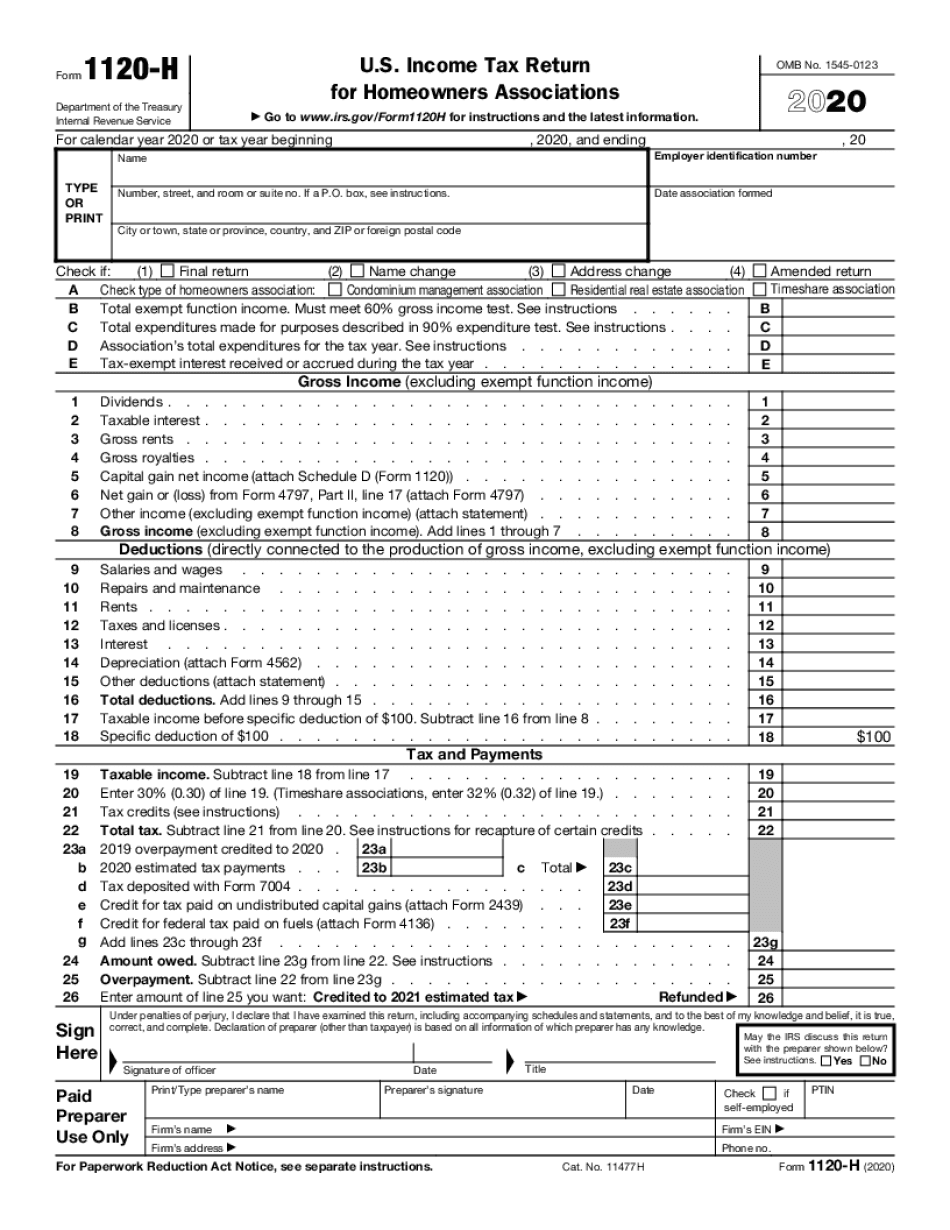

Form 1120-H 2022

Form 1120-H 2022 - Income tax return for homeowners associations, including recent updates, related forms and instructions on how to file. It's an important tax form because it provides several specific tax benefits. These benefits, in effect, allow the association to exclude exempt function income from its. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania. A homeowners association files this form as its income tax return to take advantage of certain tax benefits. For calendar year 2022 or tax year beginning, 2022, ending. For instructions and the latest information. This form is for income earned in tax year 2022, with tax returns due in april 2023. If the association's principal business or office is located in. Number, street, and room or suite no.

