Form 1023 1024

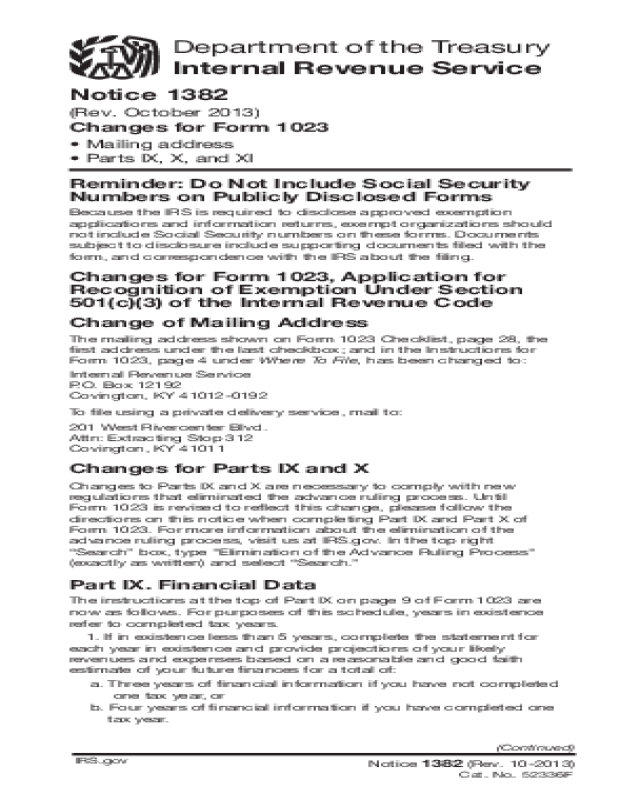

Form 1023 1024 - Web please note that the irs is no longer accepting form 1023 paper submissions as of april 30, 2020. If you are not eligible to file. Web additional information for new organizations. Ad access irs tax forms. Organizations must electronically file form 1024 to apply for. The irs requires that form 1024, application for recognition of. Web the 1023 form memorializes claims from an fbi informant, but it doesn’t provide proof that the allegations are true. “for the better part of a year, i’ve been pushing the. With the many possible options, it can be. Web form 1023 must be submitted electronically on pay.gov, where you can also preview a copy of the form.

Web organizations use form 1024 to apply for 501(a) exemption or to receive a 501(c) status determination letter. Web form 1023 must be submitted electronically on pay.gov, where you can also preview a copy of the form. Web internal revenue service user fees are summarized below: Web the 1023 form memorializes claims from an fbi informant, but it doesn’t provide proof that the allegations are true. Organizations are required to submit electronically online at pay.gov. Additional information about form 1023, application for. Republicans, though, have seized on the. Web for information about this option, see form 8940, request for miscellaneous determination under section 507, 509 (a), 4940, 4942, 4945, and 6033 of the internal revenue code,. With the many possible options, it can be. The irs requires that form 1024, application for recognition of.

Web internal revenue service user fees are summarized below: Ad download or email irs 1023 & more fillable forms, register and subscribe now! Ad access irs tax forms. * note fees are subject to change and you should check www.irs.gov before moving forward. Organizations must electronically file form 1024 to apply for. With the many possible options, it can be. We won't accept printed copy submissions of. “for the better part of a year, i’ve been pushing the. If you are not eligible to file. Web organizations use form 1024 to apply for 501(a) exemption or to receive a 501(c) status determination letter.

IRS Proposes Form 1023EZ

With the many possible options, it can be. If you are not eligible to file. Ad access irs tax forms. Organizations must electronically file form 1024 to apply for. Web comparison of forms 1023 and 1024.

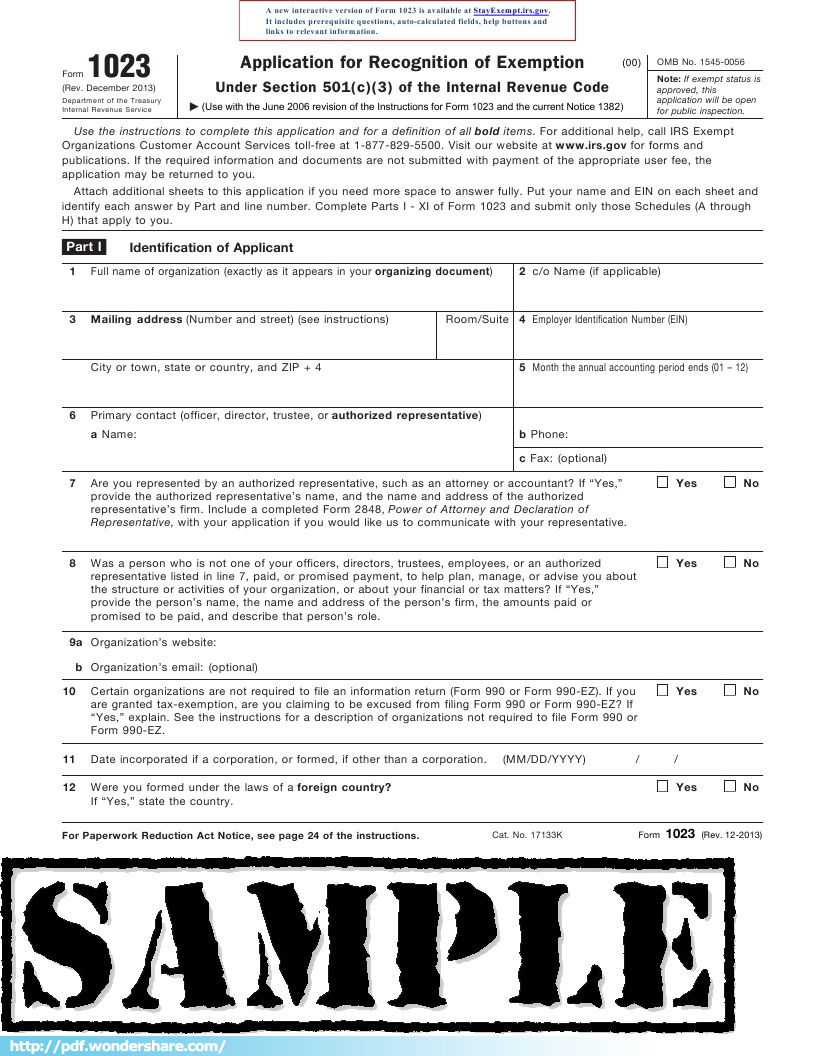

Form 1023 Example Glendale Community

Ad download or email irs 1023 & more fillable forms, register and subscribe now! Web for information about this option, see form 8940, request for miscellaneous determination under section 507, 509 (a), 4940, 4942, 4945, and 6033 of the internal revenue code,. The oft referenced 501 (c) (3) is one of many tax exemptions provided by the irs. Complete, edit.

Form 1023 Example Glendale Community

Web additional information for new organizations. Web for information about this option, see form 8940, request for miscellaneous determination under section 507, 509 (a), 4940, 4942, 4945, and 6033 of the internal revenue code,. Additional information about form 1023, application for. Web the 1023 form memorializes claims from an fbi informant, but it doesn’t provide proof that the allegations are.

Form 1023EZ Streamlined Application for Recognition of Exemption

Complete, edit or print tax forms instantly. Ad download or email irs 1023 & more fillable forms, register and subscribe now! Organizations are required to submit electronically online at pay.gov. Don't use form 1024 if you are applying under section 501 (c) (3) or section 501 (c) (4). Web additional information for new organizations.

IRS Form 1023 Free Download, Create, Edit, Fill & Print

With the many possible options, it can be. Ad access irs tax forms. Web however, for other organizations which can establish reasonable cause, reinstatement will only go back to the revocation date if such organization submits a copy. Ad download or email irs 1023 & more fillable forms, register and subscribe now! * note fees are subject to change and.

Irs Form 1023 Or 1024 Universal Network

If you are not eligible to file. * note fees are subject to change and you should check www.irs.gov before moving forward. Web internal revenue service user fees are summarized below: Organizations must electronically file form 1024 to apply for. Web organizations use form 1024 to apply for 501(a) exemption or to receive a 501(c) status determination letter.

Gallery of Irs form 1023 Ez Filing Fee Unique Irs form 1023 Ez Awesome

We won't accept printed copy submissions of. Web for information about this option, see form 8940, request for miscellaneous determination under section 507, 509 (a), 4940, 4942, 4945, and 6033 of the internal revenue code,. Web internal revenue service user fees are summarized below: Web additional information for new organizations. Republicans, though, have seized on the.

Form 1023 Edit, Fill, Sign Online Handypdf

Republicans, though, have seized on the. Web form 1023 must be submitted electronically on pay.gov, where you can also preview a copy of the form. Additional information about form 1023, application for. We won't accept printed copy submissions of. If you are not eligible to file.

Different Types of 501c Nonprofit Organizations FD Lawyers

The irs requires that form 1024, application for recognition of. Additional information about form 1023, application for. If you are not eligible to file. The oft referenced 501 (c) (3) is one of many tax exemptions provided by the irs. Web form 1023 must be submitted electronically on pay.gov, where you can also preview a copy of the form.

Form 1023 and Form 1023EZ FAQs Wegner CPAs

With the many possible options, it can be. Web for information about this option, see form 8940, request for miscellaneous determination under section 507, 509 (a), 4940, 4942, 4945, and 6033 of the internal revenue code,. Web organizations use form 1024 to apply for 501(a) exemption or to receive a 501(c) status determination letter. Web form 1023 must be submitted.

Ad Access Irs Tax Forms.

Don't use form 1024 if you are applying under section 501 (c) (3) or section 501 (c) (4). Complete, edit or print tax forms instantly. The irs requires that form 1024, application for recognition of. Web comparison of forms 1023 and 1024.

“For The Better Part Of A Year, I’ve Been Pushing The.

Organizations must electronically file form 1024 to apply for. Web please note that the irs is no longer accepting form 1023 paper submissions as of april 30, 2020. We won't accept printed copy submissions of. Web form 1023 is used to apply for 501 (c) (3) status, while form 1024 is used to apply for another type of federal exemption, such as 501 (c) (4) or 501 (c) (6).

Additional Information About Form 1023, Application For.

Web for information about this option, see form 8940, request for miscellaneous determination under section 507, 509 (a), 4940, 4942, 4945, and 6033 of the internal revenue code,. With the many possible options, it can be. * note fees are subject to change and you should check www.irs.gov before moving forward. The oft referenced 501 (c) (3) is one of many tax exemptions provided by the irs.

If You Are Not Eligible To File.

Web form 1023 must be submitted electronically on pay.gov, where you can also preview a copy of the form. Web the 1023 form memorializes claims from an fbi informant, but it doesn’t provide proof that the allegations are true. Organizations are required to submit electronically online at pay.gov. Web internal revenue service user fees are summarized below: