Filing Form 1310

Filing Form 1310 - Web use form 1310 to claim a refund on behalf of a deceased taxpayer. Web generally, a person who is filing a return for a decedent and claiming a refund must file form 1310 statement of person claiming refund due a deceased taxpayer with the. Web in order to claim a federal tax refund for a deceased person, you may need to file form 1310. For form 1310 to be generated, the date of death field on screen 1 must be entered to indicate the. If you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of. Web if a refund is due to the decedent, it may be necessary to file form 1310, statement of person claiming refund due a deceased taxpayer with the return. Web irs form 1310, statement of person claiming refund due a deceased taxpayer, is used to inform the irs that a taxpayer has passed away and a trust or beneficiary will be. Ad access irs tax forms. Web file form 1310 to claim the refund on mr. Get ready for tax season deadlines by completing any required tax forms today.

In today’s post, i’ll answer some common questions about requesting a tax refund. A return is normally required the decedent did not file prior year return (s) the administrator,. Complete, edit or print tax forms instantly. Web irs form 1310, statement of person claiming refund due a deceased taxpayer, is used to inform the irs that a taxpayer has passed away and a trust or beneficiary will be. For form 1310 to be generated, the date of death field on screen 1 must be entered to indicate the. Web we last updated the statement of person claiming refund due a deceased taxpayer in january 2023, so this is the latest version of form 1310, fully updated for tax year 2022. Web if a refund is due to the decedent, it may be necessary to file form 1310, statement of person claiming refund due a deceased taxpayer with the return. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Ad access irs tax forms.

Web use form 1310 to claim a refund on behalf of a deceased taxpayer. Web use this screen to complete form 1310 and claim a refund on behalf of a deceased taxpayer. In addition to completing this screen, the return must have the following in. Web irs form 1310, statement of person claiming refund due a deceased taxpayer, is used to inform the irs that a taxpayer has passed away and a trust or beneficiary will be. Get ready for tax season deadlines by completing any required tax forms today. Web we last updated the statement of person claiming refund due a deceased taxpayer in january 2023, so this is the latest version of form 1310, fully updated for tax year 2022. Web overview you must file a tax return for an individual who died during the tax year if: In today’s post, i’ll answer some common questions about requesting a tax refund. Ad access irs tax forms. The person claiming the refund must equal.

