Fake 1099 Tax Form

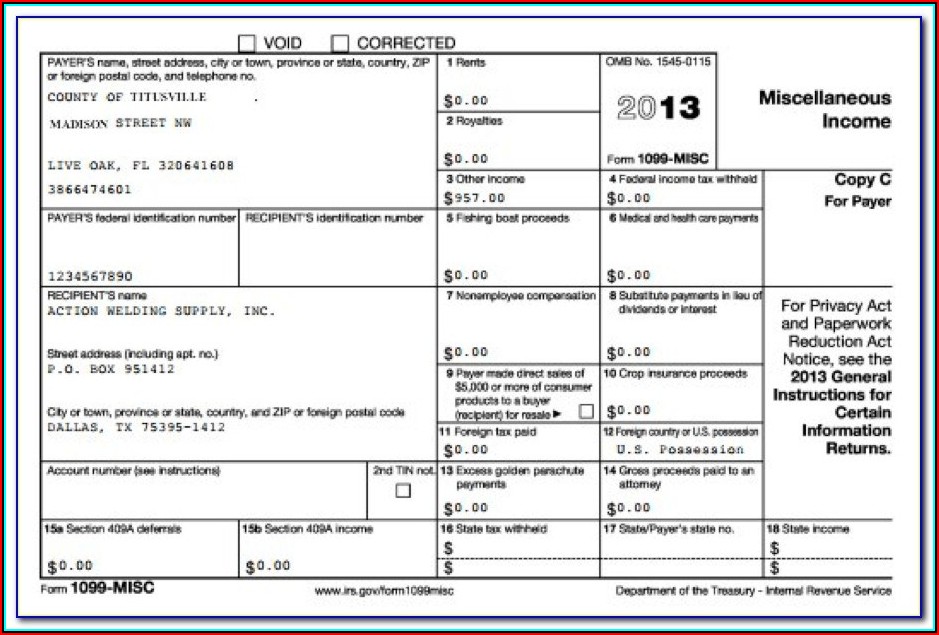

Fake 1099 Tax Form - Web form 1099 is one of several irs tax forms (see the variants section) used in the united states to prepare and file an information return to report various types of income other. Web a ma msa is an archer msa chosen by medicare to be used solely to pay qualified medical expenses of the account holder enrolled in medicare. Ad get the latest 1099 misc online. Web if you continue to run in to problems addressing an incorrect 1099, legal representation may be your best option. The attorneys at robinson & henry can help. Someone used his social security number to get contract work with an arizona company. Web a false or altered document failure to pay tax unreported income organized crime failure to withhold failure to follow the tax laws rewards to claim a reward for. Fill, edit, sign, download & print. Web this little known plugin reveals the answer. Register and subscribe now to work on irs nonemployee compensation & more fillable forms.

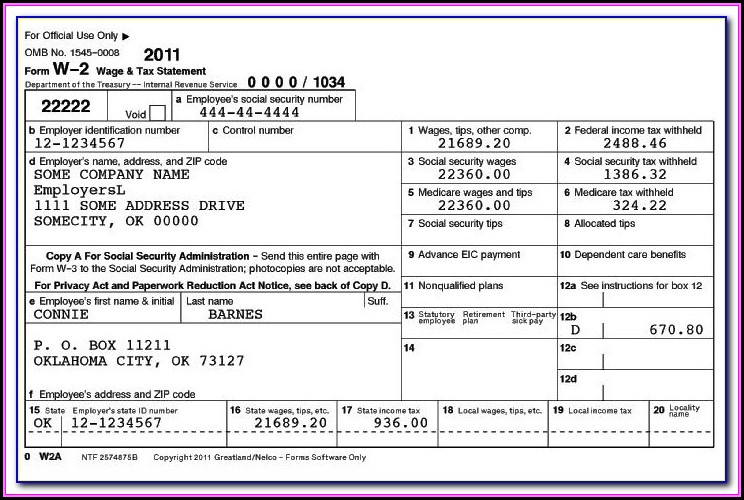

Web instructions for recipient recipient’s taxpayer identification number (tin). This is a form of tax fraud and can result in. Do not miss the deadline Web form 1099 misc must be completed and filed for each person paid by your company during the year: Web then he got a bogus 1099. The payer fills out the 1099 form and sends copies to you and. Web in recent years, the irs has observed variations of these scams where fake irs documents are used in to lend legitimacy to the bogus request. Web taxpayers and tax professionals should be alert to fake communications from scammers posing as legitimate organizations in the tax and financial community,. If the fake form isn’t fixed, he could get a tax bill. The form reports the interest income you.

The irs cautions taxpayers to avoid getting caught up in schemes disguised as a debt payment option for credit cards or mortgage debt. Web some individuals or entities may create fake 1099 forms to falsely report income or payments made to someone. Web form 1099 is one of several irs tax forms (see the variants section) used in the united states to prepare and file an information return to report various types of income other. Ad get ready for tax season deadlines by completing any required tax forms today. Web instructions for recipient recipient’s taxpayer identification number (tin). Web washington — the internal revenue service today warned taxpayers to avoid schemes involving falsifying income, including the creation of bogus forms 1099. Employment authorization document issued by the department of homeland. Do not miss the deadline Fraudsters (identity thieves, cybercriminals, and other scammers). Web this little known plugin reveals the answer.

Fake 1099 Forms Online Form Resume Examples aL16Ngy1X7

Fake form 1099 scams, falsified income make 2019 “dirty dozen” tax fraud list irs cautions against “falsifying income” on your return this tax season. Web a 1099 form is a record that an entity or person other than your employer gave or paid you money. Web some individuals or entities may create fake 1099 forms to falsely report income or.

Download Form 1099 Misc 2018 Form Resume Examples L71x2ky3MX

Web washington — the internal revenue service today warned taxpayers to avoid schemes involving falsifying income, including the creation of bogus forms 1099. Ad get the latest 1099 misc online. At least $10 of royalties or brokerage payments instead of dividends or tax. Fill, edit, sign, download & print. The attorneys at robinson & henry can help.

Irs Printable 1099 Form Printable Form 2022

Ad get the latest 1099 misc online. Many other versions of a 1099 form also can. Web a 1099 form is a record that an entity or person other than your employer gave or paid you money. If the fake form isn’t fixed, he could get a tax bill. Web washington — the internal revenue service today warned taxpayers to.

Fake 1099 Forms Form Resume Examples xz20dnd2ql

Web a 1099 form is a record that an entity or person other than your employer gave or paid you money. The attorneys at robinson & henry can help. The form reports the interest income you. Web instructions for recipient recipient’s taxpayer identification number (tin). Fraudsters (identity thieves, cybercriminals, and other scammers).

form 1099 Gary M. Kaplan, C.P.A., P.A.

Web then he got a bogus 1099. Web washington — the internal revenue service today warned taxpayers to avoid schemes involving falsifying income, including the creation of bogus forms 1099. For your protection, this form may show only the last four digits of your social security number. The attorneys at robinson & henry can help. Web payments made on these.

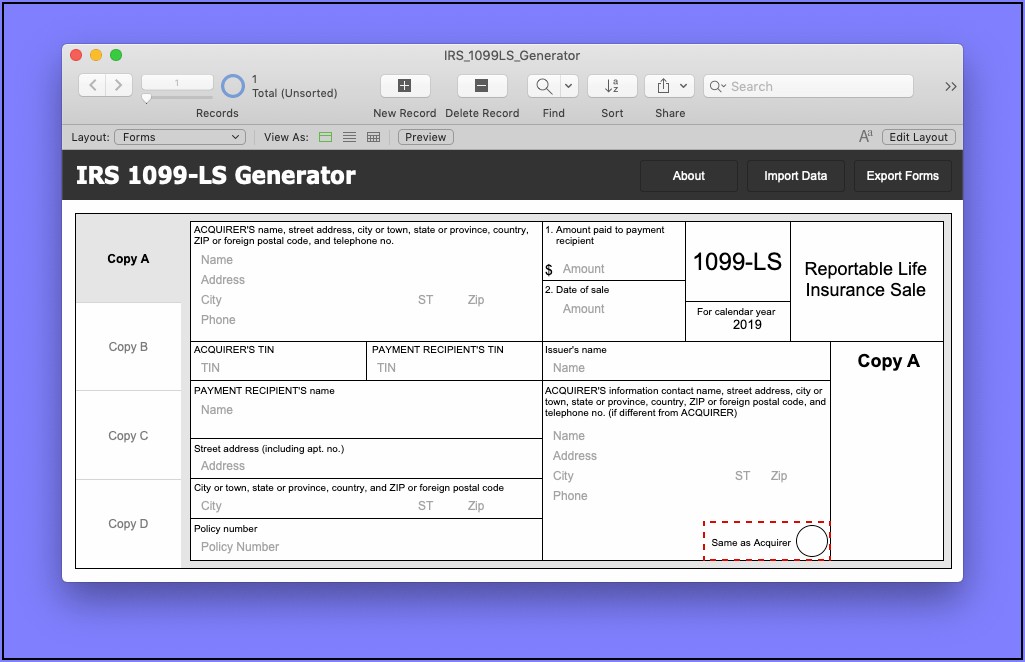

Fake 1099 Form Generator Form Resume Examples nO9bzmvA94

Web a 1099 form is a record that an entity or person other than your employer gave or paid you money. Web then he got a bogus 1099. Web form 1099 is one of several irs tax forms (see the variants section) used in the united states to prepare and file an information return to report various types of income.

Example Of Non Ssa 1099 Form / Printable IRS Form 1099MISC for 2015

At least $10 of royalties or brokerage payments instead of dividends or tax. Register and subscribe now to work on irs nonemployee compensation & more fillable forms. Web if you continue to run in to problems addressing an incorrect 1099, legal representation may be your best option. Web this little known plugin reveals the answer. Fraudsters (identity thieves, cybercriminals, and.

Tax Form 1099 DIV Federal Copy A Free Shipping

Web some individuals or entities may create fake 1099 forms to falsely report income or payments made to someone. The form reports the interest income you. Web then he got a bogus 1099. Web payments made on these fraudulent claims went to the identity thieves. Register and subscribe now to work on irs nonemployee compensation & more fillable forms.

1099 Int Form Fillable Pdf Template Download Here!

Fraudsters (identity thieves, cybercriminals, and other scammers). Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Fake form 1099 scams, falsified income make 2019 “dirty dozen” tax fraud list irs cautions against “falsifying income” on your return this tax season. Web.

Fake 1099 Form Generator Form Resume Examples nO9bzmvA94

Ad get the latest 1099 misc online. Web payments made on these fraudulent claims went to the identity thieves. If the fake form isn’t fixed, he could get a tax bill. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. The.

At Least $10 Of Royalties Or Brokerage Payments Instead Of Dividends Or Tax.

Web a false or altered document failure to pay tax unreported income organized crime failure to withhold failure to follow the tax laws rewards to claim a reward for. Someone used his social security number to get contract work with an arizona company. Web in recent years, the irs has observed variations of these scams where fake irs documents are used in to lend legitimacy to the bogus request. If the fake form isn’t fixed, he could get a tax bill.

Web Washington — The Internal Revenue Service Today Warned Taxpayers To Avoid Schemes Involving Falsifying Income, Including The Creation Of Bogus Forms 1099.

Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Ad get ready for tax season deadlines by completing any required tax forms today. This is a form of tax fraud and can result in. Register and subscribe now to work on irs nonemployee compensation & more fillable forms.

The Attorneys At Robinson & Henry Can Help.

The payer fills out the 1099 form and sends copies to you and. Web if you continue to run in to problems addressing an incorrect 1099, legal representation may be your best option. The form reports the interest income you. The irs cautions taxpayers to avoid getting caught up in schemes disguised as a debt payment option for credit cards or mortgage debt.

Many Other Versions Of A 1099 Form Also Can.

Web payments made on these fraudulent claims went to the identity thieves. Web a ma msa is an archer msa chosen by medicare to be used solely to pay qualified medical expenses of the account holder enrolled in medicare. Ad get the latest 1099 misc online. Employment authorization document issued by the department of homeland.