Colorado Tax Extension Form

Colorado Tax Extension Form - Web you need to either pay through revenue online or submit your payment with the extension payment form. Web the state filing deadline is april 18, 2023. If you cannot file by that date, you can get an. Web this form is for income earned in tax year 2022, with tax returns due in april 2023. Expressextension supports the filing of colorado business income tax. Return this form only if you need to make an additional payment of tax. We will update this page with a new version of the form for 2024 as soon as it is made available. If you owe co income taxes, you will either have to submit a co tax. Pay all or some of your colorado income taxes online via: If you owe state income tax, 90% of the tax liability must be paid on or.

Once you have paid at least 90% of your income tax. Instructions on how to efile an irs income tax return extension colorado income. Expressextension supports the filing of colorado business income tax. We will update this page with a new version of the form for 2024 as soon as it is made available. Web form 2350, application for extension of time to file u.s. If you owe co income taxes, you will either have to submit a co tax. If you owe state income tax, 90% of the tax liability must be paid on or. Citizens and resident aliens abroad who expect to qualify for special. Web you need to either pay through revenue online or submit your payment with the extension payment form. Web extended deadline with colorado tax extension:

You must pay your balance due to the state on or before the original deadline. Web the state filing deadline is april 18, 2023. If you owe state income tax, 90% of the tax liability must be paid on or. Expressextension supports the filing of colorado business income tax. Web pay online by credit/debit card or echeck. If you owe co income taxes, you will either have to submit a co tax. Income tax return (for u.s. Web $34.95 now only $29.95 file your personal tax extension now! We will update this page with a new version of the form for 2024 as soon as it is made available. Once you have paid at least 90% of your income tax.

Colorado Divorce Forms 1111 Universal Network

Instructions on how to efile an irs income tax return extension colorado income. Web income tax return (calendar year — due april 15, 2022) filing extensions are granted automatically. You can then mail your printable form by paper to the state. Web $34.95 now only $29.95 file your personal tax extension now! Web pay online by credit/debit card or echeck.

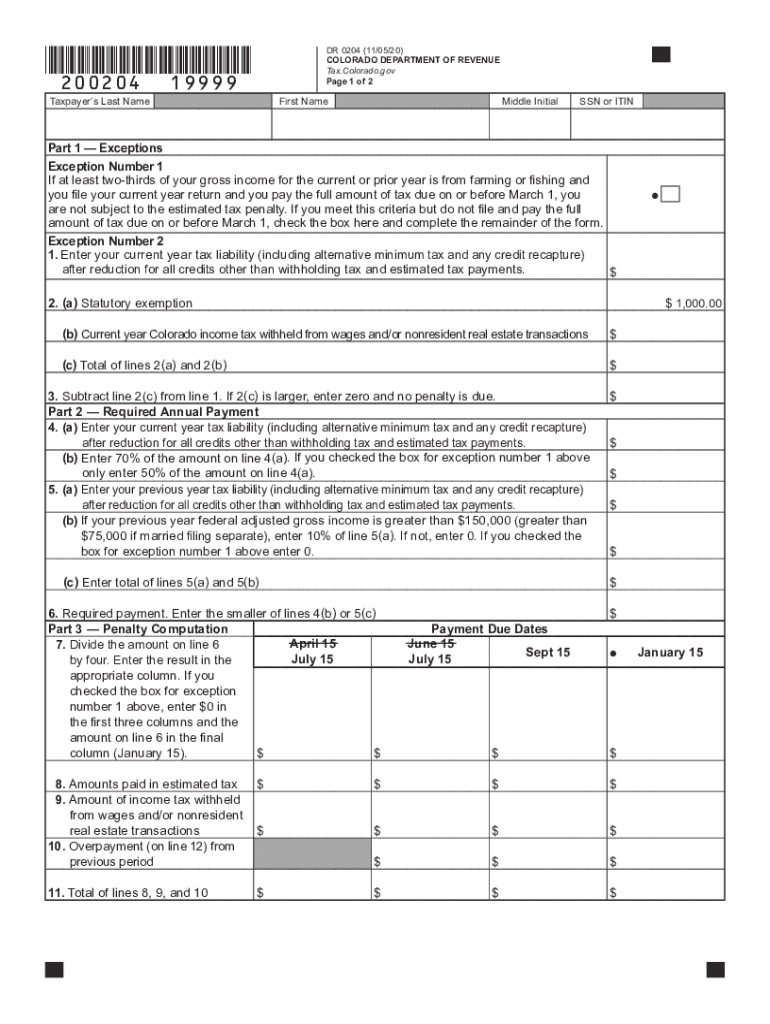

Dr 0204 Form Fill Out and Sign Printable PDF Template signNow

Instructions on how to receive an automatic colorado income tax extension step 2: At least 90% of the net tax liability must be paid by the return due date. Colorado personal income tax returns are due by april 15. Expressextension supports the filing of colorado business income tax. Automatic filing extension april 15, the deadline for filing.

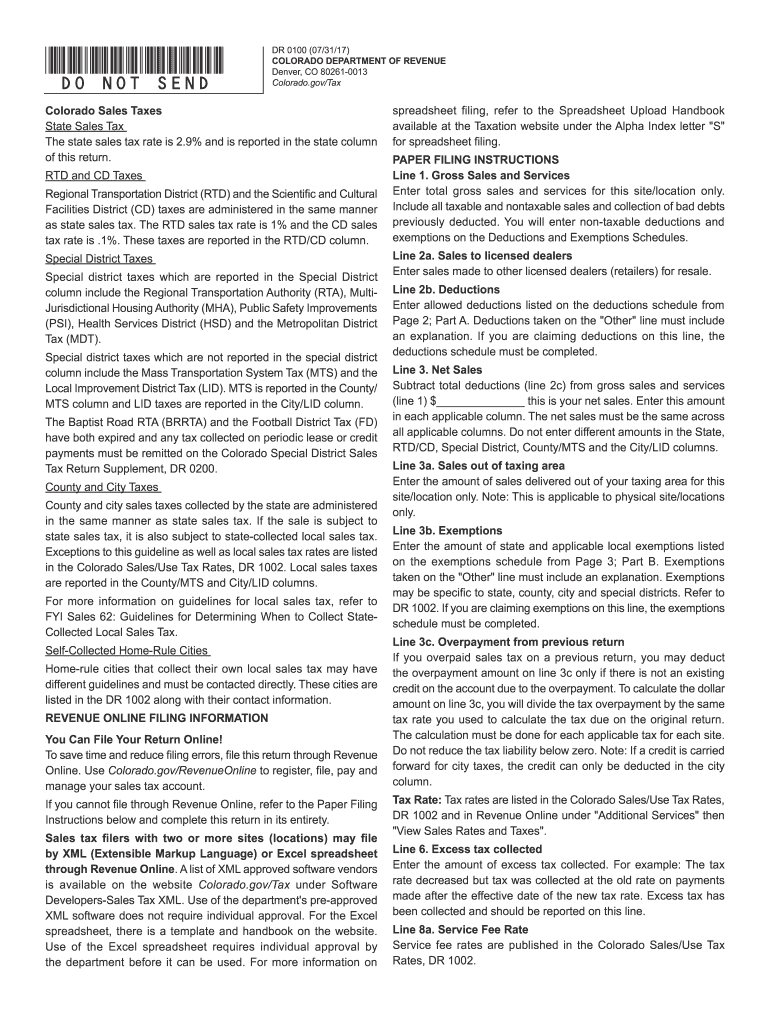

Colorado Retail Sales Tax Form Fill Out and Sign Printable PDF

Expressextension supports the filing of colorado business income tax. Once you have paid at least 90% of your income tax. Colorado personal income tax returns are due by april 15. If you owe state income tax, 90% of the tax liability must be paid on or. Web the state filing deadline is april 18, 2023.

