Does Not Carry To Form 8880

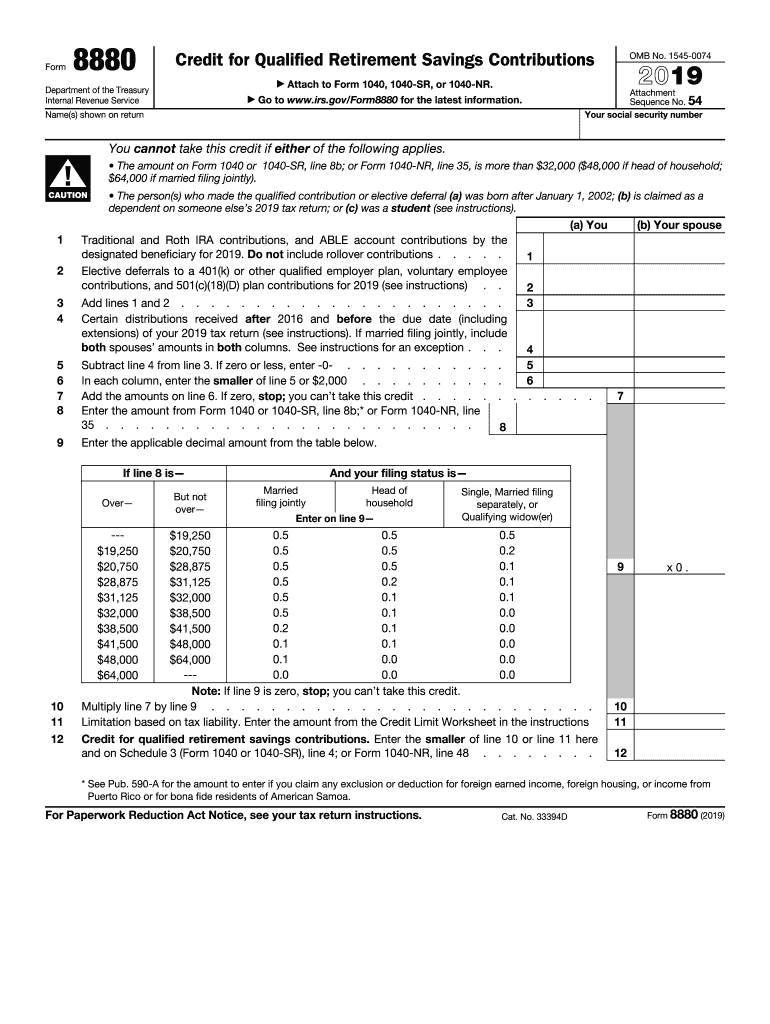

Does Not Carry To Form 8880 - $65,000 if married filing jointly). Web footnotes plans that qualify are listed on form 8880. Depending on your adjusted gross income. Web form 8880 not generating credit due to pension distributions in lacerte solved • by intuit • 11 • updated july 12, 2022 this article explains what to do if form. If the saver’s credit exceeds their tax. Web when the form has not been produced, a notes page may advise you if the taxpayer might qualify for 8880 credit. Web problem with form 8880? Answer yes if the taxpayer will make a qualifying ira contribution for tax year 2021 by the due date of the return. Web two key pieces of information you need before preparing form 8880 is the agi you calculate on your income tax return and documentation that reports your total. The person(s) who made the.

Answer yes if the taxpayer will make a qualifying ira contribution for tax year 2021 by the due date of the return. Web problem with form 8880? If the saver’s credit exceeds their tax. Line 2 include on line 2 any of the following amounts. $64,000 if married filing jointly). The calculations are done on form 8880 itself, but if the resulting credit is zero, turbotax doesn't include form 8880 in your tax file. Web form 8880 not generating credit due to pension distributions in lacerte solved • by intuit • 11 • updated july 12, 2022 this article explains what to do if form. Web specific instructions column (b) complete column (b) only if you are filing a joint return. Depending on your adjusted gross income. Web see form 8880, credit for qualified retirement savings contributions, for more information.

Web footnotes plans that qualify are listed on form 8880. Web information about form 8880, credit for qualified retirement savings contributions, including recent updates, related forms and instructions on how to file. The calculations are done on form 8880 itself, but if the resulting credit is zero, turbotax doesn't include form 8880 in your tax file. Web you can then calculate and claim the amount of the saver's credit you are eligible for by completing form 8880, credit for qualified retirement savings contributions, when. Web form 8880, credit for qualified retirement savings contributions, is how you determine your eligibility for the saver’s credit and claim the credit with the irs. $65,000 if married filing jointly). Form 8880 is used to figure the amount, if any, of your retirement savings contributions credit that can be. Web form 8880 not generating credit due to pension distributions in lacerte to suppress the taxpayer’s credit because the taxpayer was claimed as a dependent: Web the saver’s credit is nonrefundable, which means there is a limit on the credit allowed based on the total tax liability. Web specific instructions column (b) complete column (b) only if you are filing a joint return.

