Ct W4 Form

Ct W4 Form - Amended connecticut reconciliation of withholding: Reduced withholding amount per pay period: Leave those steps blank for the other jobs. Additional withholding amount per pay period: Your withholding is subject to review by the irs. Additional withholding amount per pay period: Keep a copy for your records. Enter withholding code letter chosen from above. You are required to pay connecticut income tax as income is earned or received during the year. Enter withholding code letter chosen from above.

Your withholding is subject to review by the irs. Reduced withholding amount per pay period: Amended connecticut reconciliation of withholding: Enter withholding code letter chosen from above. Your withholding is subject to review by the irs. Leave those steps blank for the other jobs. Additional withholding amount per pay period: Additional withholding amount per pay period: Enter withholding code letter chosen from above. You are required to pay connecticut income tax as income is earned or received during the year.

Reduced withholding amount per pay period: Amended connecticut reconciliation of withholding: Leave those steps blank for the other jobs. Your withholding is subject to review by the irs. Additional withholding amount per pay period: Keep a copy for your records. Enter withholding code letter chosen from above. Claim dependents if your total income will be $200,000 or less ($400,000 or less if married. Your withholding is subject to review by the irs. Additional withholding amount per pay period:

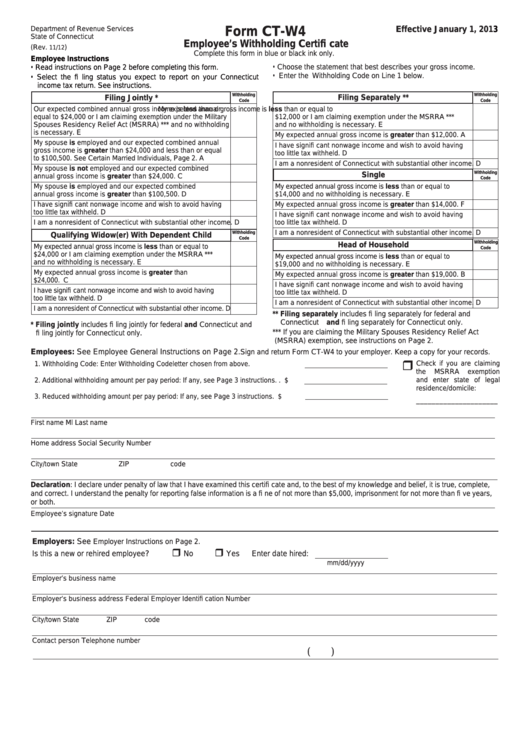

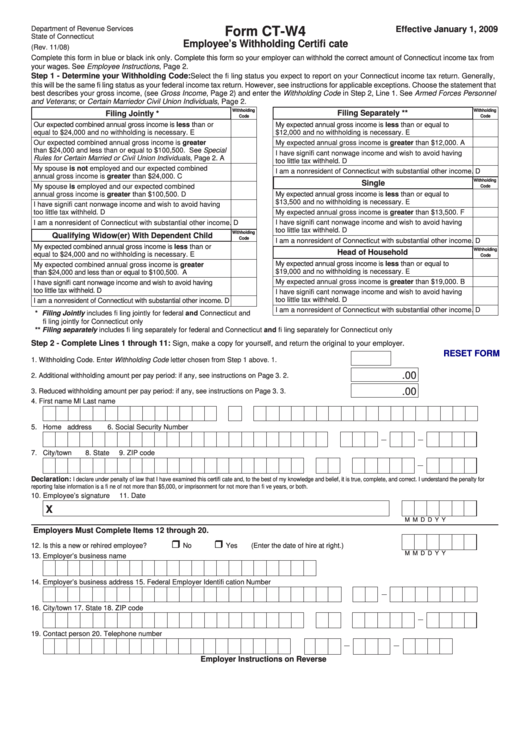

Form CtW4 Employee'S Withholding Certifi Cate 2013 printable pdf

Additional withholding amount per pay period: Enter withholding code letter chosen from above. Enter withholding code letter chosen from above. Reduced withholding amount per pay period: Keep a copy for your records.