Colorado State Tax Form

Web is now easier than before! At least 90% of the net tax liability must be paid by the return due date. Web the state filing deadline is april 18, 2023. Web $34.95 now only $29.95 file your personal tax extension now! If you owe co income taxes, you will either have to submit a co tax.

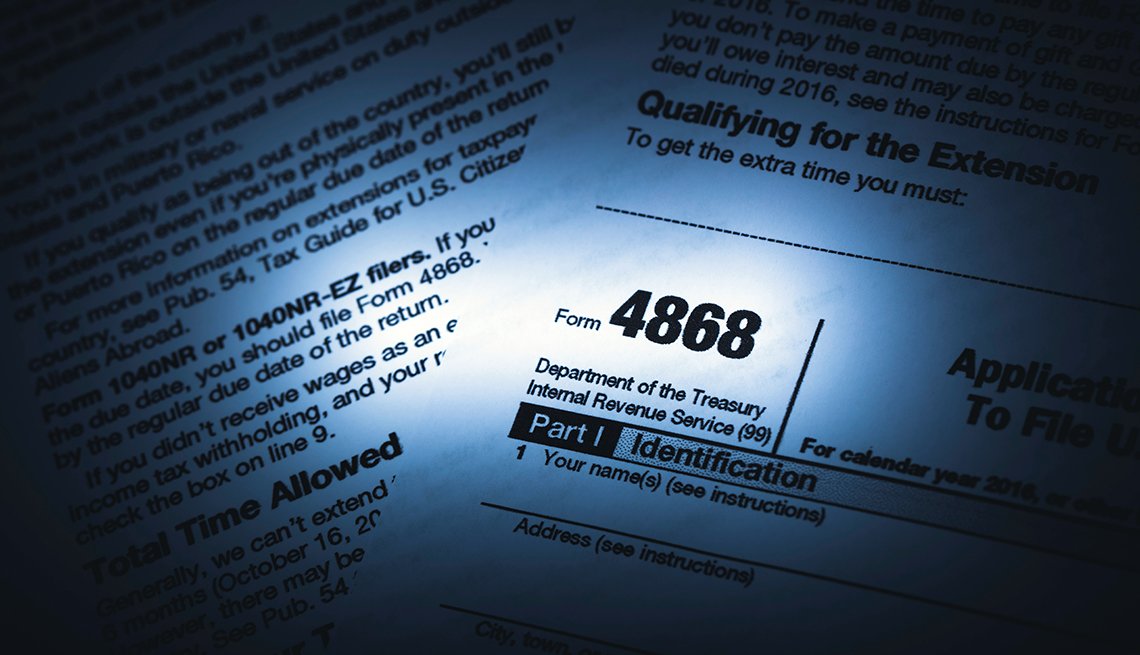

How to File a 2019 Tax Return Extension by July 15

Web the state filing deadline is april 18, 2023. Once you have paid at least 90% of your income tax. Automatic filing extension april 15, the deadline for filing. Pay all or some of your colorado income taxes online via: No application is required for an extension to file.

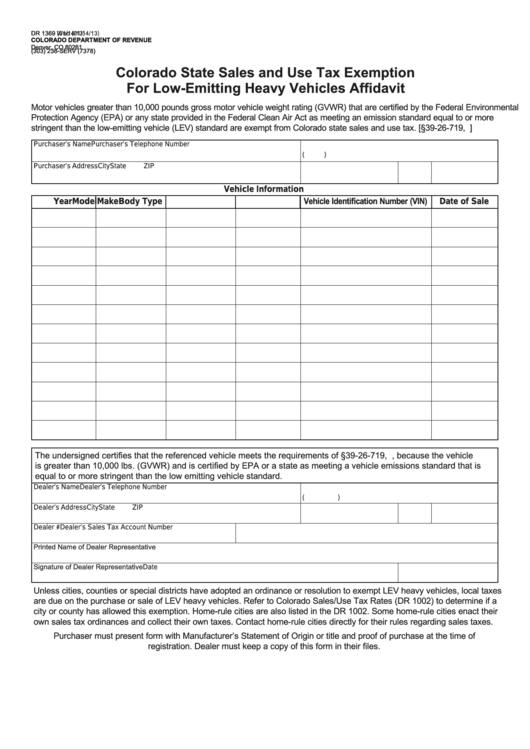

Form Dr 1369 Colorado State Sales And Use Tax Exemption For Low

Automatic filing extension april 15, the deadline for filing. If you owe state income tax, 90% of the tax liability must be paid on or. Citizens and resident aliens abroad who expect to qualify for special. Instructions on how to efile an irs income tax return extension colorado income. Instructions on how to receive an automatic colorado income tax extension.

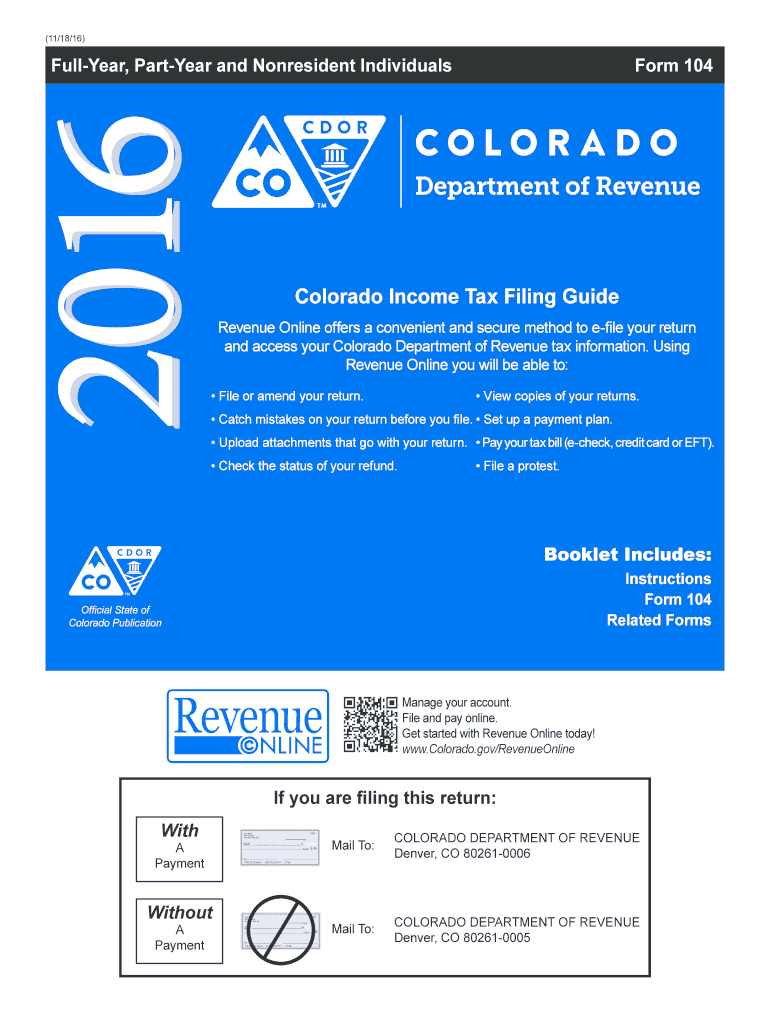

2016 Colorado Tax Form Fill Out and Sign Printable PDF Template signNow

You can then mail your printable form by paper to the state. If you owe state income tax, 90% of the tax liability must be paid on or. Automatic filing extension april 15, the deadline for filing. Web you need to either pay through revenue online or submit your payment with the extension payment form. Web pay online by credit/debit.

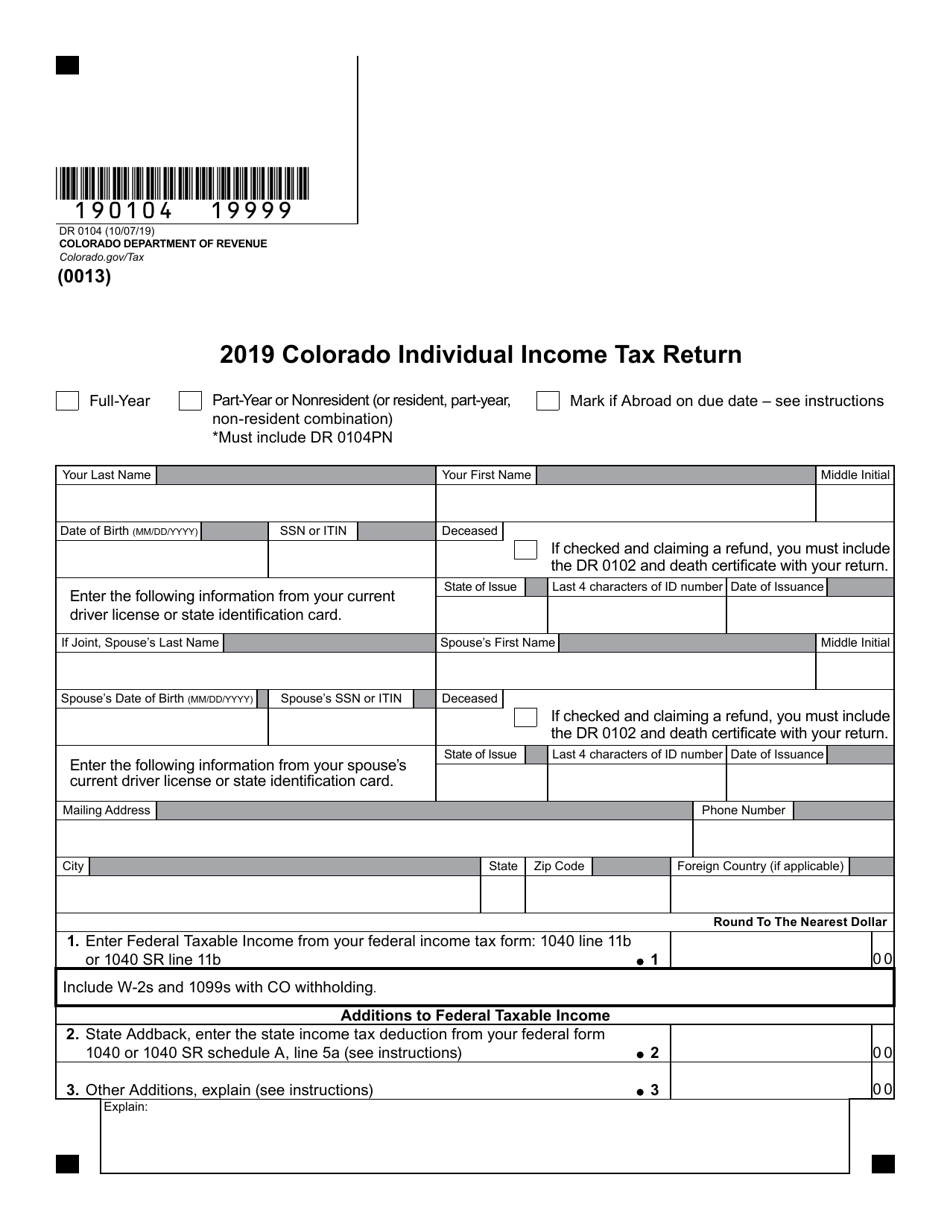

Form DR0104 Download Fillable PDF or Fill Online Colorado Individual

At least 90% of the net tax liability must be paid by the return due date. At least 90% of the net tax liability must be paid by the return due date. Automatic filing extension april 15, the deadline for filing. Web is now easier than before! Web pay online by credit/debit card or echeck.

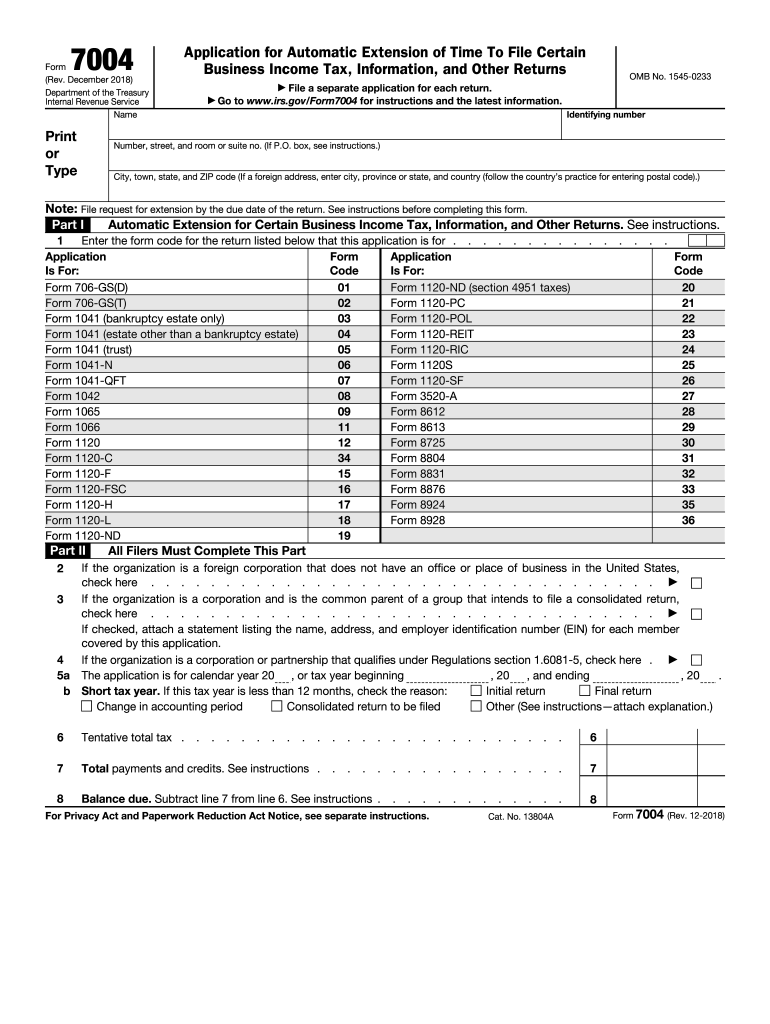

IRS 7004 2018 Fill and Sign Printable Template Online US Legal Forms

Income tax return (for u.s. Web pay online by credit/debit card or echeck. If you owe state income tax, 90% of the tax liability must be paid on or. You can then mail your printable form by paper to the state. At least 90% of the net tax liability must be paid by the return due date.

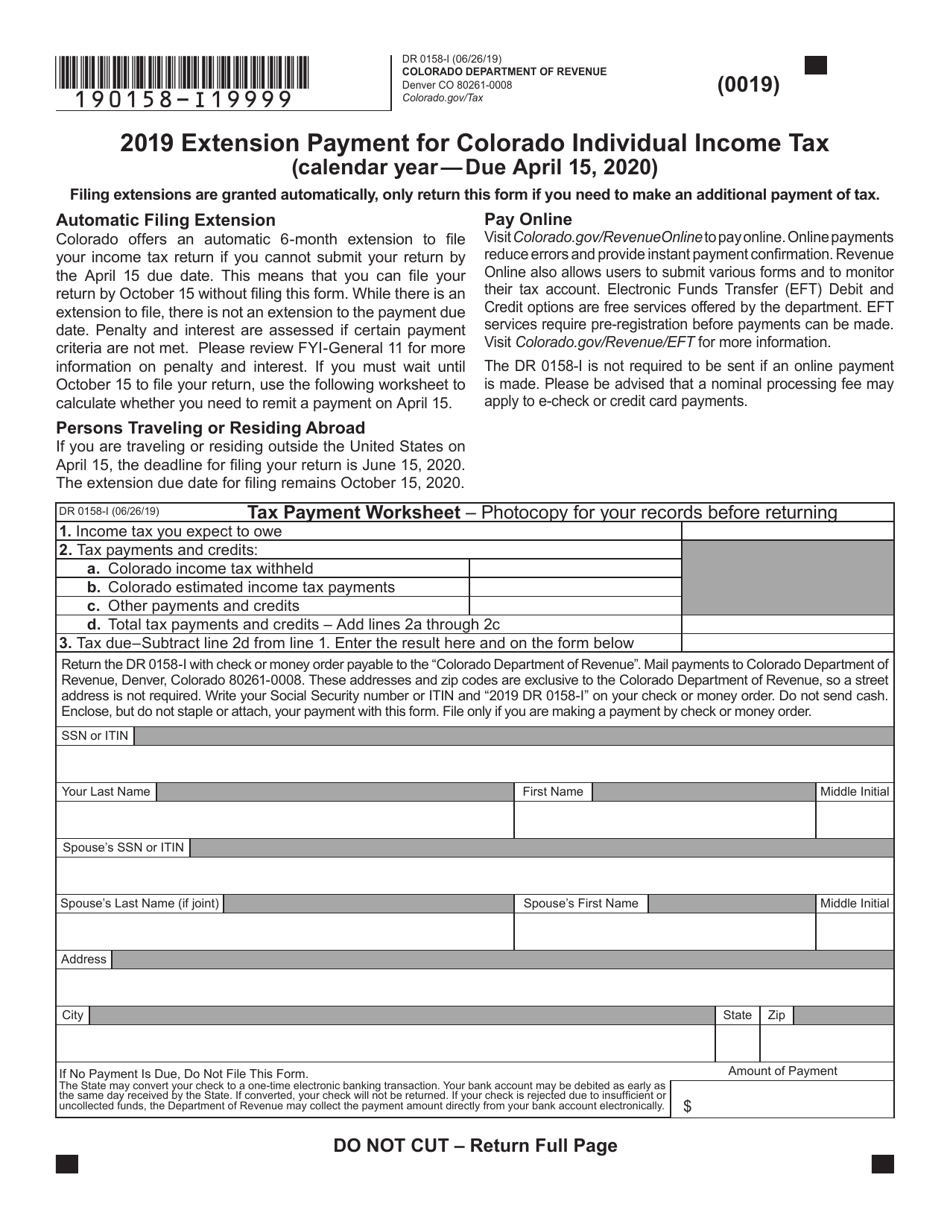

Form DR0158I Download Fillable PDF or Fill Online Extension Payment

Return this form only if you need to make an additional payment of tax. You can then mail your printable form by paper to the state. We will update this page with a new version of the form for 2024 as soon as it is made available. Web you need to either pay through revenue online or submit your payment.

Income Tax Return (For U.s.

Web income tax return (calendar year — due april 15, 2022) filing extensions are granted automatically. Web pay online by credit/debit card or echeck. Automatic filing extension april 15, the deadline for filing. At least 90% of the net tax liability must be paid by the return due date.

Web You Need To Either Pay Through Revenue Online Or Submit Your Payment With The Extension Payment Form.

Web filing extensions are granted automatically, only return this form if you need to make an additional payment of tax. Pay all or some of your colorado income taxes online via: You can then mail your printable form by paper to the state. Instructions on how to efile an irs income tax return extension colorado income.

Web Form 2350, Application For Extension Of Time To File U.s.

Expressextension supports the filing of colorado business income tax. Web is now easier than before! Once you have paid at least 90% of your income tax. Web $34.95 now only $29.95 file your personal tax extension now!

At Least 90% Of The Net Tax Liability Must Be Paid By The Return Due Date.

If you owe state income tax, 90% of the tax liability must be paid on or. Instructions on how to receive an automatic colorado income tax extension step 2: We will update this page with a new version of the form for 2024 as soon as it is made available. Citizens and resident aliens abroad who expect to qualify for special.