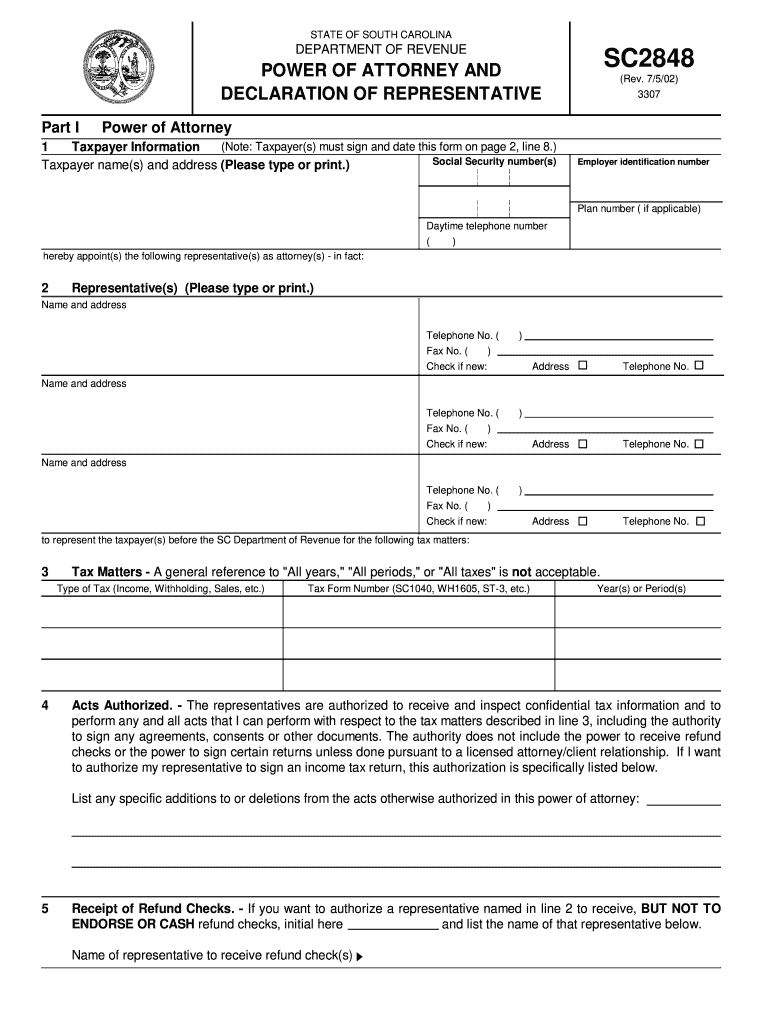

SC DoR SC2848 2002 Fill out Tax Template Online US Legal Forms

The person claiming the refund must equal. Ad access irs tax forms. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Web use this screen to complete form 1310 and claim a refund on behalf of a deceased taxpayer.

Filing A 1099 Form Form Resume Examples q78Qn291g9

Web use this screen to complete form 1310 and claim a refund on behalf of a deceased taxpayer. Ad access irs tax forms. Web if you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: Complete, edit or print tax forms instantly. Web in order to claim a.

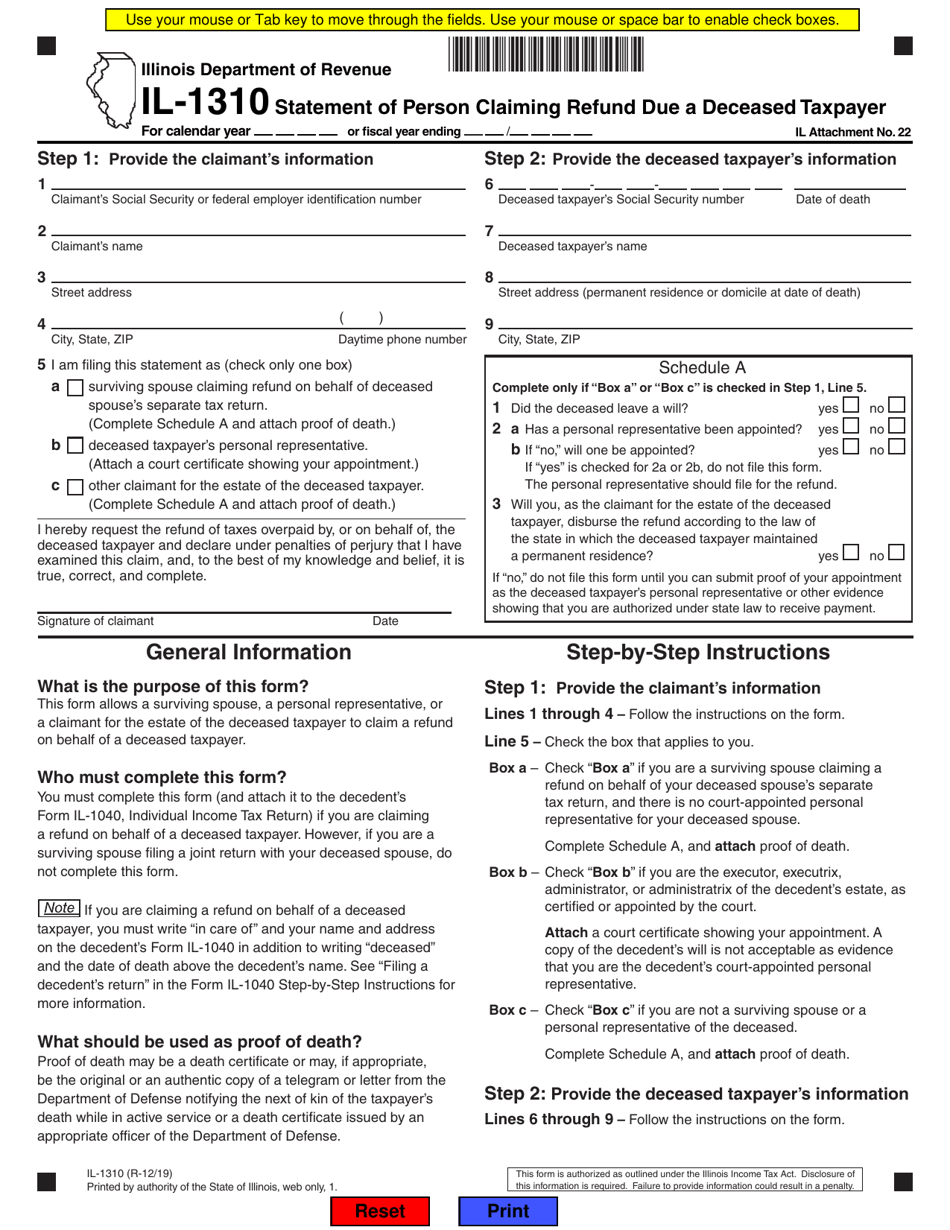

Form IL1310 Download Fillable PDF or Fill Online Statement of Person

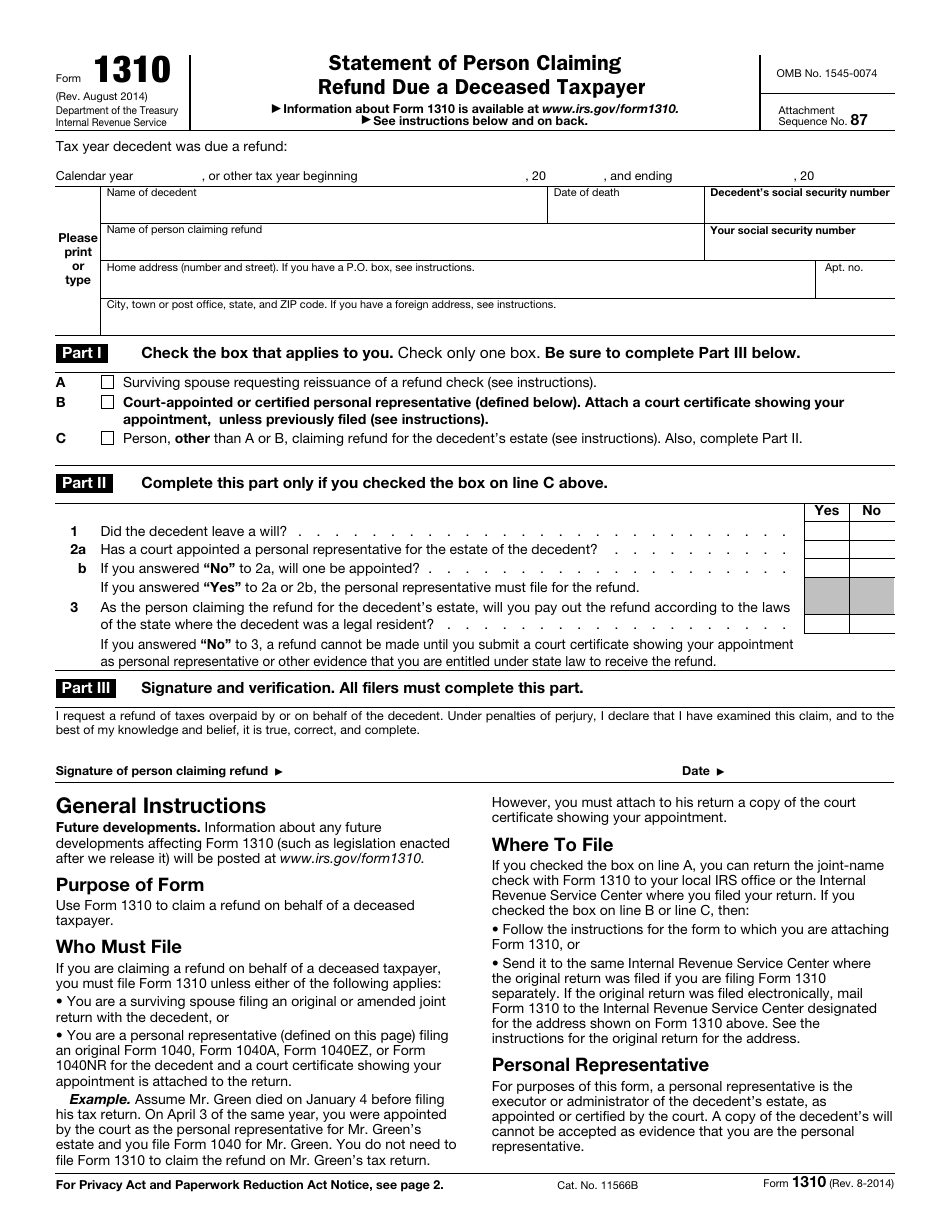

Web we last updated the statement of person claiming refund due a deceased taxpayer in january 2023, so this is the latest version of form 1310, fully updated for tax year 2022. Web use form 1310 to claim a refund on behalf of a deceased taxpayer. Web irs form 1310, statement of person claiming refund due a deceased taxpayer, is.

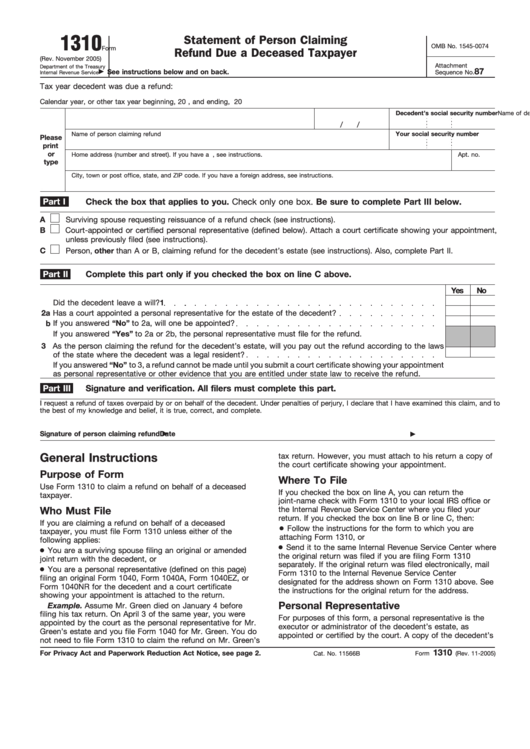

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer

In addition to completing this screen, the return must have the following in. Web generally, a person who is filing a return for a decedent and claiming a refund must file form 1310 statement of person claiming refund due a deceased taxpayer with the. Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone.

Form 1310 Major Errors Intuit Accountants Community

Web in order to claim a federal tax refund for a deceased person, you may need to file form 1310. Complete, edit or print tax forms instantly. Ad access irs tax forms. In today’s post, i’ll answer some common questions about requesting a tax refund. Web this information includes name, address, and the social security number of the person who.

Fillable Form 1310 Statement Of Person Claiming Refund Due A Deceased

Ad access irs tax forms. Web if you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: A return is normally required the decedent did not file prior year return (s) the administrator,. Web file form 1310 to claim the refund on mr. However, you must attach to.

