Fax Form 2848

Fax Form 2848 - Form 2848 is used to authorize an eligible individual to. Fax number* alabama, arkansas, connecticut, delaware, district of Web we have provided a list of irs fax numbers above on where to fax your form 2848, based on your residency. Web you can only submit one form at a time. If you're already working with an irs representative, they may request that you fax the form to a certain number. To find the service center address, see the related tax return instructions. Web information about form 2848, power of attorney and declaration of representative, including recent updates, related forms, and instructions on how to file. Once you’ve entered the correct irs fax number to send your form 2848, the final step is to confirm payment. Then it's time to send it to the irs. Upload a completed version of a signed form 8821 or form 2848.

Mail your form 2848 directly to the irs address in the where to file chart. Web we have provided a list of irs fax numbers above on where to fax your form 2848, based on your residency. Web information about form 2848, power of attorney and declaration of representative, including recent updates, related forms, and instructions on how to file. Upload a completed version of a signed form 8821 or form 2848. If form 2848 is for a specific use, mail or fax it to the Web you can only submit one form at a time. Web fax or mail forms 2848 and 8821. If you're already working with an irs representative, they may request that you fax the form to a certain number. To find the service center address, see the related tax return instructions. Web generally, mail or fax form 2848 directly to the centralized authorization file (caf) unit at the service center where the related return was, or will be, filed.

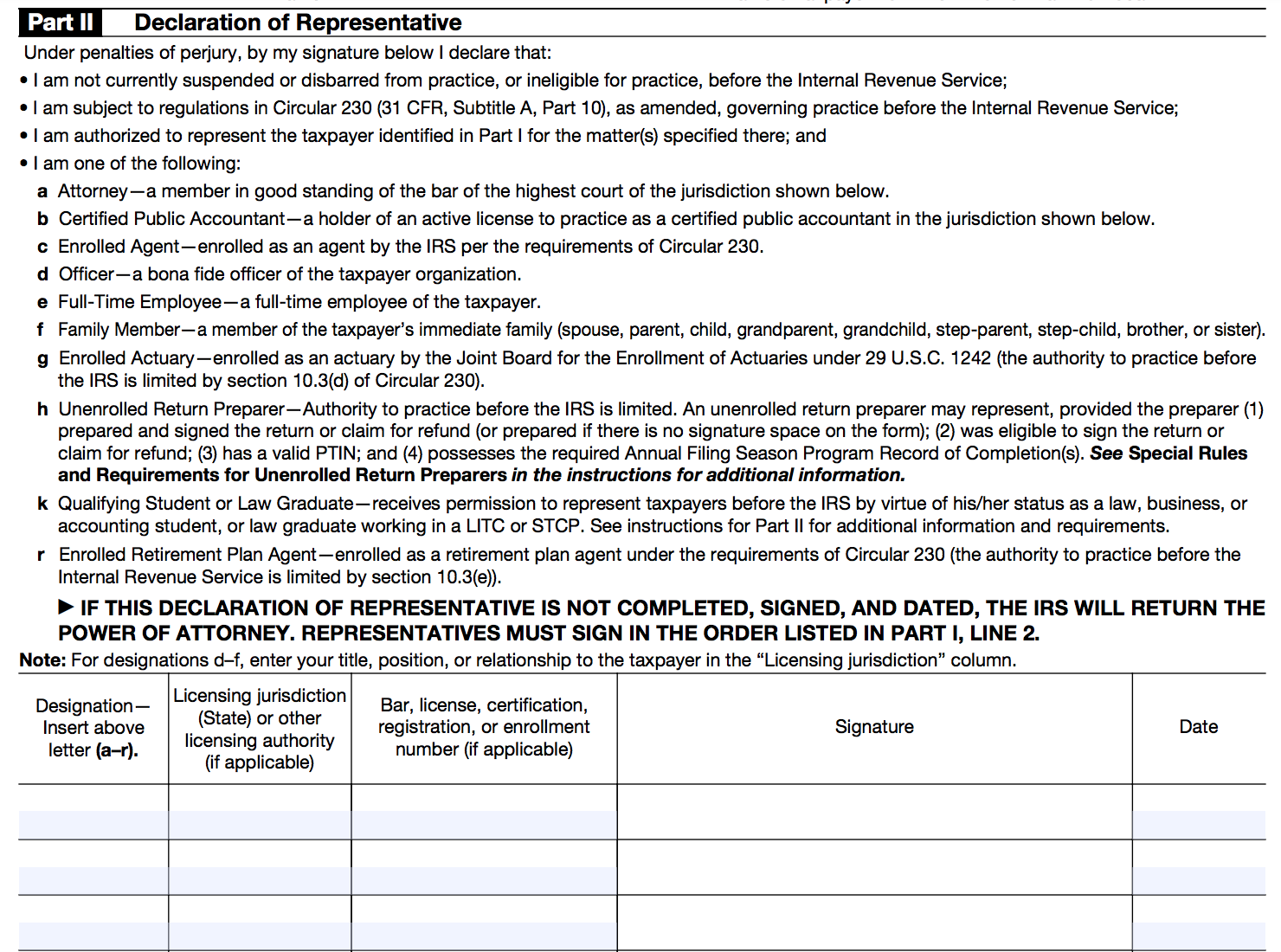

If form 2848 is for a specific use, mail or fax it to the Otherwise, mail or fax form 2848 directly to the irs address according to the where to file chart. Do not submit a form online if you've already submitted it by fax or mail. Then it's time to send it to the irs. Where to file chart if you live in. Upload a completed version of a signed form 8821 or form 2848. If you're already working with an irs representative, they may request that you fax the form to a certain number. Form 2848 is used to authorize an eligible individual to. Fax your form 2848 to the irs fax number in the where to file chart. January 2021) and declaration of representative department of the treasury internal revenue service go to www.irs.gov/form2848 for instructions and the latest information.

Breanna Form 2848 Fax Number Irs

Form 2848 is used to authorize an eligible individual to. Upload a completed version of a signed form 8821 or form 2848. If form 2848 is for a specific use, mail or fax it to the Web power of attorney form (rev. Fax number* alabama, arkansas, connecticut, delaware, district of

20142023 Form MA DoR M2848 Fill Online, Printable, Fillable, Blank

Web power of attorney form (rev. Do not submit a form online if you've already submitted it by fax or mail. Faxaroo accepts payment via visa or mastercard. Web fax or mail forms 2848 and 8821. Then it's time to send it to the irs.

Fax Cover Sheet Template

Fax number* alabama, arkansas, connecticut, delaware, district of Web we have provided a list of irs fax numbers above on where to fax your form 2848, based on your residency. If you're already working with an irs representative, they may request that you fax the form to a certain number. Where to file chart if you live in. Part i.

26+ Fax Cover Sheet Templates Free Word, PDF Formats

Fax number* alabama, arkansas, connecticut, delaware, district of Fax your form 2848 to the irs fax number in the where to file chart. A separate form 2848 must be completed for each taxpayer. Form 2848 is used to authorize an eligible individual to. Otherwise, mail or fax form 2848 directly to the irs address according to the where to file.

20182020 Form IRS 2848 Fill Online, Printable, Fillable, Blank PDFfiller

Web information about form 2848, power of attorney and declaration of representative, including recent updates, related forms, and instructions on how to file. Once you’ve entered the correct irs fax number to send your form 2848, the final step is to confirm payment. Web even better than fax is to submit the form online. To find the service center address,.

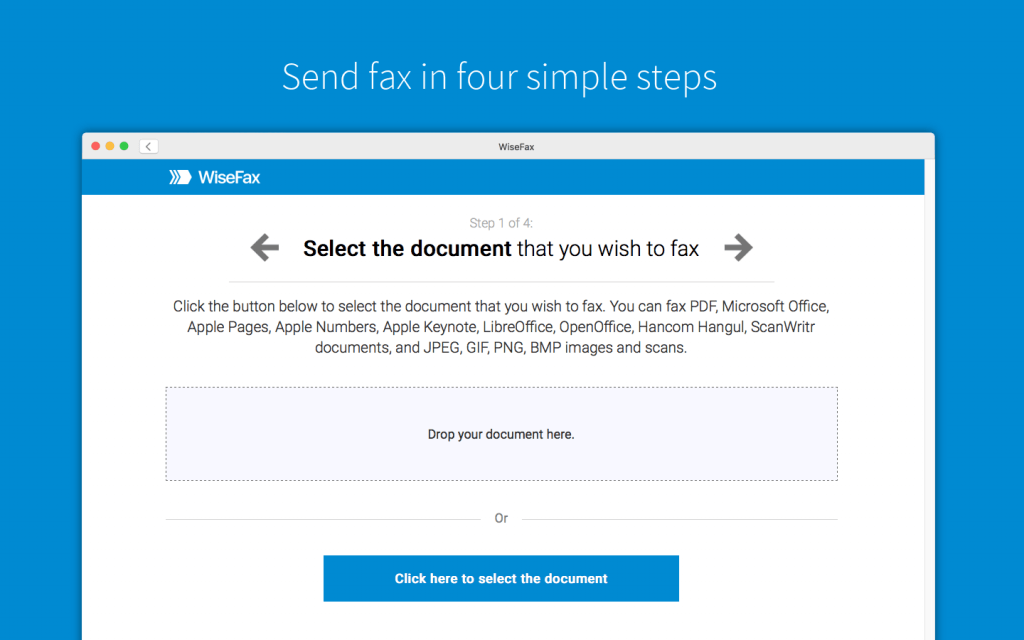

Fax Form 2848 Online Quickly and Easily With WiseFax

Web power of attorney form (rev. Web even better than fax is to submit the form online. Do not submit a form online if you've already submitted it by fax or mail. If you can’t use an online option, you can fax or mail authorization forms to us. Mail your form 2848 directly to the irs address in the where.

Form 2848 Instructions for IRS Power of Attorney Community Tax

To find the service center address, see the related tax return instructions. If form 2848 is for a specific use, mail or fax it to the Form 2848 is used to authorize an eligible individual to. Upload a completed version of a signed form 8821 or form 2848. Web fax or mail forms 2848 and 8821.

All About IRS Form 2848 SmartAsset

Web you can only submit one form at a time. Upload a completed version of a signed form 8821 or form 2848. Web if you check the box on line 4, mail or fax form 2848 to the irs office handling the specific matter. Fax your form 2848 to the irs fax number in the where to file chart. To.

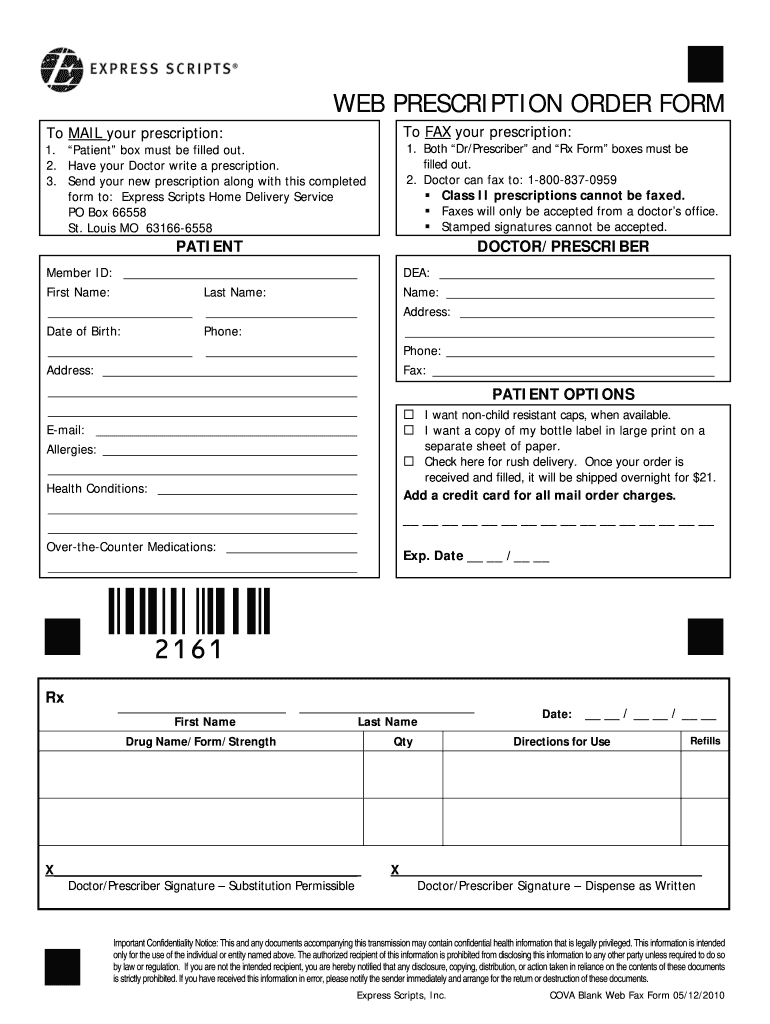

Express Scripts Fax Form Fill and Sign Printable Template Online US

Part i power of attorney caution: Web you can only submit one form at a time. If you can’t use an online option, you can fax or mail authorization forms to us. Once you’ve entered the correct irs fax number to send your form 2848, the final step is to confirm payment. Web power of attorney form (rev.

Used Auto Parts Fax Order Form

A separate form 2848 must be completed for each taxpayer. Web even better than fax is to submit the form online. Web if you check the box on line 4, mail or fax form 2848 to the irs office handling the specific matter. Prior authorizations retained or revoked. To find the service center address, see the related tax return instructions.

If Form 2848 Is For A Specific Use, Mail Or Fax It To The

To find the service center address, see the related tax return instructions. Web power of attorney form (rev. Fax number* alabama, arkansas, connecticut, delaware, district of Web generally, mail or fax form 2848 directly to the centralized authorization file (caf) unit at the service center where the related return was, or will be, filed.

January 2021) And Declaration Of Representative Department Of The Treasury Internal Revenue Service Go To Www.irs.gov/Form2848 For Instructions And The Latest Information.

To submit multiple forms, select “submit another form and answer the questions about the authorization. Mail your form 2848 directly to the irs address in the where to file chart. Prior authorizations retained or revoked. A separate form 2848 must be completed for each taxpayer.

Web We Have Provided A List Of Irs Fax Numbers Above On Where To Fax Your Form 2848, Based On Your Residency.

Once you’ve entered the correct irs fax number to send your form 2848, the final step is to confirm payment. Web if you check the box on line 4, mail or fax form 2848 to the irs office handling the specific matter. Web you can only submit one form at a time. Web fax or mail forms 2848 and 8821.

Then It's Time To Send It To The Irs.

Upload a completed version of a signed form 8821 or form 2848. Otherwise, mail or fax form 2848 directly to the irs address according to the where to file chart. Any tax matter or period. Fax your form 2848 to the irs fax number in the where to file chart.