Empower 401K Rollover Form

Empower 401K Rollover Form - Let the experts at capitalize handle your 401(k) rollover, for free! Web rollover is a transaction used to transfer eligible assets from one qualified retirement plan to another. To rollover your 401(k) to an ira, follow these steps: Explore the options for rolling over your retirement account to another qualified account or cashing out your retirement savings. Web easily manage your assets and reduce the need for multiple accounts. Web an empower 401(k) rollover lets you move, or roll, your existing empower retirement funds to a new retirement plan. Our online process and team of experts make it easy to roll over your 401(k) fast. Eligible rollover distributions are made payable directly to your new employer’s roth plan or to a roth ira. Inform your former employer that you want to roll over your 401(k) funds into an ira. For more details, review the important information associated with the acquisition pdf file opens in a new window.

Web complete the participant information section of the incoming rollover election form. Web how to roll over your 401(k) to an ira. Make sure the check is payable to the financial services company, instead of you personally — this is referred to as a direct. Inform your former employer that you want to roll over your 401(k) funds into an ira. As with any financial decision, you are encouraged to discuss moving money between accounts, including rollovers, with a financial advisor and to consider costs, risks, investment options and limitations prior to investing. Eligible rollover distributions are made payable directly to your new employer’s roth plan or to a roth ira. Web easily manage your assets and reduce the need for multiple accounts. Open an ira if you don’t have one. Our online process and team of experts make it easy to roll over your 401(k) fast. Web an empower 401(k) rollover lets you move, or roll, your existing empower retirement funds to a new retirement plan.

Inform your former employer that you want to roll over your 401(k) funds into an ira. Eligible rollover distributions are made payable directly to your new employer’s roth plan or to a roth ira. Web determine if a rollover is the right option for you. Web complete the participant information section of the incoming rollover election form. Web rollover is a transaction used to transfer eligible assets from one qualified retirement plan to another. Please send a copy of the check stub, showing the amount of the distribution and withholding, from the previous provider. Web how to roll over your 401(k) to an ira. Web rollover to roth accounts (if applicable) before submitting a direct rollover request, you need to verify that the new plan provides for a designated roth account and can accept rollovers. Make sure the check is payable to the financial services company, instead of you personally — this is referred to as a direct. For more details, review the important information associated with the acquisition pdf file opens in a new window.

Empower Retirement 401k Rollover Form Fill Online, Printable

Web complete the participant information section of the incoming rollover election form. Let the experts at capitalize handle your 401(k) rollover, for free! To rollover your 401(k) to an ira, follow these steps: Explore the options for rolling over your retirement account to another qualified account or cashing out your retirement savings. As with any financial decision, you are encouraged.

Transamerica 401k Rollover Form Universal Network

Web complete the participant information section of the incoming rollover election form. Web easily manage your assets and reduce the need for multiple accounts. Web an empower 401(k) rollover lets you move, or roll, your existing empower retirement funds to a new retirement plan. If a plan allows incoming rollovers, participants may generally contribute a eligible rollover from their previous.

401k Rollover Tax Form Universal Network

Our online process and team of experts make it easy to roll over your 401(k) fast. Web an empower 401(k) rollover lets you move, or roll, your existing empower retirement funds to a new retirement plan. Web easily manage your assets and reduce the need for multiple accounts. Web rollover is a transaction used to transfer eligible assets from one.

Home Depot 401k Rollover Form Form Resume Examples Rg8Dk7w3Mq

Eligible rollover distributions are made payable directly to your new employer’s roth plan or to a roth ira. Web rollover is a transaction used to transfer eligible assets from one qualified retirement plan to another. Let the experts at capitalize handle your 401(k) rollover, for free! Please send a copy of the check stub, showing the amount of the distribution.

401k Rollover Tax Form Universal Network

Eligible rollover distributions are made payable directly to your new employer’s roth plan or to a roth ira. Open an ira if you don’t have one. Please send a copy of the check stub, showing the amount of the distribution and withholding, from the previous provider. Web determine if a rollover is the right option for you. Explore the options.

How To Rollover 401k From Empower To Fidelity

Web rollover to roth accounts (if applicable) before submitting a direct rollover request, you need to verify that the new plan provides for a designated roth account and can accept rollovers. Web how to roll over your 401(k) to an ira. Web an empower 401(k) rollover lets you move, or roll, your existing empower retirement funds to a new retirement.

401k Enrollment Form Examples Form Resume Examples E4Y4ybxVlB

As with any financial decision, you are encouraged to discuss moving money between accounts, including rollovers, with a financial advisor and to consider costs, risks, investment options and limitations prior to investing. Make sure the check is payable to the financial services company, instead of you personally — this is referred to as a direct. Let the experts at capitalize.

401k Rollover Form 5498 Universal Network

Web rollover to roth accounts (if applicable) before submitting a direct rollover request, you need to verify that the new plan provides for a designated roth account and can accept rollovers. Please send a copy of the check stub, showing the amount of the distribution and withholding, from the previous provider. Inform your former employer that you want to roll.

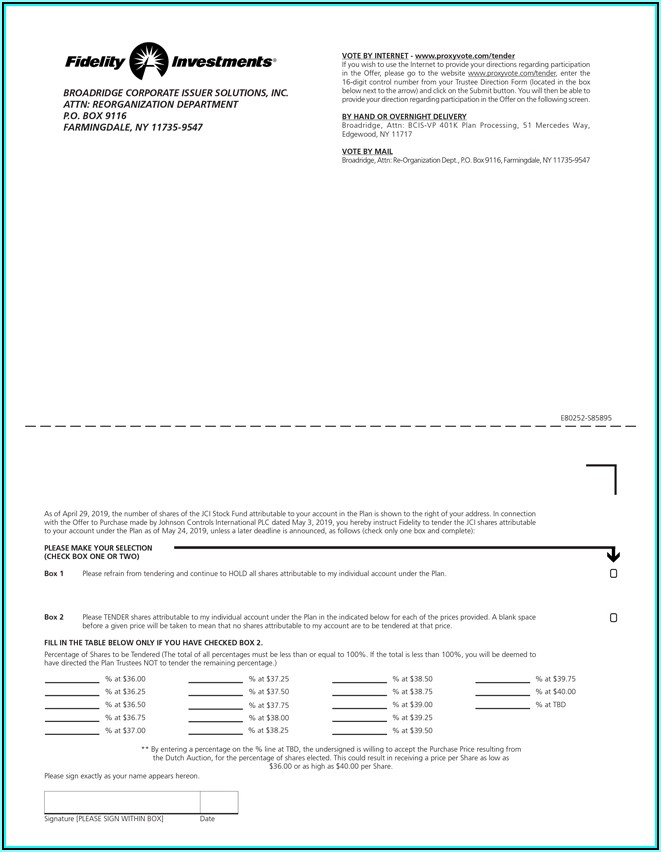

401k Rollover Form Fidelity Investments Form Resume Examples

If a plan allows incoming rollovers, participants may generally contribute a eligible rollover from their previous employer’s retirement plan or from their individual retirement account (ira) into their current employer’s retirement plan. Explore the options for rolling over your retirement account to another qualified account or cashing out your retirement savings. Web easily manage your assets and reduce the need.

401k Rollover Form Voya Universal Network

Explore the options for rolling over your retirement account to another qualified account or cashing out your retirement savings. Let the experts at capitalize handle your 401(k) rollover, for free! Web an empower 401(k) rollover lets you move, or roll, your existing empower retirement funds to a new retirement plan. Eligible rollover distributions are made payable directly to your new.

Web An Empower 401(K) Rollover Lets You Move, Or Roll, Your Existing Empower Retirement Funds To A New Retirement Plan.

Web easily manage your assets and reduce the need for multiple accounts. Web complete the participant information section of the incoming rollover election form. Explore the options for rolling over your retirement account to another qualified account or cashing out your retirement savings. Make sure the check is payable to the financial services company, instead of you personally — this is referred to as a direct.

For More Details, Review The Important Information Associated With The Acquisition Pdf File Opens In A New Window.

Let the experts at capitalize handle your 401(k) rollover, for free! Web determine if a rollover is the right option for you. Eligible rollover distributions are made payable directly to your new employer’s roth plan or to a roth ira. Open an ira if you don’t have one.

Our Online Process And Team Of Experts Make It Easy To Roll Over Your 401(K) Fast.

