Form 301 Arizona

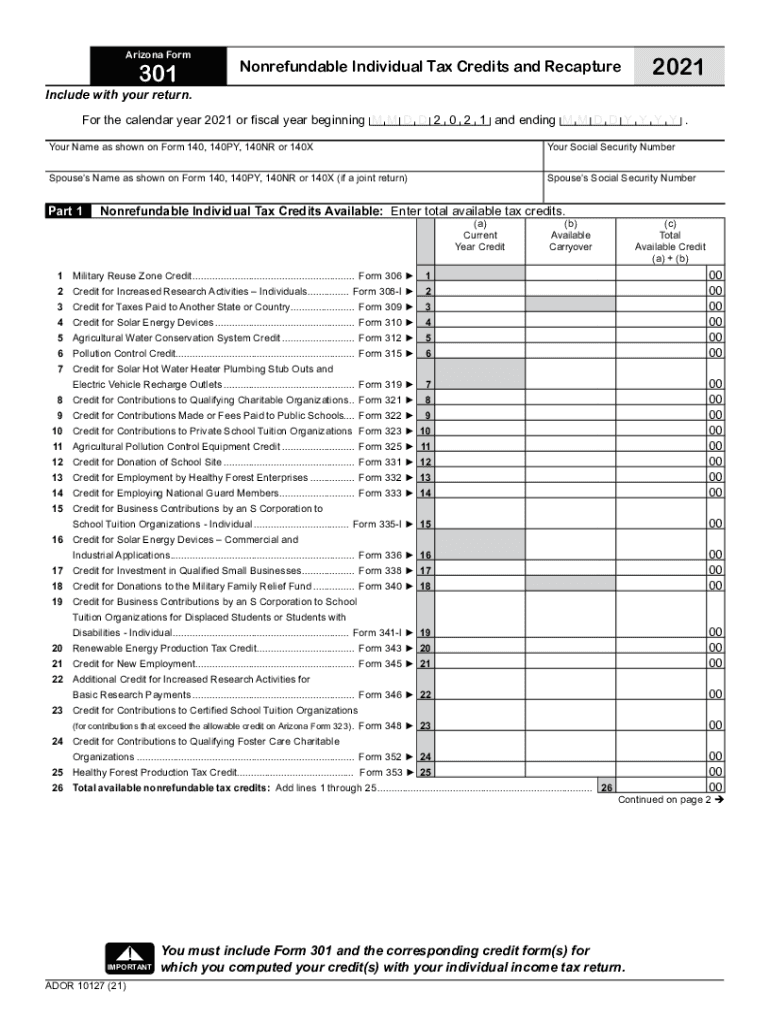

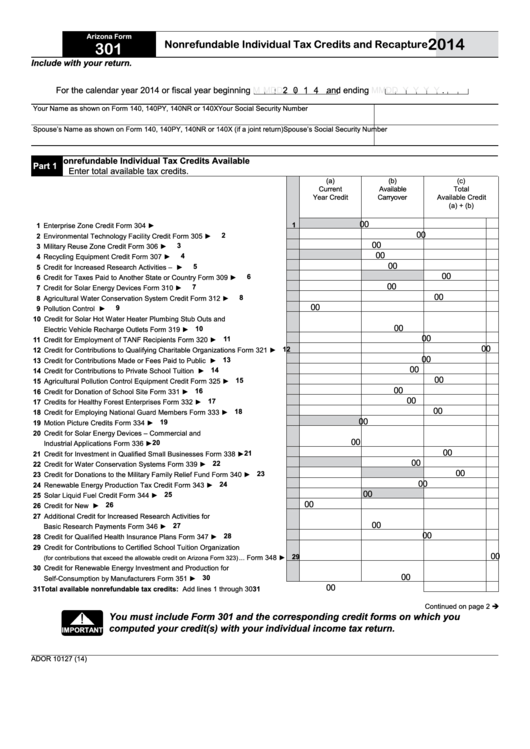

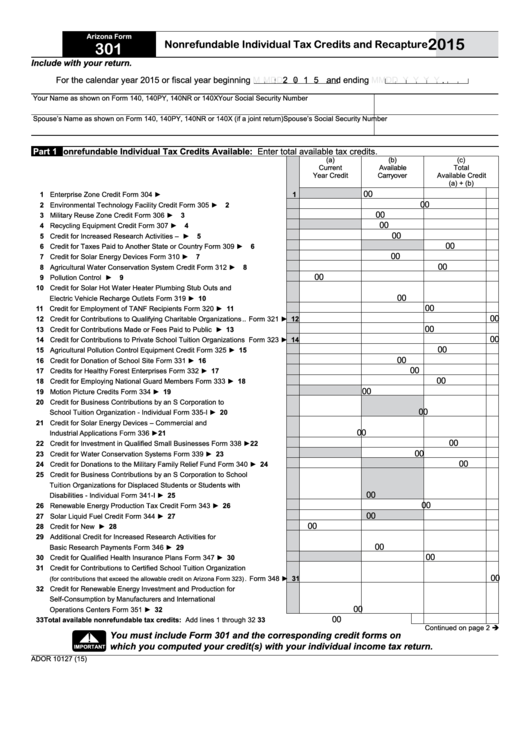

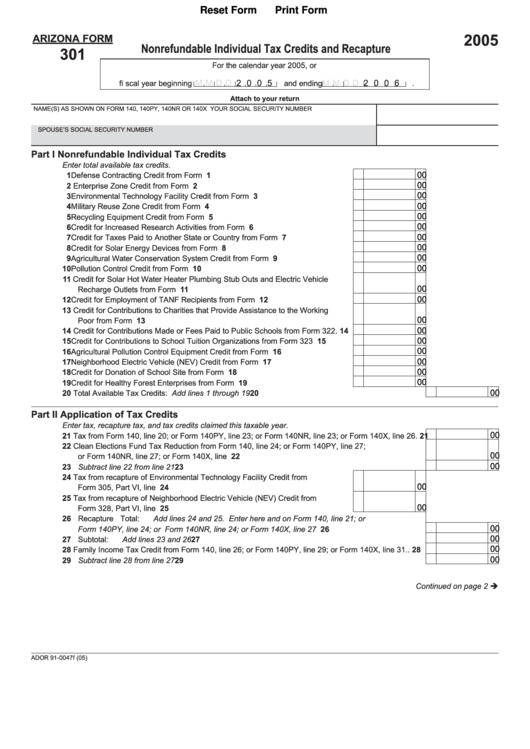

Form 301 Arizona - Web what is arizona form 301? Ador 10127 (19) a orm 301 2019 page 2 of 2 your name (as shown on page 1) your social security. Web also, enter this amount on arizona form 301, part 1, line 20, column (c). Nonrefundable corporate tax credits and. Web ador 10127 (20) a orm 301 2020 page 2 of 2 your name (as shown on page 1) your social security number part 2 application of tax credits and recapture: Ad register and edit, fill, sign now your az dor form 301 & more fillable forms. Web arizona form 301 nonrefundable individual tax credits and recapture 2019. Web we last updated the nonrefundable individual tax credits and recapture in february 2023, so this is the latest version of form 301, fully updated for tax year 2022. Az allows carryover of unused credits. Summarization of taxpayer's application of nonrefundable tax credits and credit.

Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the. Az allows carryover of unused credits. Web also, enter this amount on arizona form 301, part 1, line 20, column (c). If your client receives a “tax correction notice” from the az department of revenue (dor) that limits a claimed credit. Web 26 rows tax credits forms : Web we last updated arizona form 301 in february 2023 from the arizona department of revenue. Select the document you will need in the collection of legal forms. Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the. Upload, modify or create forms. Nonrefundable corporate tax credits and.

Web 24 rows nonrefundable individual tax credits and recapture. Select the document you will need in the collection of legal forms. Arizona department of revenue subject: Web also, enter this amount on arizona form 301, part 1, line 20, column (c). Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the. Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the. Web what is arizona form 301? Upload, modify or create forms. Form 335 is used in claiming the corporate tax. Web arizona state income tax forms 301, 323, and 348 are used for claiming the original and plus/overflow tuition tax credits.

2021 AZ DoR Form 301 Fill Online, Printable, Fillable, Blank pdfFiller

Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the. Web arizona form 301 101 () you must include form 301 and the corresponding credit form(s) for important which you computed your credit(s) with your individual income tax. Ador 10127.

Fillable Arizona Form 301 Nonrefundable Individual Tax Credits And

Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the. Arizona department of revenue subject: Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless.

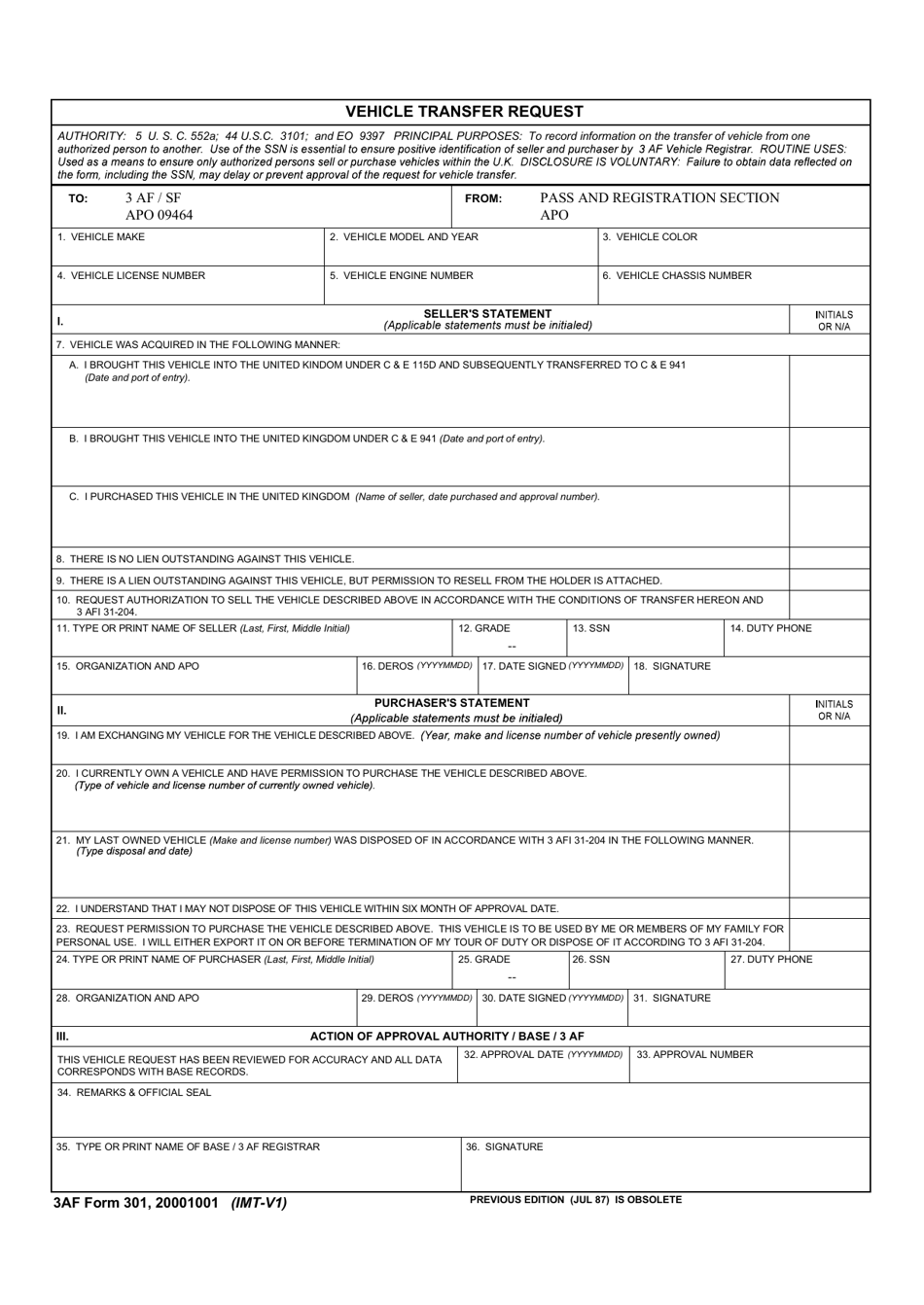

3 AF Form 301 Download Fillable PDF or Fill Online Vehicle Transfer

Select the document you will need in the collection of legal forms. Web arizona state income tax forms 301, 323, and 348 are used for claiming the original and plus/overflow tuition tax credits. Summarization of taxpayer's application of nonrefundable tax credits and credit. Upload, modify or create forms. Web you must complete and include arizona form 301 and the credit.

Fillable Arizona Form 301 Nonrefundable Individual Tax Credits And

If your client receives a “tax correction notice” from the az department of revenue (dor) that limits a claimed credit. This form is for income earned in tax year 2022, with tax returns due in april. Web ador 10127 (20) a orm 301 2020 page 2 of 2 your name (as shown on page 1) your social security number part.

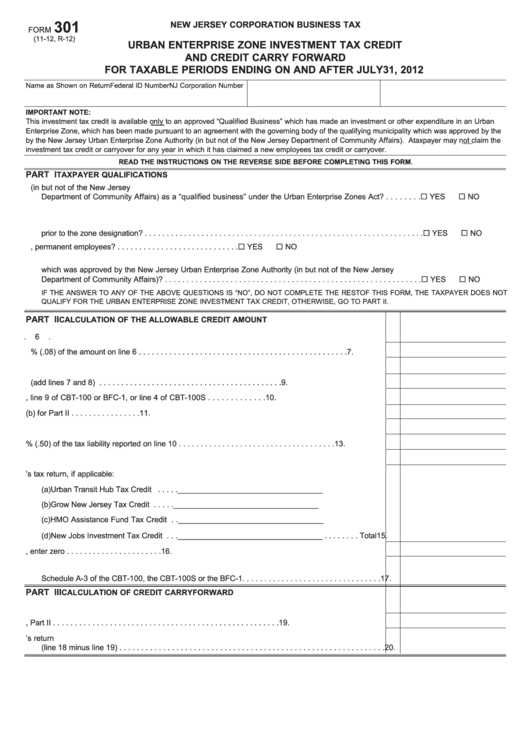

Form 301 Nebraska Enterprise Zone Investment Tax Credit And Credit

Web we last updated the nonrefundable individual tax credits and recapture in february 2023, so this is the latest version of form 301, fully updated for tax year 2022. Upload, modify or create forms. Arizona department of revenue subject: Web 24 rows nonrefundable individual tax credits and recapture. Summarization of taxpayer's application of nonrefundable tax credits and credit.

OSHA 301 Mobile Form Aptora AllInOne Field Service Management

Web what is arizona form 301? Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the. Form 335 is used in claiming the corporate tax. Open the template in the online. Arizona department of revenue subject:

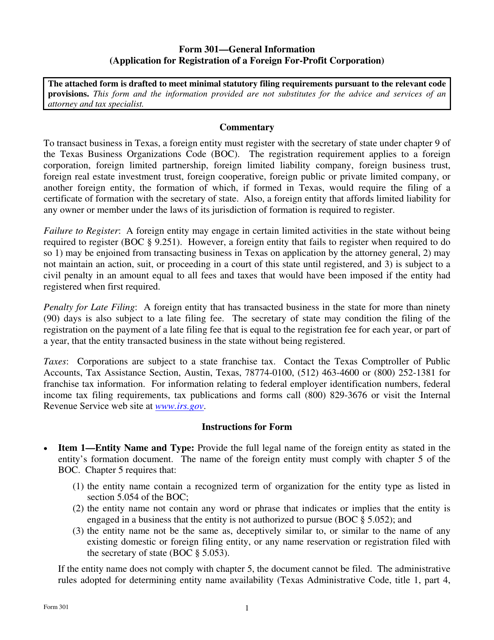

Form 301 Download Fillable PDF or Fill Online Application for

Az allows carryover of unused credits. Web arizona form 301 101 () you must include form 301 and the corresponding credit form(s) for important which you computed your credit(s) with your individual income tax. Summarization of taxpayer's application of nonrefundable tax credits and credit. Web 26 rows tax credits forms : Web you must complete and include arizona form 301.

Fillable Arizona Form 301 Nonrefundable Individual Tax Credits And

Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the. Upload, modify or create forms. Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless.

AZ Form 301, Nonrefundable Individual Tax Credits and Recapture

Ad register and edit, fill, sign now your az dor form 301 & more fillable forms. Web arizona state income tax forms 301, 323, and 348 are used for claiming the original and plus/overflow tuition tax credits. Web arizona form 301 included with form 309. Web you must complete and include arizona form 301 and the credit form(s) with your.

Form COM301 Download Fillable PDF or Fill Online Compliance

Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the. This form is for income earned in tax year 2022, with tax returns due in april. Web we last updated the nonrefundable individual tax credits and recapture in february 2023,.

Ad Register And Edit, Fill, Sign Now Your Az Dor Form 301 & More Fillable Forms.

Summarization of taxpayer's application of nonrefundable tax credits and credit. Web arizona form 301 nonrefundable individual tax credits and recapture 2019. Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the. Web ador 10127 (20) a orm 301 2020 page 2 of 2 your name (as shown on page 1) your social security number part 2 application of tax credits and recapture:

Select The Document You Will Need In The Collection Of Legal Forms.

This form is for income earned in tax year 2022, with tax returns due in april. Web arizona form 301 included with form 309. Web we last updated arizona form 301 in february 2023 from the arizona department of revenue. Web what is arizona form 301?

Az Allows Carryover Of Unused Credits.

Web we last updated the nonrefundable individual tax credits and recapture in february 2023, so this is the latest version of form 301, fully updated for tax year 2022. Web stick to these simple instructions to get az dor form 301 prepared for sending: Web 26 rows tax credits forms : Web 24 rows nonrefundable individual tax credits and recapture.

Web Arizona State Income Tax Forms 301, 323, And 348 Are Used For Claiming The Original And Plus/Overflow Tuition Tax Credits.

Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the. Web you must complete and include arizona form 301 and the credit form(s) with your arizona income tax return to claim nonrefundable tax credits unless you meet one of the. Arizona department of revenue subject: Upload, modify or create forms.