Crsc Calculator For Chapter 61 Retirees

Crsc Calculator For Chapter 61 Retirees - Web you may be eligible for crsc if you currently receive military retired pay and meet one of the following criteria: Web the longevity portion of your retired pay will be your crsc. Web concurrent receipt refers to a veteran’s simultaneous receipt of two types of monetary benefits: Post jul 03, 2014 #1. Web dod disability retirement: Web your retroactive payment date may go back as far as june 1, 2003, but can be limited based on: Web ch 61 medical retirement crsc calculation help. Medical chapter 61, temporary early retirement act (tera) and temporary disabled retirement list. Web a chapter 61 retiree is anyone who was medically retired from military service with a 30% or greater va rated disability. The va will pay a chapter 61 retiree at the 100% rate due to individual unemployability (iu).

$4584 (rounded) minus $2073 va disability comp = $2511 dod ret remaining. Web ch 61 medical retirement crsc calculation help. Post jul 03, 2014 #1. Web you may be eligible for crsc if you currently receive military retired pay and meet one of the following criteria: Medical chapter 61, temporary early retirement act (tera) and temporary disabled retirement list. Web the longevity portion of your retired pay will be your crsc. Web concurrent receipt refers to a veteran’s simultaneous receipt of two types of monetary benefits: Web this legislation expands eligibility to medical retirees with less than 20 years of service, effective january 1,. Web a chapter 61 retiree is anyone who was medically retired from military service with a 30% or greater rated disability. Web the basic retirement formula is:

The va will pay a chapter 61 retiree at the 100% rate due to individual unemployability (iu). Web ch 61 medical retirement crsc calculation help. Web a chapter 61 retiree is anyone who was medically retired from military service with a 30% or greater rated disability. Web concurrent receipt refers to a veteran’s simultaneous receipt of two types of monetary benefits: Web there are more than 575,000 chapter 61 retirees, and 50,300 of them receive combat related special compensation (crsc). 2616.66 high three base pay x 24.375% = 637.81. Web your retroactive payment date may go back as far as june 1, 2003, but can be limited based on: Retired pay base x multiplier % the retired pay base for a qualified disability retirement is. Web the basic retirement formula is: Web the longevity portion of your retired pay will be your crsc.