Download Connecticut Form CTW4 (2012) for Free FormTemplate

Amended connecticut reconciliation of withholding: Enter withholding code letter chosen from above. Your withholding is subject to review by the irs. Enter withholding code letter chosen from above. Additional withholding amount per pay period:

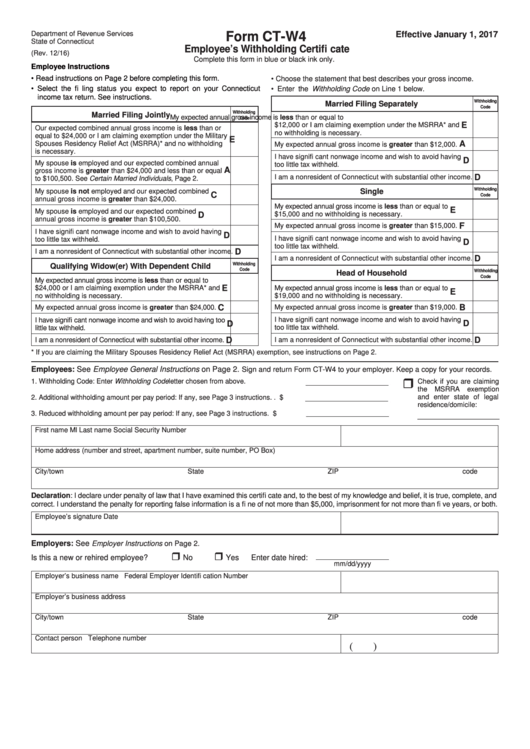

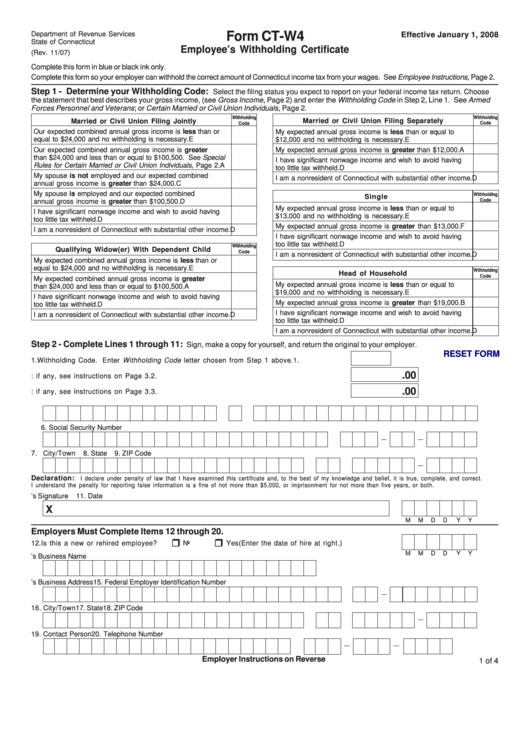

Form CtW4 Employee'S Withholding Certificate printable pdf download

Your withholding is subject to review by the irs. Additional withholding amount per pay period: You are required to pay connecticut income tax as income is earned or received during the year. Reduced withholding amount per pay period: Leave those steps blank for the other jobs.

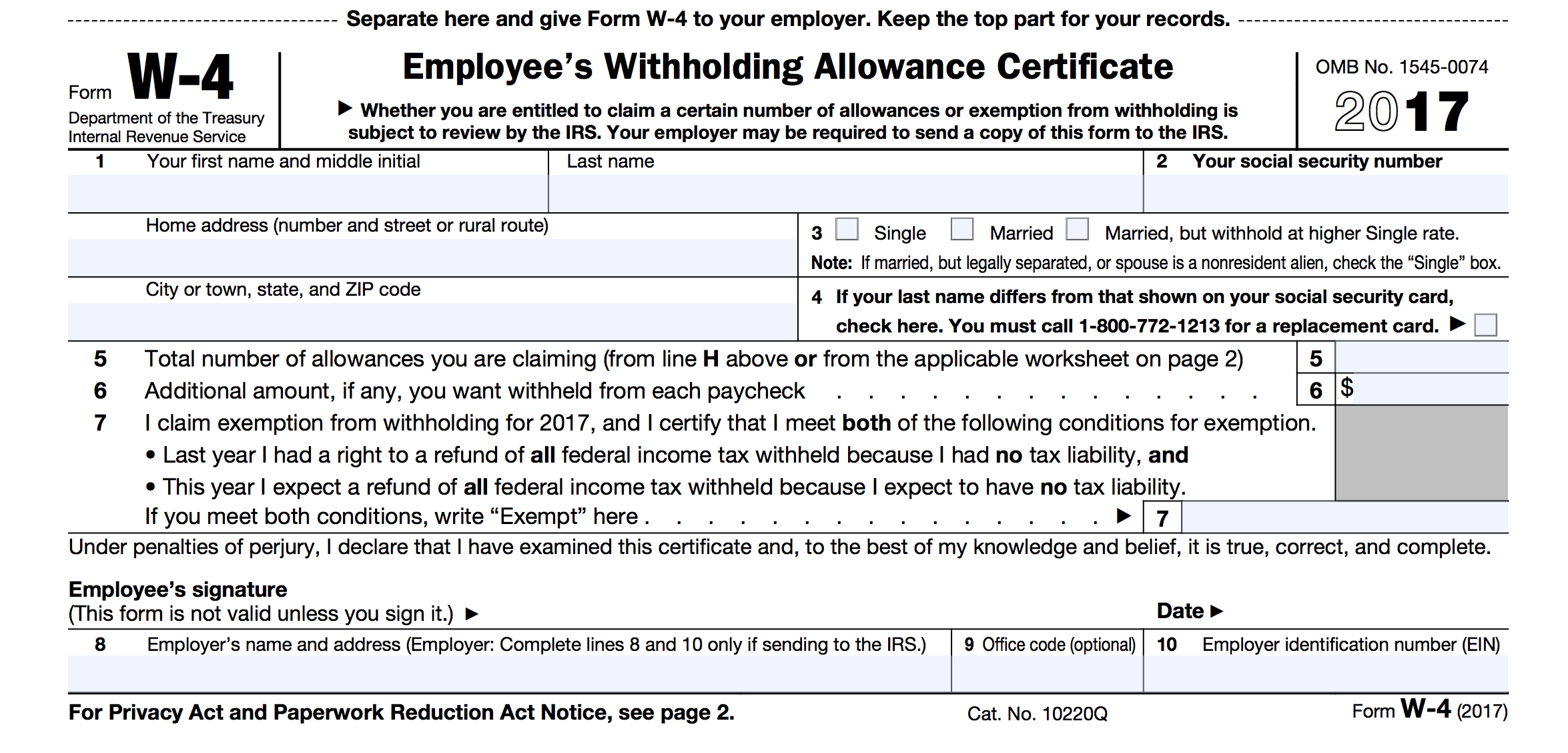

Printable W4 And I9 Forms 2022 W4 Form

Reduced withholding amount per pay period: Your withholding is subject to review by the irs. Your withholding is subject to review by the irs. Claim dependents if your total income will be $200,000 or less ($400,000 or less if married. You are required to pay connecticut income tax as income is earned or received during the year.

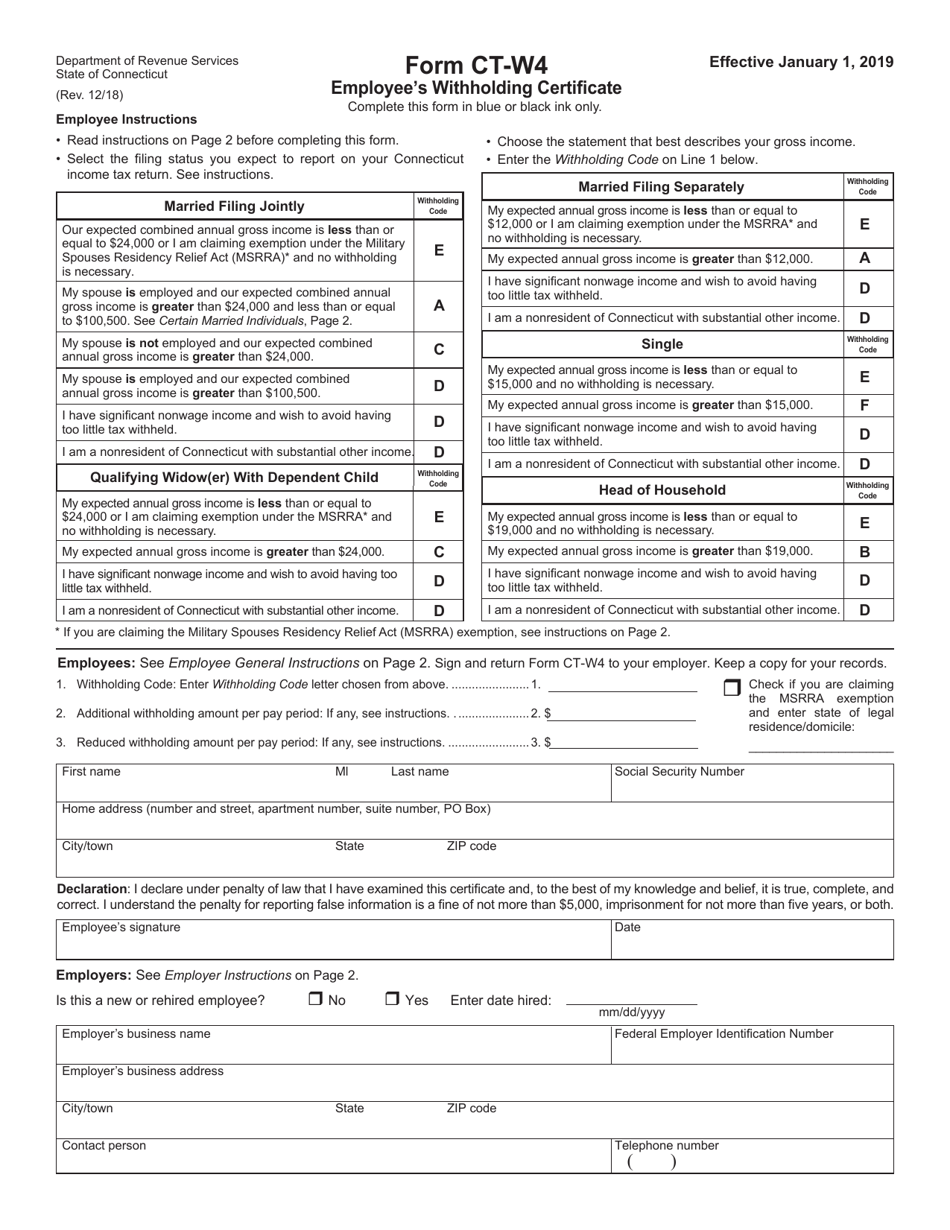

Form CTW4 Download Printable PDF or Fill Online Employee's Withholding

Additional withholding amount per pay period: Reduced withholding amount per pay period: Claim dependents if your total income will be $200,000 or less ($400,000 or less if married. You are required to pay connecticut income tax as income is earned or received during the year. Leave those steps blank for the other jobs.

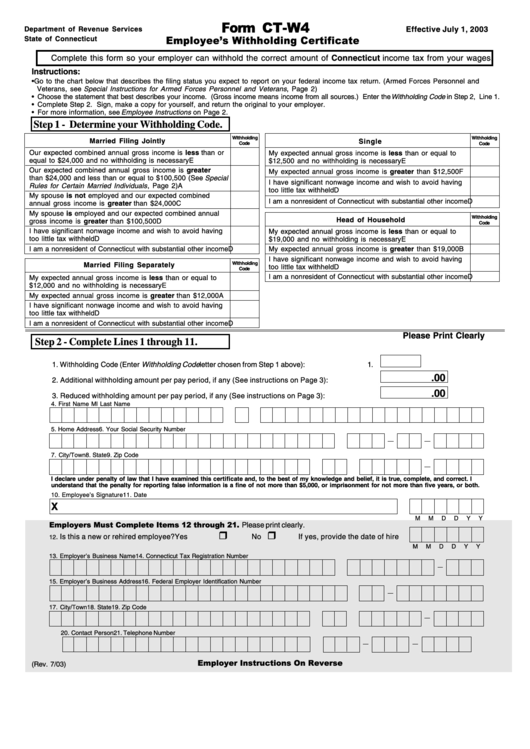

Form CtW4 Employee'S Withholding Certificate 2003 printable pdf

Your withholding is subject to review by the irs. Claim dependents if your total income will be $200,000 or less ($400,000 or less if married. Enter withholding code letter chosen from above. Leave those steps blank for the other jobs. Additional withholding amount per pay period:

Ct W4 20202022 Fill and Sign Printable Template Online US Legal Forms

Enter withholding code letter chosen from above. Additional withholding amount per pay period: Leave those steps blank for the other jobs. Your withholding is subject to review by the irs. Keep a copy for your records.

Fillable Form CtW4 Employee'S Withholding Certificate printable pdf

Enter withholding code letter chosen from above. Your withholding is subject to review by the irs. Additional withholding amount per pay period: Additional withholding amount per pay period: Keep a copy for your records.

Fillable Form CtW4 Employee'S Withholding Certificate printable pdf

Claim dependents if your total income will be $200,000 or less ($400,000 or less if married. Your withholding is subject to review by the irs. Leave those steps blank for the other jobs. Amended connecticut reconciliation of withholding: Additional withholding amount per pay period:

Download Connecticut Form CTW4 (2013) for Free TidyTemplates

You are required to pay connecticut income tax as income is earned or received during the year. Reduced withholding amount per pay period: Claim dependents if your total income will be $200,000 or less ($400,000 or less if married. Leave those steps blank for the other jobs. Keep a copy for your records.

Enter Withholding Code Letter Chosen From Above.

Reduced withholding amount per pay period: Your withholding is subject to review by the irs. Claim dependents if your total income will be $200,000 or less ($400,000 or less if married. Additional withholding amount per pay period:

Leave Those Steps Blank For The Other Jobs.

Amended connecticut reconciliation of withholding: You are required to pay connecticut income tax as income is earned or received during the year. Enter withholding code letter chosen from above. Keep a copy for your records.

Your Withholding Is Subject To Review By The Irs.

Additional withholding amount per pay period: