Does Form 114 Need An Extension

Does Form 114 Need An Extension - For calendar year 2022, the deadline for filing fincen form 114 is april 15, 2023. If the combined value of your foreign financial assets surpasses $10,000 anytime throughout. The fbar is the foreign bank account reporting form. Web up to $40 cash back the deadline to file form 114, also known as the report of foreign bank and financial accounts (fbar), is typically april 15th of each year. Web for 2016, the form is now due april 18, 2017, but the financial crimes enforcement network (fincen) is providing an automatic extension for all filers of the. Web in many cases, us persons may have both financial interest and signature authority accounts to report. Taxpayers in certain disaster areas do not need to submit an extension. Web before you know it, you have savings accounts, investments, and more. Get the rundown on what you need to know about fbar filing and. Web you must file your extension request no later than the regular due date of your return.

When (and how) do i report money in foreign bank accounts? Web before you know it, you have savings accounts, investments, and more. Web the extension of the federal income tax filing due date and other tax deadlines for individuals to may 17, 2021, does not affect the fbar requirement. If the combined value of your foreign financial assets surpasses $10,000 anytime throughout. The fbar is not a complicated form to complete, but failing to file an. Web in many cases, us persons may have both financial interest and signature authority accounts to report. Web automatic extension to submit fbar: It is technically referred to as fincen form 114. Persons with an interest in or signature or other authority over foreign financial accounts where the total value exceeded $10,000 at any time during 2022 must. For calendar year 2022, the deadline for filing fincen form 114 is april 15, 2023.

Persons with an interest in or signature or other authority over foreign financial accounts where the total value exceeded $10,000 at any time during 2022 must. Web at a glance what is an fbar? Web before you know it, you have savings accounts, investments, and more. Web do you need to file an extension for form 114? Do you need to file an extension for form 114? If the combined value of your foreign financial assets surpasses $10,000 anytime throughout. Web up to $40 cash back the deadline to file form 114, also known as the report of foreign bank and financial accounts (fbar), is typically april 15th of each year. Web the extension of the federal income tax filing due date and other tax deadlines for individuals to may 17, 2021, does not affect the fbar requirement. Even though the fbar is not a tax form, since 2003 the internal revenue service has taken over enforcement of fincen form 114. Forms 114 are filed with fincen (not the internal revenue service.

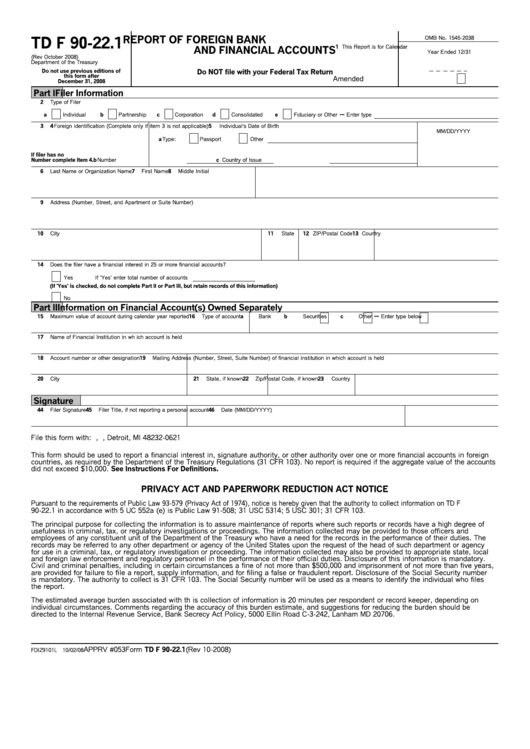

USAFA Form 114 Fill Out, Sign Online and Download Fillable PDF

Persons with an interest in or signature or other authority over foreign financial accounts where the total value exceeded $10,000 at any time during 2022 must. Web you must file your extension request no later than the regular due date of your return. It is technically referred to as fincen form 114. Web up to $40 cash back the deadline.

Does Report of Foreign Bank and Financial Accounts (FBAR) on FinCEN

Web do you need to file an extension for form 114? Web form 114 is the form used to report financial interests or signatory authority over foreign financial interests as required under the report of foreign bank and financial accounts. For calendar year 2022, the deadline for filing fincen form 114 is april 15, 2023. Taxpayers in certain disaster areas.

Does Report of Foreign Bank and Financial Accounts (FBAR) on FinCEN

For calendar year 2022, the deadline for filing fincen form 114 is april 15, 2023. Web automatic extension to submit fbar: If the combined value of your foreign financial assets surpasses $10,000 anytime throughout. Taxpayers in certain disaster areas do not need to submit an extension. Web do you need to file an extension for form 114?

