Download 941 Form 2020

Download 941 Form 2020 - Department use only (mm/dd/yy) amended return. Employer s quarterly federal tax return keywords: You must complete all five pages. April, may, june trade name (if any). Enter the irs form 941 2020 in the editor. July 2020) employer’s quarterly federal tax return 950120 omb no. Type or print within the boxes. Instructions for form 941 (2021) pdf. April, may, june read the separate instructions before completing this form. Web form 941 worksheet for 2022.

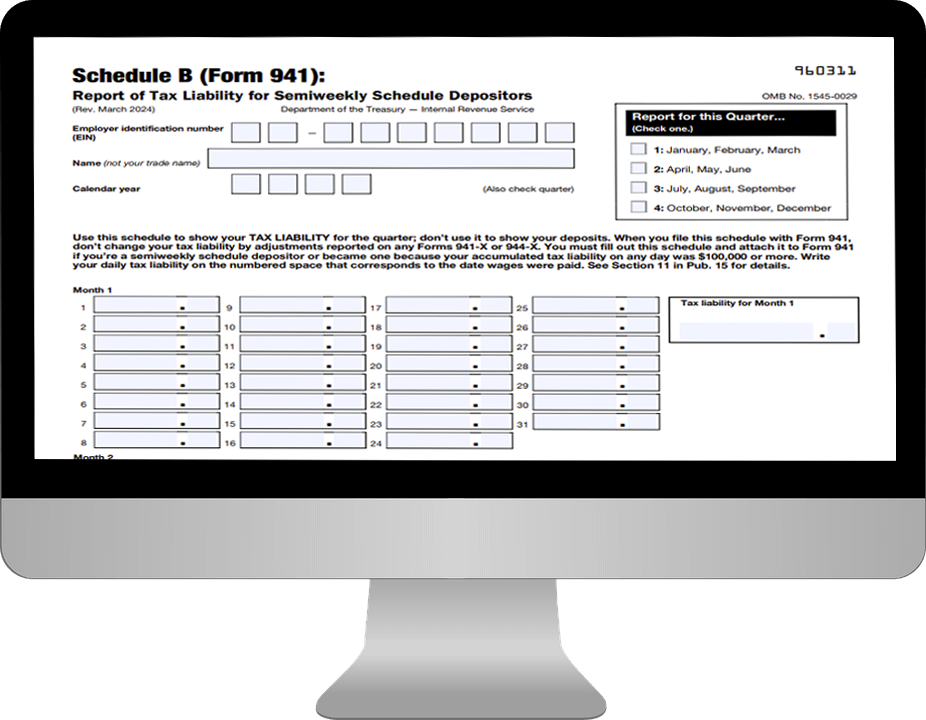

Web department of the treasury — internal revenue service 950117 omb no. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax (also known as schedule b). April, may, june trade name (if any). To help business owners calculate the tax credits they are eligible for, the irs has created worksheet. Enter the irs form 941 2020 in the editor. For additional information and to locate the refund request form visit the online credit inquiry system at. Department use only (mm/dd/yy) amended return. Pick the first field and start writing the requested info. January, february, march name (not your trade name) 2: Instructions for form 941 (2021) pdf.

January, february, march name (not your trade name) 2: To help business owners calculate the tax credits they are eligible for, the irs has created worksheet. You should simply follow the instructions: Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Department use only (mm/dd/yy) amended return. Employer s quarterly federal tax return keywords: For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax (also known as schedule b). Web form 941 worksheet for 2022. April, may, june trade name (if any). Web department of the treasury — internal revenue service 950117 omb no.

You Will Probably See These Changes on the Revised Form 941… Blog

To help business owners calculate the tax credits they are eligible for, the irs has created worksheet. Web employer's quarterly federal tax return for 2021. Territories will file form 941, or, if you prefer your form and instructions in spanish, you can file new form 941 (sp), declaración del impuesto federal trimestral del You must complete all five pages. Instead,.

Form Fillable Schedule Printable Forms Free Online

April, may, june trade name (if any). Web department of the treasury — internal revenue service 950117 omb no. Territories will file form 941, or, if you prefer your form and instructions in spanish, you can file new form 941 (sp), declaración del impuesto federal trimestral del July 2020) employer’s quarterly federal tax return 950120 omb no. Instructions for form.

2020 Form IRS 941SS Fill Online, Printable, Fillable, Blank pdfFiller

For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax (also known as schedule b). Web employer's quarterly federal tax return for 2021. April, may, june read the separate instructions before completing this form. Employer’s return of income taxes withheld. This worksheet does not have to be attached.

How do I download Form 941?

Web how to complete a fillable 941 form 2020? Pick the first field and start writing the requested info. To help business owners calculate the tax credits they are eligible for, the irs has created worksheet. For additional information and to locate the refund request form visit the online credit inquiry system at. Web employer's quarterly federal tax return for.

How to Fill Out 2020 Form 941 Employer’s Quarterly Federal Tax Return

You should simply follow the instructions: However, it is a great tool for completing form 941 for. Web department of the treasury — internal revenue service 950117 omb no. Pick the first field and start writing the requested info. To help business owners calculate the tax credits they are eligible for, the irs has created worksheet.

7 Awesome Reasons To File Your Form 941 With TaxBandits Blog TaxBandits

Employer’s return of income taxes withheld. To help business owners calculate the tax credits they are eligible for, the irs has created worksheet. Web how to complete a fillable 941 form 2020? January, february, march name (not your trade name) 2: July 2020) employer’s quarterly federal tax return 950120 omb no.

2020 Form IRS Instructions 941 Fill Online, Printable, Fillable, Blank

July 2020) employer’s quarterly federal tax return 950120 omb no. Web how to complete a fillable 941 form 2020? Employer s quarterly federal tax return keywords: Web form 941 worksheet for 2022. Type or print within the boxes.

Fillable Form 941 Schedule B 2020 Download Printable 941 for Free

However, it is a great tool for completing form 941 for. To help business owners calculate the tax credits they are eligible for, the irs has created worksheet. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Employer’s return of income taxes withheld. This worksheet does not have.

The NoWorry Guide To File Form 941 During Tax Year 2020 Blog

Territories will file form 941, or, if you prefer your form and instructions in spanish, you can file new form 941 (sp), declaración del impuesto federal trimestral del Employer’s return of income taxes withheld. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Pick the first field and.

941 Form 2021

Pick the first field and start writing the requested info. Department use only (mm/dd/yy) amended return. For additional information and to locate the refund request form visit the online credit inquiry system at. You should simply follow the instructions: Web department of the treasury — internal revenue service 950117 omb no.

You Should Simply Follow The Instructions:

January, february, march name (not your trade name) 2: Instructions for form 941 (2021) pdf. Employer s quarterly federal tax return keywords: Employer’s return of income taxes withheld.

This Worksheet Does Not Have To Be Attached.

To help business owners calculate the tax credits they are eligible for, the irs has created worksheet. April, may, june read the separate instructions before completing this form. Enter the irs form 941 2020 in the editor. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file.

Form 941 Is Used By Employers Who Withhold Income Taxes From Wages Or Who Must Pay Social Security Or Medicare Tax.

Department use only (mm/dd/yy) amended return. Web department of the treasury — internal revenue service 950117 omb no. For additional information and to locate the refund request form visit the online credit inquiry system at. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax (also known as schedule b).

However, It Is A Great Tool For Completing Form 941 For.

You must complete all five pages. Instead, employers in the u.s. Web form 941 worksheet for 2022. Pick the first field and start writing the requested info.