Form 1116 Instructions 2022

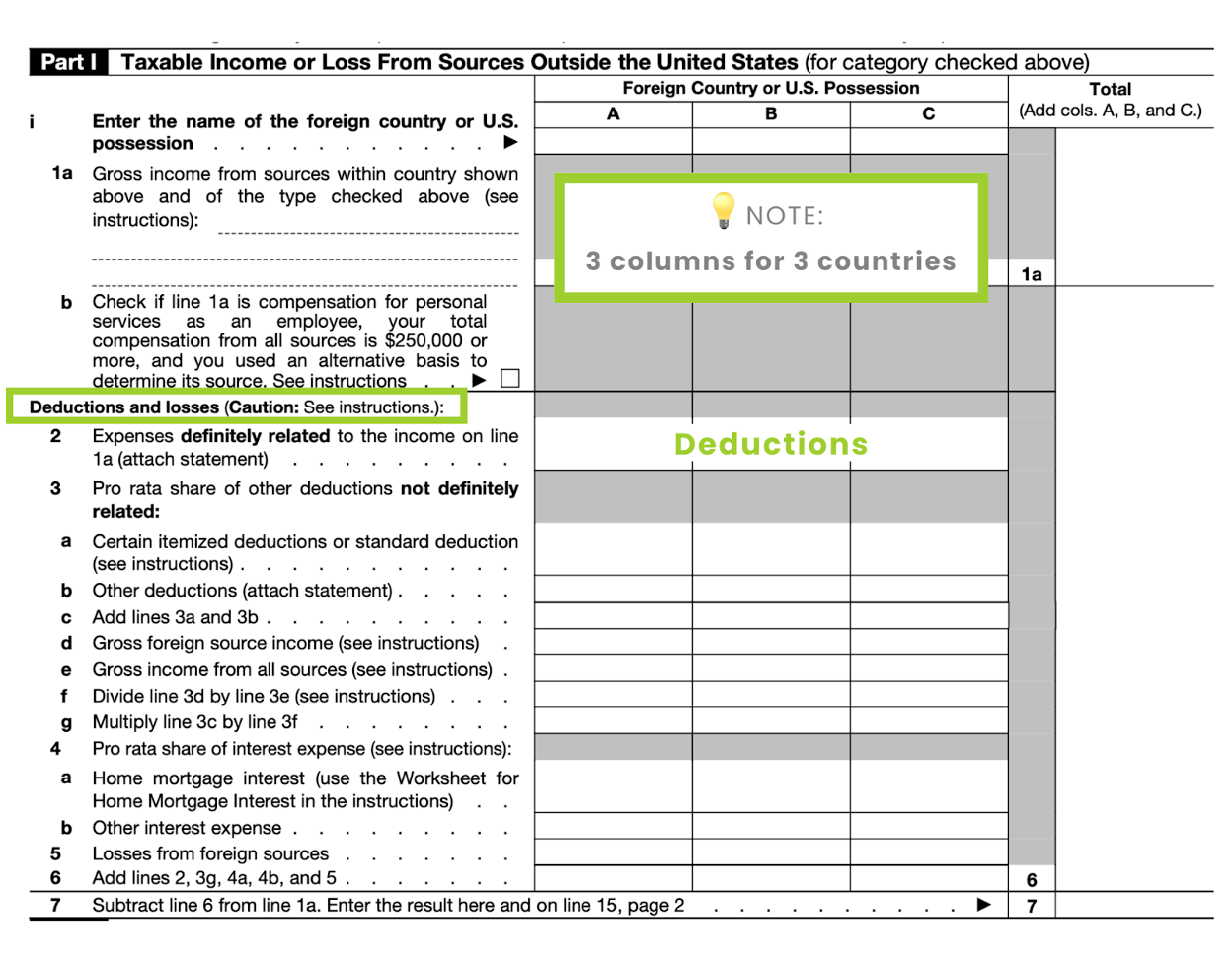

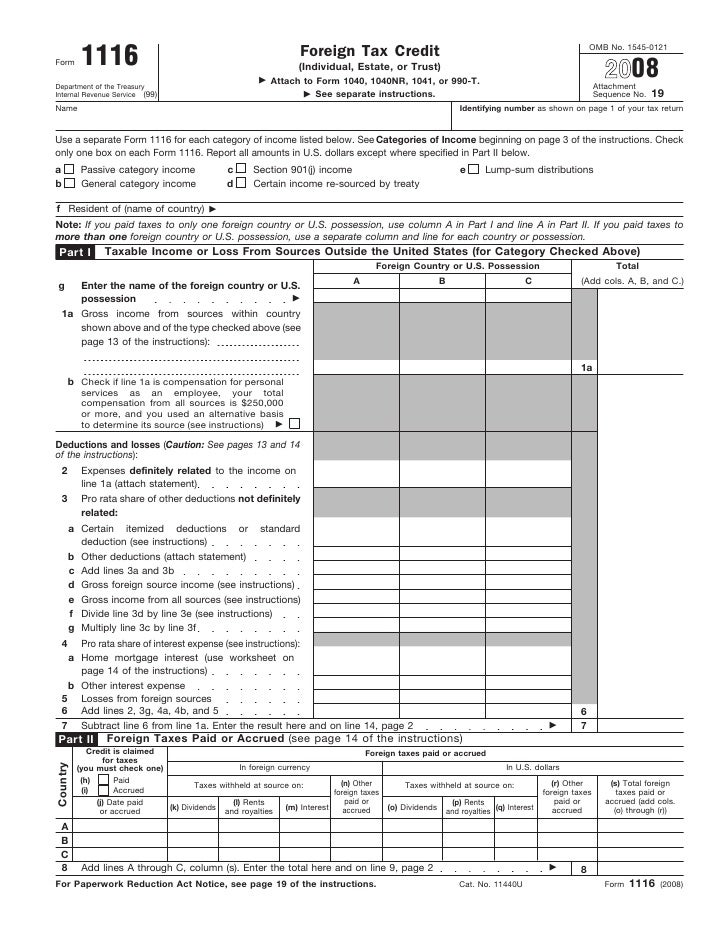

Form 1116 Instructions 2022 - Web instructions for schedule b (form 1116) (12/2022) foreign tax carryover reconciliation schedule section references are to the internal revenue code unless otherwise noted. Web schedule c (form 1116) is used to identify foreign tax redeterminations that occur in the current tax year in each separate category, the years to which they relate, and other information that satisfies your obligation to notify the irs of foreign tax redeterminations that occurred in the current year that relate to prior years. • use schedule c (form 1116) to report foreign tax redeterminations that occurred in the current tax year and Web use form 1116 to claim the foreign tax credit (ftc) and subtract the taxes they paid to another country from whatever they owe the irs. For example, if your total income falls into three categories, you’ll need to use three separate forms 1116. Go to www.irs.gov/form1116 for instructions and the latest information. Web use schedule b (form 1116) to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Start your expat taxes today with the tax experts at h&r block! Web file form 1116, foreign tax credit, to claim the foreign tax credit if you are an individual, estate or trust, and you paid or accrued certain foreign taxes to a foreign country or u.s. Use a separate form 1116 for each category of income listed below.

Go to www.irs.gov/form1116 for instructions and the latest information. Web instructions for schedule b (form 1116) (12/2022) foreign tax carryover reconciliation schedule section references are to the internal revenue code unless otherwise noted. Corporations file form 1118, foreign tax credit—corporations , to claim a foreign tax credit. Web october 25, 2022 resource center forms form 1116: Web dec 29, 2022 who must file with respect to each separate category of income, if you’re filing form 1116 that has a foreign tax carryover in the prior tax year, the current tax year, or both, you must file schedule b for that separate category of. Start your expat taxes today with the tax experts at h&r block! Categorize your income since the irs requires you to use a separate form 1116 for each income category, you must categorize your income so you can know how many forms 1116 to use. Claiming the foreign tax credit at a glance find out what irs form 1116 is used for and how to file it to get the foreign tax credit. • use schedule c (form 1116) to report foreign tax redeterminations that occurred in the current tax year and Web use form 1116 to claim the foreign tax credit (ftc) and subtract the taxes they paid to another country from whatever they owe the irs.