Form 114 Due Date

Web automatic extension to submit fbar: Web form 114 is the form used to report financial interests or signatory authority over foreign financial interests as required under the report of foreign bank and financial accounts. Even though the fbar is not a tax form, since 2003 the internal revenue service has taken over enforcement of fincen form 114. Web do.

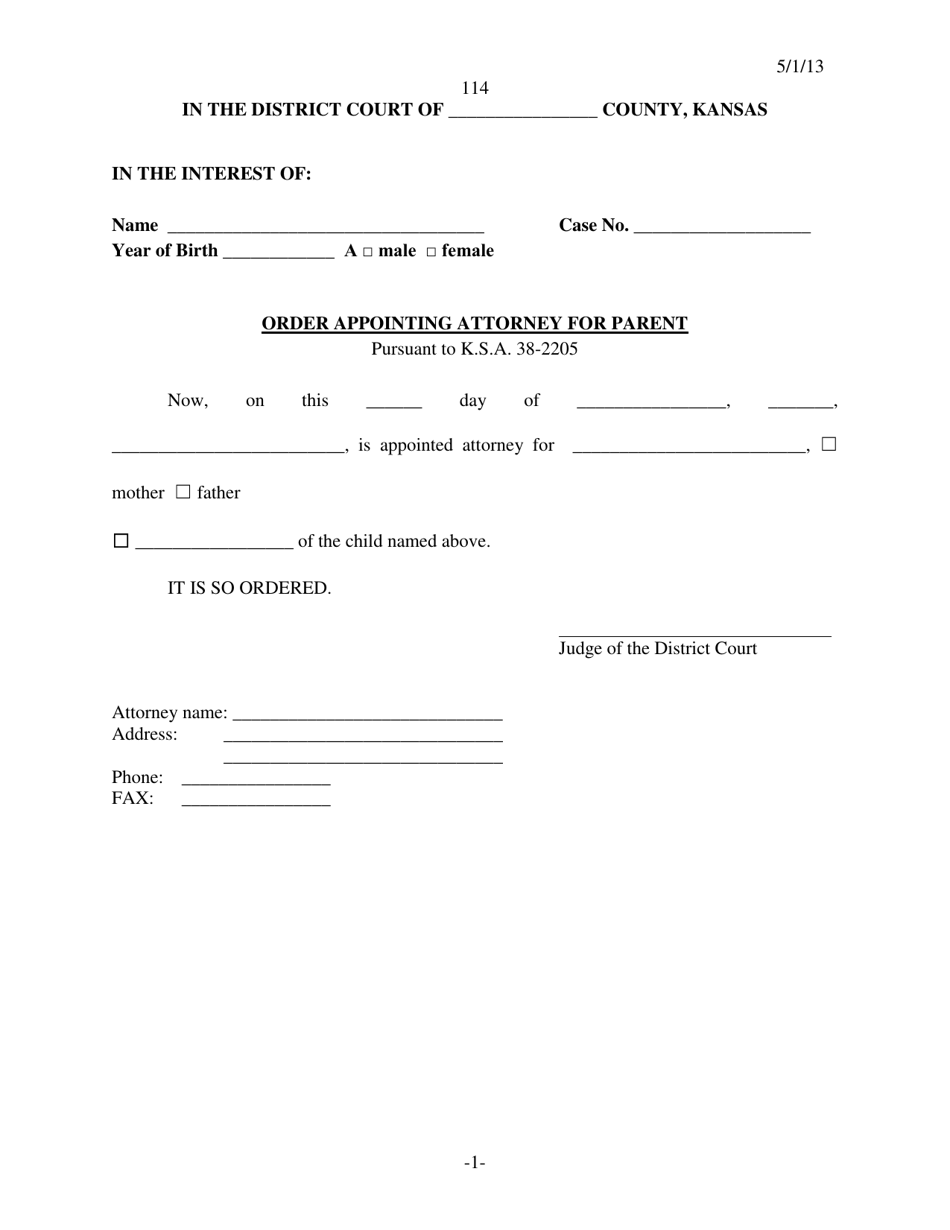

Form 114 Download Fillable PDF or Fill Online Order Appointing Attorney

Do you need to file an extension for form 114? Taxpayers in certain disaster areas do not need to submit an extension. Forms 114 are filed with fincen (not the internal revenue service. Web additional information for form 114 is available on the united states department of the treasury, financial crimes enforcement network (fincen) website:. Web in many cases, us.

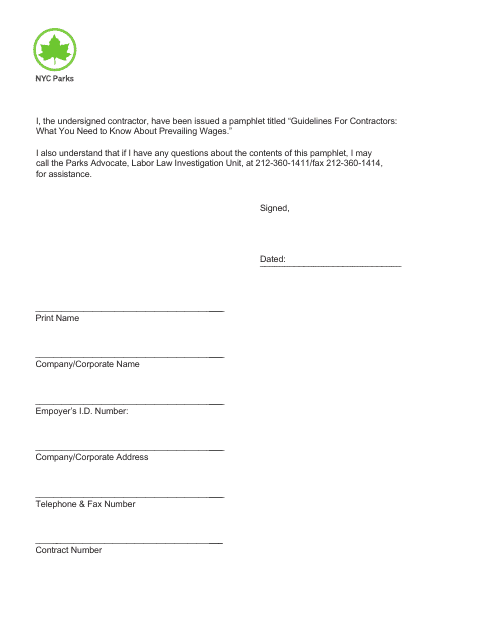

Form 114 Download Printable PDF or Fill Online Prevailing Wage

No action is required in ultratax cs to extend fincen form 114 (fbar) since specific requests for this extension are not required. Web form 114 is the form used to report financial interests or signatory authority over foreign financial interests as required under the report of foreign bank and financial accounts. Fincen is the financial crimes. Web do you need.

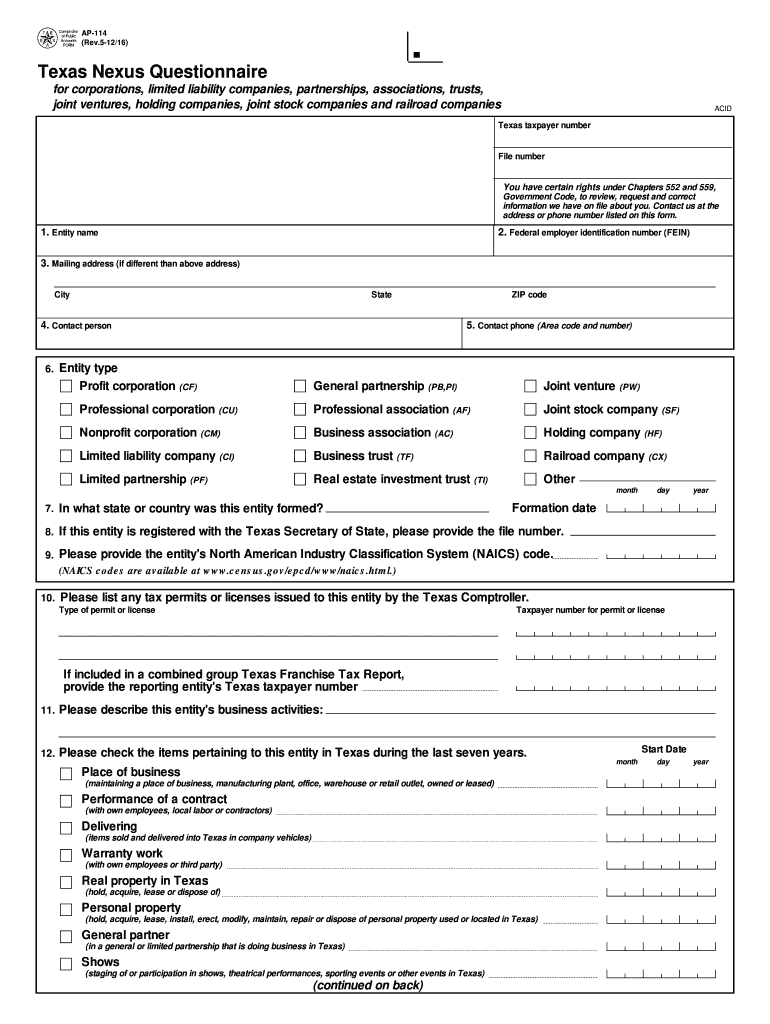

Ap 114 Form Fill Out and Sign Printable PDF Template signNow

Web in many cases, us persons may have both financial interest and signature authority accounts to report. If the combined value of your foreign financial assets surpasses $10,000 anytime throughout. Persons with an interest in or signature or other authority over foreign financial accounts where the total value exceeded $10,000 at any time during 2022 must. Web up to $40.

Form 114 Due Date

Web additionally, if you are unable to file the form by april 15, there is no need to file an extension, as you are allowed an automatic extension until october 15. Web before you know it, you have savings accounts, investments, and more. Web for 2016, the form is now due april 18, 2017, but the financial crimes enforcement network.

Are you a Corporate or SCorp? Know your Extension Form Type in Form

For calendar year 2022, the deadline for filing fincen form 114 is april 15, 2023. Web for 2016, the form is now due april 18, 2017, but the financial crimes enforcement network (fincen) is providing an automatic extension for all filers of the. It is technically referred to as fincen form 114. Web before you know it, you have savings.

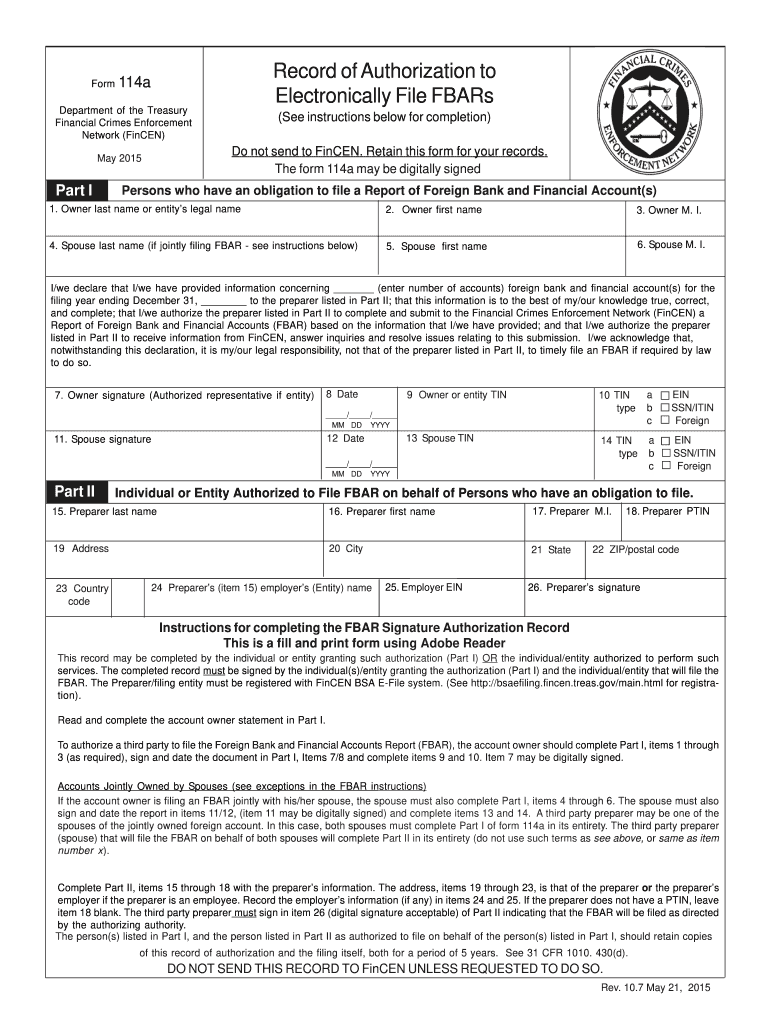

20152021 FinCen Form 114a Fill Online, Printable, Fillable, Blank

No action is required in ultratax cs to extend fincen form 114 (fbar) since specific requests for this extension are not required. Web at a glance what is an fbar? The fbar is the foreign bank account reporting form. Fincen is the financial crimes. For calendar year 2022, the deadline for filing fincen form 114 is april 15, 2023.

Fincen Is The Financial Crimes.

Taxpayers in certain disaster areas do not need to submit an extension. The fbar is the foreign bank account reporting form. Get the rundown on what you need to know about fbar filing and. Forms 114 are filed with fincen (not the internal revenue service.

Web Additional Information For Form 114 Is Available On The United States Department Of The Treasury, Financial Crimes Enforcement Network (Fincen) Website:.

Persons with an interest in or signature or other authority over foreign financial accounts where the total value exceeded $10,000 at any time during 2022 must. Web for 2016, the form is now due april 18, 2017, but the financial crimes enforcement network (fincen) is providing an automatic extension for all filers of the. The fbar is not a complicated form to complete, but failing to file an. If the combined value of your foreign financial assets surpasses $10,000 anytime throughout.

Web Form 114 Is The Form Used To Report Financial Interests Or Signatory Authority Over Foreign Financial Interests As Required Under The Report Of Foreign Bank And Financial Accounts.

It is technically referred to as fincen form 114. Web in many cases, us persons may have both financial interest and signature authority accounts to report. Web at a glance what is an fbar? Even though the fbar is not a tax form, since 2003 the internal revenue service has taken over enforcement of fincen form 114.

Web Before You Know It, You Have Savings Accounts, Investments, And More.

Web additionally, if you are unable to file the form by april 15, there is no need to file an extension, as you are allowed an automatic extension until october 15. When (and how) do i report money in foreign bank accounts? Web you must file your extension request no later than the regular due date of your return. Web the extension of the federal income tax filing due date and other tax deadlines for individuals to may 17, 2021, does not affect the fbar requirement.