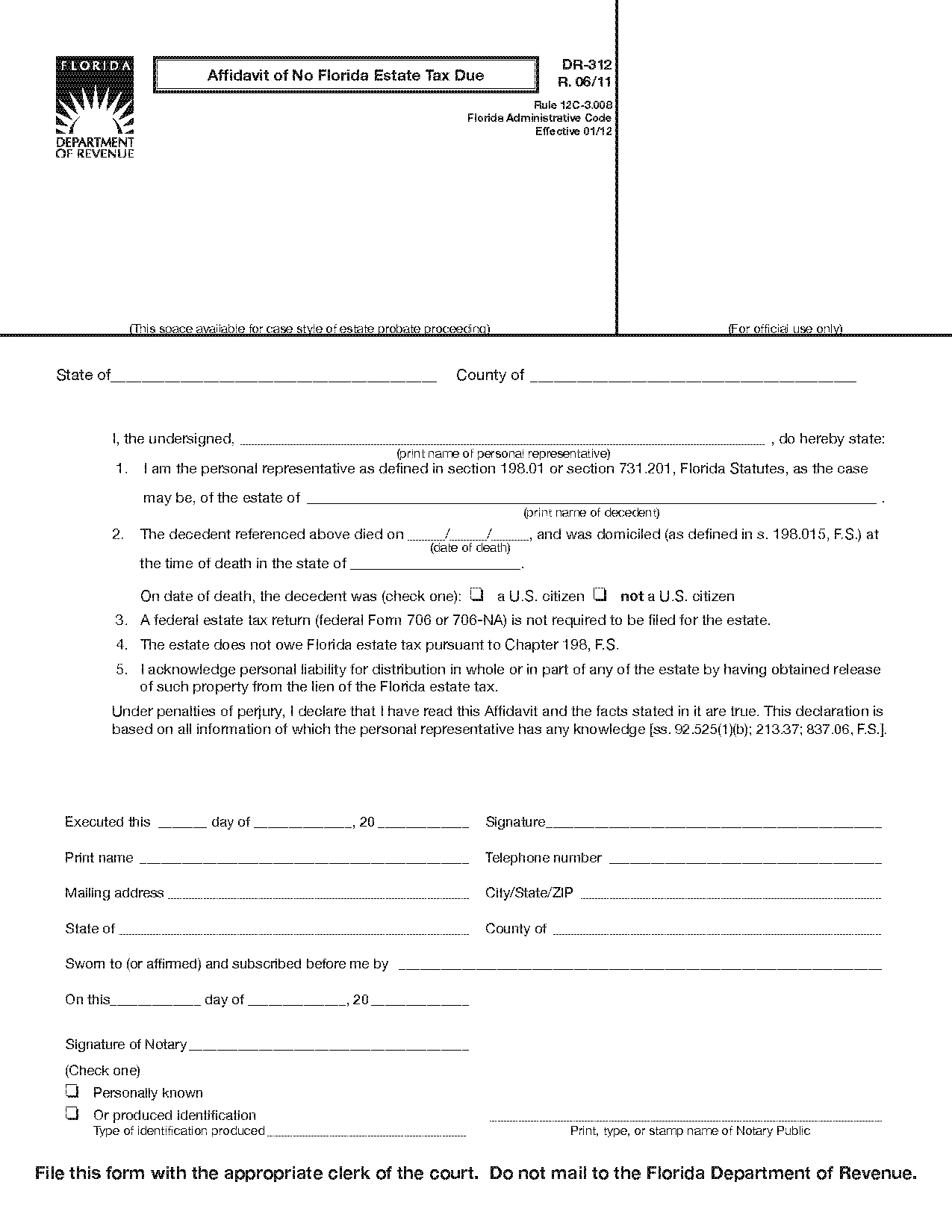

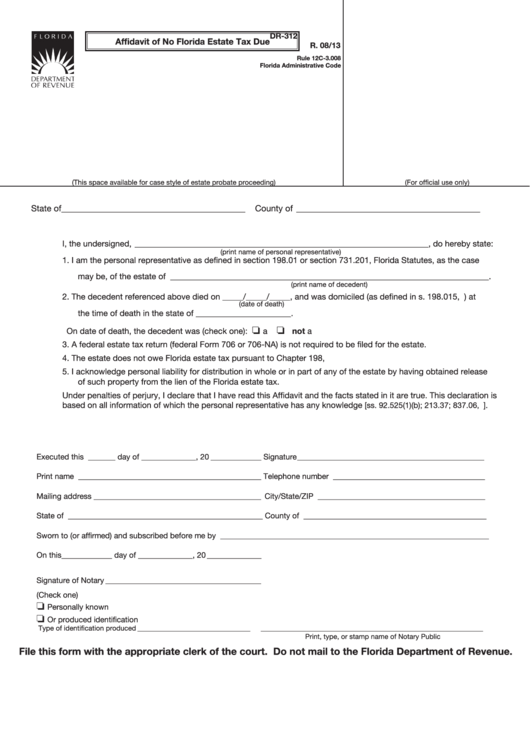

Florida Form Dr 312

Florida Form Dr 312 - Web we would like to show you a description here but the site won’t allow us. Affidavit of no florida estate tax due when federal return is. Affidavit of no florida estate tax due: Affidavit of no florida estate tax due form. The florida department of revenue will no longer. What this means for you is that if your loved one died after the beginning of 2005, then there is no state estate tax due.form. The forms are permitted by f.s. Web the florida department of revenue (dor) jan. The florida department of revenue will no longer. §198.32(2) only when a personal.

This is a florida form and can be use in. The forms are permitted by f.s. Web fl dr 312 form is a critical form that must be completed in order to obtain an medical marijuana card in the state of florida. The florida department of revenue will no longer. Use a dr 312 2021 template to make your document workflow more streamlined. Affidavit of no florida estate tax due when federal return is. Complete, edit or print tax forms instantly. §198.32(2) only when a personal. These forms must be filed with the. Web we would like to show you a description here but the site won’t allow us.

Web the florida department of revenue (dor) jan. Affidavit of no florida estate tax due: Web the florida department of revenue. These forms must be filed with the. Affidavit of no florida estate tax due when federal return is. §198.32(2) only when a personal. Use a dr 312 2021 template to make your document workflow more streamlined. This is a florida form and can be use in. Web the florida department of revenue (dor) jan. The florida department of revenue will no longer.

20162021 Form FL DR15AIR Fill Online, Printable, Fillable, Blank

Web the florida department of revenue (dor) jan. The florida department of revenue. Web the florida department of revenue (dor) jan. The florida department of revenue will no longer. The forms are permitted by f.s.

2002 Form FL DoR DR312 Fill Online, Printable, Fillable, Blank pdfFiller

The florida department of revenue will no longer. What this means for you is that if your loved one died after the beginning of 2005, then there is no state estate tax due.form. Web we would like to show you a description here but the site won’t allow us. Affidavit of no florida estate tax due: Affidavit of no florida.

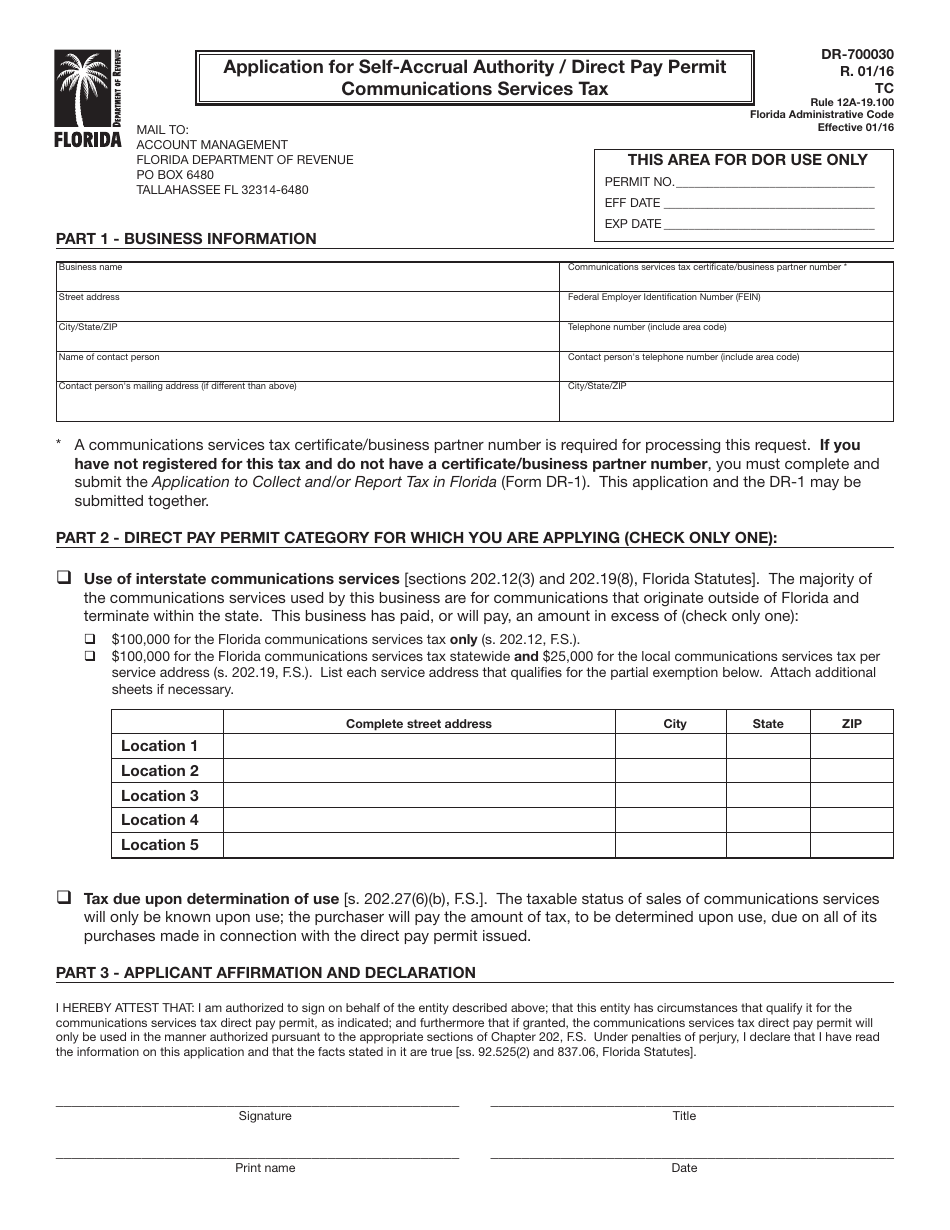

Form DR700030 Download Printable PDF or Fill Online Application for

The florida department of revenue. Affidavit of no florida estate tax due form. What this means for you is that if your loved one died after the beginning of 2005, then there is no state estate tax due.form. The florida department of revenue will no longer. Web the florida department of revenue.

Form DR191 Download Printable PDF or Fill Online Application for

What this means for you is that if your loved one died after the beginning of 2005, then there is no state estate tax due.form. Use a dr 312 2021 template to make your document workflow more streamlined. The florida department of revenue will no longer. The forms are permitted by f.s. Web the florida department of revenue.

Affidavit Of No Florida Estate Tax Due Form Dr 312

Web the florida department of revenue (dor) jan. Affidavit of no florida estate tax due form. What this means for you is that if your loved one died after the beginning of 2005, then there is no state estate tax due.form. The florida department of revenue will no longer. The form can be found on the department of.

20202023 Form FL DoR DR15 Fill Online, Printable, Fillable, Blank

The form can be found on the department of. Affidavit of no florida estate tax due form. Web the florida department of revenue (dor) jan. These forms must be filed with the. Complete, edit or print tax forms instantly.

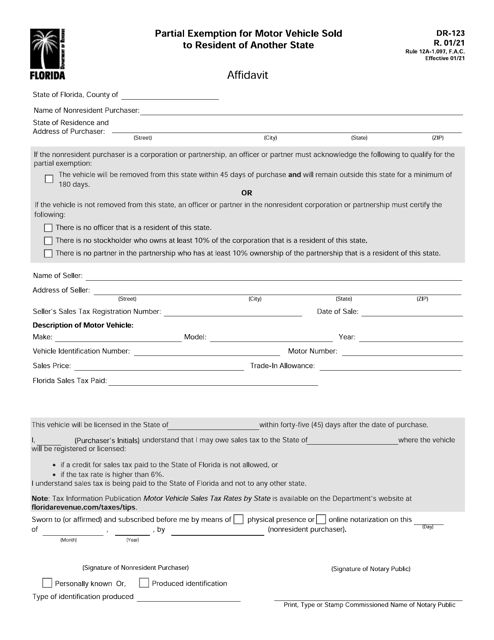

Form DR123 Download Fillable PDF or Fill Online Affidavit for Partial

Web the florida department of revenue (dor) jan. The florida department of revenue will no longer. Affidavit of no florida estate tax due when federal return is. What this means for you is that if your loved one died after the beginning of 2005, then there is no state estate tax due.form. The forms are permitted by f.s.

Florida form dr 13 Fill out & sign online DocHub

Affidavit of no florida estate tax due: What this means for you is that if your loved one died after the beginning of 2005, then there is no state estate tax due.form. The florida department of revenue. Affidavit of no florida estate tax due when federal return is. The florida department of revenue will no longer.

Form Dr312 Affidavit Of No Florida Estate Tax Due printable pdf download

This is a florida form and can be use in. Web the florida department of revenue (dor) jan. The florida department of revenue will no longer. §198.32(2) only when a personal. These forms must be filed with the.

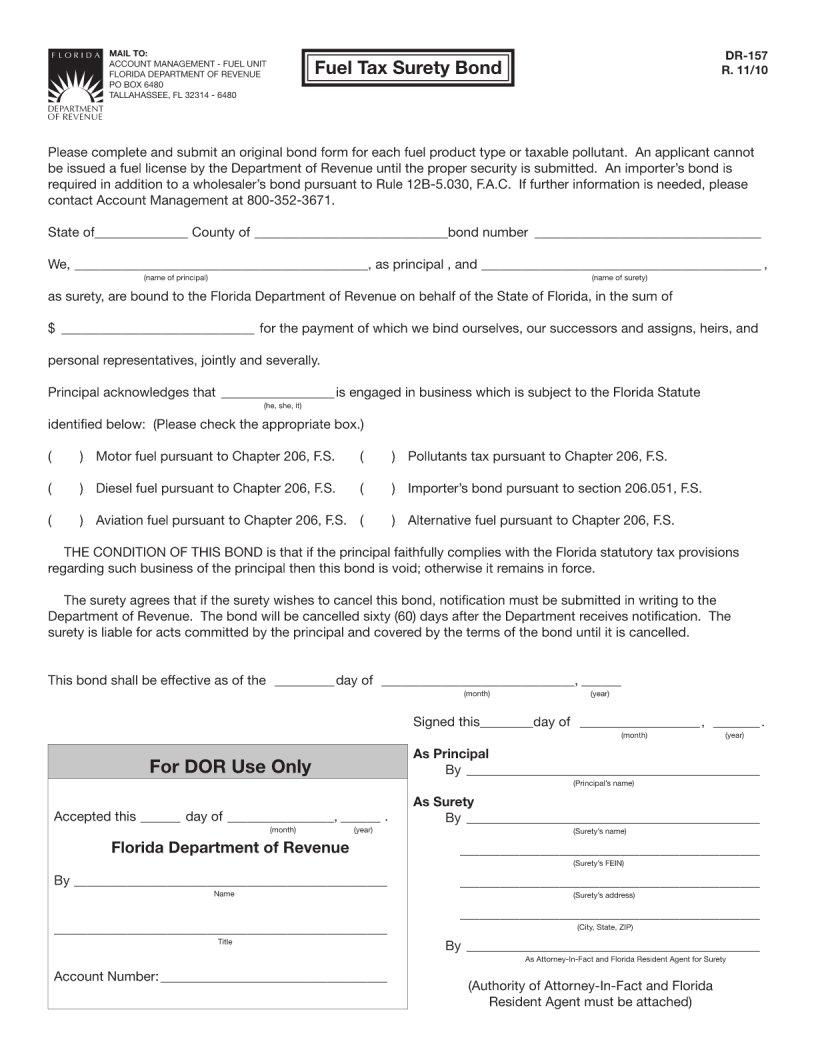

Florida Form Dr 157 ≡ Fill Out Printable PDF Forms Online

Web fl dr 312 form is a critical form that must be completed in order to obtain an medical marijuana card in the state of florida. These forms must be filed with the. §198.32(2) only when a personal. The forms are permitted by f.s. Web the florida department of revenue (dor) jan.

Web We Would Like To Show You A Description Here But The Site Won’t Allow Us.

Affidavit of no florida estate tax due form. Web the florida department of revenue (dor) jan. Web fl dr 312 form is a critical form that must be completed in order to obtain an medical marijuana card in the state of florida. The florida department of revenue will no longer.

The Florida Department Of Revenue Will No Longer.

The florida department of revenue. Use a dr 312 2021 template to make your document workflow more streamlined. The form can be found on the department of. Web the florida department of revenue (dor) jan.

The Forms Are Permitted By F.s.

This is a florida form and can be use in. Web the florida department of revenue. These forms must be filed with the. What this means for you is that if your loved one died after the beginning of 2005, then there is no state estate tax due.form.

Complete, Edit Or Print Tax Forms Instantly.

Affidavit of no florida estate tax due when federal return is. Affidavit of no florida estate tax due: §198.32(2) only when a personal.