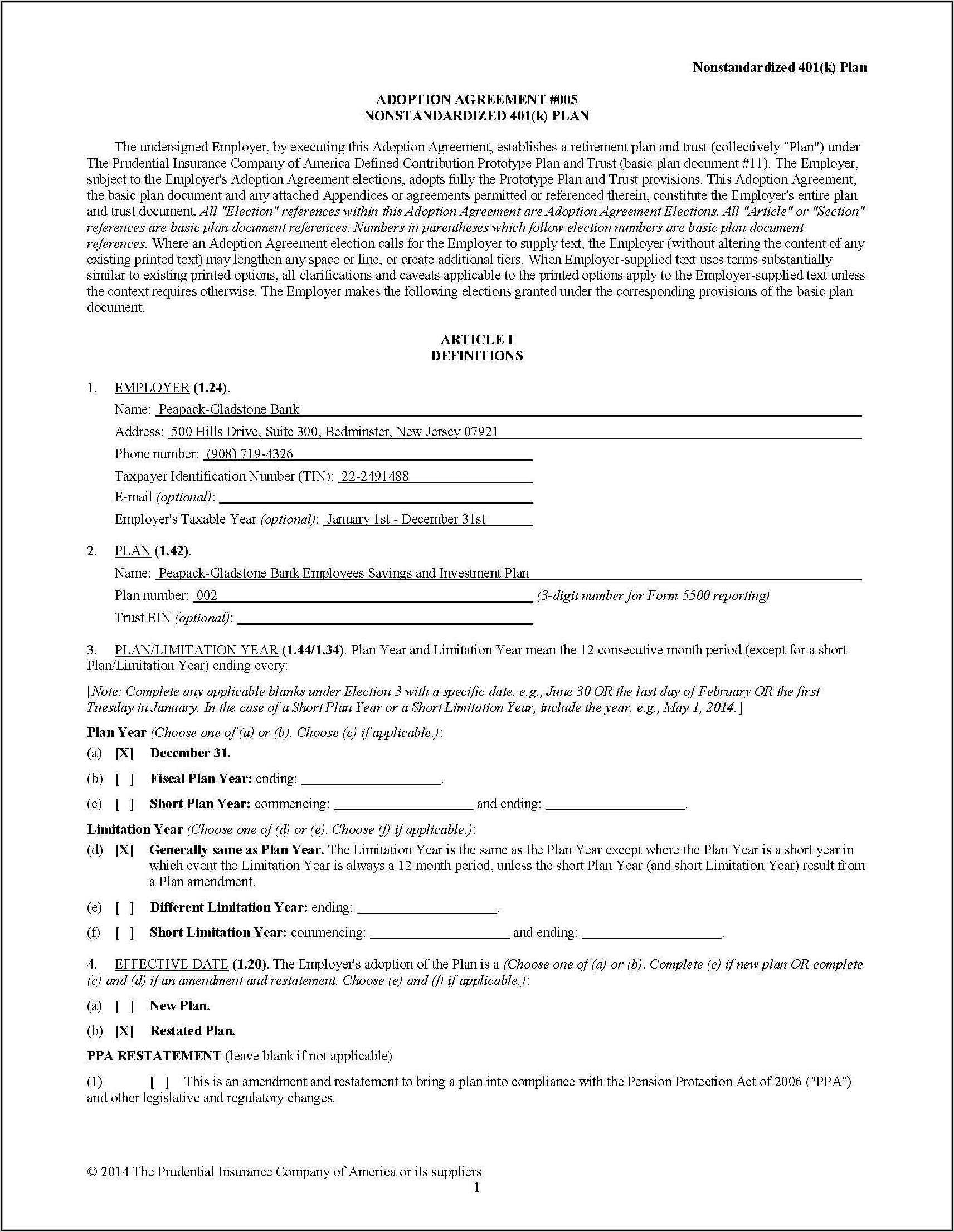

Web how to roll over your 401(k) to an ira. Web rollover to roth accounts (if applicable) before submitting a direct rollover request, you need to verify that the new plan provides for a designated roth account and can accept rollovers. To rollover your 401(k) to an ira, follow these steps: If a plan allows incoming rollovers, participants may generally contribute a eligible rollover from their previous employer’s retirement plan or from their individual retirement account (ira) into their current employer’s retirement plan.

Web Rollover Is A Transaction Used To Transfer Eligible Assets From One Qualified Retirement Plan To Another.

As with any financial decision, you are encouraged to discuss moving money between accounts, including rollovers, with a financial advisor and to consider costs, risks, investment options and limitations prior to investing. Inform your former employer that you want to roll over your 401(k) funds into an ira. Please send a copy of the check stub, showing the amount of the distribution and withholding, from the previous provider.