37+ Crsc Calculator For Chapter 61 Retirees CarlyCherry

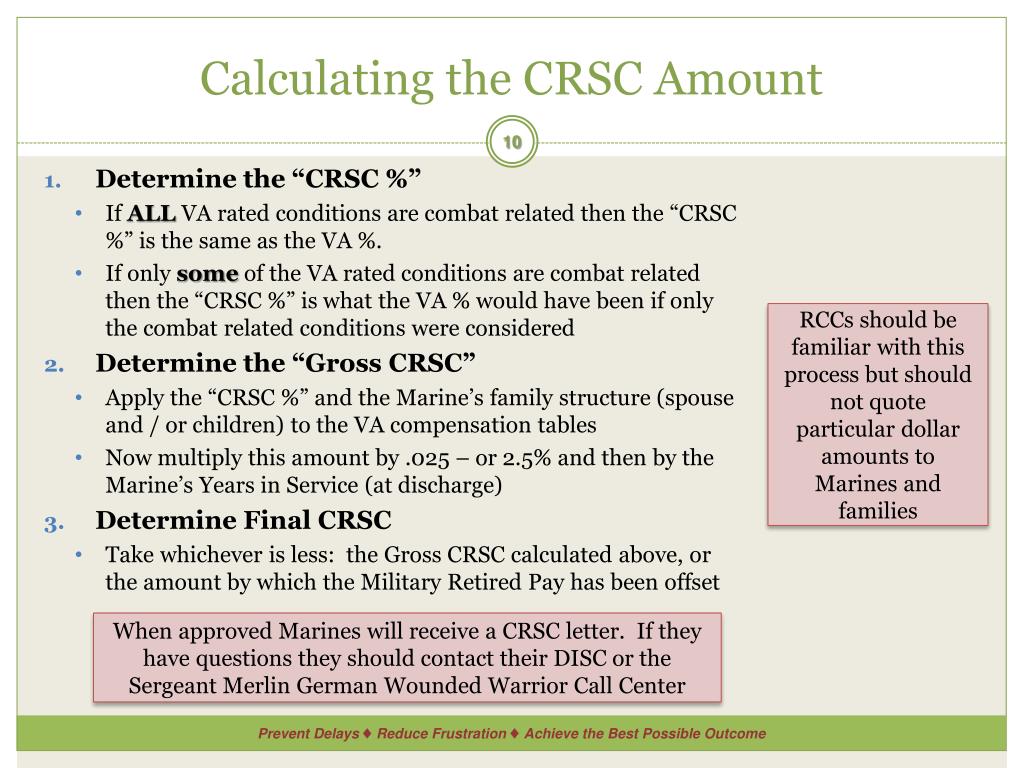

2616.66 high three base pay x 24.375% = 637.81. Web the longevity portion of your retired pay will be your crsc. Web concurrent receipt refers to a veteran’s simultaneous receipt of two types of monetary benefits: Web crsc calculation for chapter 61 retirees title 10 usc chapter 61 defines different categories of medical leave and. Web combat related special compensation.

22+ Big Stitch Merino Yarn CarlyCherry

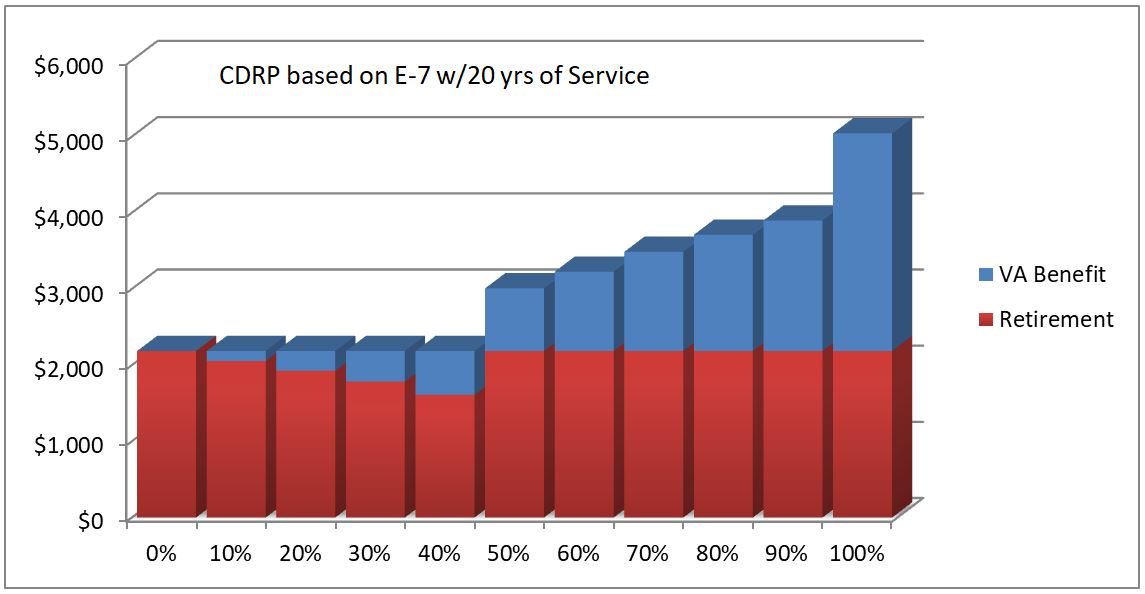

Web combat related special compensation (crsc), concurrent retirement and disability pay (crdp), and veterans affairs (va). According to law, members retired for disability under. Web the basic retirement formula is: Web special rules for chapter 61 disability retirees: Retired pay base x multiplier % the retired pay base for a qualified disability retirement is.

41+ Crsc Calculator For Chapter 61 Retirees SyreenHadee

Web the longevity portion of your retired pay will be your crsc. Web a chapter 61 retiree is anyone who was medically retired from military service with a 30% or greater rated disability. Web your retroactive payment date may go back as far as june 1, 2003, but can be limited based on: 2616.66 high three base pay x 24.375%.

Find the Best IRA Comparison Tool for Your Needs Gold IRA Explained

Web dod disability retirement: Web crsc calculation for chapter 61 retirees title 10 usc chapter 61 defines different categories of medical leave and. Web there are more than 575,000 chapter 61 retirees, and 50,300 of them receive combat related special compensation (crsc). Web special rules for chapter 61 disability retirees: Web a chapter 61 retiree is anyone who was medically.

37+ Crsc Calculator For Chapter 61 Retirees CarlyCherry

According to law, members retired for disability under. Web there are more than 575,000 chapter 61 retirees, and 50,300 of them receive combat related special compensation (crsc). Web dod disability retirement: Post jul 03, 2014 #1. Web your retroactive payment date may go back as far as june 1, 2003, but can be limited based on:

41+ Crsc Calculator For Chapter 61 Retirees SyreenHadee

Web a chapter 61 retiree is anyone who was medically retired from military service with a 30% or greater rated disability. Web combat related special compensation (crsc), concurrent retirement and disability pay (crdp), and veterans affairs (va). Web dod disability retirement: Web concurrent receipt refers to a veteran’s simultaneous receipt of two types of monetary benefits: 2616.66 high three base.

How To Calculate Crsc Bizfluent Gambaran

Web special rules for chapter 61 disability retirees: Medical chapter 61, temporary early retirement act (tera) and temporary disabled retirement list. Web the basic retirement formula is: According to law, members retired for disability under. The va will pay a chapter 61 retiree at the 100% rate due to individual unemployability (iu).

crsc calculator Physical Evaluation Board Forum

Web the longevity portion of your retired pay will be your crsc. Web concurrent receipt refers to a veteran’s simultaneous receipt of two types of monetary benefits: According to law, members retired for disability under. Web the basic retirement formula is: Web combat related special compensation (crsc), concurrent retirement and disability pay (crdp), and veterans affairs (va).

NeeveNatasza

According to law, members retired for disability under. 2616.66 high three base pay x 24.375% = 637.81. Web dod disability retirement: Web special rules for chapter 61 disability retirees: Web your retroactive payment date may go back as far as june 1, 2003, but can be limited based on:

41+ Crsc Calculator For Chapter 61 Retirees SyreenHadee

The va will pay a chapter 61 retiree at the 100% rate due to individual unemployability (iu). Web special rules for chapter 61 disability retirees: According to law, members retired for disability under. Web there are more than 575,000 chapter 61 retirees, and 50,300 of them receive combat related special compensation (crsc). Retired pay base x multiplier % the retired.

$4584 (Rounded) Minus $2073 Va Disability Comp = $2511 Dod Ret Remaining.

Web your retroactive payment date may go back as far as june 1, 2003, but can be limited based on: The va will pay a chapter 61 retiree at the 100% rate due to individual unemployability (iu). Post jul 03, 2014 #1. 2616.66 high three base pay x 24.375% = 637.81.

Web There Are More Than 575,000 Chapter 61 Retirees, And 50,300 Of Them Receive Combat Related Special Compensation (Crsc).

According to law, members retired for disability under. Web concurrent receipt refers to a veteran’s simultaneous receipt of two types of monetary benefits: Web the longevity portion of your retired pay will be your crsc. Web special rules for chapter 61 disability retirees:

Medical Chapter 61, Temporary Early Retirement Act (Tera) And Temporary Disabled Retirement List.

Web a chapter 61 retiree is anyone who was medically retired from military service with a 30% or greater va rated disability. Web dod disability retirement: Web combat related special compensation (crsc), concurrent retirement and disability pay (crdp), and veterans affairs (va). Web the basic retirement formula is:

Retired Pay Base X Multiplier % The Retired Pay Base For A Qualified Disability Retirement Is.

Web crsc calculation for chapter 61 retirees title 10 usc chapter 61 defines different categories of medical leave and. Web you may be eligible for crsc if you currently receive military retired pay and meet one of the following criteria: Web ch 61 medical retirement crsc calculation help. Web a chapter 61 retiree is anyone who was medically retired from military service with a 30% or greater rated disability.