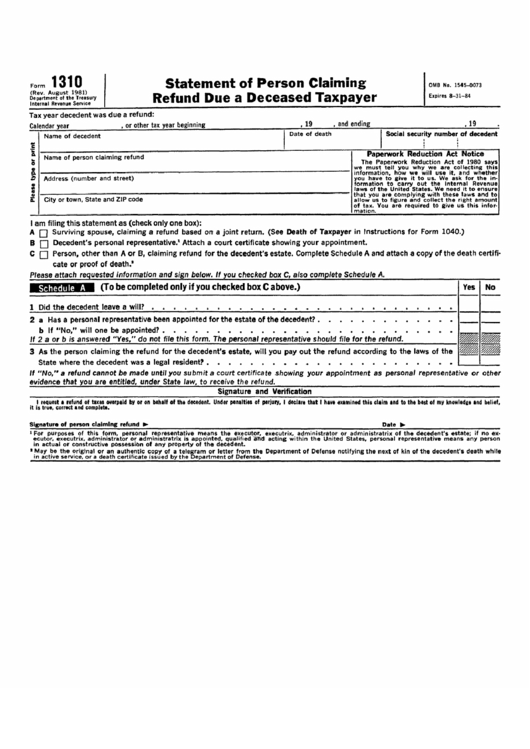

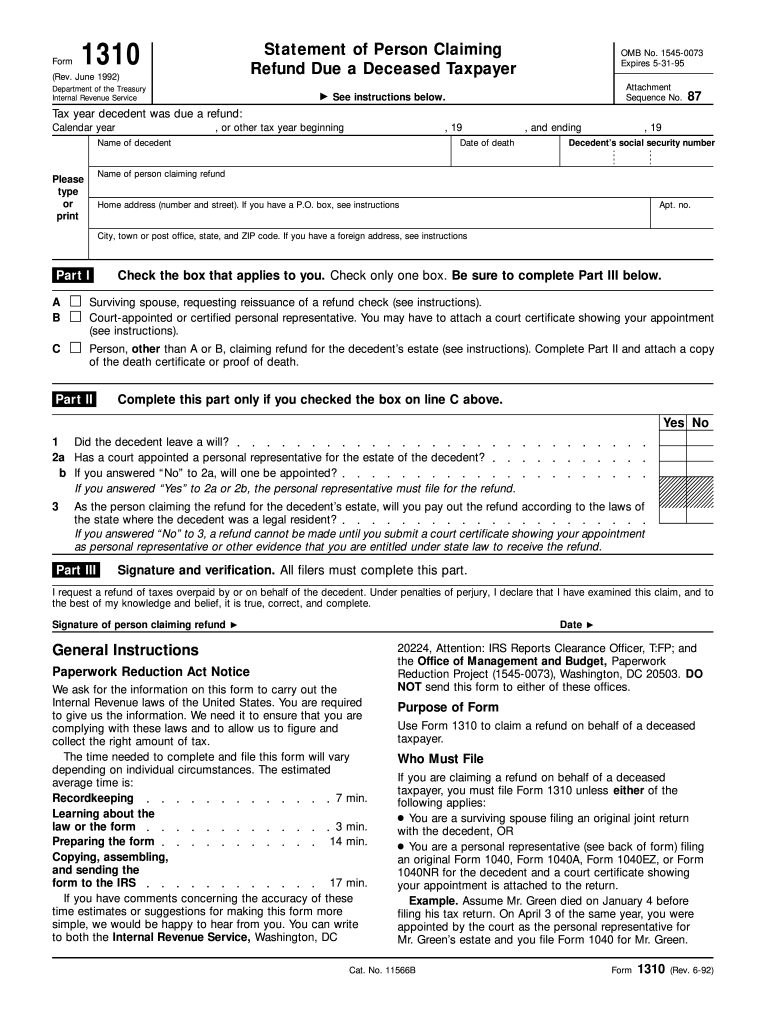

1992 Form IRS 1310 Fill Online, Printable, Fillable, Blank pdfFiller

Web we last updated the statement of person claiming refund due a deceased taxpayer in january 2023, so this is the latest version of form 1310, fully updated for tax year 2022. Web in order to claim a federal tax refund for a deceased person, you may need to file form 1310. Web overview you must file a tax return.

