Download Crypto.com Tax Form

Download Crypto.com Tax Form - Whether you are filing yourself, using a tax software like turbotax or working with an accountant. How to get crypto.com tax forms __________________________________________________ new project channel:. Web calculate and prepare your crypto.com app taxes in under 20 minutes. Web you need to report your taxable crypto transactions on your us individual tax return (irs form 1040 and its state equivalents, where applicable). We’re excited to share that u.s. Web download your completed tax forms to file yourself, send to your accountant, or import into your preferred filing software. Web what tax form should i use to report cryptocurrency? Web downloading trading activity for tax preparation. Import trades automatically and download all tax forms & documents for crypto.com app. Your net capital gain or loss should then be reported on.

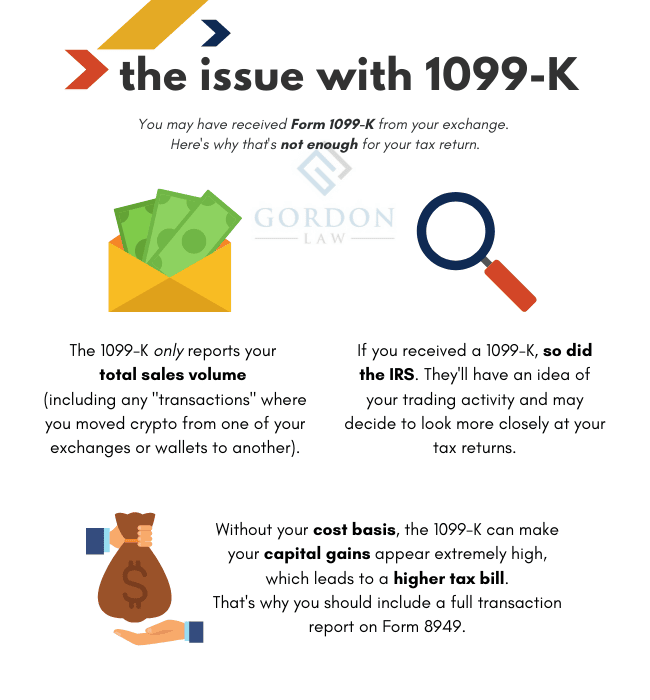

Your net capital gain or loss should then be reported on. It only becomes a taxable. Web you need to report your taxable crypto transactions on your us individual tax return (irs form 1040 and its state equivalents, where applicable). See how you can access and. Web download your completed tax forms to file yourself, send to your accountant, or import into your preferred filing software. Web to report your crypto tax to the irs, follow 5 steps: This form is more taxpayer. Web when required by the irs, the crypto exchange or broker you use, including coinbase, has to report certain types of activity directly to the irs using specific forms and provide you. We’re excited to share that u.s. Web learn the ins and outs of crypto.com tax to file returns and get an overview of the tax rules for the us, canada, the uk, and australia.

See how you can access and. Koinly can generate the right crypto tax reports. How to get crypto.com tax forms __________________________________________________ new project channel:. Web jan 26, 2022. View example report trusted turbotax partner partnered. Web downloading trading activity for tax preparation. Your net capital gain or loss should then be reported on. Web to report your crypto tax to the irs, follow 5 steps: Register your account in crypto.com tax step 2: This report includes all of your short term and long term gains from your.

How To Pick The Best Crypto Tax Software

How to get crypto.com tax forms __________________________________________________ new project channel:. In the u.s., cryptocurrency disposals are reported on form 8949. Select the tax settings you’d like to generate your tax reports. Web mar 18, 2022 how to generate crypto tax report with crypto.com tax | canada users watch on bid farewell to tax season jitters this year! View example report.

How To Do Crypto Taxes In Minutes! (The Best Crypto Tax Software

This report includes all of your short term and long term gains from your. And canada users can now generate their 2021 crypto tax reports on crypto.com tax, which is also available to. Whether you are filing yourself, using a tax software like turbotax or working with an accountant. How to get crypto.com tax forms __________________________________________________ new project channel:. It.

