Citibank Ira Withdrawal Form

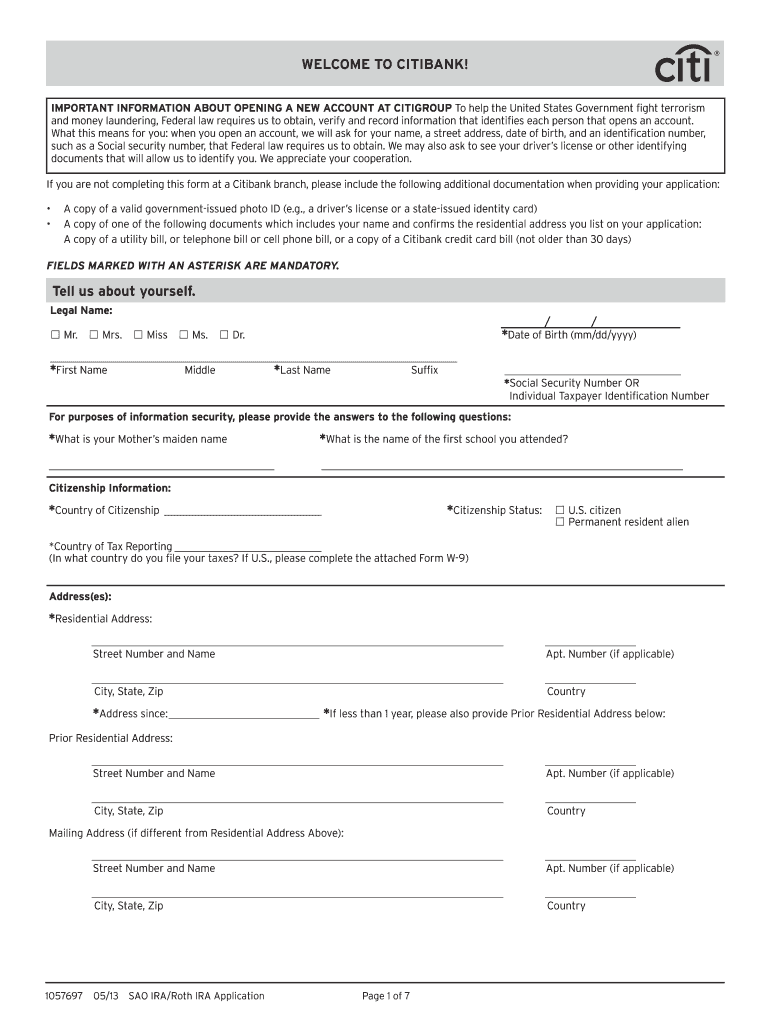

Citibank Ira Withdrawal Form - Web converting a traditional ira to a roth ira • please attach a completed citibank roth ira application form to a completed withdrawal and tax withholding election form. When returning this form by mail, please mail to: If you already have a citibank roth ira, please use the roth ira contribution form to convert from a traditional ira to a roth ira. • if a completed roth ira application form. Web attach a completed citibank ira and roth ira withdrawal and tax withholding election form. Complete the required fields which are colored in yellow. If you already have a citibank roth ira, please use the roth ira contribution form to convert from a traditional ira to a roth ira. That way, citi can add beneficiaries to your ira safely and securely. Web these traditional ira plan documents will provide you with information concerning your traditional ira and your savings and investment choices. Choose your product with an ira with citibank, you can choose from two types of deposit accounts:

Complete the required fields which are colored in yellow. A roth ira conversion cannot be undone or recharacterized. Web the tips below will help you fill out citibank ira withdrawal form quickly and easily: A roth ira conversion cannot be undone or recharacterized. Web provide the necessary information and documents to verify your ira beneficiaries. • if a completed roth ira application form. Click the arrow with the inscription next to move from one field to another. If you already have a citibank roth ira, please use the roth ira contribution form to convert from a traditional ira to a roth ira. Web the candidates must submit it before the laps of the deadline, which can be checked from the table below.application form released onjuly 25, 2017last date to submit application form(for national candidates)september 08, 2017 september 15, 2017last date to submit the application form(by foreign national and nri)february 15, 2018iift mba ib. When returning this form by mail, please mail to:

Click the arrow with the inscription next to move from one field to another. Choose your product with an ira with citibank, you can choose from two types of deposit accounts: Web these traditional ira plan documents will provide you with information concerning your traditional ira and your savings and investment choices. A roth ira conversion cannot be undone or recharacterized. That way, citi can add beneficiaries to your ira safely and securely. Web attach a completed citibank ira and roth ira withdrawal and tax withholding election form. If you already have a citibank roth ira, please use the roth ira contribution form to convert from a traditional ira to a roth ira. • a roth ira conversion cannot be undone or recharacterized. If you already have a citibank roth ira, please use the roth ira contribution form to convert from a traditional ira to a roth ira. You cannot make a contribution to an inherited ira.

Ira Withdrawal Form Citibank Universal Network

Click the arrow with the inscription next to move from one field to another. You cannot make a contribution to an inherited ira. Web please attach a completed citibank roth ira application form to a completed withdrawal and tax withholding election form. • attach a completed citibank ira and roth ira withdrawal and tax withholding election form. Web provide the.

Hr Block Ira Withdrawal Form Universal Network

• a roth ira conversion cannot be undone or recharacterized. Web provide the necessary information and documents to verify your ira beneficiaries. Web the tips below will help you fill out citibank ira withdrawal form quickly and easily: You cannot make a contribution to an inherited ira. • if a completed roth ira application form.

Ira Withdrawal Formula Universal Network

When returning this form by mail, please mail to:. That way, citi can add beneficiaries to your ira safely and securely. Choose your product with an ira with citibank, you can choose from two types of deposit accounts: Click the arrow with the inscription next to move from one field to another. Web the tips below will help you fill.

What You Need to Know About Withdrawing from an IRA (Infographic)

• if a completed roth ira application form. If you already have a citibank roth ira, please use the roth ira contribution form to convert from a traditional ira to a roth ira. Web attach a completed citibank ira and roth ira withdrawal and tax withholding election form. Insured money market accounts or certificates of deposit (cds). A roth ira.

ads/responsive.txt John Hancock Ira withdrawal form Best Of Unnecessary

Insured money market accounts or certificates of deposit (cds). • attach a completed citibank ira and roth ira withdrawal and tax withholding election form. Web converting a traditional ira to a roth ira • please attach a completed citibank roth ira application form to a completed withdrawal and tax withholding election form. If you already have a citibank roth ira,.

Fidelity Ira Distribution Request Form Universal Network

Web attach a completed citibank ira and roth ira withdrawal and tax withholding election form. Web these traditional ira plan documents will provide you with information concerning your traditional ira and your savings and investment choices. • attach a completed citibank ira and roth ira withdrawal and tax withholding election form. A roth ira conversion cannot be undone or recharacterized..

Citibank Ira Withdrawal Form Fill Out and Sign Printable PDF Template

Complete the required fields which are colored in yellow. If you already have a citibank roth ira, please use the roth ira contribution form to convert from a traditional ira to a roth ira. Web attach a completed citibank ira and roth ira withdrawal and tax withholding election form. Choose your product with an ira with citibank, you can choose.

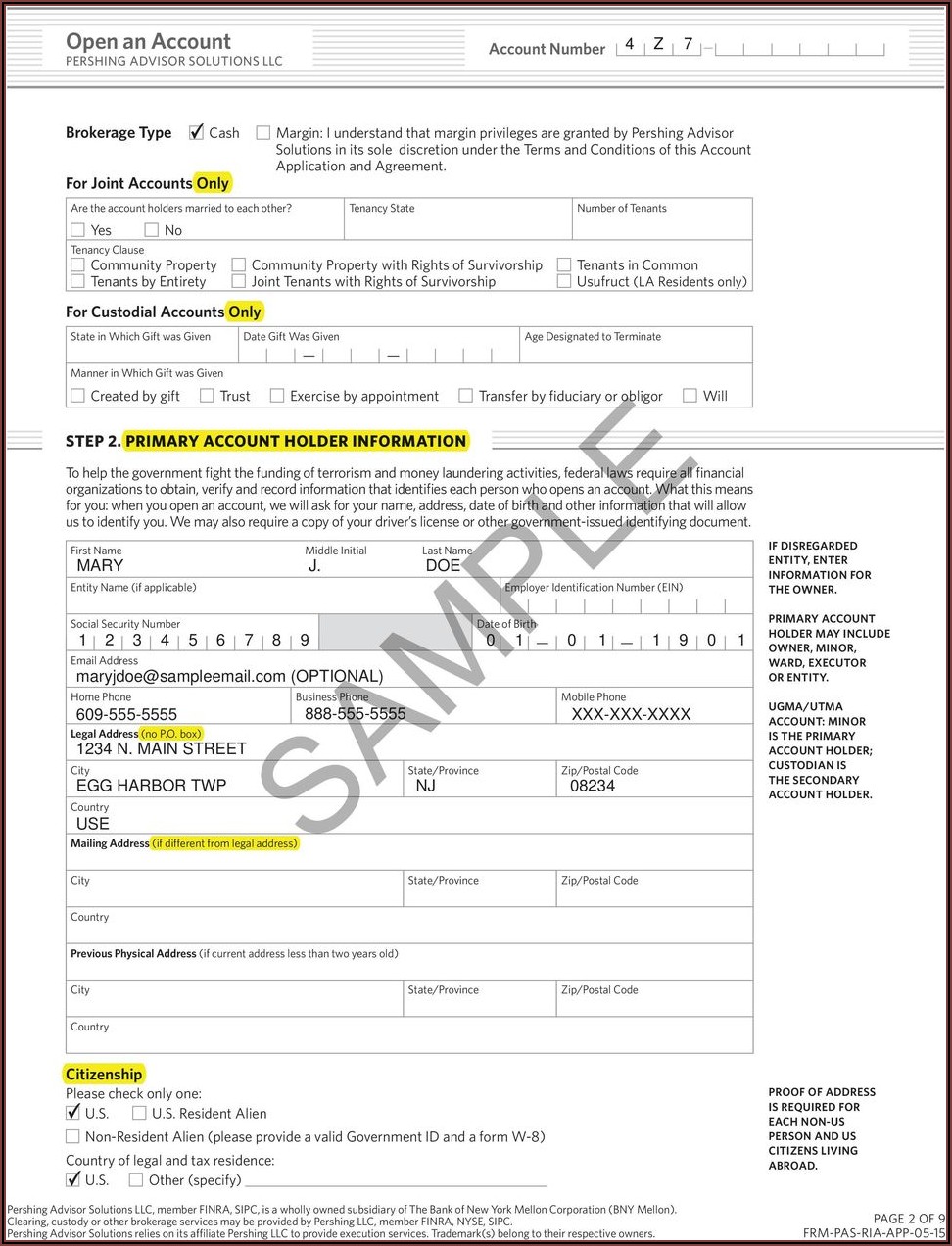

Pershing Ira Withdrawal Form Form Resume Examples goVLdJqpVv

Web the tips below will help you fill out citibank ira withdrawal form quickly and easily: Insured money market accounts or certificates of deposit (cds). Web attach a completed citibank ira and roth ira withdrawal and tax withholding election form. A roth ira conversion cannot be undone or recharacterized. • attach a completed citibank ira and roth ira withdrawal and.

Ira Mandatory Withdrawal Formula Universal Network

That way, citi can add beneficiaries to your ira safely and securely. Web attach a completed citibank ira and roth ira withdrawal and tax withholding election form. Web the tips below will help you fill out citibank ira withdrawal form quickly and easily: Click the arrow with the inscription next to move from one field to another. You cannot make.