Web file form 1116, foreign tax credit, to claim the foreign tax credit if you are an individual, estate or trust, and you paid or accrued certain foreign taxes to a foreign country or u.s. Web instructions for schedule b (form 1116) (12/2022) foreign tax carryover reconciliation schedule section references are to the internal revenue code unless otherwise noted. Web use schedule b (form 1116) to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. See schedule b (form 1116) and its instructions, and the instructions for line 10, later, for more information. Web october 25, 2022 resource center forms form 1116: For example, if your total income falls into three categories, you’ll need to use three separate forms 1116. • use schedule c (form 1116) to report foreign tax redeterminations that occurred in the current tax year and Use a separate form 1116 for each category of income listed below. Web use form 1116 to claim the foreign tax credit (ftc) and subtract the taxes they paid to another country from whatever they owe the irs. Start your expat taxes today with the tax experts at h&r block!

Foreign Tax Credit Form 1116 Instructions

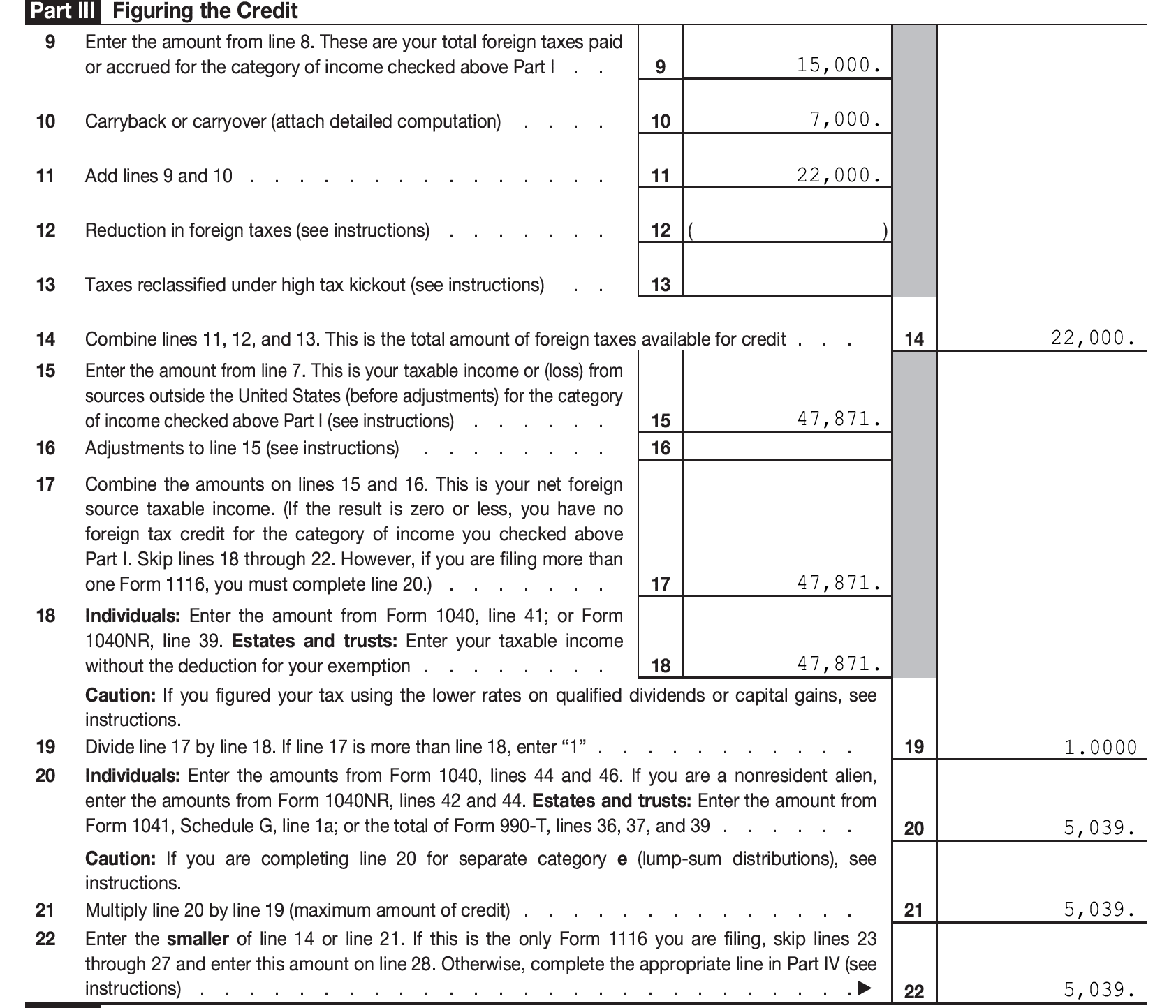

Web use form 1116 to claim the foreign tax credit (ftc) and subtract the taxes they paid to another country from whatever they owe the irs. As shown on page 1 of your tax return. Categorize your income since the irs requires you to use a separate form 1116 for each income category, you must categorize your income so you.

Download Instructions for IRS Form 1116 Foreign Tax Credit (Individual

• use schedule c (form 1116) to report foreign tax redeterminations that occurred in the current tax year and For example, if your total income falls into three categories, you’ll need to use three separate forms 1116. See schedule b (form 1116) and its instructions, and the instructions for line 10, later, for more information. Here are the income categories.

Publication 514, Foreign Tax Credit for Individuals; Simple Example

Corporations file form 1118, foreign tax credit—corporations , to claim a foreign tax credit. Go to www.irs.gov/form1116 for instructions and the latest information. Use a separate form 1116 for each category of income listed below. As shown on page 1 of your tax return. For example, if your total income falls into three categories, you’ll need to use three separate.

Form 1116Foreign Tax Credit

• use schedule c (form 1116) to report foreign tax redeterminations that occurred in the current tax year and Go to www.irs.gov/form1116 for instructions and the latest information. Web instructions for schedule b (form 1116) (12/2022) foreign tax carryover reconciliation schedule section references are to the internal revenue code unless otherwise noted. Web dec 29, 2022 who must file with.

Form 1116 Instructions 2021 2022 IRS Forms Zrivo

Web use schedule b (form 1116) to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. • use schedule c (form 1116) to report foreign tax redeterminations that occurred in the current tax year and Web file form 1116, foreign tax credit, to claim the foreign tax credit if you are an individual, estate or.

Form 1116 Instructions 2022 2023 IRS Forms Zrivo

Web file form 1116, foreign tax credit, to claim the foreign tax credit if you are an individual, estate or trust, and you paid or accrued certain foreign taxes to a foreign country or u.s. Web october 25, 2022 resource center forms form 1116: Web schedule c (form 1116) is used to identify foreign tax redeterminations that occur in the.

コンセク1116 コンセク 変換ロッドネジ

Start your expat taxes today with the tax experts at h&r block! Categorize your income since the irs requires you to use a separate form 1116 for each income category, you must categorize your income so you can know how many forms 1116 to use. Here are the income categories for irs. Web file form 1116, foreign tax credit, to.

Casual What Is Form 1116 Explanation Statement? Proprietor Capital

Use a separate form 1116 for each category of income listed below. Web october 25, 2022 resource center forms form 1116: Web use schedule b (form 1116) to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. For example, if your total income falls into three categories, you’ll need to use three separate forms 1116..

Foreign Tax Credit Form 1116 Instructions

Use a separate form 1116 for each category of income listed below. Web schedule c (form 1116) is used to identify foreign tax redeterminations that occur in the current tax year in each separate category, the years to which they relate, and other information that satisfies your obligation to notify the irs of foreign tax redeterminations that occurred in the.

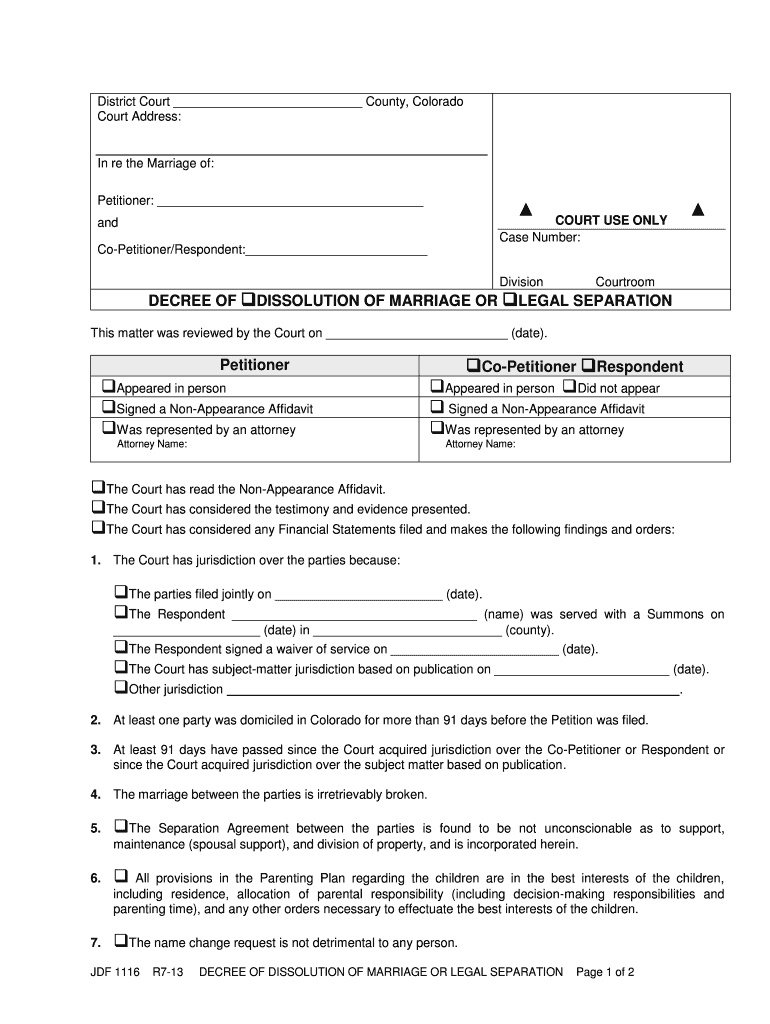

20132021 Form CO JDF 1116 Fill Online, Printable, Fillable, Blank

Corporations file form 1118, foreign tax credit—corporations , to claim a foreign tax credit. Start your expat taxes today with the tax experts at h&r block! See schedule b (form 1116) and its instructions, and the instructions for line 10, later, for more information. Web use form 1116 to claim the foreign tax credit (ftc) and subtract the taxes they.

Web Instructions For Schedule B (Form 1116) (12/2022) Foreign Tax Carryover Reconciliation Schedule Section References Are To The Internal Revenue Code Unless Otherwise Noted.

Claiming the foreign tax credit at a glance find out what irs form 1116 is used for and how to file it to get the foreign tax credit. Corporations file form 1118, foreign tax credit—corporations , to claim a foreign tax credit. Here are the income categories for irs. Web schedule c (form 1116) is used to identify foreign tax redeterminations that occur in the current tax year in each separate category, the years to which they relate, and other information that satisfies your obligation to notify the irs of foreign tax redeterminations that occurred in the current year that relate to prior years.

Start Your Expat Taxes Today With The Tax Experts At H&R Block!

Use a separate form 1116 for each category of income listed below. Go to www.irs.gov/form1116 for instructions and the latest information. See schedule b (form 1116) and its instructions, and the instructions for line 10, later, for more information. Web file form 1116, foreign tax credit, to claim the foreign tax credit if you are an individual, estate or trust, and you paid or accrued certain foreign taxes to a foreign country or u.s.

Web Use Schedule B (Form 1116) To Reconcile Your Prior Year Foreign Tax Carryover With Your Current Year Foreign Tax Carryover.

As shown on page 1 of your tax return. Web october 25, 2022 resource center forms form 1116: Categorize your income since the irs requires you to use a separate form 1116 for each income category, you must categorize your income so you can know how many forms 1116 to use. Web use form 1116 to claim the foreign tax credit (ftc) and subtract the taxes they paid to another country from whatever they owe the irs.

For Example, If Your Total Income Falls Into Three Categories, You’ll Need To Use Three Separate Forms 1116.

• use schedule c (form 1116) to report foreign tax redeterminations that occurred in the current tax year and Web dec 29, 2022 who must file with respect to each separate category of income, if you’re filing form 1116 that has a foreign tax carryover in the prior tax year, the current tax year, or both, you must file schedule b for that separate category of.