Depreciation Expense Income Statement Or Balance Sheet

Depreciation Expense Income Statement Or Balance Sheet - It is reported on the income statement along with other normal business expenses. It accounts for depreciation charged to expense for the. Depreciation expense is not a current asset; On an income statement or balance sheet. For income statements, depreciation is listed as an expense. Accumulated depreciation appears in a contra asset. Web on the income statement, it is listed as depreciation expense, and refers to the amount of depreciation that was charged to expense only in that reporting period. The depreciation reported on the balance sheet is the accumulated or the cumulative total amount of depreciation that has been reported as depreciation expense on the. On the balance sheet, it is listed as. Accumulated depreciation is listed on the balance.

It is reported on the income statement along with other normal business expenses. Web depreciation on the balance sheet. For income statements, depreciation is listed as an expense. Accumulated depreciation is listed on the balance. Web depreciation is typically tracked one of two places: Web on the income statement, it is listed as depreciation expense, and refers to the amount of depreciation that was charged to expense only in that reporting period. Depreciation expense is not a current asset; The depreciation reported on the balance sheet is the accumulated or the cumulative total amount of depreciation that has been reported as depreciation expense on the. Accumulated depreciation appears in a contra asset. On an income statement or balance sheet.

Accumulated depreciation appears in a contra asset. Web depreciation is typically tracked one of two places: Accumulated depreciation is listed on the balance. On an income statement or balance sheet. Depreciation expense is not a current asset; On the balance sheet, it is listed as. For income statements, depreciation is listed as an expense. Web on the income statement, it is listed as depreciation expense, and refers to the amount of depreciation that was charged to expense only in that reporting period. Web depreciation on the balance sheet. It accounts for depreciation charged to expense for the.

You may have to read this Accumulated Depreciation Balance Sheet

Accumulated depreciation is listed on the balance. For income statements, depreciation is listed as an expense. Web depreciation on the balance sheet. Accumulated depreciation appears in a contra asset. It is reported on the income statement along with other normal business expenses.

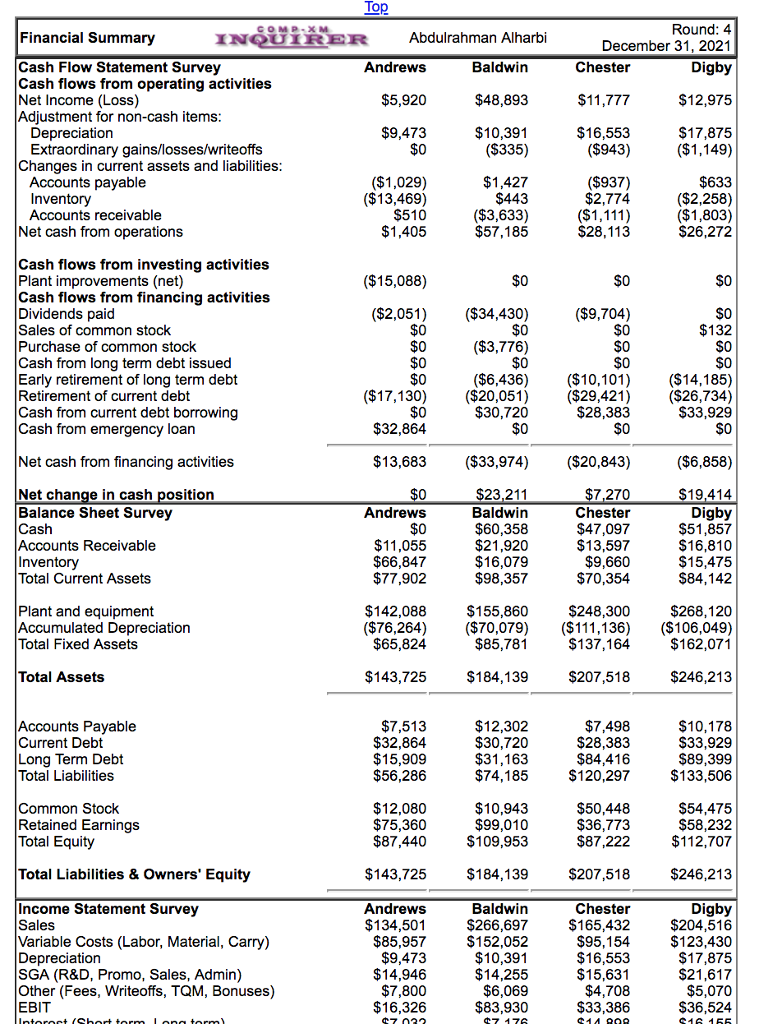

Solved Roun Financial Summary INQUIRER Abdulrahman Alharbi

Accumulated depreciation appears in a contra asset. On the balance sheet, it is listed as. Web on the income statement, it is listed as depreciation expense, and refers to the amount of depreciation that was charged to expense only in that reporting period. For income statements, depreciation is listed as an expense. On an income statement or balance sheet.