For calendar year 2022 or tax year beginning, 2022, and ending, 20type or print. Income tax return for homeowners associations, including recent updates, related forms and instructions on how to file. We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. Income tax return for homeowners associations go to www.irs.gov/form1120h for instructions and the latest information. Number, street, and room or suite no. For calendar year 2022 or tax year beginning, 2022, ending. The form requests information related to amount of money received and spent on rent, repairs, and other specific deductibles. If the association's principal business or office is located in. These benefits, in effect, allow the association to exclude exempt function income from its. It's an important tax form because it provides several specific tax benefits.

Number, street, and room or suite no. Department of the treasury internal revenue service. These benefits, in effect, allow the association to exclude exempt function income from its. It's an important tax form because it provides several specific tax benefits. For calendar year 2022 or tax year beginning, 2022, ending. The form requests information related to amount of money received and spent on rent, repairs, and other specific deductibles. Income tax return for homeowners associations, including recent updates, related forms and instructions on how to file. For instructions and the latest information. If the association's principal business or office is located in. Income tax return for homeowners associations as its income tax return, in order to take advantage of certain tax benefits.

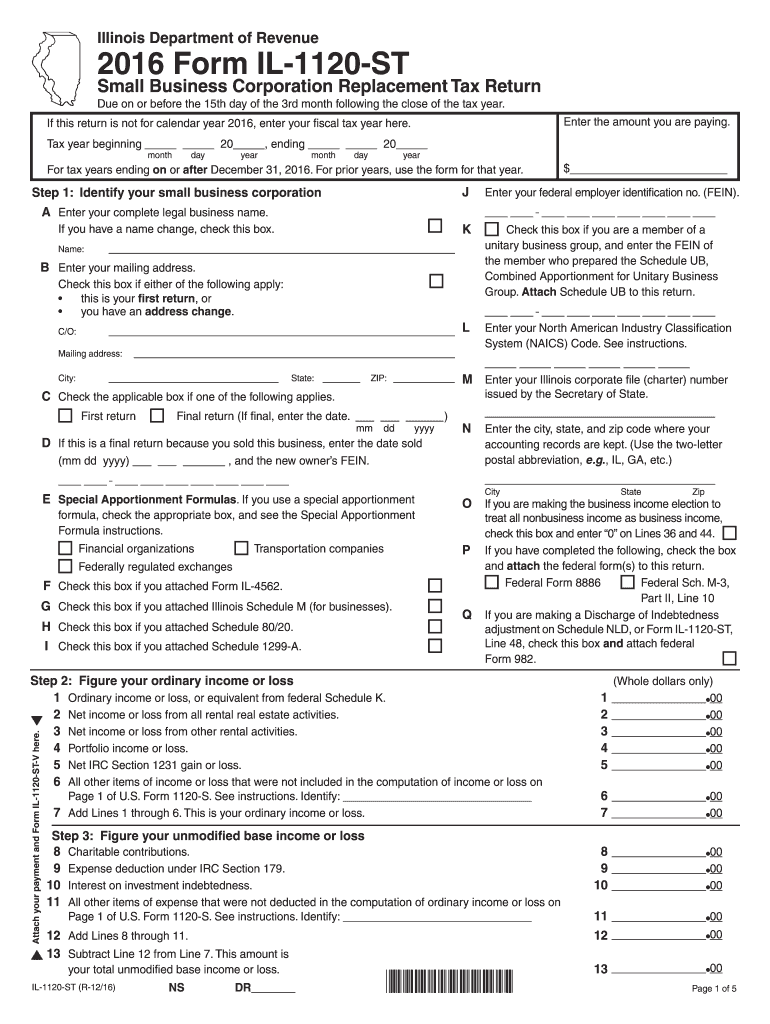

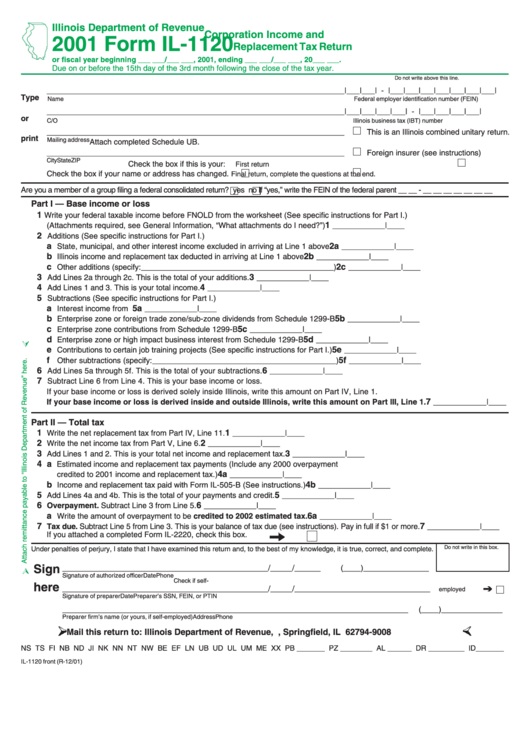

Form Il 1120 St Fill Out and Sign Printable PDF Template signNow

These benefits, in effect, allow the association to exclude exempt function income from its. Number, street, and room or suite no. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania. Use the following irs center address. It's an important tax form because it provides several specific.

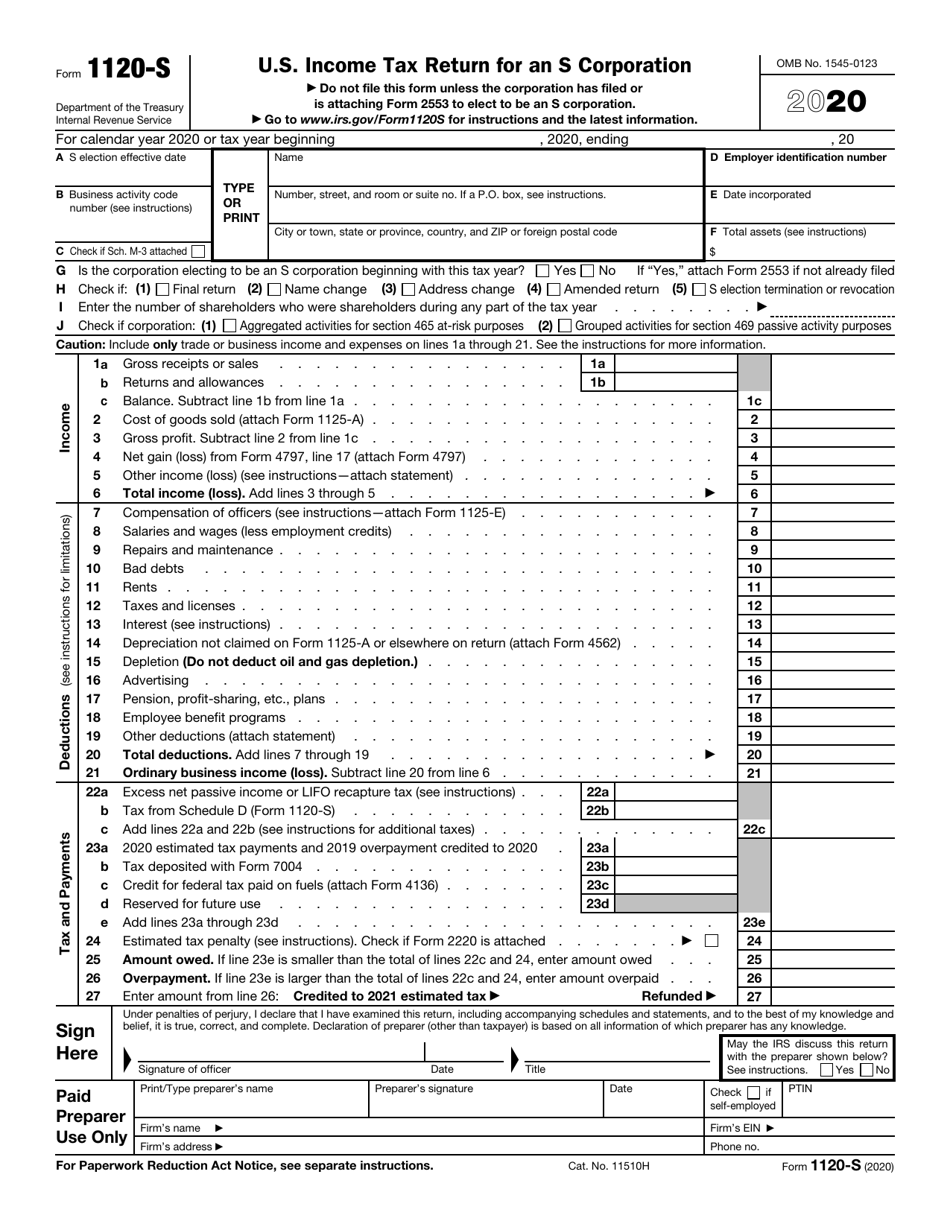

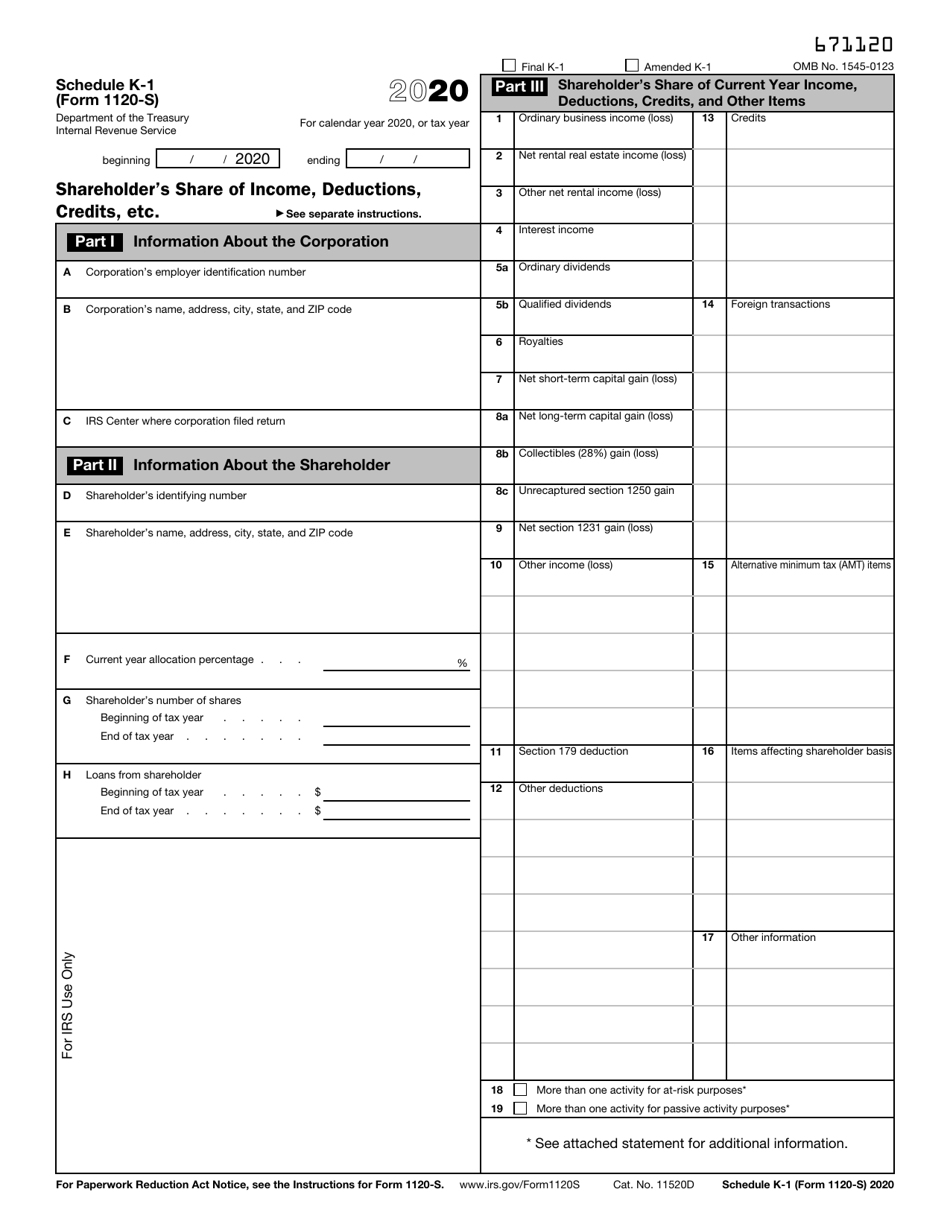

IRS Form 1120S Download Fillable PDF or Fill Online U.S. Tax

Use the following irs center address. Income tax return for homeowners associations go to www.irs.gov/form1120h for instructions and the latest information. For calendar year 2022 or tax year beginning, 2022, and ending, 20type or print. For calendar year 2022 or tax year beginning, 2022, ending. We will update this page with a new version of the form for 2024 as.

2020 Form IRS 1120 Fill Online, Printable, Fillable, Blank pdfFiller

Income tax return for homeowners associations, including recent updates, related forms and instructions on how to file. Number, street, and room or suite no. For calendar year 2022 or tax year beginning, 2022, and ending, 20type or print. Income tax return for homeowners associations as its income tax return, in order to take advantage of certain tax benefits. These benefits,.

Can you look over this corporate tax return form 1120 I did based on

For instructions and the latest information. For calendar year 2022 or tax year beginning, 2022, ending. This form is for income earned in tax year 2022, with tax returns due in april 2023. Income tax return for homeowners associations go to www.irs.gov/form1120h for instructions and the latest information. Income tax return for homeowners associations, including recent updates, related forms and.

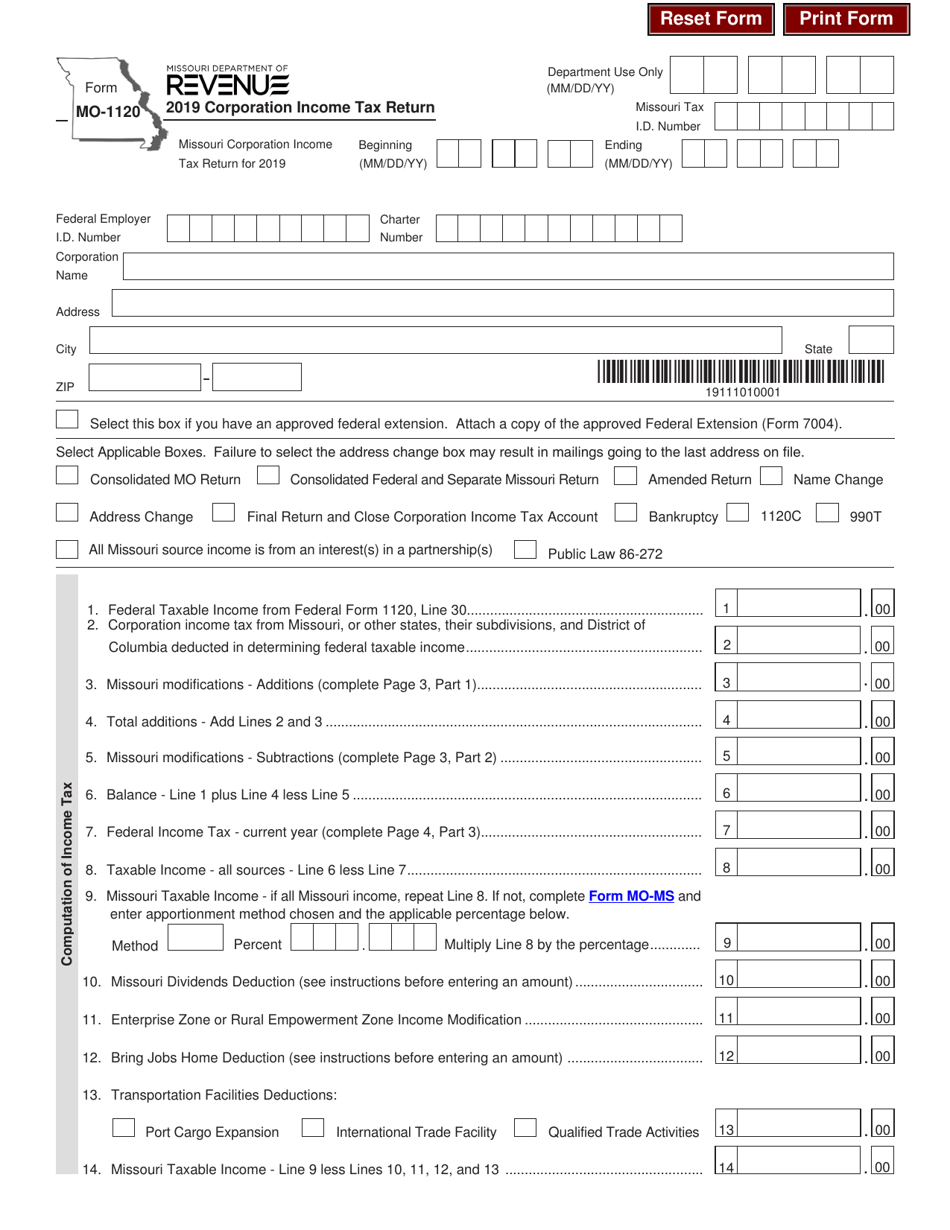

Form MO1120 Download Fillable PDF or Fill Online Corporation

Department of the treasury internal revenue service. For instructions and the latest information. Number, street, and room or suite no. We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. Income tax return for homeowners associations, including recent updates, related forms and instructions on how.

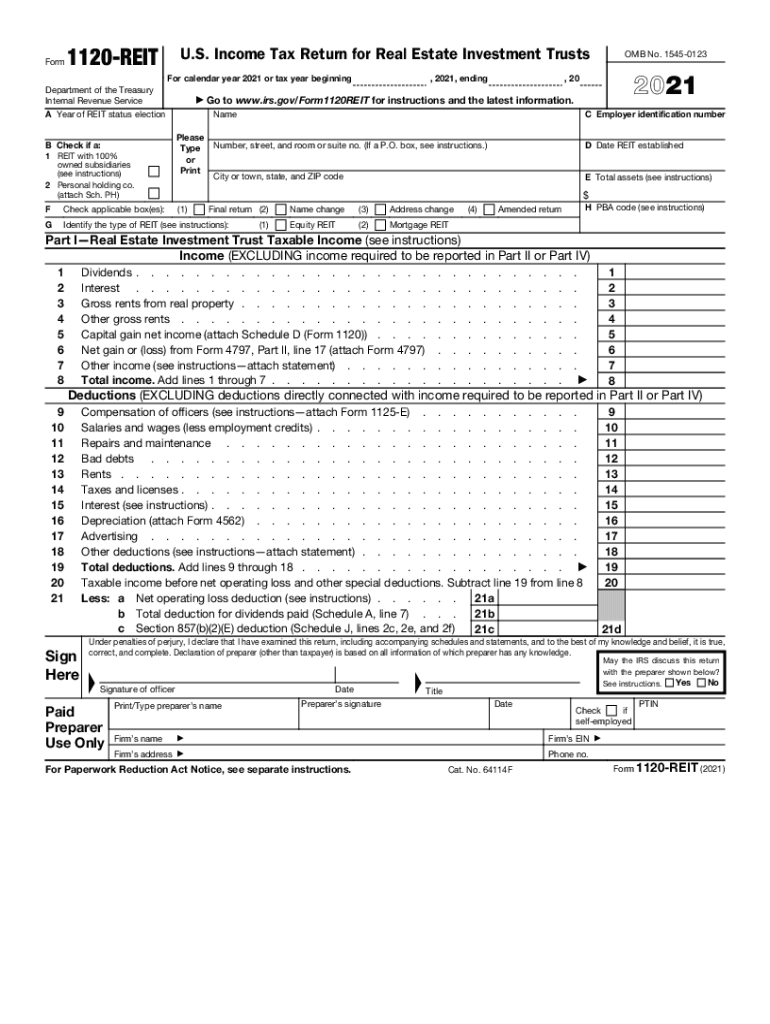

2021 Form IRS 1120REIT Fill Online, Printable, Fillable, Blank pdfFiller

If the association's principal business or office is located in. For instructions and the latest information. Income tax return for homeowners associations as its income tax return, in order to take advantage of certain tax benefits. For calendar year 2022 or tax year beginning, 2022, ending. For calendar year 2022 or tax year beginning, 2022, and ending, 20type or print.

IRS Form 1120S Schedule K1 Download Fillable PDF or Fill Online

Income tax return for homeowners associations, including recent updates, related forms and instructions on how to file. It's an important tax form because it provides several specific tax benefits. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania. Department of the treasury internal revenue service. These.

Form Il1120 Corporation And Replacement Tax Return 2001

Department of the treasury internal revenue service. For instructions and the latest information. Income tax return for homeowners associations, including recent updates, related forms and instructions on how to file. These benefits, in effect, allow the association to exclude exempt function income from its. Use the following irs center address.

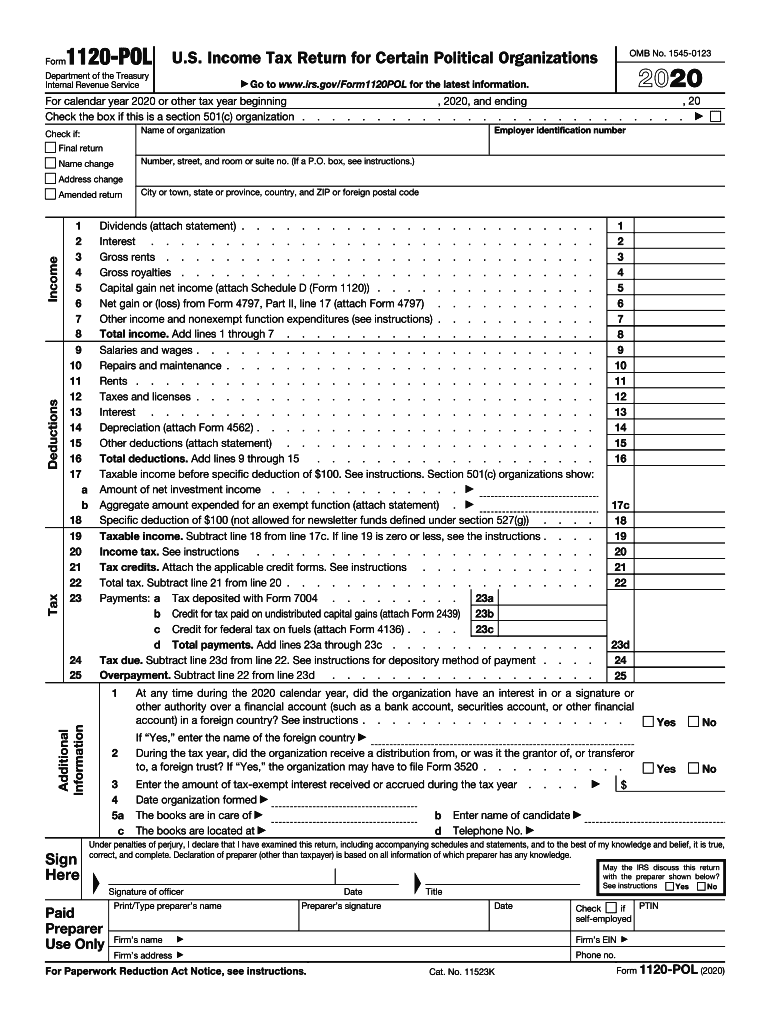

IRS 1120POL 20202021 Fill out Tax Template Online US Legal Forms

Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania. A homeowners association files this form as its income tax return to take advantage of certain tax benefits. Income tax return for homeowners associations as its income tax return, in order to take advantage of certain tax.

Edit Document Form 1120 With Us Fastly, Easyly, And Securely

Use the following irs center address. If the association's principal business or office is located in. The form requests information related to amount of money received and spent on rent, repairs, and other specific deductibles. A homeowners association files this form as its income tax return to take advantage of certain tax benefits. For calendar year 2022 or tax year.

We Will Update This Page With A New Version Of The Form For 2024 As Soon As It Is Made Available By The Federal Government.

If the association's principal business or office is located in. This form is for income earned in tax year 2022, with tax returns due in april 2023. It's an important tax form because it provides several specific tax benefits. The form requests information related to amount of money received and spent on rent, repairs, and other specific deductibles.

A Homeowners Association Files This Form As Its Income Tax Return To Take Advantage Of Certain Tax Benefits.

Income tax return for homeowners associations as its income tax return, in order to take advantage of certain tax benefits. For calendar year 2022 or tax year beginning, 2022, and ending, 20type or print. For instructions and the latest information. Income tax return for homeowners associations go to www.irs.gov/form1120h for instructions and the latest information.

Income Tax Return For Homeowners Associations, Including Recent Updates, Related Forms And Instructions On How To File.

These benefits, in effect, allow the association to exclude exempt function income from its. For calendar year 2022 or tax year beginning, 2022, ending. Use the following irs center address. Connecticut, delaware, district of columbia, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania.

Number, Street, And Room Or Suite No.

Department of the treasury internal revenue service.