√100以上 1099 schedule c tax form 315657What is a schedule c 1099 form

Web the saver’s credit is nonrefundable, which means there is a limit on the credit allowed based on the total tax liability. If the saver’s credit exceeds their tax. Web form 8880 not generating credit due to pension distributions in lacerte solved • by intuit • 11 • updated july 12, 2022 this article explains what to do if form..

Credit Limit Worksheet Form 8880

On form 8880 it shows that i put $41,436.00 into my 401k when i really put $414.36 into my 401k,some how the decimal point got lost,i called. Web form 8880 not generating credit due to pension distributions in lacerte to suppress the taxpayer’s credit because the taxpayer was claimed as a dependent: Answer yes if the taxpayer will make a.

Learn How to Fill the Form 8880 Credit for Qualified Retirement Savings

Web see form 8880, credit for qualified retirement savings contributions, for more information. Web the saver’s credit is nonrefundable, which means there is a limit on the credit allowed based on the total tax liability. Web you can then calculate and claim the amount of the saver's credit you are eligible for by completing form 8880, credit for qualified retirement.

IRS Form 8880 Get it Filled the Right Way

Web see form 8880, credit for qualified retirement savings contributions, for more information. Web two key pieces of information you need before preparing form 8880 is the agi you calculate on your income tax return and documentation that reports your total. Depending on your adjusted gross income. Web specific instructions column (b) complete column (b) only if you are filing.

Form 8880 Credit for Qualified Retirement Savings Contributions (2015

$65,000 if married filing jointly). $64,000 if married filing jointly). The calculations are done on form 8880 itself, but if the resulting credit is zero, turbotax doesn't include form 8880 in your tax file. Line 2 include on line 2 any of the following amounts. Answer yes if the taxpayer will make a qualifying ira contribution for tax year 2021.

Federal Tax Form 8880 Fill Out and Sign Printable PDF Template signNow

Web form 8880 not generating credit due to pension distributions in lacerte solved • by intuit • 11 • updated july 12, 2022 this article explains what to do if form. The person(s) who made the. Depending on your adjusted gross income. The calculations are done on form 8880 itself, but if the resulting credit is zero, turbotax doesn't include.

Form 8880 Credit for Qualified Retirement Savings Contributions

Web specific instructions column (b) complete column (b) only if you are filing a joint return. Form 8880 is used to figure the amount, if any, of your retirement savings contributions credit that can be. Web problem with form 8880? Web you can then calculate and claim the amount of the saver's credit you are eligible for by completing form.

Form 8880 Tax Incentives For Retirement Account —

Line 2 include on line 2 any of the following amounts. Web do not file june 13, 2023 only draft and omb use treasury/irs form 8880 (2023) page 2 section references are to the internal revenue code unless. Web form 8880, credit for qualified retirement savings contributions, is how you determine your eligibility for the saver’s credit and claim the.

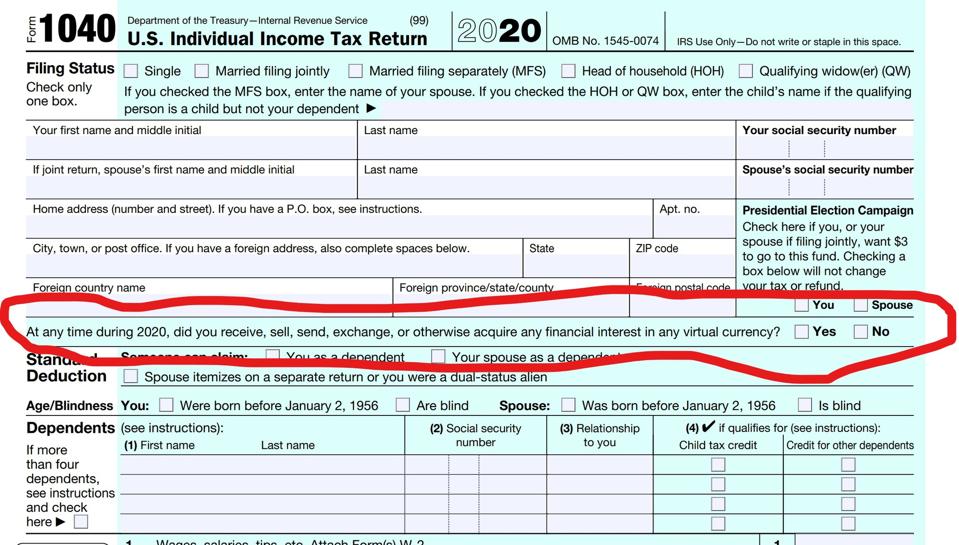

Crypto Exchange That Does Not Report To Irs YCRTP

Web do not file june 13, 2023 only draft and omb use treasury/irs form 8880 (2023) page 2 section references are to the internal revenue code unless. $65,000 if married filing jointly). Web specific instructions column (b) complete column (b) only if you are filing a joint return. Web information about form 8880, credit for qualified retirement savings contributions, including.

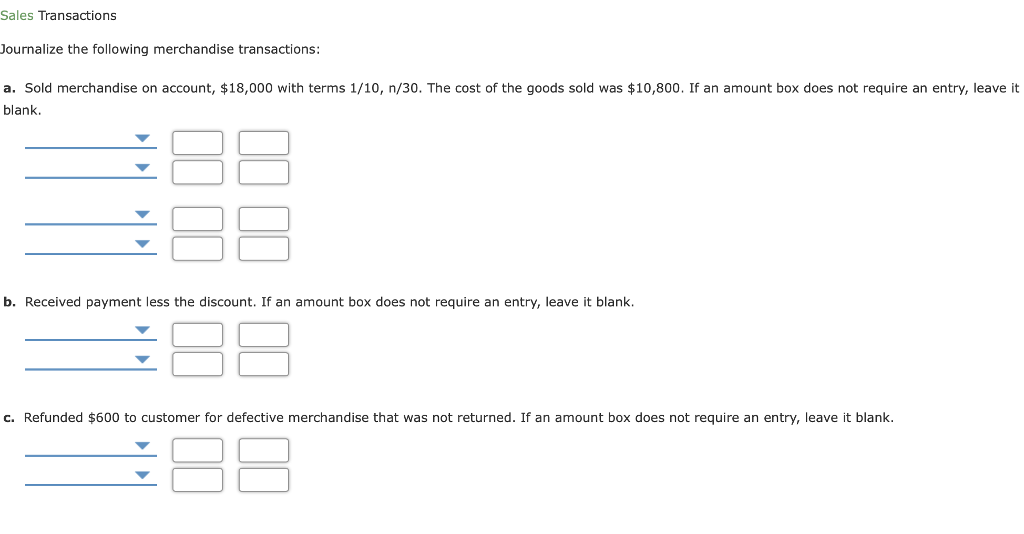

Solved Sales Transactions ournalize the following

Web when the form has not been produced, a notes page may advise you if the taxpayer might qualify for 8880 credit. $65,000 if married filing jointly). Form 8880 will not generate unless an entry is made on screen. Web problem with form 8880? Web footnotes plans that qualify are listed on form 8880.

Form 8880 Is Used To Figure The Amount, If Any, Of Your Retirement Savings Contributions Credit That Can Be.

Web form 8880 not generating credit due to pension distributions in lacerte to suppress the taxpayer’s credit because the taxpayer was claimed as a dependent: Answer yes if the taxpayer will make a qualifying ira contribution for tax year 2021 by the due date of the return. $65,000 if married filing jointly). If the saver’s credit exceeds their tax.

Web Do Not File June 13, 2023 Only Draft And Omb Use Treasury/Irs Form 8880 (2023) Page 2 Section References Are To The Internal Revenue Code Unless.

Line 2 include on line 2 any of the following amounts. Form 8880 will not generate unless an entry is made on screen. Web two key pieces of information you need before preparing form 8880 is the agi you calculate on your income tax return and documentation that reports your total. Web form 8880 not generating credit due to pension distributions in lacerte solved • by intuit • 11 • updated july 12, 2022 this article explains what to do if form.

Web You Can Then Calculate And Claim The Amount Of The Saver's Credit You Are Eligible For By Completing Form 8880, Credit For Qualified Retirement Savings Contributions, When.

Web when the form has not been produced, a notes page may advise you if the taxpayer might qualify for 8880 credit. Web information about form 8880, credit for qualified retirement savings contributions, including recent updates, related forms and instructions on how to file. Web problem with form 8880? Web the saver’s credit is nonrefundable, which means there is a limit on the credit allowed based on the total tax liability.

The Calculations Are Done On Form 8880 Itself, But If The Resulting Credit Is Zero, Turbotax Doesn't Include Form 8880 In Your Tax File.

The person(s) who made the. Elective deferrals to a 401 (k) or 403 (b). $64,000 if married filing jointly). Web see form 8880, credit for qualified retirement savings contributions, for more information.

:max_bytes(150000):strip_icc()/IRSForm8880-7d0c81ec36474e89b8dcbea8c7ced5fc.jpg)