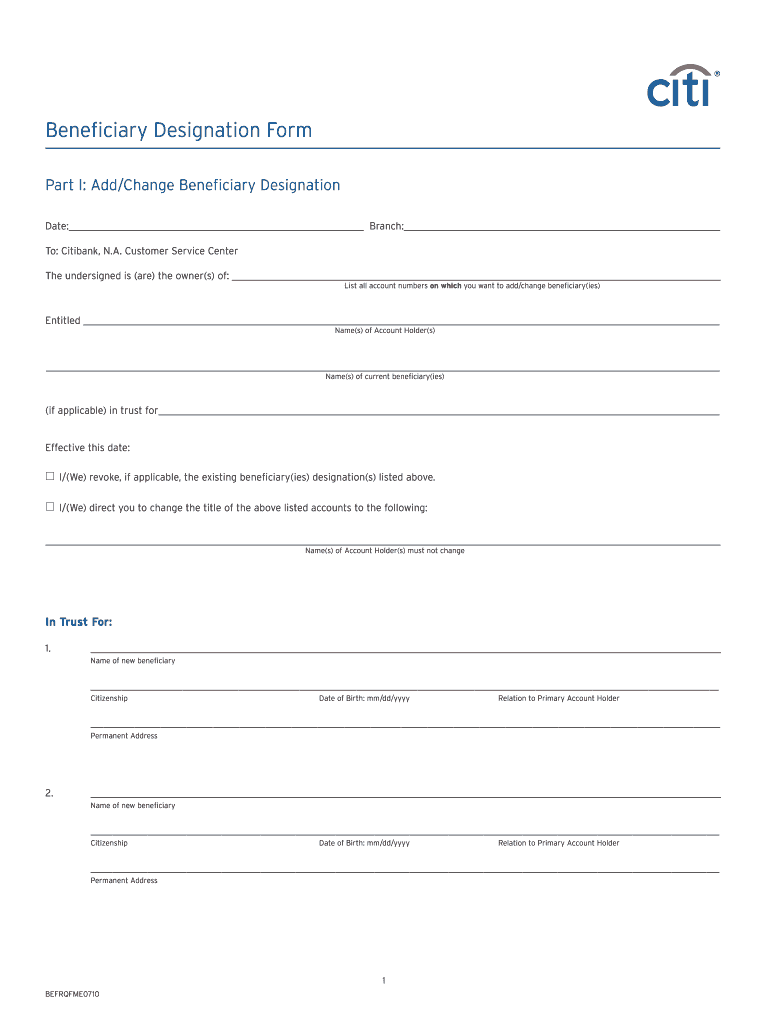

Beneficiary Form Fill Out and Sign Printable PDF Template signNow

Click the arrow with the inscription next to move from one field to another. A roth ira conversion cannot be undone or recharacterized. That way, citi can add beneficiaries to your ira safely and securely. • attach a completed citibank ira and roth ira withdrawal and tax withholding election form. Web the candidates must submit it before the laps of.

Complete The Required Fields Which Are Colored In Yellow.

Web the candidates must submit it before the laps of the deadline, which can be checked from the table below.application form released onjuly 25, 2017last date to submit application form(for national candidates)september 08, 2017 september 15, 2017last date to submit the application form(by foreign national and nri)february 15, 2018iift mba ib. You cannot make a contribution to an inherited ira. • a roth ira conversion cannot be undone or recharacterized. Web please attach a completed citibank roth ira application form to a completed withdrawal and tax withholding election form.

That Way, Citi Can Add Beneficiaries To Your Ira Safely And Securely.

Web the tips below will help you fill out citibank ira withdrawal form quickly and easily: Choose your product with an ira with citibank, you can choose from two types of deposit accounts: When returning this form by mail, please mail to:. Web converting a traditional ira to a roth ira • please attach a completed citibank roth ira application form to a completed withdrawal and tax withholding election form.

If You Already Have A Citibank Roth Ira, Please Use The Roth Ira Contribution Form To Convert From A Traditional Ira To A Roth Ira.

Insured money market accounts or certificates of deposit (cds). When returning this form by mail, please mail to: If you already have a citibank roth ira, please use the roth ira contribution form to convert from a traditional ira to a roth ira. Web attach a completed citibank ira and roth ira withdrawal and tax withholding election form.

Web Attach A Completed Citibank Ira And Roth Ira Withdrawal And Tax Withholding Election Form.

Web provide the necessary information and documents to verify your ira beneficiaries. • attach a completed citibank ira and roth ira withdrawal and tax withholding election form. Web these traditional ira plan documents will provide you with information concerning your traditional ira and your savings and investment choices. A roth ira conversion cannot be undone or recharacterized.