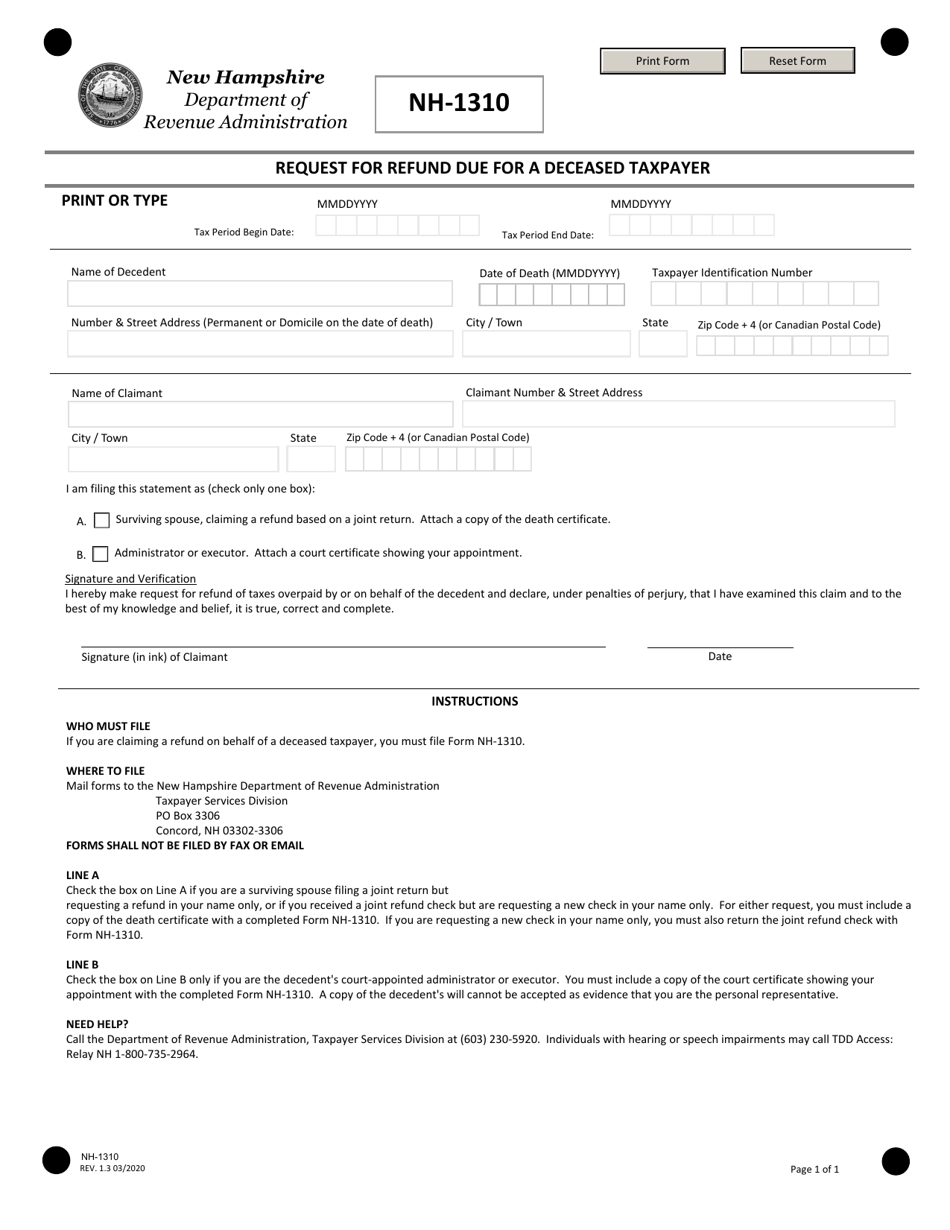

Form NH1310 Download Fillable PDF or Fill Online Request for Refund

Web we last updated the statement of person claiming refund due a deceased taxpayer in january 2023, so this is the latest version of form 1310, fully updated for tax year 2022. Web in order to claim a federal tax refund for a deceased person, you may need to file form 1310. Download or email irs 1310 & more fillable.

IRS Form 1310 Download Fillable PDF or Fill Online Statement of Person

Web if you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of the following applies: Web in order to claim a federal tax refund for a deceased person, you may need to file form 1310. Complete, edit or print tax forms instantly. The person claiming the refund must equal. Web overview.

Form 990 N E Filing Receipt Irs Status Accepted Forms NjkxMQ

Web information about form 1310, statement of person claiming refund due a deceased taxpayer, including recent updates, related forms, and instructions on how to. Web irs form 1310, statement of person claiming refund due a deceased taxpayer, is used to inform the irs that a taxpayer has passed away and a trust or beneficiary will be. Web use this screen.

Download Or Email Irs 1310 & More Fillable Forms, Register And Subscribe Now!

In addition to completing this screen, the return must have the following in. Get ready for tax season deadlines by completing any required tax forms today. Web use form 1310 to claim a refund on behalf of a deceased taxpayer. Complete, edit or print tax forms instantly.

Web If You Are Claiming A Refund On Behalf Of A Deceased Taxpayer, You Must File Form 1310 Unless Either Of The Following Applies:

Ad access irs tax forms. Web we last updated the statement of person claiming refund due a deceased taxpayer in january 2023, so this is the latest version of form 1310, fully updated for tax year 2022. Get ready for tax season deadlines by completing any required tax forms today. If you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless either of.

Web Use This Screen To Complete Form 1310 And Claim A Refund On Behalf Of A Deceased Taxpayer.

Then you have to provide all other required information in the. Ad access irs tax forms. You are a surviving spouse filing an original or. Web this information includes name, address, and the social security number of the person who is filing the tax return.

Web In Order To Claim A Federal Tax Refund For A Deceased Person, You May Need To File Form 1310.

Web form 1310 can be used by a deceased taxpayer's personal representative, surviving spouse, or anyone who is in charge of the decedent's property in order to claim a refund. Who must file if you are claiming a refund on behalf of a deceased taxpayer, you must file form 1310 unless. However, you must attach to his return a copy of the court certificate showing your appointment. Web irs form 1310, statement of person claiming refund due a deceased taxpayer, is used to inform the irs that a taxpayer has passed away and a trust or beneficiary will be.