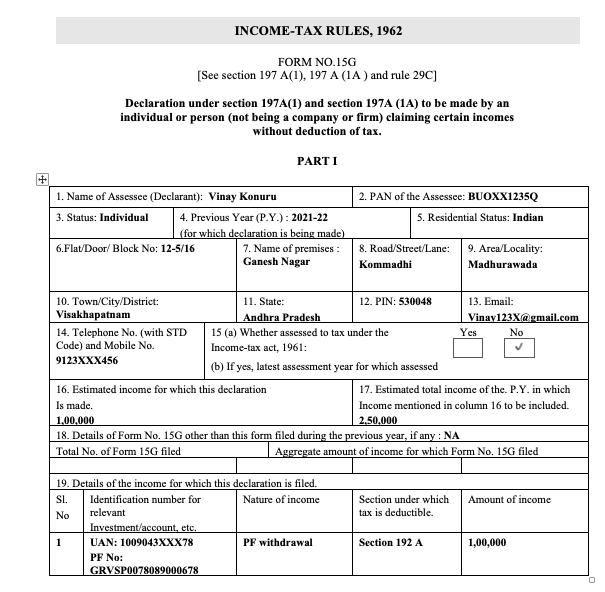

Form 15G Download

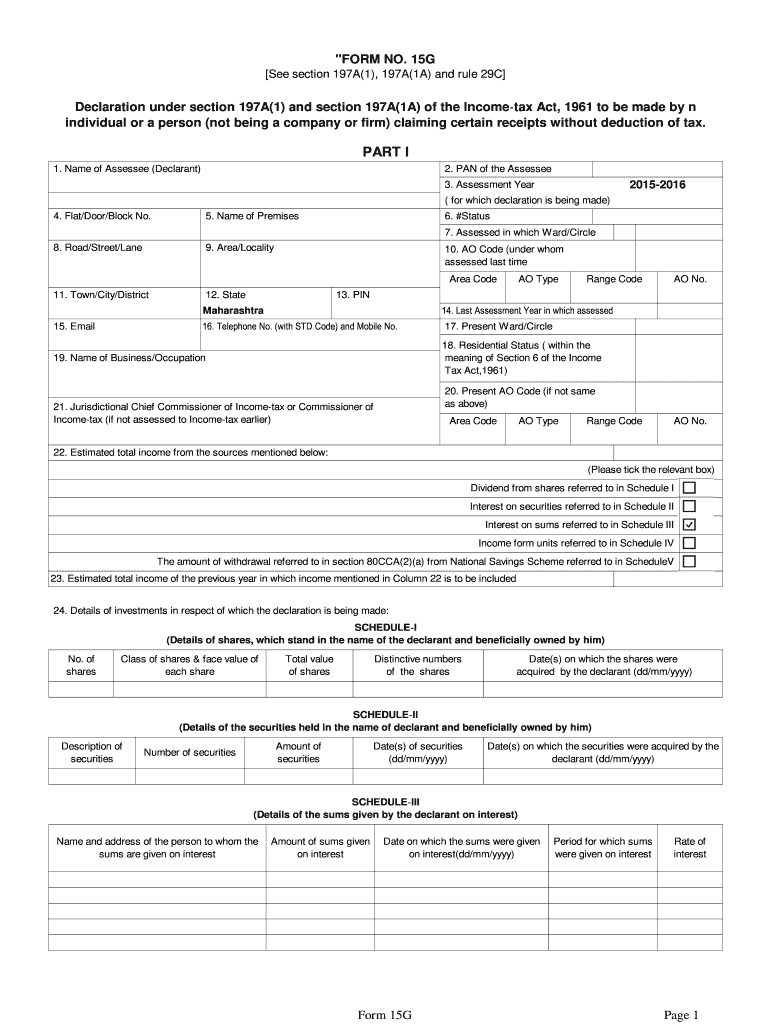

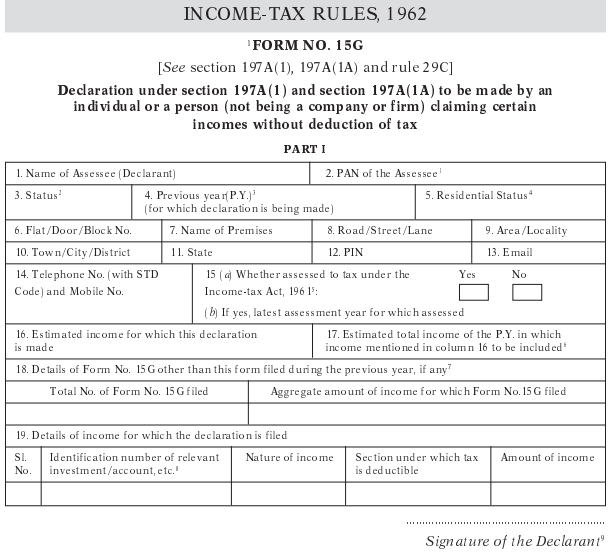

Form 15G Download - Web you can get form 15g from epfo’s online portal or the websites of major banks. Part i name of assessee (declarant) pan of the assessee Web click here for free form 15g download/15g form pdf you also have the option of submitting form 15g online on the website of most major banks in india. 15g [see section 197a(1), 197a(1a) and rule 29c]declaration under section 197a(1) and section 197a(1a) of the income‐tax act, 1961 to be made by an individual or a person (not being a company or firm) claiming certain receipts without deduction of tax. Simply log in and search for pf form 15g download, and you can download it to your computer or smartphone. Form 15g pf withdrawal pdf to be made by an individual or a person (not being a company or firm) claiming certain incomes without deduction of tax for pf withdrawal. Web form 15g can be easily found and downloaded for free from the website of all major banks in india as well as the official epfo portal. Moreover, you also have the facility to submit form 15g online on the website of most major banks of india. The general instructions is provided in the utility. Additionally, this form can also be easily downloaded from the income tax department website.

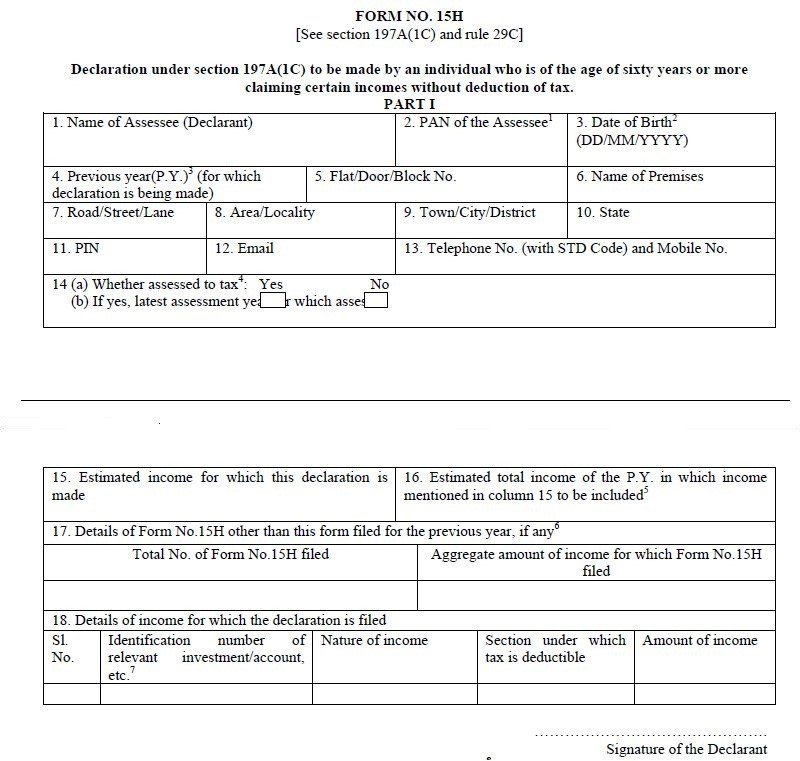

Form 15g sample most banks and financial institutions offer their own variants of form 15g, but, the generic version of the form is available on the official income tax department website. Furthermore, you can also visit the income. Web you can download pf withdrawal form 15g from the online portal of epfo. 15g [see section 197a(1c), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income tax act, 1961 to be made ‐ by an individual or person (not being a company or firm) claiming certain receipts without deduction of tax. Web you can get form 15g from epfo’s online portal or the websites of major banks. Click on “online services” and then go to “online claim” and fill in the required details. Moreover, you also have the facility to submit form 15g online on the website of most major banks of india. Choose the part you want to fill from the dropdown and click continue. Web form 15g for pf withdrawal pdf read online or download for free from the incometaxindia.gov.in link given at the bottom of this article. 15g [see section 197a(1), 197a(1a) and rule 29c]declaration under section 197a(1) and section 197a(1a) of the income‐tax act, 1961 to be made by an individual or a person (not being a company or firm) claiming certain receipts without deduction of tax.

Simply log in and search for pf form 15g download, and you can download it to your computer or smartphone. Furthermore, you can also visit the income. 15g [see section 197a(1), 197a(1a) and rule 29c]declaration under section 197a(1) and section 197a(1a) of the income‐tax act, 1961 to be made by an individual or a person (not being a company or firm) claiming certain receipts without deduction of tax. Form 15g sample most banks and financial institutions offer their own variants of form 15g, but, the generic version of the form is available on the official income tax department website. Fill details on the remitter, remittee and remittance details. Web form 15g for pf withdrawal pdf read online or download for free from the incometaxindia.gov.in link given at the bottom of this article. The general instructions is provided in the utility. Web form 15g can be easily found and downloaded for free from the website of all major banks in india as well as the official epfo portal. Web you can get form 15g from epfo’s online portal or the websites of major banks. Click the form 15ca option.

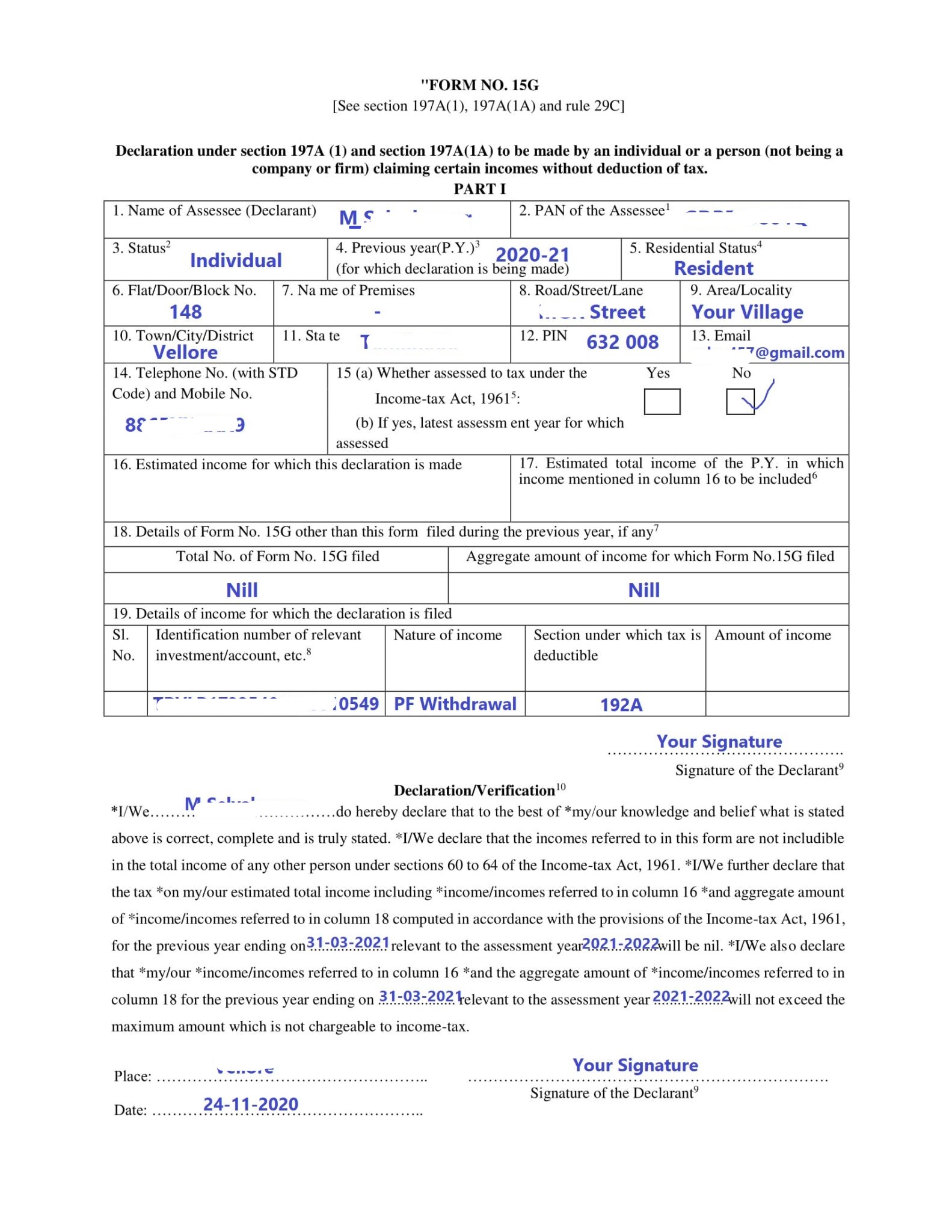

New Form 15G in Word Format for AY 202223 Download

Moreover, you also have the facility to submit form 15g online on the website of most major banks of india. Furthermore, you can also visit the income. 15g [see section 197a(1c), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income tax act, 1961 to be made ‐ by an individual or person (not being.

What is Form 15G? How to Download & Fill Form Online 15G for PF

Fill details on the remitter, remittee and remittance details. Part i name of assessee (declarant) pan of the assessee Web you can get form 15g from epfo’s online portal or the websites of major banks. Additionally, this form can also be easily downloaded from the income tax department website. The general instructions is provided in the utility.

EPF Form 15G Download Sample Filled Form 15G For PF Withdrawal GST

15g [see section 197a(1), 197a(1a) and rule 29c]declaration under section 197a(1) and section 197a(1a) of the income‐tax act, 1961 to be made by an individual or a person (not being a company or firm) claiming certain receipts without deduction of tax. Simply log in and search for pf form 15g download, and you can download it to your computer or.

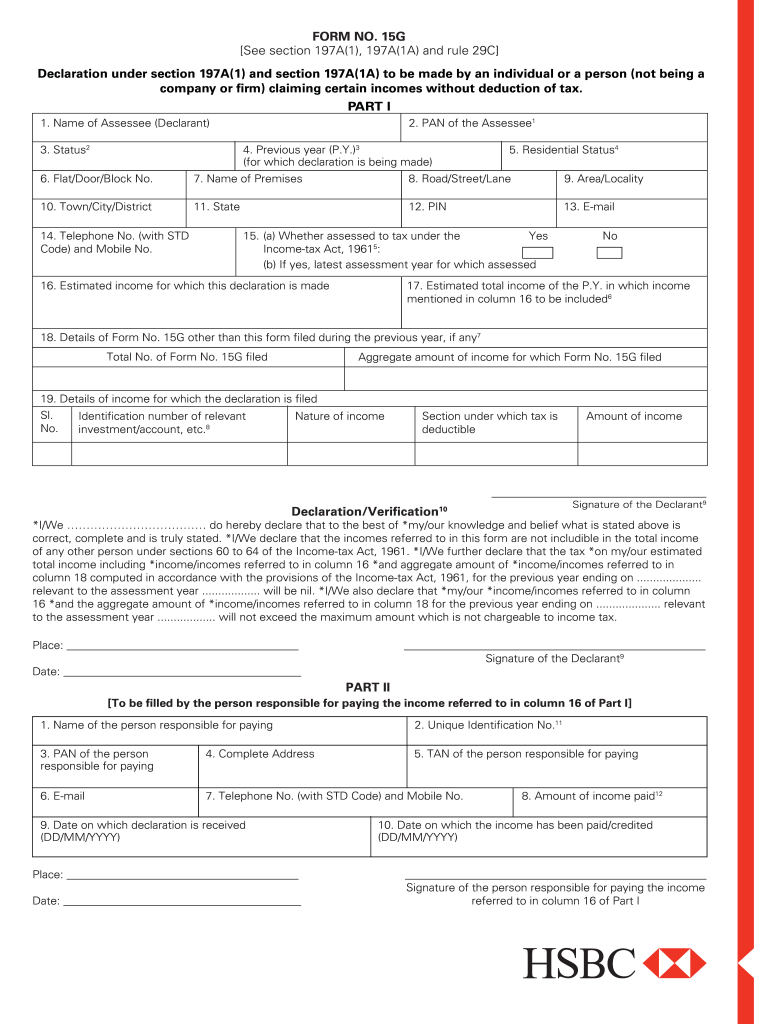

Form 15g For Pf Withdrawal Pdf Fill Online, Printable, Fillable

Web form 15g for pf withdrawal pdf read online or download for free from the incometaxindia.gov.in link given at the bottom of this article. Simply log in and search for pf form 15g download, and you can download it to your computer or smartphone. 15g [see section 197a(1c), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a).

Download Form 15G for PF Withdrawal 2022

Simply log in and search for pf form 15g download, and you can download it to your computer or smartphone. Part i name of assessee (declarant) pan of the assessee Form 15g pf withdrawal pdf to be made by an individual or a person (not being a company or firm) claiming certain incomes without deduction of tax for pf withdrawal..

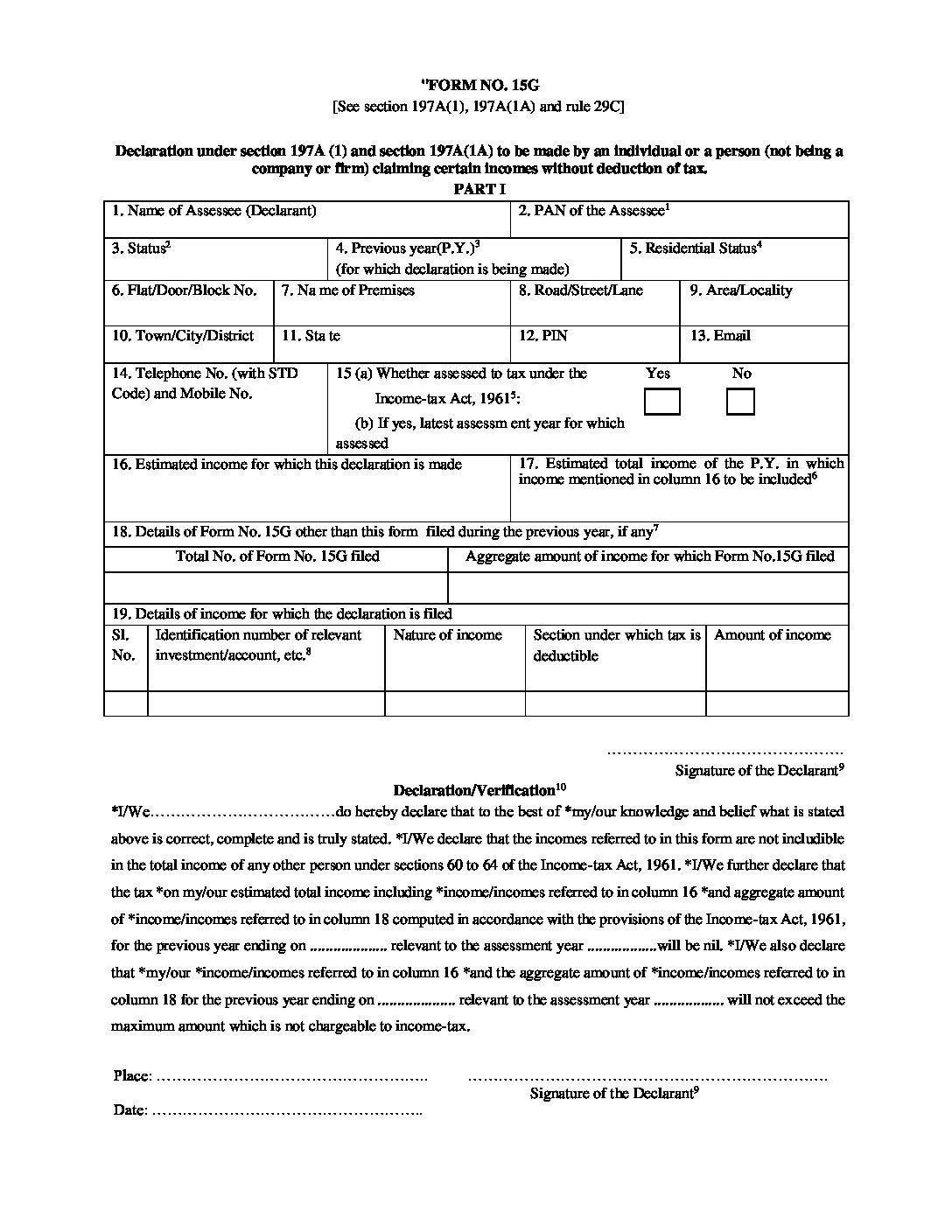

Form 15g Download In Word Format Fill Online, Printable, Fillable

Moreover, you also have the facility to submit form 15g online on the website of most major banks of india. 15g [see section 197a(1), 197a(1a) and rule 29c]declaration under section 197a(1) and section 197a(1a) of the income‐tax act, 1961 to be made by an individual or a person (not being a company or firm) claiming certain receipts without deduction of.

Form 15G How to Download Form 15G Online

Web form 15g can be easily found and downloaded for free from the website of all major banks in india as well as the official epfo portal. Web you can download pf withdrawal form 15g from the online portal of epfo. Web click here for free form 15g download/15g form pdf you also have the option of submitting form 15g.

New Form 15G & Form 15H New format & procedure

15g [see section 197a(1c), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income tax act, 1961 to be made ‐ by an individual or person (not being a company or firm) claiming certain receipts without deduction of tax. Fill details on the remitter, remittee and remittance details. Web form 15g for pf withdrawal pdf.

Form 15g Taxguru Securities (Finance) Mutual Funds Free 30day

Web click here for free form 15g download/15g form pdf you also have the option of submitting form 15g online on the website of most major banks in india. Web you can get form 15g from epfo’s online portal or the websites of major banks. The general instructions is provided in the utility. Part i name of assessee (declarant) pan.

How To Fill New Form 15G / Form 15H roy's Finance

Simply log in and search for pf form 15g download, and you can download it to your computer or smartphone. Part i name of assessee (declarant) pan of the assessee Click the form 15ca option. Web click here for free form 15g download/15g form pdf you also have the option of submitting form 15g online on the website of most.

Click The Form 15Ca Option.

Web click here for free form 15g download/15g form pdf you also have the option of submitting form 15g online on the website of most major banks in india. Furthermore, you can also visit the income. Web form 15g for pf withdrawal pdf read online or download for free from the incometaxindia.gov.in link given at the bottom of this article. Additionally, this form can also be easily downloaded from the income tax department website.

Web You Can Get Form 15G From Epfo’s Online Portal Or The Websites Of Major Banks.

Form 15g pf withdrawal pdf to be made by an individual or a person (not being a company or firm) claiming certain incomes without deduction of tax for pf withdrawal. Click on “online services” and then go to “online claim” and fill in the required details. Part i name of assessee (declarant) pan of the assessee Simply log in and search for pf form 15g download, and you can download it to your computer or smartphone.

The General Instructions Is Provided In The Utility.

Form 15g sample most banks and financial institutions offer their own variants of form 15g, but, the generic version of the form is available on the official income tax department website. Web you can download pf withdrawal form 15g from the online portal of epfo. Moreover, you also have the facility to submit form 15g online on the website of most major banks of india. Web form 15g can be easily found and downloaded for free from the website of all major banks in india as well as the official epfo portal.

15G [See Section 197A(1C), 197A(1A) And Rule 29C] Declaration Under Section 197A(1) And Section 197A (1A) Of The Income Tax Act, 1961 To Be Made ‐ By An Individual Or Person (Not Being A Company Or Firm) Claiming Certain Receipts Without Deduction Of Tax.

Fill details on the remitter, remittee and remittance details. Choose the part you want to fill from the dropdown and click continue. 15g [see section 197a(1), 197a(1a) and rule 29c]declaration under section 197a(1) and section 197a(1a) of the income‐tax act, 1961 to be made by an individual or a person (not being a company or firm) claiming certain receipts without deduction of tax.