Form 1120S 2020

Form 1120S 2020 - Web form 1120s (u.s. For calendar year corporations, this due date is. Income tax return for an s corporation, including recent updates, related forms, and instructions on how to file. Web file s corp taxes with taxact s corporation tax software which makes your business tax filing easy. Income tax return for an s corporation, for use in tax years beginning in 2020, as well as draft instructions for the. The corporation has a taxable year of less than 12 months that begins and ends in 2021. Ad simply the best payroll service for small business. Taxable period of january 1, 2020, to december 31, 2020; (i) if the llc is to be treated as a. Easy guidance & tools for c corporation tax returns.

Taxable period of january 1, 2020, to december 31, 2020; (i) if the llc is to be treated as a. We simplify complex tasks to give you time back and help you feel like an expert. Ad simply the best payroll service for small business. Check box if name changed. Sign up & make payroll a breeze. What information is on tax form 1120s? For calendar year corporations, this due date is. How do i fill out tax form 1120s? Get the essential forms to prepare and file form 1120s.

The corporation has a taxable year of less than 12 months that begins and ends in 2021. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching. Web what is form 1120s? Income tax return for an s corporation, including recent updates, related forms, and instructions on how to file. Web the 2020 form 100s may also be used if both of the following apply: Income tax return for an s corporation) is available in turbotax business. If you haven't filed form 2553, or didn't file form 2553 on time, you may be. Sign up & make payroll a breeze. Web file s corp taxes with taxact s corporation tax software which makes your business tax filing easy. Easy guidance & tools for c corporation tax returns.

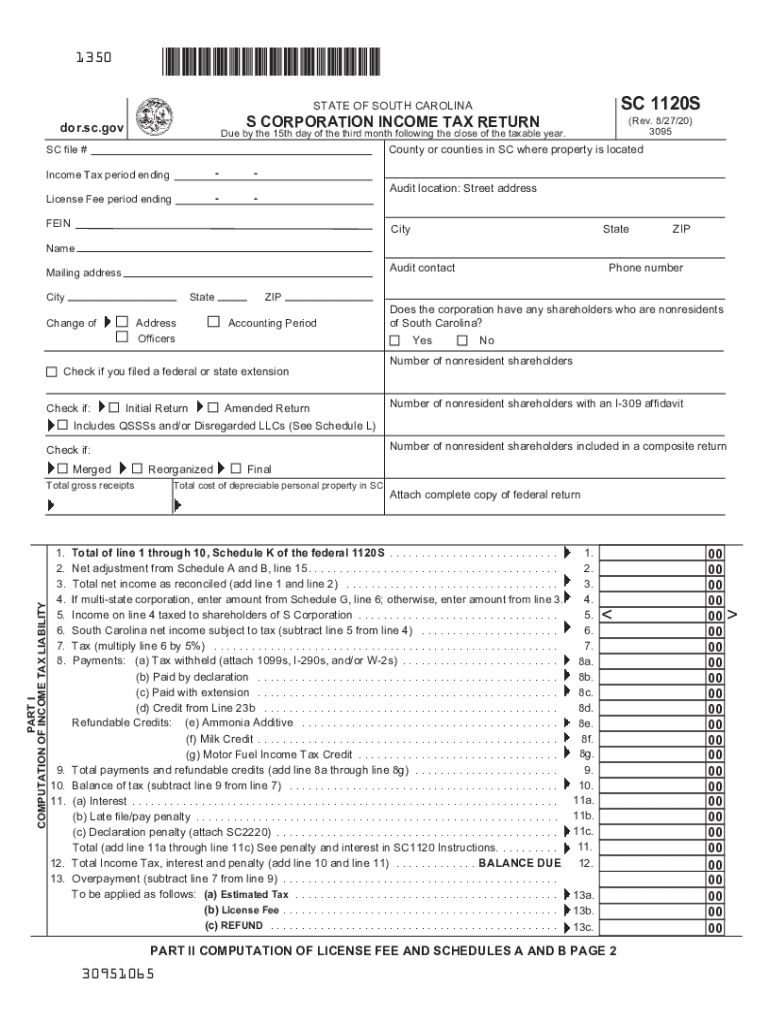

2020 Form SC DoR SC1120S Fill Online, Printable, Fillable, Blank

Income tax return for an s corporation) is available in turbotax business. If you haven't filed form 2553, or didn't file form 2553 on time, you may be. Income tax return for an s corporation, for use in tax years beginning in 2020, as well as draft instructions for the. Taxable period of january 1, 2020, to december 31, 2020;.

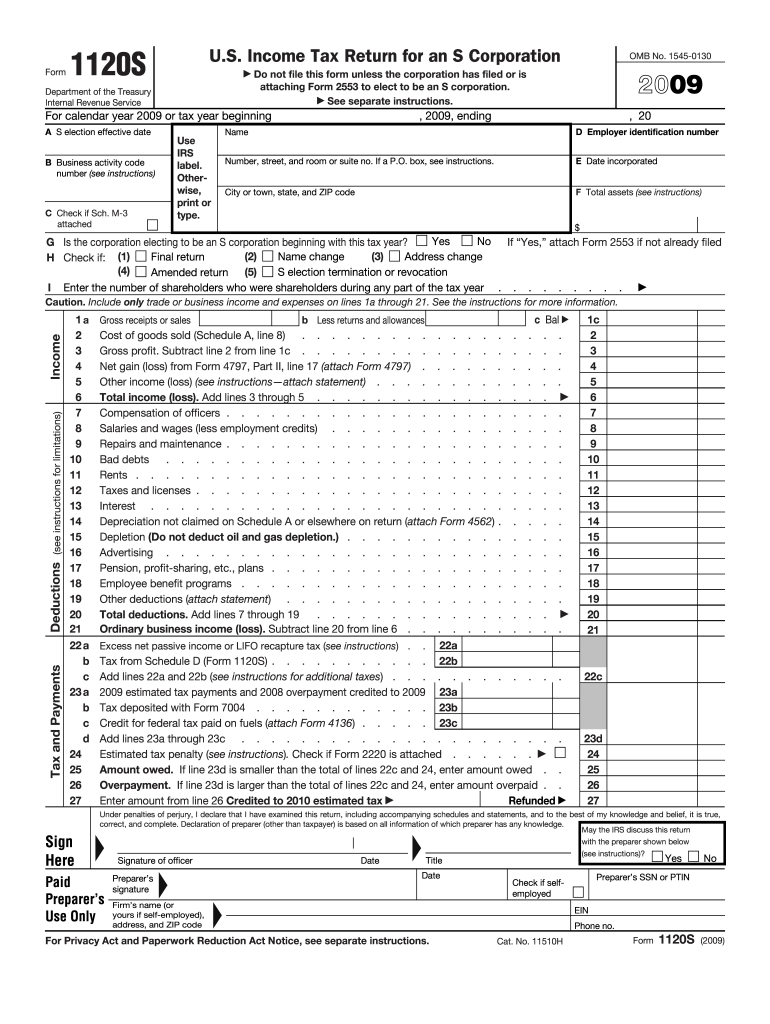

Form 1120s Fill Out and Sign Printable PDF Template signNow

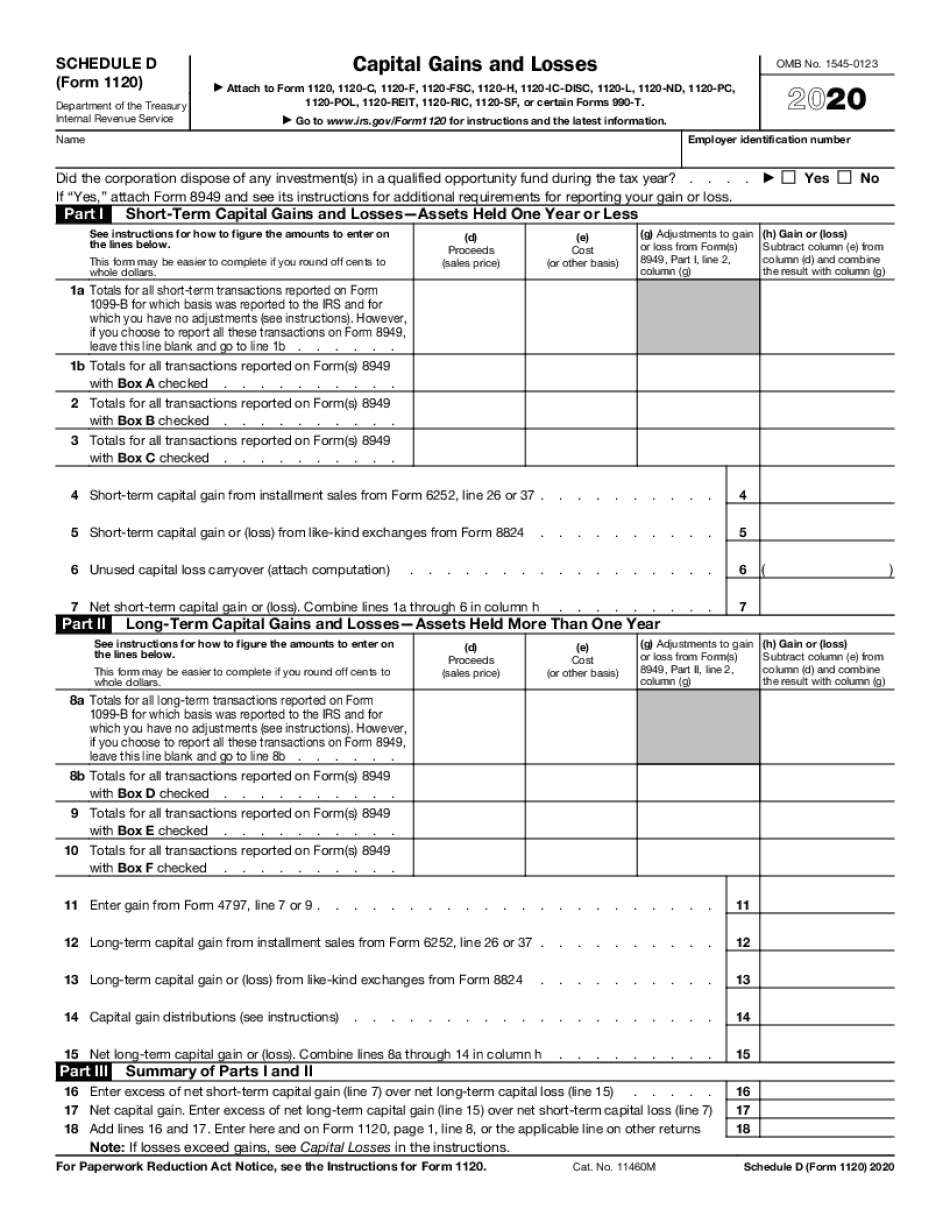

Get the essential forms to prepare and file form 1120s. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching. For calendar year corporations, this due date is. Web for calendar year ending december 31, 2020 or other tax year beginning 2020 and ending check box if amended. Taxable period.

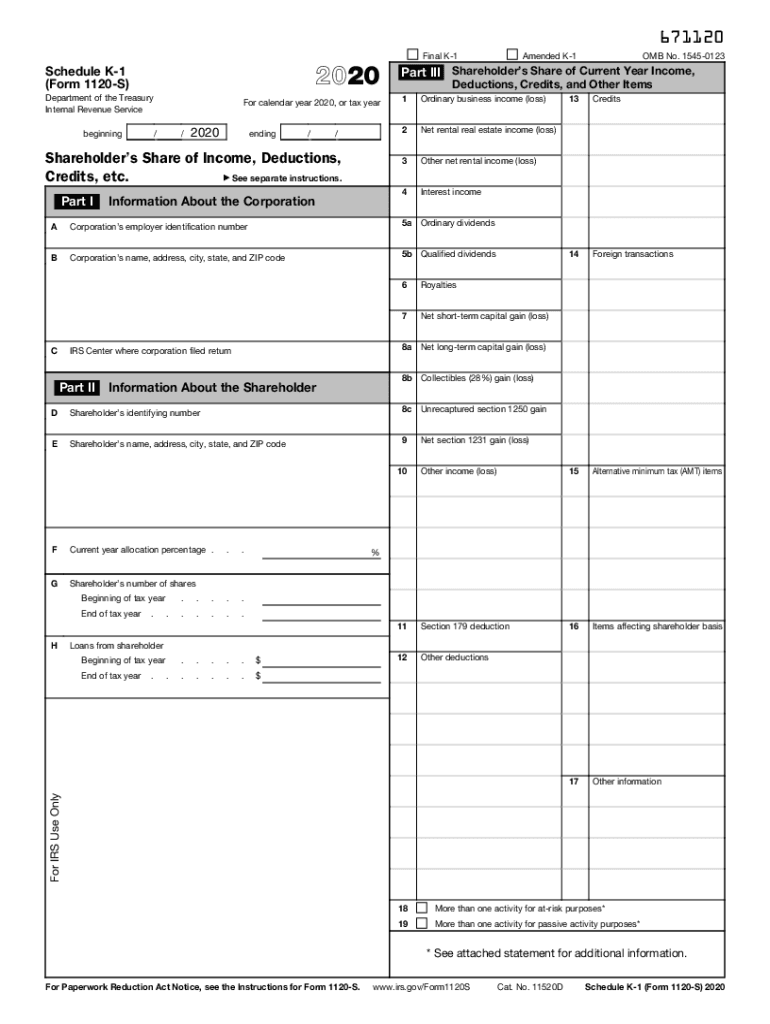

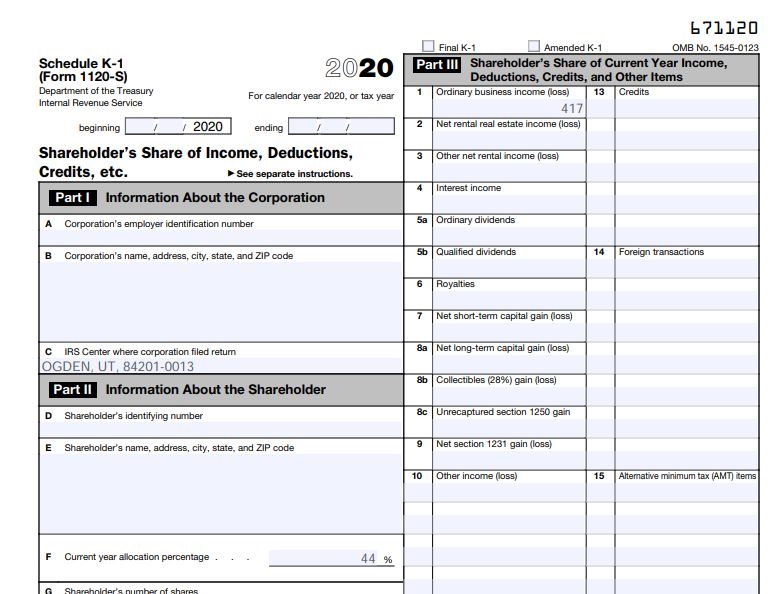

IRS 1120S Schedule K1 2020 Fill out Tax Template Online US Legal

Web what is form 1120s? Income tax return for an s corporation) is available in turbotax business. The corporation has a taxable year of less than 12 months that begins and ends in 2021. When you first start a return in turbotax business, you'll be asked. Taxable period of january 1, 2020, to december 31, 2020;

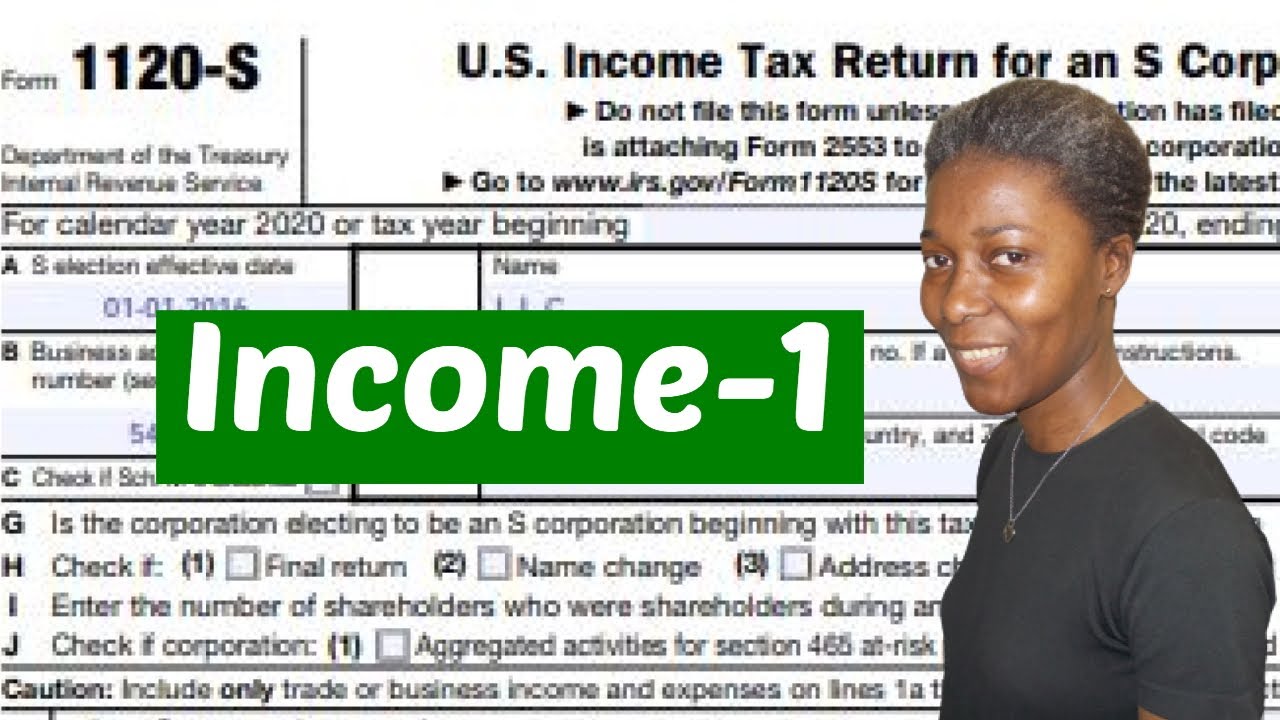

2020 Form 1120S4 YouTube

When you first start a return in turbotax business, you'll be asked. Get the essential forms to prepare and file form 1120s. How do i fill out tax form 1120s? What information is on tax form 1120s? When the due date falls on a saturday, sunday, or legal holiday, the return will be.

2020 Form 1120S4 Nina's Soap

Web file s corp taxes with taxact s corporation tax software which makes your business tax filing easy. Income tax return for an s corporation by the 15th day of the third month after the end. When you first start a return in turbotax business, you'll be asked. Income tax return for an s corporation) is available in turbotax business..

IRS Form 1120S (2020)

Easy guidance & tools for c corporation tax returns. What information is on tax form 1120s? Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching. We simplify complex tasks to give you time back and help you feel like an expert. When you first start a return in turbotax.

Form 1120S U.S. Tax Return for an S Corporation Definition

Income tax return for an s corporation) is available in turbotax business. For calendar year corporations, this due date is. Web the 2020 form 100s may also be used if both of the following apply: When the due date falls on a saturday, sunday, or legal holiday, the return will be. Web file s corp taxes with taxact s corporation.

How to Complete 2020 Form 1120S1 YouTube

When the due date falls on a saturday, sunday, or legal holiday, the return will be. Income tax return for an s corporation by the 15th day of the third month after the end. We simplify complex tasks to give you time back and help you feel like an expert. Sign up & make payroll a breeze. Check box if.

2020 Form 1120S3 YouTube

Web what is form 1120s? If you haven't filed form 2553, or didn't file form 2553 on time, you may be. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching. What information is on tax form 1120s? Sign up & make payroll a breeze.

2019 1120s Fill Online, Printable, Fillable Blank form1120

Income tax return for an s corporation by the 15th day of the third month after the end. Web what is form 1120s? How do i fill out tax form 1120s? Web the 2020 form 100s may also be used if both of the following apply: (i) if the llc is to be treated as a.

(I) If The Llc Is To Be Treated As A.

If you haven't filed form 2553, or didn't file form 2553 on time, you may be. Income tax return for an s corporation by the 15th day of the third month after the end. How do i fill out tax form 1120s? Check box if name changed.

Income Tax Return For An S Corporation, For Use In Tax Years Beginning In 2020, As Well As Draft Instructions For The.

Get the essential forms to prepare and file form 1120s. Web form 1120s (u.s. For calendar year corporations, this due date is. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching.

Sign Up & Make Payroll A Breeze.

We simplify complex tasks to give you time back and help you feel like an expert. Web the 2020 form 100s may also be used if both of the following apply: Income tax return for an s corporation, including recent updates, related forms, and instructions on how to file. Web file s corp taxes with taxact s corporation tax software which makes your business tax filing easy.

The Corporation Has A Taxable Year Of Less Than 12 Months That Begins And Ends In 2021.

Income tax return for an s corporation) is available in turbotax business. Easy guidance & tools for c corporation tax returns. Ad simply the best payroll service for small business. Taxable period of january 1, 2020, to december 31, 2020;

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)