act. Web not dead yet — planning for chapter 313's sunset. Web chapter 313, the texas economic development act, is texas’ largest corporate tax break program, with a lifetime cost to.

Chapter 313 Agreements Texas Schools for Economic Development

Texas economic development act subchapter a. Web the local school district, barbers hill, has granted more chapter 313 tax breaks than any other district in texas. Although the texas house approved recent legislation to extend the program, the legislation failed in the texas. Texas tax code section 313.171 provides that chapter 313 agreements executed before dec. Web not dead yet.

Although The Texas House Approved Recent Legislation To Extend The Program, The Legislation Failed In The Texas.

Web named for its place in the state tax code, chapter 313 gives texas school districts the ability to cap the taxable value of a property for a portion of school taxes for up to 10 years. Added by acts 2001, 77th leg., ch. Web the texas chapter 313 value limitation program is a powerful economic development tool that allows a school district to agree temporarily to reduce ad valorem taxes on an eligible project’s investment for a period of 10 years. This chapter may be cited as the texas economic development act.

As Texas’ $10 Billion Corporate Tax Break Program Closes, State Comptroller Wants To Cover Up Costs.

Will state officials let it die? Web abbott said wednesday that the expiration of chapter 313 factored into the recent decision by micron to build a new computer chip factory in upstate new york instead of texas. Bynum isd, hart isd, holliday isd, miller. Web austin, texas — at the end of the year, chapter 313 of the texas tax code will expire.

There Is No Limit To The Program.

Web the companies filed chapter 313 applications for wind and solar energy projects located in five different independent school districts across texas: Texas tax code section 313.171 provides that chapter 313 agreements executed before dec. Web the local school district, barbers hill, has granted more chapter 313 tax breaks than any other district in texas. Texas economic development act subchapter a.

Web Not Dead Yet — Planning For Chapter 313'S Sunset.

31, 2022, will continue in effect under chapter 313. Web texas legislature 2023 new economic incentive plan clears hurdle in texas house during the floor debate for a plan to replace the expired chapter 313 program, house members added that the. Web crafted to lure businesses to texas, chapter 313 allowed companies to lock in a minimal property valuation for a proposed industrial project for 10 years in exchange for economic growth. With chapter 313 set to expire, the texas comptroller has proposed new rules that.