Form 1065 Schedule K-3

Form 1065 Schedule K-3 - Department of the treasury internal revenue service omb no. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Partner’s share of income, deductions, credits, etc.—. For calendar year 2022, or tax year beginning. Web thomson reuters tax & accounting. These instructions provide additional information specific to schedule k. April 14, 2022 · 5 minute read. The 2022 form 1065 may also be used if:

These instructions provide additional information specific to schedule k. Department of the treasury internal revenue service omb no. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. For calendar year 2022, or tax year beginning. Partner’s share of income, deductions, credits, etc.—. The 2022 form 1065 may also be used if: Web thomson reuters tax & accounting. April 14, 2022 · 5 minute read.

Partner’s share of income, deductions, credits, etc.—. Department of the treasury internal revenue service omb no. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Web thomson reuters tax & accounting. For calendar year 2022, or tax year beginning. The 2022 form 1065 may also be used if: These instructions provide additional information specific to schedule k. April 14, 2022 · 5 minute read.

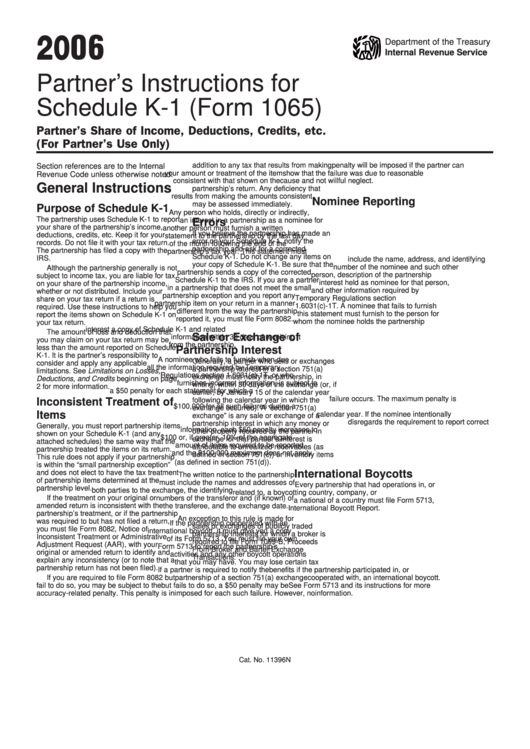

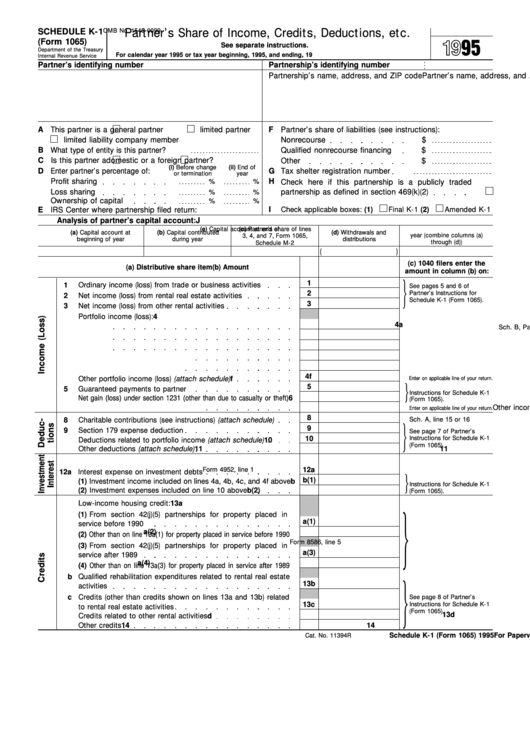

Instructions For Schedule K1 (Form 1065) Partner'S Share Of

The 2022 form 1065 may also be used if: Department of the treasury internal revenue service omb no. Web thomson reuters tax & accounting. For calendar year 2022, or tax year beginning. These instructions provide additional information specific to schedule k.

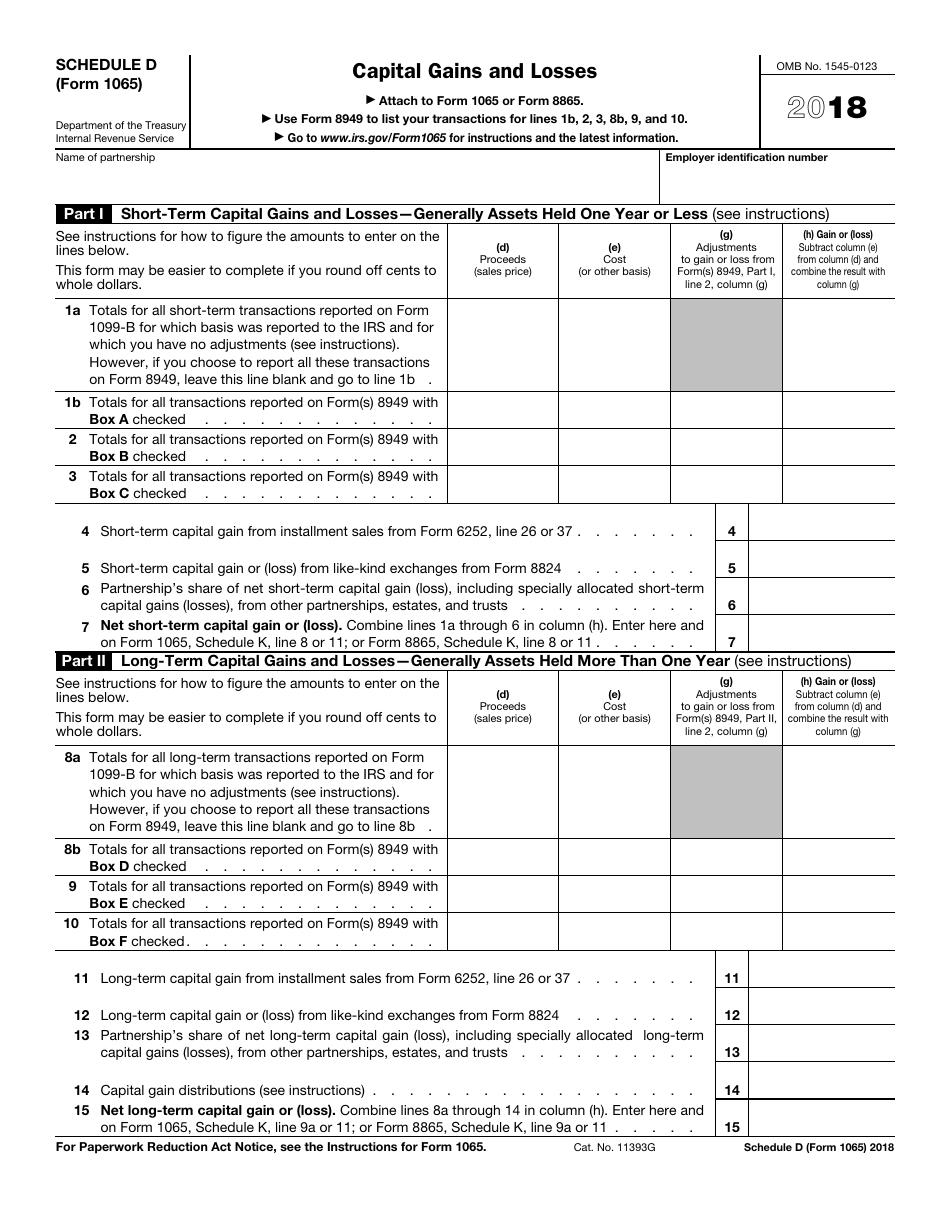

IRS Form 1065 Schedule D Download Fillable PDF or Fill Online Capital

These instructions provide additional information specific to schedule k. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. The 2022 form 1065 may also be used if: April 14, 2022 · 5 minute read. For calendar year 2022, or tax year beginning.

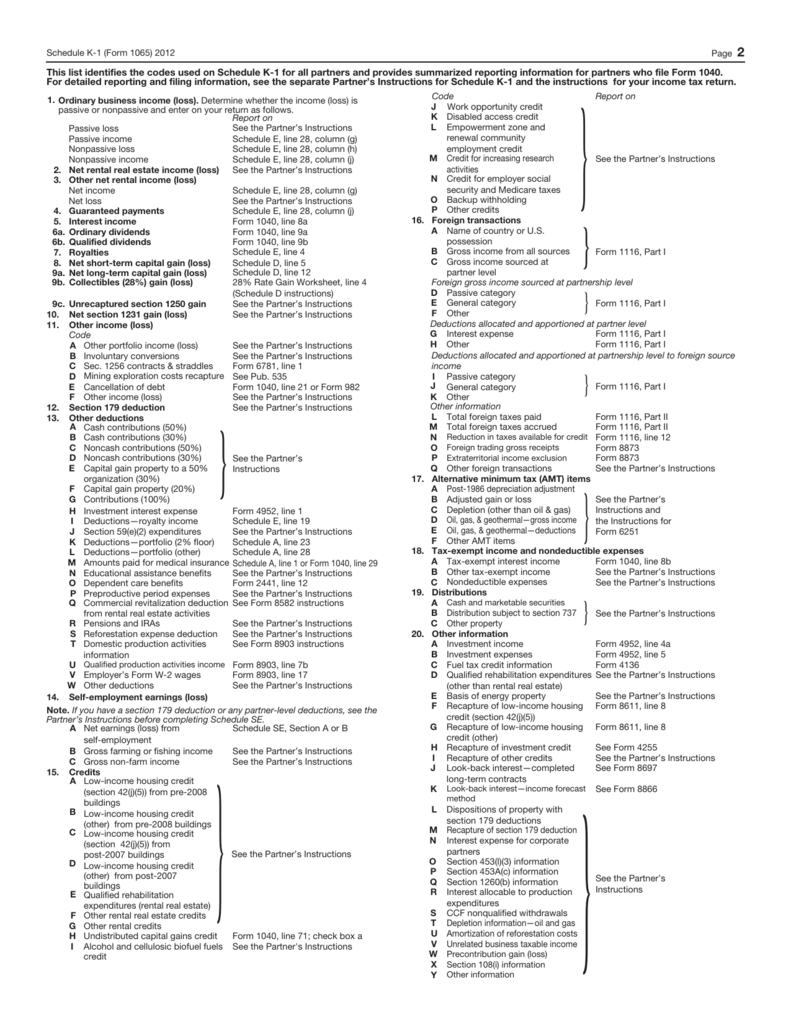

2012 Form 1065 (Schedule K1)

Department of the treasury internal revenue service omb no. Partner’s share of income, deductions, credits, etc.—. Web thomson reuters tax & accounting. The 2022 form 1065 may also be used if: For calendar year 2022, or tax year beginning.

Llc Tax Form 1065 Universal Network

The 2022 form 1065 may also be used if: Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. April 14, 2022 · 5 minute read. Partner’s share of income, deductions, credits, etc.—. For calendar year 2022, or tax year beginning.

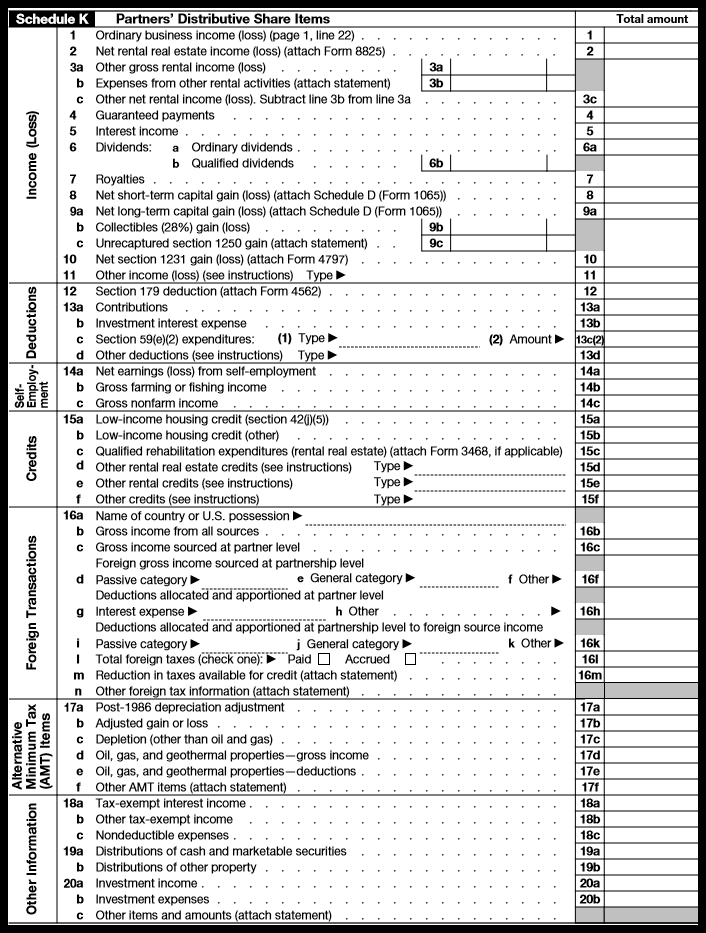

Form 1065 (Schedule K1) Partner's Share of Deductions and

These instructions provide additional information specific to schedule k. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. April 14, 2022 · 5 minute read. Partner’s share of income, deductions, credits, etc.—. The 2022 form 1065 may also be used if:

Form 1065 (Schedule M3) Net (Loss) Reconciliation for Certain

These instructions provide additional information specific to schedule k. Web thomson reuters tax & accounting. April 14, 2022 · 5 minute read. Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. The 2022 form 1065 may also be used if:

How To Complete Form 1065 With Instructions

Partner’s share of income, deductions, credits, etc.—. April 14, 2022 · 5 minute read. For calendar year 2022, or tax year beginning. These instructions provide additional information specific to schedule k. Web thomson reuters tax & accounting.

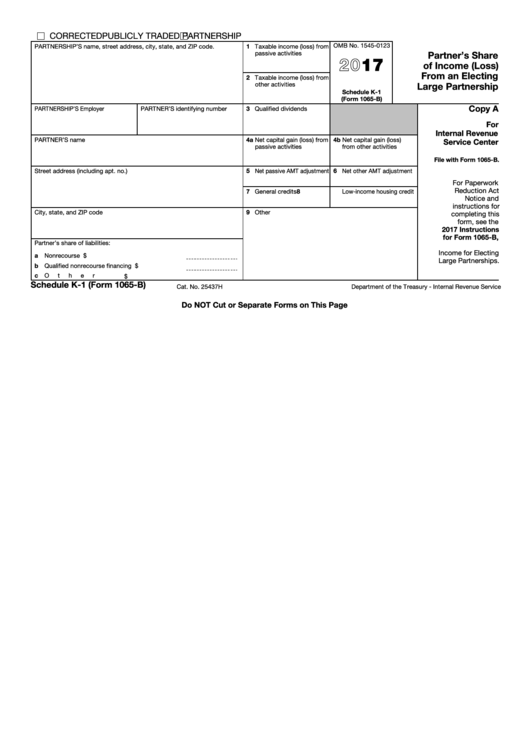

Fillable Schedule K1 (Form 1065B) Partner'S Share Of (Loss

Web thomson reuters tax & accounting. April 14, 2022 · 5 minute read. Department of the treasury internal revenue service omb no. Partner’s share of income, deductions, credits, etc.—. The 2022 form 1065 may also be used if:

Schedule K1 (Form 1065) Partner'S Share Of Credits

The 2022 form 1065 may also be used if: Partner’s share of income, deductions, credits, etc.—. Web thomson reuters tax & accounting. April 14, 2022 · 5 minute read. For calendar year 2022, or tax year beginning.

How to Prepare Form 1065 in 8 Steps [+ Free Checklist]

Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. April 14, 2022 · 5 minute read. For calendar year 2022, or tax year beginning. Web thomson reuters tax & accounting. Department of the treasury internal revenue service omb no.

April 14, 2022 · 5 Minute Read.

Web the 2022 form 1065 is an information return for calendar year 2022 and fiscal years that begin in 2022 and end in 2023. Department of the treasury internal revenue service omb no. Web thomson reuters tax & accounting. The 2022 form 1065 may also be used if:

For Calendar Year 2022, Or Tax Year Beginning.

These instructions provide additional information specific to schedule k. Partner’s share of income, deductions, credits, etc.—.

![How to Prepare Form 1065 in 8 Steps [+ Free Checklist]](https://fitsmallbusiness.com/wp-content/uploads/2019/02/word-image-743.png)