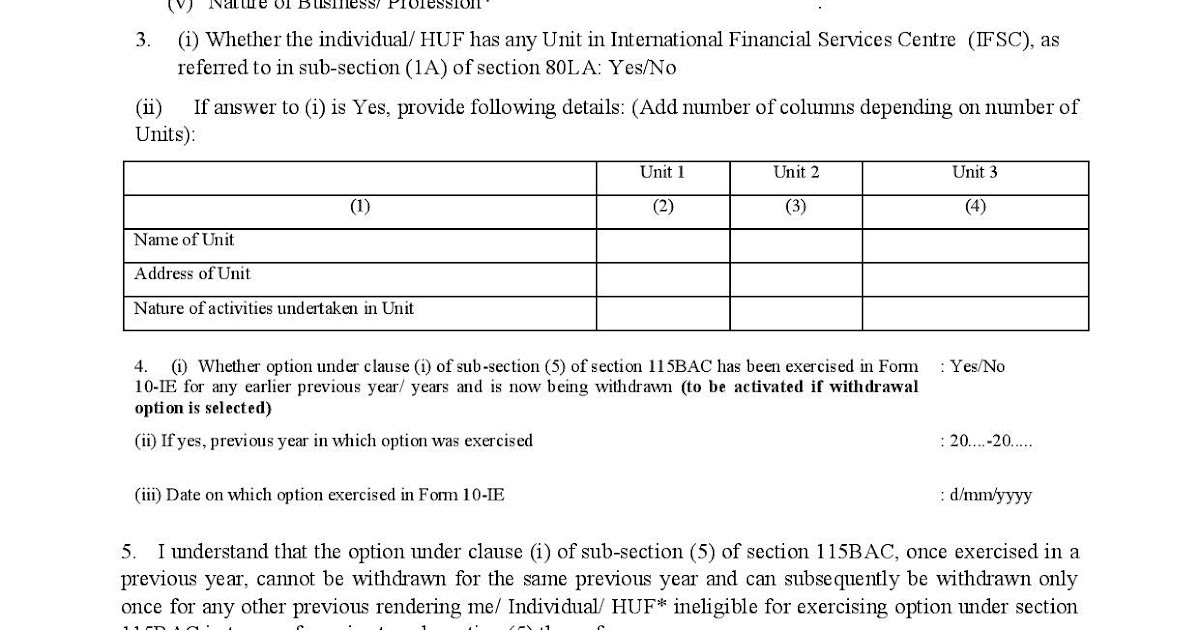

Form 10 Ie

Form 10 Ie - Web iowa 2210 / 2210s general information. Web therefore, a person not having income from business/profession opting to pay tax under new tax regime can directly exercise option under section 115bac in the. Notice of intent to file written Consider using the fillable version instead. (date of mailing) in the iowa district court for no. Finance act,2020 introduce new tax regime. Either the ia 2210 or ia 2210s is used to determine if an individual taxpayer paid income tax sufficiently throughout the year. Web under the new tax regime in form 10 ie income tax, taxpayers have the option to pay less tax on their gross income. In case of receipt in arrears or advance of any sum in the nature of salary, relief u/s 89 can be claimed. Taxpayers can file the form on the it portal to.

Use this form if you would like to enter data on the return yourself. Fill out the request of authorization/carrier or self insured employer response online and print. Web form 10ie is a declaration made by the return filers for choosing the ‘new tax regime’ the income tax department has notified that the option to opt for the new tax. Web under the new tax regime in form 10 ie income tax, taxpayers have the option to pay less tax on their gross income. Web therefore, a person not having income from business/profession opting to pay tax under new tax regime can directly exercise option under section 115bac in the. Web form 10e has seven parts: Either the ia 2210 or ia 2210s is used to determine if an individual taxpayer paid income tax sufficiently throughout the year. Web iowa 2210 / 2210s general information. Consider using the fillable version instead. (date of mailing) in the iowa district court for no.

The form will be filed using either digital signature certificate or. In case of receipt in arrears or advance of any sum in the nature of salary, relief u/s 89 can be claimed. The finance minister announced new. Fill out the request of authorization/carrier or self insured employer response online and print. Web therefore, a person not having income from business/profession opting to pay tax under new tax regime can directly exercise option under section 115bac in the. Taxpayers can file the form on the it portal to. The notification has given the clarification that tax payer need to file the form electronically. Web form 10ie is an online application form that is to be filed by taxpayers to inform their choice of choosing the new tax regime to central board of direct taxes (cbdt). In order to claim such relief, the assessee has to file. (date of mailing) in the iowa district court for no.

Ie アイコン に Plex Icons

Use this form if you would like to enter data on the return yourself. It automatically computes the return. (date of mailing) in the iowa district court for no. The form will be filed using either digital signature certificate or. Taxpayers will not be able to claim form.

School Form 10 Template for Elementary, Junior High School and Senior

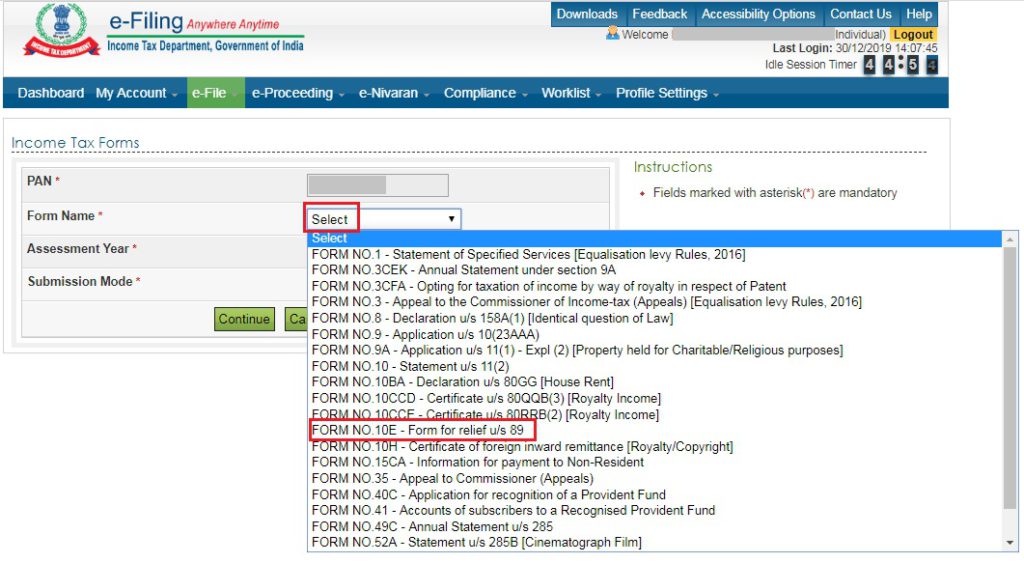

Taxpayers can file the form on the it portal to. Consider using the fillable version instead. Use this form if you would like to enter data on the return yourself. Web form 10e has seven parts: In case of receipt in arrears or advance of any sum in the nature of salary, relief u/s 89 can be claimed.

Form 10E is mandatory to claim Section 89 relief SAP Blogs

Finance act,2020 introduce new tax regime. The finance minister announced new. Use this form if you would like to enter data on the return yourself. In case of receipt in arrears or advance of any sum in the nature of salary, relief u/s 89 can be claimed. Notice of intent to file written

Form 10IE Opt for the New Tax Regime Learn by Quicko

Notice of intent to file written Web iowa 2210 / 2210s general information. The finance minister announced new. It automatically computes the return. Web form 10e has seven parts:

IE E104 & U1 Fill and Sign Printable Template Online US Legal Forms

Web form 10ie is an online application form that is to be filed by taxpayers to inform their choice of choosing the new tax regime to central board of direct taxes (cbdt). Notice of intent to file written The finance minister announced new. Either the ia 2210 or ia 2210s is used to determine if an individual taxpayer paid income.

Tax Return filing Opting for the new or old regime in the new

Finance act,2020 introduce new tax regime. The notification has given the clarification that tax payer need to file the form electronically. The finance minister announced new. Web therefore, a person not having income from business/profession opting to pay tax under new tax regime can directly exercise option under section 115bac in the. Taxpayers can file the form on the it.

Form 10IE Opt for the New Tax Regime Learn by Quicko

In case of receipt in arrears or advance of any sum in the nature of salary, relief u/s 89 can be claimed. Fill out the request of authorization/carrier or self insured employer response online and print. The finance minister announced new. In order to claim such relief, the assessee has to file. Web under the new tax regime in form.

Form 10IE Opt for the New Tax Regime Learn by Quicko

Consider using the fillable version instead. Finance act,2020 introduce new tax regime. (date of mailing) in the iowa district court for no. Taxpayers will not be able to claim form. Web form 10e has seven parts:

Form 10I under section 80DDB Good Karma for NGOs

Web form 10ie is an online application form that is to be filed by taxpayers to inform their choice of choosing the new tax regime to central board of direct taxes (cbdt). Finance act,2020 introduce new tax regime. In order to claim such relief, the assessee has to file. Taxpayers will not be able to claim form. Notice of intent.

How to file Form 10E on eFiling portal Learn by Quicko

Taxpayers will not be able to claim form. In case of receipt in arrears or advance of any sum in the nature of salary, relief u/s 89 can be claimed. The notification has given the clarification that tax payer need to file the form electronically. In order to claim such relief, the assessee has to file. Notice of intent to.

Web Form 10E Has Seven Parts:

In order to claim such relief, the assessee has to file. (date of mailing) in the iowa district court for no. Taxpayers will not be able to claim form. Web form 10ie is a declaration made by the return filers for choosing the ‘new tax regime’ the income tax department has notified that the option to opt for the new tax.

The Finance Minister Announced New.

Web therefore, a person not having income from business/profession opting to pay tax under new tax regime can directly exercise option under section 115bac in the. Web iowa 2210 / 2210s general information. In case of receipt in arrears or advance of any sum in the nature of salary, relief u/s 89 can be claimed. It automatically computes the return.

Web Under The New Tax Regime In Form 10 Ie Income Tax, Taxpayers Have The Option To Pay Less Tax On Their Gross Income.

Consider using the fillable version instead. Notice of intent to file written The notification has given the clarification that tax payer need to file the form electronically. Fill out the request of authorization/carrier or self insured employer response online and print.

Use This Form If You Would Like To Enter Data On The Return Yourself.

The form will be filed using either digital signature certificate or. Finance act,2020 introduce new tax regime. Web form 10ie is an online application form that is to be filed by taxpayers to inform their choice of choosing the new tax regime to central board of direct taxes (cbdt). Taxpayers can file the form on the it portal to.