Basics of Crypto Taxes Ebook Donnelly Tax Law

Register your account in crypto.com tax step 2: Whether you are filing yourself, using a tax software like turbotax or working with an accountant. You may refer to this section on how to set up your tax. You might need any of these crypto. And canada users can now generate their 2021 crypto tax reports on crypto.com tax, which is.

Tax Introduces New Features

Learn how to access your equities trading activity and forms for tax reporting within the client center. See how you can access and. You might need any of these crypto. Web 72k views 2 years ago. And canada users can now generate their 2021 crypto tax reports on crypto.com tax, which is also available to.

Your Crypto Tax Questions Answered by a Tax Attorney & CPA

Web learn the ins and outs of crypto.com tax to file returns and get an overview of the tax rules for the us, canada, the uk, and australia. Web 72k views 2 years ago. In the u.s., cryptocurrency disposals are reported on form 8949. Crypto tax refers to the taxation. And canada users can now generate their 2021 crypto tax.

How To Get Tax Forms 🔴 YouTube

See how you can access and. Select the tax settings you’d like to generate your tax reports. Web calculate and prepare your crypto.com app taxes in under 20 minutes. Crypto tax refers to the taxation. In the u.s., cryptocurrency disposals are reported on form 8949.

Tax Adds 2Factor Authentication and SHIB Imports

Web download your completed tax forms to file yourself, send to your accountant, or import into your preferred filing software. Register your account in crypto.com tax step 2: View example report trusted turbotax partner partnered. Web downloading trading activity for tax preparation. Web learn the ins and outs of crypto.com tax to file returns and get an overview of the.

Crypto Tax YouTube

We’re excited to share that u.s. Learn how to access your equities trading activity and forms for tax reporting within the client center. Web jan 26, 2022. Your net capital gain or loss should then be reported on. Web mar 18, 2022 how to generate crypto tax report with crypto.com tax | canada users watch on bid farewell to tax.

Crypto Taxes Basic example YouTube

You might need any of these crypto. Web calculate and prepare your crypto.com app taxes in under 20 minutes. This form is more taxpayer. Web you need to report your taxable crypto transactions on your us individual tax return (irs form 1040 and its state equivalents, where applicable). Your net capital gain or loss should then be reported on.

Crypto Tax Guide 101 on Cheddar

So if you have 2k in cro then use that to buy 2k in eth, you've now held 4k worth of property. Web 72k views 2 years ago. Koinly can generate the right crypto tax reports. Web downloading trading activity for tax preparation. Web reporting crypto activity can require a handful of crypto tax forms depending on the type of.

Web You Need To Report Your Taxable Crypto Transactions On Your Us Individual Tax Return (Irs Form 1040 And Its State Equivalents, Where Applicable).

So if you have 2k in cro then use that to buy 2k in eth, you've now held 4k worth of property. Web download your completed tax forms to file yourself, send to your accountant, or import into your preferred filing software. How to get crypto.com tax forms __________________________________________________ new project channel:. Web when required by the irs, the crypto exchange or broker you use, including coinbase, has to report certain types of activity directly to the irs using specific forms and provide you.

Register Your Account In Crypto.com Tax Step 2:

Select the tax settings you’d like to generate your tax reports. And canada users can now generate their 2021 crypto tax reports on crypto.com tax, which is also available to. In the u.s., cryptocurrency disposals are reported on form 8949. View example report trusted turbotax partner partnered.

Whether You Are Filing Yourself, Using A Tax Software Like Turbotax Or Working With An Accountant.

Web it's because crypto is viewed as property and not currency. Your net capital gain or loss should then be reported on. Crypto tax refers to the taxation. This report includes all of your short term and long term gains from your.

You Need To Know Your Capital Gains, Losses, Income And Expenses.

This form is more taxpayer. It only becomes a taxable. Web mar 18, 2022 how to generate crypto tax report with crypto.com tax | canada users watch on bid farewell to tax season jitters this year! Web to report your crypto tax to the irs, follow 5 steps: