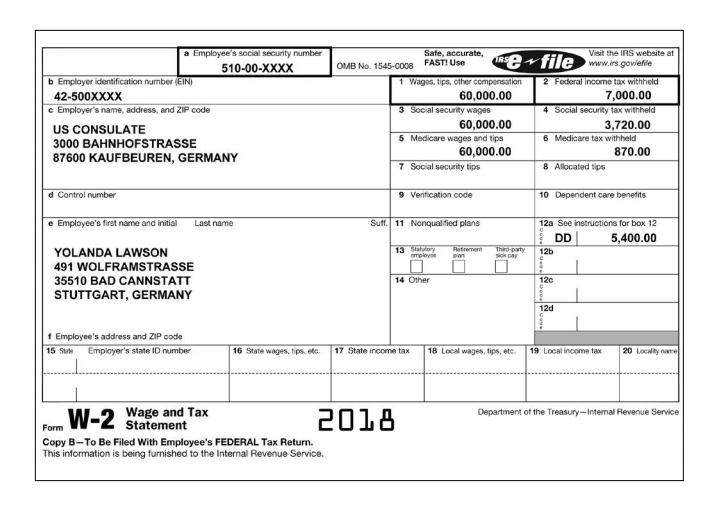

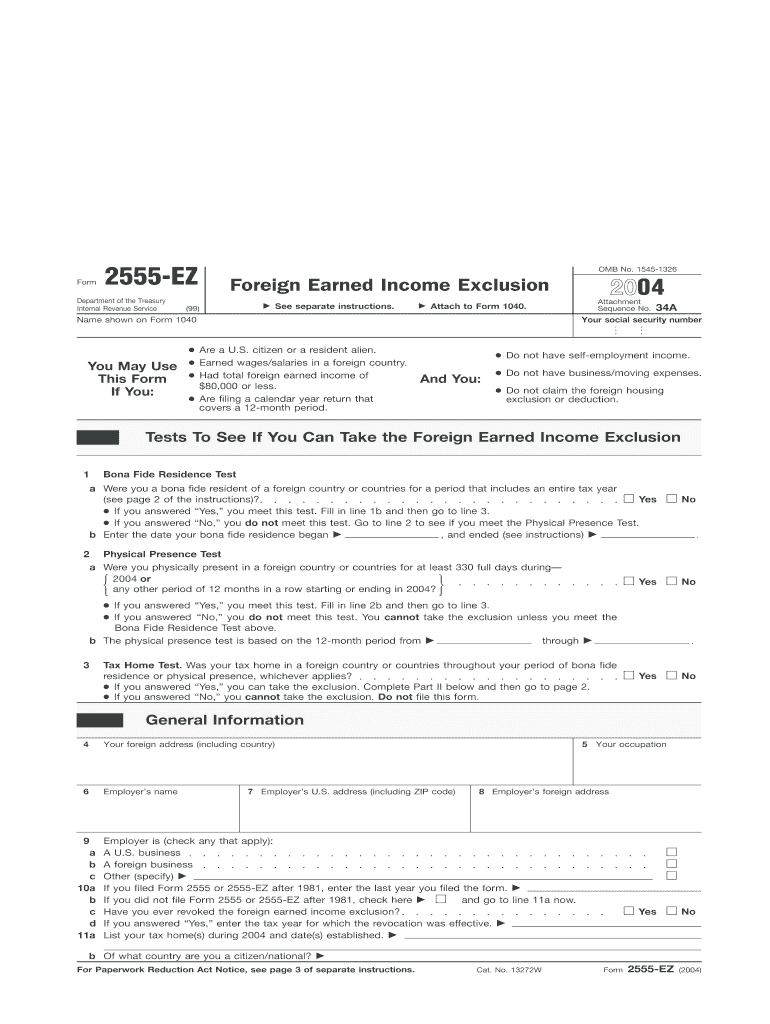

Federal Form 2555

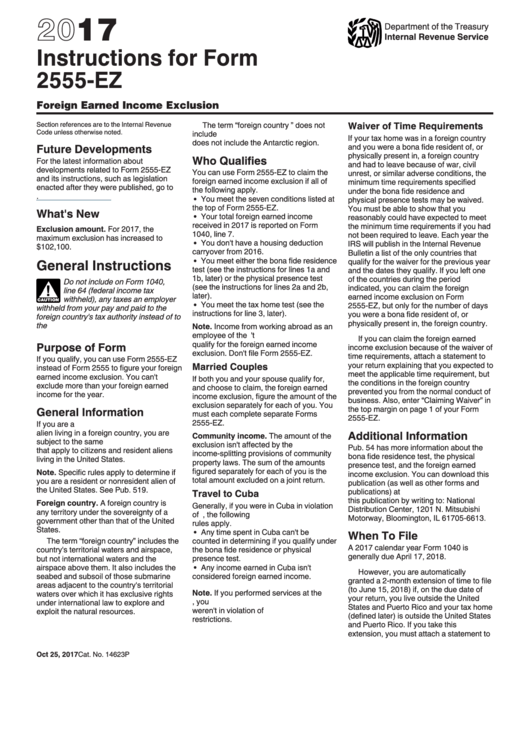

Federal Form 2555 - Amounts from federal forms 2555, lines 45 and 50, and 4563,. Foreign earned income exclusion tax credit: Web about form 2555, foreign earned income. Web these related forms may also be needed with the federal form 2555. Taxpayers qualifying under bona fide residence test part v: Web if you filed federal form 1040, enter the total of any: Exclusion of income from puerto rico, plus; Ad access irs tax forms. You may also qualify to exclude. Company e other (specify) 6 a if you previously filed form 2555 or.