Prepare Financial Statements Using the Adjusted Trial Balance SPSCC

On an income statement or balance sheet. Accumulated depreciation appears in a contra asset. The depreciation reported on the balance sheet is the accumulated or the cumulative total amount of depreciation that has been reported as depreciation expense on the. Web depreciation is typically tracked one of two places: Web depreciation on the balance sheet.

Why does accumulated depreciation have a credit balance on the balance

Accumulated depreciation is listed on the balance. The depreciation reported on the balance sheet is the accumulated or the cumulative total amount of depreciation that has been reported as depreciation expense on the. For income statements, depreciation is listed as an expense. It is reported on the income statement along with other normal business expenses. Web depreciation on the balance.

4.5 Prepare Financial Statements Using the Adjusted Trial Balance

On the balance sheet, it is listed as. Web on the income statement, it is listed as depreciation expense, and refers to the amount of depreciation that was charged to expense only in that reporting period. Web depreciation on the balance sheet. Accumulated depreciation is listed on the balance. It accounts for depreciation charged to expense for the.

LO 4.5 Prepare Financial Statements Using the Adjusted Trial Balance

Accumulated depreciation is listed on the balance. Web depreciation is typically tracked one of two places: On the balance sheet, it is listed as. Web depreciation on the balance sheet. It is reported on the income statement along with other normal business expenses.

Depreciation Turns Capital Expenditures into Expenses Over Time

Depreciation expense is not a current asset; Web depreciation is typically tracked one of two places: On an income statement or balance sheet. For income statements, depreciation is listed as an expense. It is reported on the income statement along with other normal business expenses.

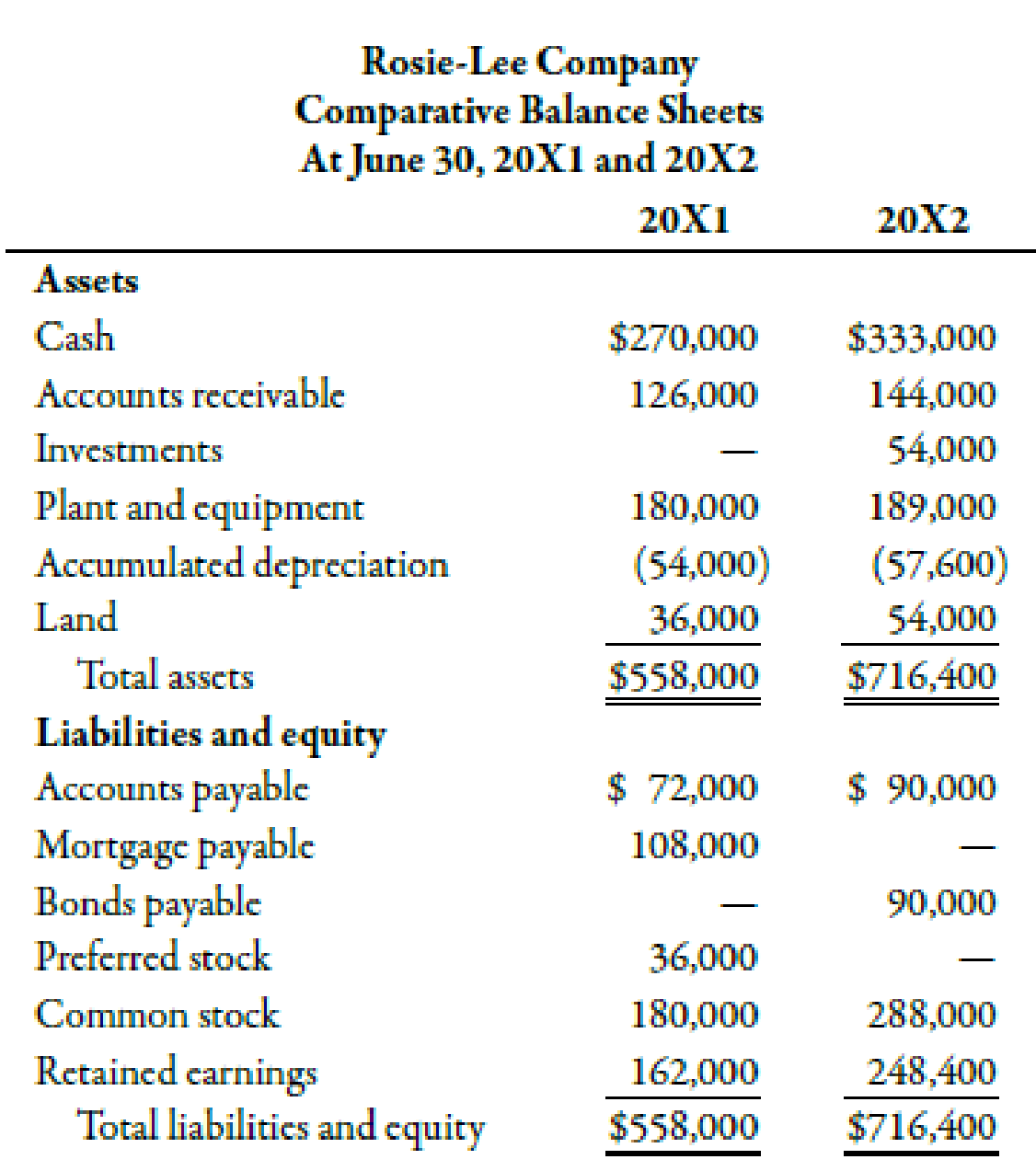

The following balance sheets and statement were taken from the

Web depreciation is typically tracked one of two places: It is reported on the income statement along with other normal business expenses. Accumulated depreciation is listed on the balance. Depreciation expense is not a current asset; For income statements, depreciation is listed as an expense.

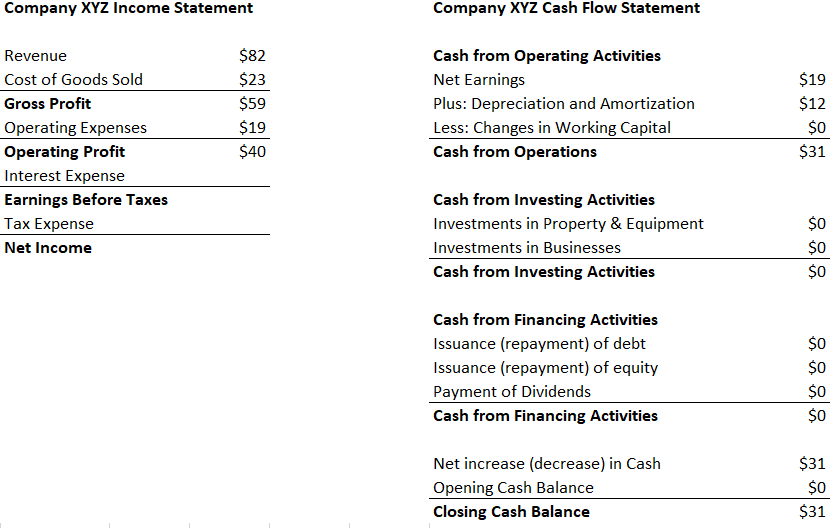

Statements for Business Owners Enkel BackOffice Solutions

Accumulated depreciation appears in a contra asset. It accounts for depreciation charged to expense for the. On the balance sheet, it is listed as. Accumulated depreciation is listed on the balance. For income statements, depreciation is listed as an expense.

Solved STATEMENT Sales Cost of goods sold

It is reported on the income statement along with other normal business expenses. On the balance sheet, it is listed as. Accumulated depreciation appears in a contra asset. For income statements, depreciation is listed as an expense. It accounts for depreciation charged to expense for the.

On The Balance Sheet, It Is Listed As.

For income statements, depreciation is listed as an expense. It is reported on the income statement along with other normal business expenses. Accumulated depreciation is listed on the balance. Web depreciation on the balance sheet.

Web Depreciation Is Typically Tracked One Of Two Places:

Web on the income statement, it is listed as depreciation expense, and refers to the amount of depreciation that was charged to expense only in that reporting period. Accumulated depreciation appears in a contra asset. On an income statement or balance sheet. The depreciation reported on the balance sheet is the accumulated or the cumulative total amount of depreciation that has been reported as depreciation expense on the.

Depreciation Expense Is Not A Current Asset;

It accounts for depreciation charged to expense for the.