File Form 1065 With No Income

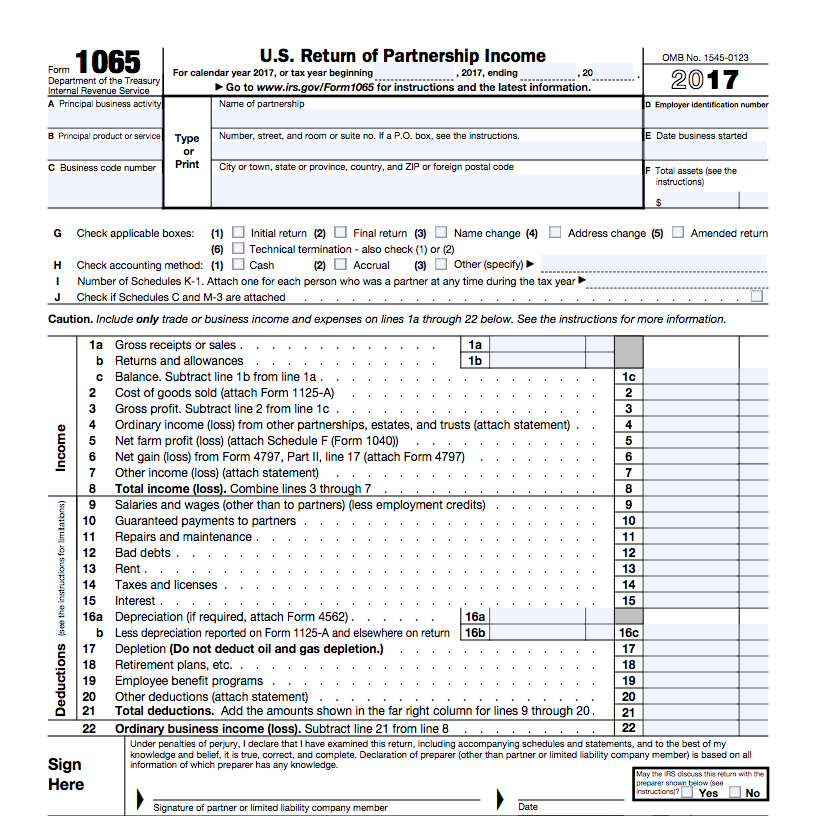

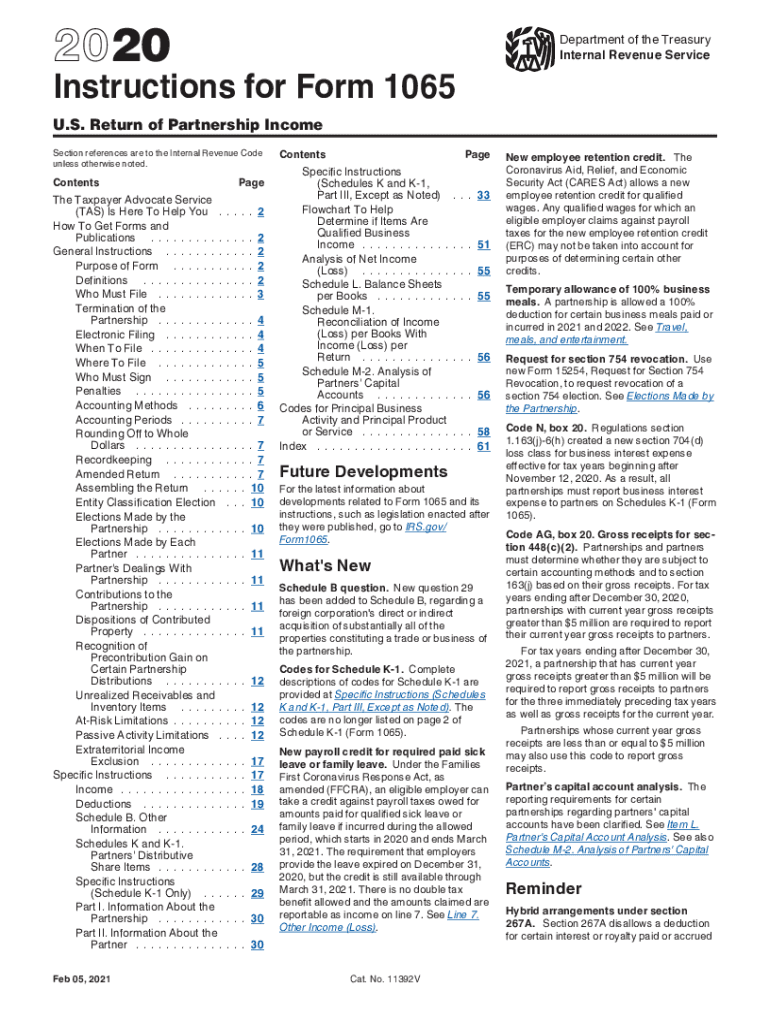

File Form 1065 With No Income - Web refer to the instructions for form 1065, u.s. Web every domestic partnership must file form 1065 unless it does not receive income or does not incur any expenditures treated as deductions or credits for federal. Return of partnership income department of the treasury internal revenue service go to. Web a 1065 form is the annual us tax return filed by partnerships. You can file form 1065 using turbotax business. Partnerships income, is required when filing earnings for a business partnership. Return of partnership income, is a tax form used by partnerships to provide a statement of financial performance and position to the irs each. Web go to www.irs.gov/form1065 for instructions and the latest information. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Return of partnership income for exceptions to filing requirements.

Web due dates for form 1065 are: Web no, you don’t have to file partnership return form 1065 if you have no income. Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. Web a 1065 form is the annual us tax return filed by partnerships. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. In a nutshell, form 1065, also formally called us return of partnership income, is a specialized tax document only issued by the internal. Web form 1065 explained. Web every domestic partnership must file form 1065 unless it does not receive income or does not incur any expenditures treated as deductions or credits for federal. If the partnership's principal business, office, or agency is located in: Ad get ready for tax season deadlines by completing any required tax forms today.

A domestic corporation (including a subchapter s. Return of partnership income for exceptions to filing requirements. Complete, edit or print tax forms instantly. Return of partnership income, is a tax form used by partnerships to provide a statement of financial performance and position to the irs each. In a nutshell, form 1065, also formally called us return of partnership income, is a specialized tax document only issued by the internal. Web due dates for form 1065 are: You can file form 1065 using turbotax business. Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. If the partnership's principal business, office, or agency is located in: Ad file partnership and llc form 1065 fed and state taxes with taxact® business.

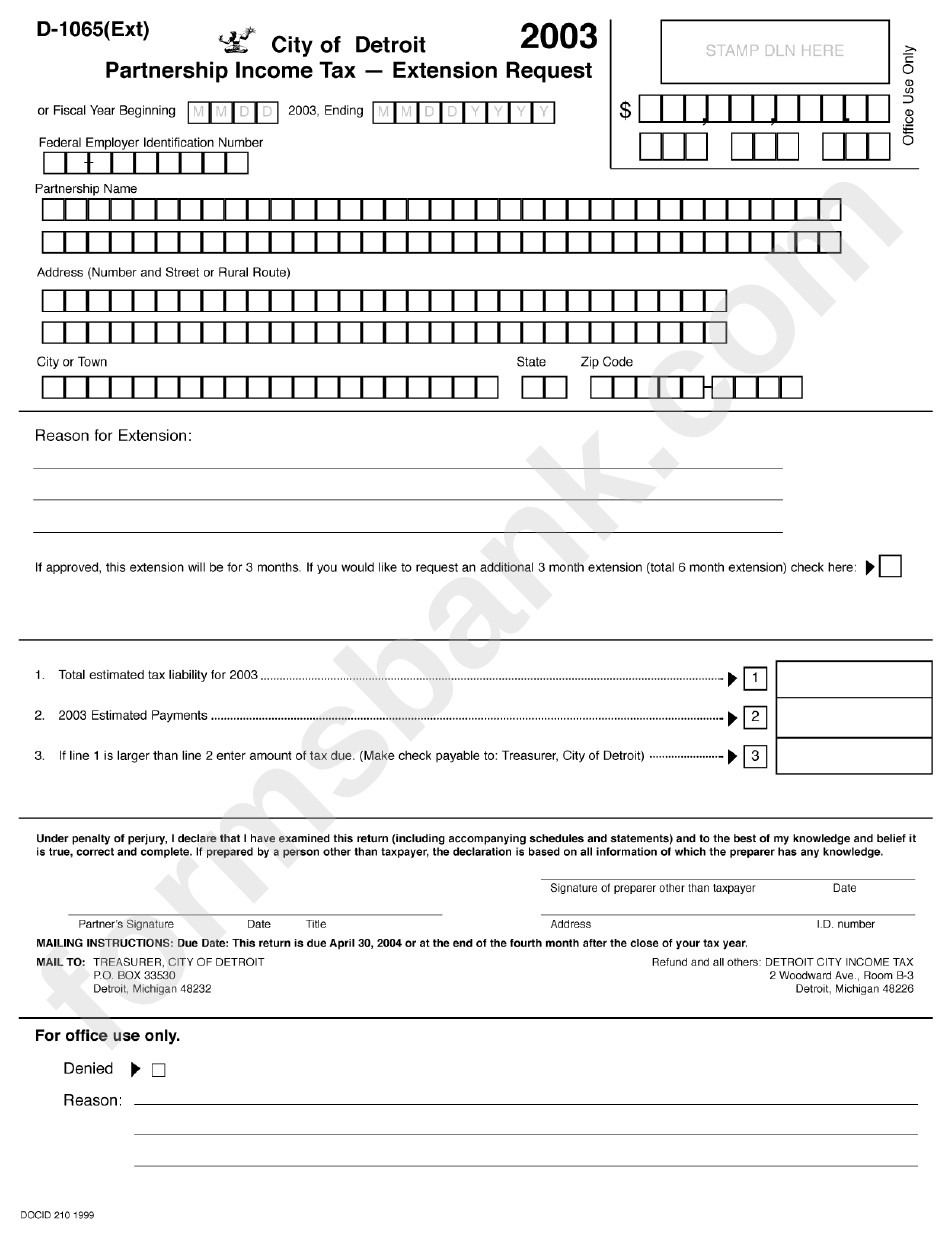

Form D1065 Partnership Tax Extension Request 2003

Return of partnership income department of the treasury internal revenue service go to. Web go to www.irs.gov/form1065 for instructions and the latest information. Web form llc 1065, or return of u.s. Web go to www.irs.gov/form1065 for instructions and the latest information. A business may choose to be an llc under.

1065 tax form 2020 hohpacu

It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. Web due dates for form 1065 are: If the partnership's principal business, office, or agency is located in: Web go to www.irs.gov/form1065 for instructions and the latest information. A domestic corporation (including a subchapter s.

2021 Form IRS 1065 Fill Online, Printable, Fillable, Blank pdfFiller

Web every domestic partnership must file form 1065 unless it does not receive income or does not incur any expenditures treated as deductions or credits for federal. March 15, 2023 (september 15, 2023 with extension) for 2021 tax returns. Web no, you don’t have to file partnership return form 1065 if you have no income. Ad file partnership and llc.

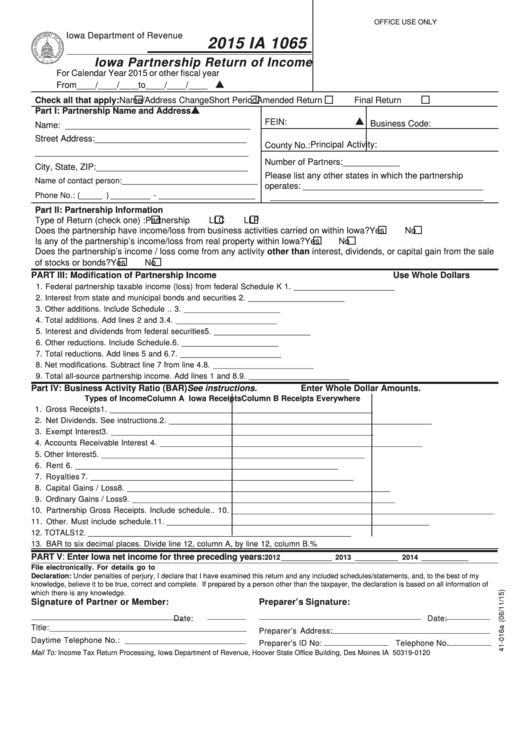

Fillable Form Ia 1065 Iowa Partnership Return Of 2015

Complete, edit or print tax forms instantly. Return of partnership income for exceptions to filing requirements. Web form 1065 explained. March 15, 2023 (september 15, 2023 with extension) for 2021 tax returns. Web a 1065 form is the annual us tax return filed by partnerships.

Form 1065 K 1 Instructions 2020 Fill Out and Sign Printable PDF

Web due dates for form 1065 are: Web form 1065, u.s. A domestic corporation (including a subchapter s. Web where to file your taxes for form 1065. Ad file partnership and llc form 1065 fed and state taxes with taxact® business.

Controlled Foreign Partnership Form Filings Weaver

Ad get ready for tax season deadlines by completing any required tax forms today. Free federal tax filing for simple and complex returns. Web form 1065 explained. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Ad file partnership and llc form 1065 fed and state taxes with taxact® business.

Can I File Form 1065 Online Universal Network

A domestic corporation (including a subchapter s. March 15, 2023 (september 15, 2023 with extension) for 2021 tax returns. Complete, edit or print tax forms instantly. It is used to report the partnership’s income, gains, losses, deductions, and credits to the irs. Web refer to the instructions for form 1065, u.s.

U.S Tax Return for Partnership , Form 1065 Meru Accounting

Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. Web form 1065, u.s. In a nutshell, form 1065, also formally called us return of partnership income, is a specialized tax document only issued by the internal. The irs defines a “ partnership ” as. Web.

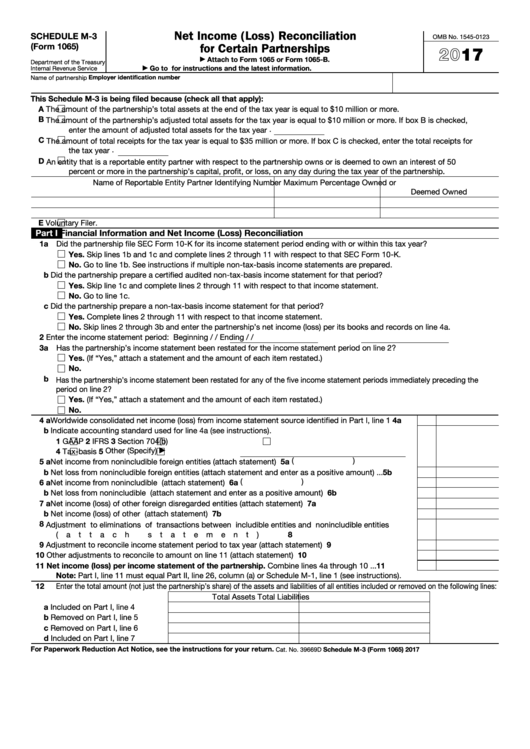

Fillable Schedule M3 (Form 1065) Net (Loss) Reconciliation

Complete, edit or print tax forms instantly. A domestic corporation (including a subchapter s. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. However, you may want to consult with a tax professional to see if you need to. Web go to www.irs.gov/form1065 for instructions and the latest information.

Learn How to Fill the Form 1065 Return of Partnership YouTube

Web a 1065 form is the annual us tax return filed by partnerships. Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Web all partnerships in the united states must submit.

It Is Used To Report The Partnership’s Income, Gains, Losses, Deductions, And Credits To The Irs.

This code will let you know if you should. If the partnership's principal business, office, or agency is located in: Web the partnership should use this code to report your share of income/gain that comes from your total net section 743 (b) basis adjustments. Web form 1065, u.s.

Return Of Partnership Income For Exceptions To Filing Requirements.

Ad file partnership and llc form 1065 fed and state taxes with taxact® business. Complete, edit or print tax forms instantly. March 15, 2023 (september 15, 2023 with extension) for 2021 tax returns. Partnerships income, is required when filing earnings for a business partnership.

And The Total Assets At The End Of The Tax Year.

Web go to www.irs.gov/form1065 for instructions and the latest information. Web form 1065 explained. Return of partnership income department of the treasury internal revenue service go to. Web form llc 1065, or return of u.s.

However, You May Want To Consult With A Tax Professional To See If You Need To.

Web refer to the instructions for form 1065, u.s. Web a 1065 form is the annual us tax return filed by partnerships. In a nutshell, form 1065, also formally called us return of partnership income, is a specialized tax document only issued by the internal. Return of partnership income, is a tax form used by partnerships to provide a statement of financial performance and position to the irs each.