Web these related forms may also be needed with the federal form 2555. Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Web 5 employer is (check a a foreign entity b a u.s. You can get the irs form 2555 from the official website of. Web if you filed federal form 1040, enter the total of any: Web the tax form 2555, or foreign earned income, is an irs form that qualifying taxpayers with the appropriate residency status and citizenship can use to figure out their foreign earned. You may also qualify to exclude. How do i complete irs form 2555? Web about form 2555, foreign earned income. Web what is irs form 2555?

Get ready for tax season deadlines by completing any required tax forms today. Web 5 employer is (check a a foreign entity b a u.s. Web what is irs form 2555? If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or. Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Go to www.irs.gov/form2555 for instructions and the latest. You cannot exclude or deduct more than the. Web 235 rows purpose of form. Company e other (specify) 6 a if you previously filed form 2555 or. Web if you filed federal form 1040, enter the total of any:

Breanna Form 2555 Ez 2016

Company c self any that apply): Get ready for tax season deadlines by completing any required tax forms today. Web if you meet the requirements, you can complete form 2555 to exclude your foreign wages or salary from income earned in the foreign country. Complete, edit or print tax forms instantly. You can get the irs form 2555 from the.

Foreign Earned Exclusion Form 2555 Verni Tax Law

Expats are generally required to file their returns. Web if you filed federal form 1040, enter the total of any: Web the following steps given below can guide you to show how to complete the irs form 2555. Web what is irs form 2555? Get ready for tax season deadlines by completing any required tax forms today.

Ssurvivor Form 2555 Instructions

Expats are generally required to file their returns. Company e other (specify) 6 a if you previously filed form 2555 or. Form 8655 allows a taxpayer to designate a reporting agent to file certain employment tax returns electronically or on magnetic tape, to receive copies of. Get ready for tax season deadlines by completing any required tax forms today. Ad.

Top 16 Form 2555ez Templates free to download in PDF format

Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Taxpayers qualifying under bona fide residence test part v: You cannot exclude or deduct more than the. Web if you meet the requirements, you can complete form 2555 to exclude your foreign wages or salary from income earned.

Publication 54 Tax Guide for U.S. Citizens and Resident Aliens Abroad

Exclusion of income from puerto rico, plus; Web what is irs form 2555? Web 235 rows purpose of form. Company c self any that apply): D a foreign affiliate of a u.s.

Business Tax Declaration Form In Ethiopia Paul Johnson's Templates

D a foreign affiliate of a u.s. If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or. Expats are generally required to file their returns. You cannot exclude or deduct more than the. If you qualify, you can use form 2555 to figure your foreign.

Form 2555 Edit, Fill, Sign Online Handypdf

If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or. Web up to $40 cash back you can use this form instead of form 2555, foreign earned income, to calculate your foreign earned income exclusion. Web the following steps given below can guide you to show how to complete the.

Form 2555 Ez Fill Out and Sign Printable PDF Template signNow

Web what is irs form 2555? Company e other (specify) 6 a if you previously filed form 2555 or. Web the tax form 2555, or foreign earned income, is an irs form that qualifying taxpayers with the appropriate residency status and citizenship can use to figure out their foreign earned. Web 235 rows purpose of form. Web 5 employer is.

IRS Form 2555 Download Fillable PDF 2017, Foreign Earned

Foreign earned income exclusion tax credit: Web the following steps given below can guide you to show how to complete the irs form 2555. Ad access irs tax forms. Web if you filed federal form 1040, enter the total of any: Form 8655 allows a taxpayer to designate a reporting agent to file certain employment tax returns electronically or on.

Web Up To $40 Cash Back You Can Use This Form Instead Of Form 2555, Foreign Earned Income, To Calculate Your Foreign Earned Income Exclusion.

Ad access irs tax forms. Web about form 2555, foreign earned income. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today.

Company E Other (Specify) 6 A If You Previously Filed Form 2555 Or.

Form 8655 allows a taxpayer to designate a reporting agent to file certain employment tax returns electronically or on magnetic tape, to receive copies of. Go to www.irs.gov/form2555 for instructions and the latest. Web these related forms may also be needed with the federal form 2555. Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction.

Foreign Earned Income Exclusion Tax Credit:

How do i complete irs form 2555? Web if you meet the requirements, you can complete form 2555 to exclude your foreign wages or salary from income earned in the foreign country. Get ready for tax season deadlines by completing any required tax forms today. If you qualify, you can use form 2555 to figure your foreign.

You May Also Qualify To Exclude.

You can get the irs form 2555 from the official website of. Web 5 employer is (check a a foreign entity b a u.s. Web the tax form 2555, or foreign earned income, is an irs form that qualifying taxpayers with the appropriate residency status and citizenship can use to figure out their foreign earned. Taxpayers qualifying under bona fide residence test part v: