Form 199 Instructions

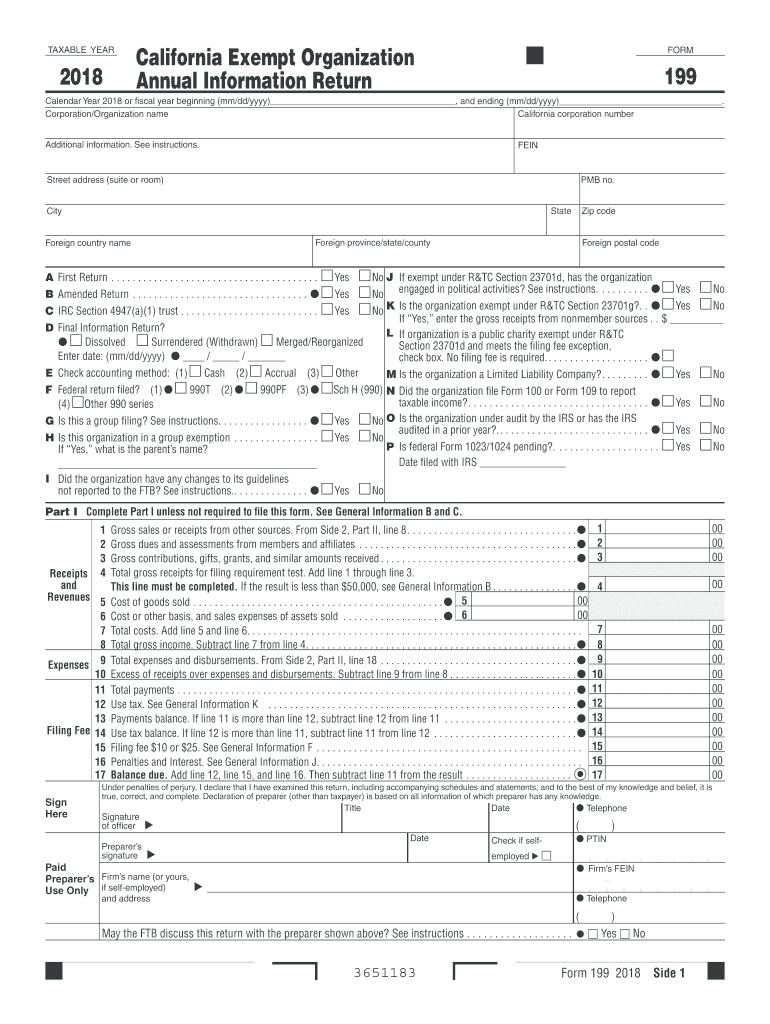

Form 199 Instructions - You can also download it, export it or print it out. Draw your signature, type it,. Web exempt organization returns (form 199). Web of it is not covered in this report.) the deduction may be claimed on the form 1040, after eligible taxpayers take the standard deduction or the sum of their itemized. Web they are required to file form 199, not form 541, california fiduciary income tax return. Web share your form with others. Use get form or simply click on the template preview to open it in the editor. Web quick steps to complete and design form 199 online: Web washington — the internal revenue service today issued final regulations permitting a regulated investment company (ric) that receives qualified real. 2gross dues and assessments from members and.

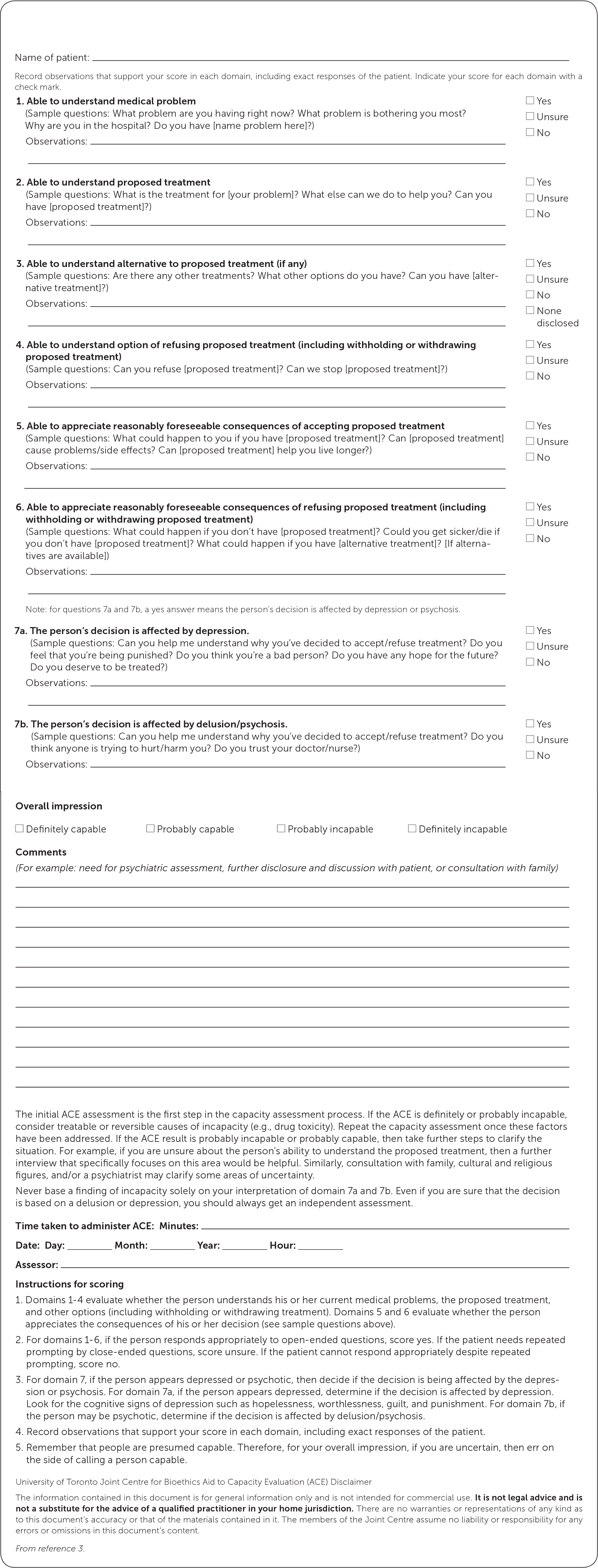

Sign it in a few clicks. Continue on separate attachment if necessary.) 1. Web of it is not covered in this report.) the deduction may be claimed on the form 1040, after eligible taxpayers take the standard deduction or the sum of their itemized. This law doesn't apply to the filing. Web form 199, california exempt organization annual information return, is used by the following organizations: Start completing the fillable fields and carefully. 2gross dues and assessments from members and. • religious or apostolic organizations described in r&tc section 23701k must attach a. You can find a complete list of the acceptable forms and schedules on the ftb website. Type text, add images, blackout confidential details, add comments, highlights and more.

From side 2, part ii, line 8.•100. Web form 199 2020 side 1. 2gross dues and assessments from members and. Type text, add images, blackout confidential details, add comments, highlights and more. You can also download it, export it or print it out. Draw your signature, type it,. • religious or apostolic organizations described in r&tc section 23701k must attach a. Part ii organizations with gross receipts of more than $50,000 and private foundations regardless of amount of gross receipts — complete part ii or. Accounts solely in the name of decedent Web of it is not covered in this report.) the deduction may be claimed on the form 1040, after eligible taxpayers take the standard deduction or the sum of their itemized.

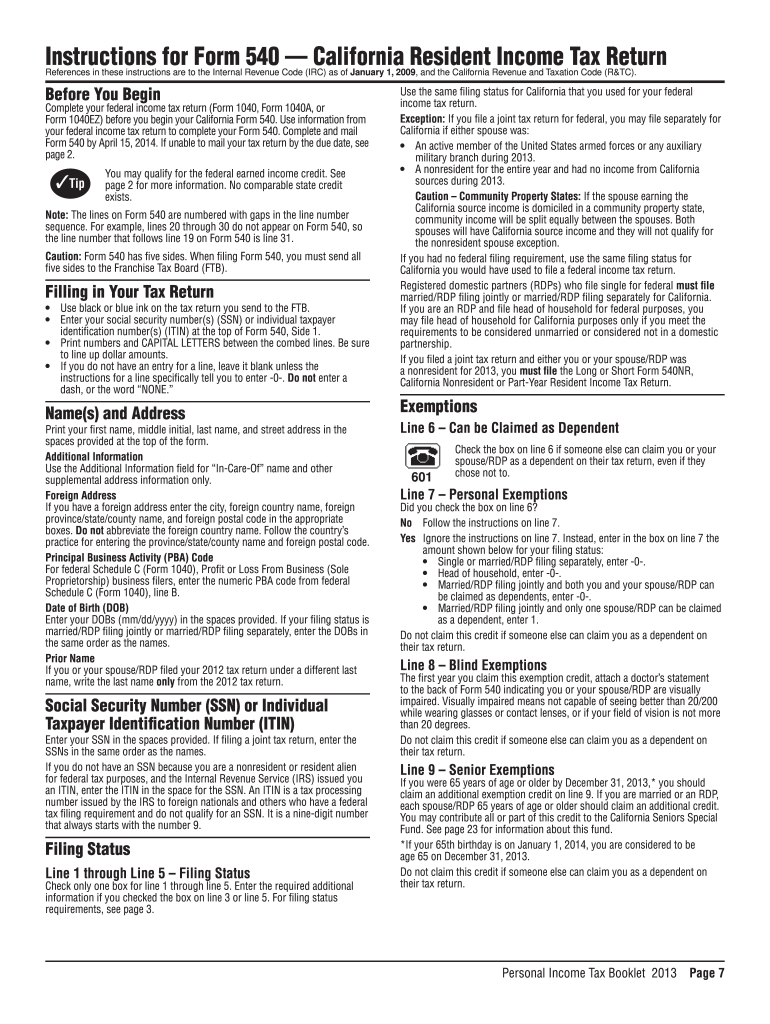

2013 Form CA FTB 540 Instructions Fill Online, Printable, Fillable

Use get form or simply click on the template preview to open it in the editor. Type text, add images, blackout confidential details, add comments, highlights and more. Edit your ca 199 instructions online. You can also download it, export it or print it out. All persons engaging in an offering of or transaction in securities within or from new.

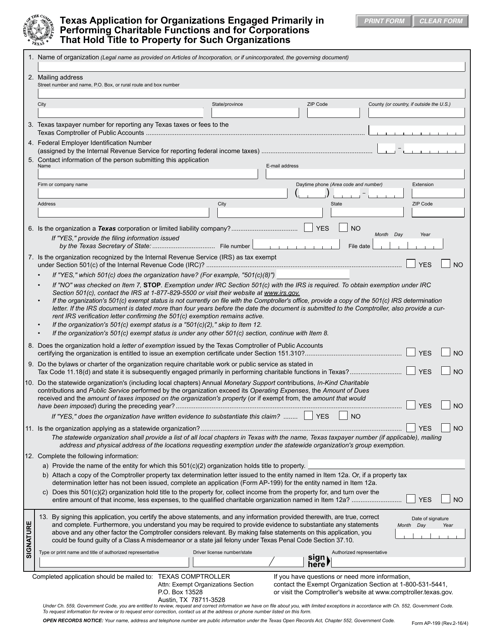

Form AP199 Download Fillable PDF or Fill Online Texas Application for

Accounts solely in the name of decedent 2gross dues and assessments from members and. Type text, add images, blackout confidential details, add comments, highlights and more. You can also download it, export it or print it out. You can find a complete list of the acceptable forms and schedules on the ftb website.

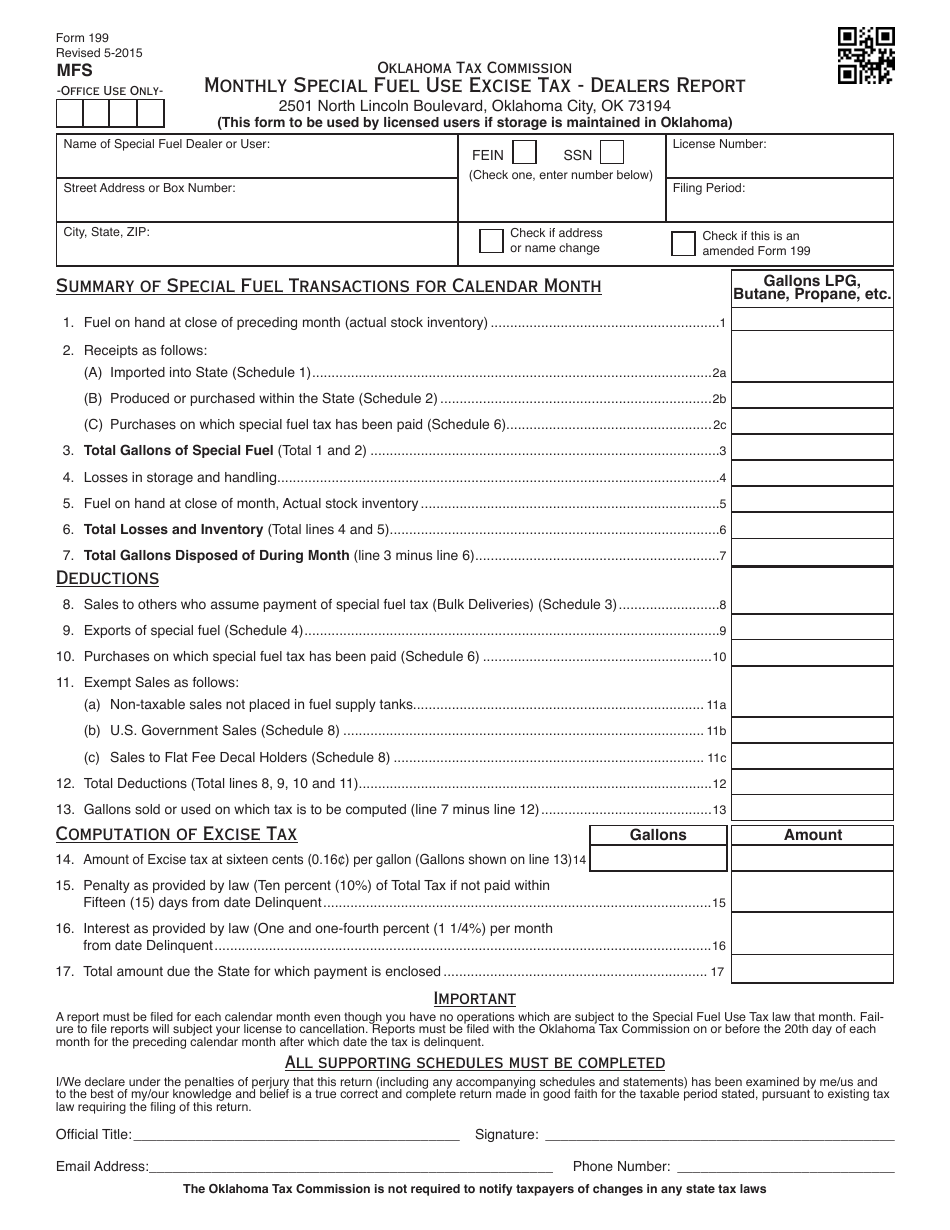

OTC Form 199 Download Fillable PDF or Fill Online Monthly Special Fuel

Web preliminary inventory (give values as of date of decedent’s death. Part ii organizations with gross receipts of more than $50,000 and private foundations regardless of amount of gross receipts — complete part ii or. Use get form or simply click on the template preview to open it in the editor. Edit your ca 199 instructions online. Continue on separate.

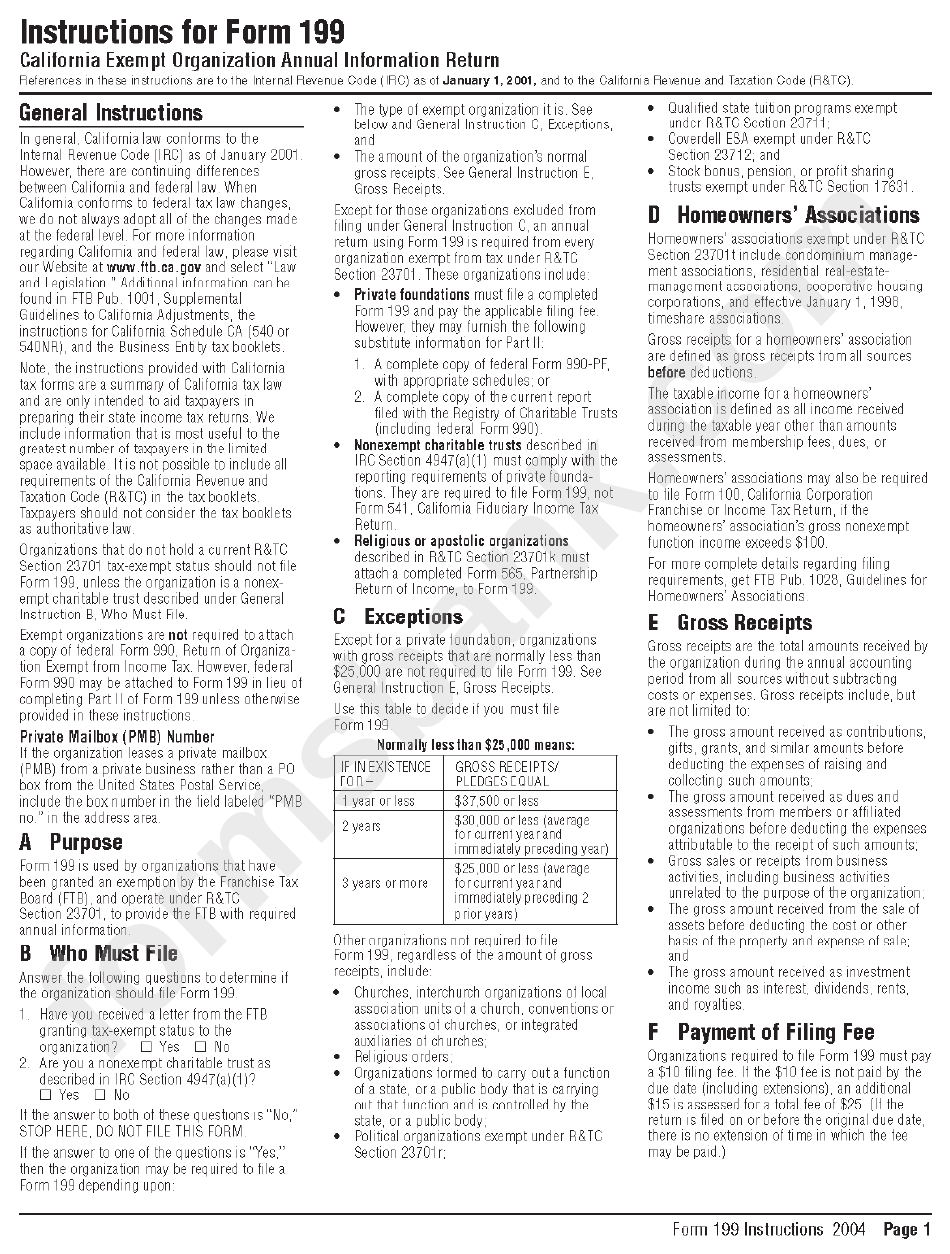

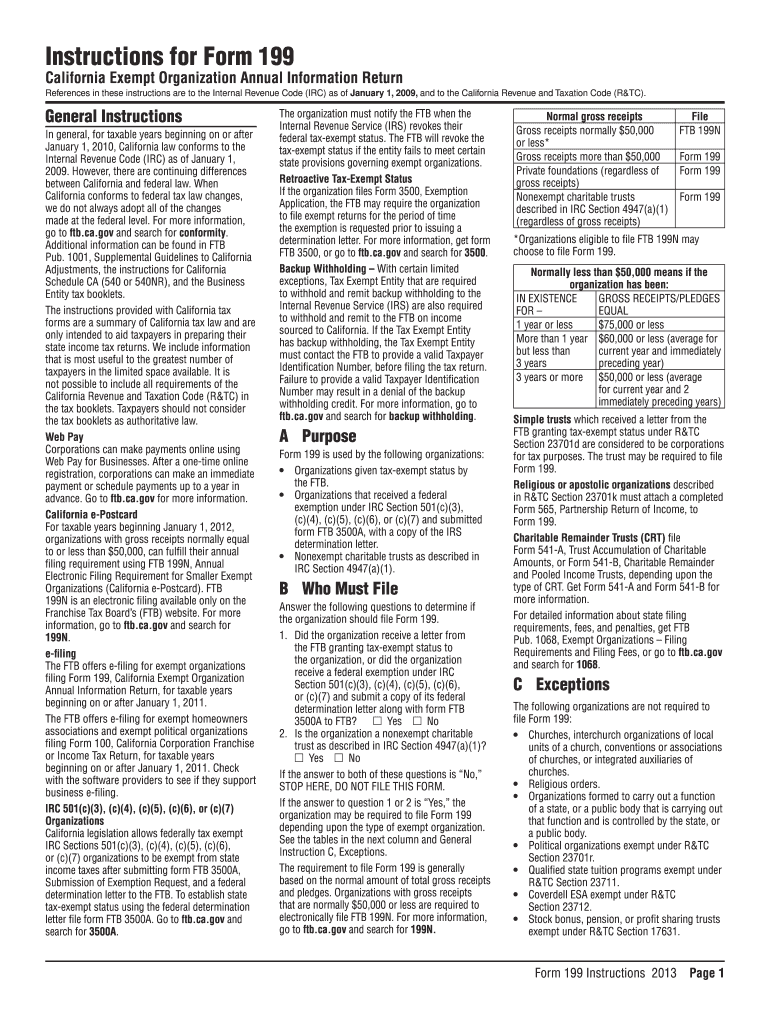

Instructions For Form 199 California Exempt Organization Annual

Web form 199, california exempt organization annual information return, is used by the following organizations: Use get form or simply click on the template preview to open it in the editor. Continue on separate attachment if necessary.) 1. Web exempt organization returns (form 199). Web they are required to file form 199, not form 541, california fiduciary income tax return.

Form 199 Instructions Fill Out and Sign Printable PDF Template signNow

Web exempt organization returns (form 199). Continue on separate attachment if necessary.) 1. This law doesn't apply to the filing. Web they are required to file form 199, not form 541, california fiduciary income tax return. All persons engaging in an offering of or transaction in securities within or from new.

ea form 2018 Dominic Churchill

• religious or apostolic organizations described in r&tc section 23701k must attach a. Web quick steps to complete and design form 199 online: Web they are required to file form 199, not form 541, california fiduciary income tax return. You can find a complete list of the acceptable forms and schedules on the ftb website. Send ftb form 199 insructions.

california form 199 Fill out & sign online DocHub

Send ftb form 199 insructions via email, link, or fax. Web they are required to file form 199, not form 541, california fiduciary income tax return. Start completing the fillable fields and carefully. Web form 199, california exempt organization annual information return, is used by the following organizations: Draw your signature, type it,.

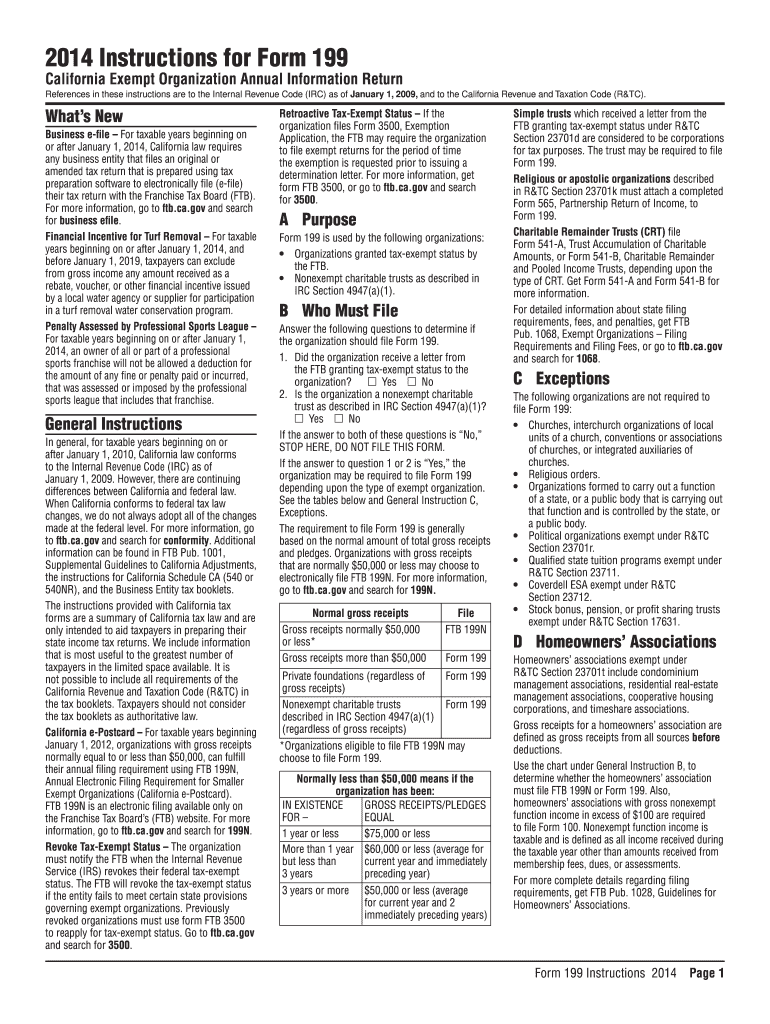

2014 Form CA FTB 199 Instructions Fill Online, Printable, Fillable

Web preliminary inventory (give values as of date of decedent’s death. 2gross dues and assessments from members and. • religious or apostolic organizations described in r&tc section 23701k must attach a. Web of it is not covered in this report.) the deduction may be claimed on the form 1040, after eligible taxpayers take the standard deduction or the sum of.

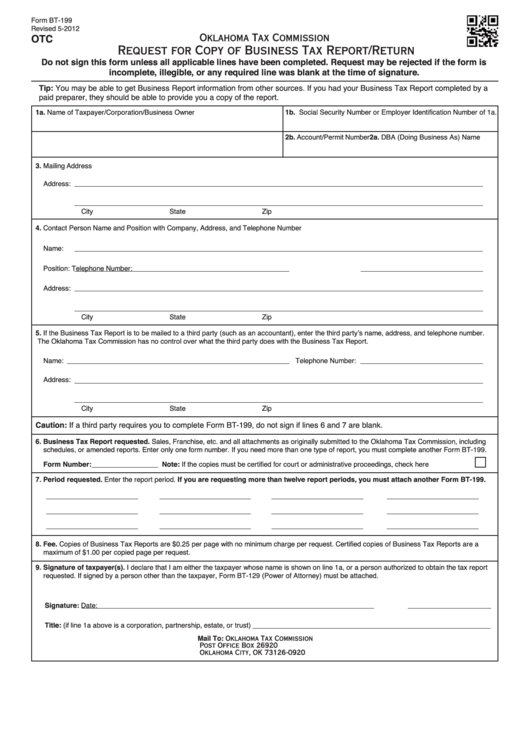

Fillable Form Bt199 Otc Request For Copy Of Business Tax Report

Web exempt organization returns (form 199). You can find a complete list of the acceptable forms and schedules on the ftb website. Draw your signature, type it,. Web preliminary inventory (give values as of date of decedent’s death. Annual registration renewal fee report.

How to File Form 199 For the California Deadline

Type text, add images, blackout confidential details, add comments, highlights and more. Part ii organizations with gross receipts of more than $50,000 and private foundations regardless of amount of gross receipts — complete part ii or. Sign it in a few clicks. Web share your form with others. Draw your signature, type it,.

Part Ii Organizations With Gross Receipts Of More Than $50,000 And Private Foundations Regardless Of Amount Of Gross Receipts — Complete Part Ii Or.

Sign it in a few clicks. 1gross sales or receipts from other sources. Web form 199 2020 side 1. Web of it is not covered in this report.) the deduction may be claimed on the form 1040, after eligible taxpayers take the standard deduction or the sum of their itemized.

Web They Are Required To File Form 199, Not Form 541, California Fiduciary Income Tax Return.

This law doesn't apply to the filing. From side 2, part ii, line 8.•100. Start completing the fillable fields and carefully. Continue on separate attachment if necessary.) 1.

Use Get Form Or Simply Click On The Template Preview To Open It In The Editor.

Web preliminary inventory (give values as of date of decedent’s death. Web share your form with others. • religious or apostolic organizations described in r&tc section 23701k must attach a. Edit your form 199 online.

You Can Also Download It, Export It Or Print It Out.

All persons engaging in an offering of or transaction in securities within or from new. Annual registration renewal fee report. Accounts solely in the name of decedent Edit your ca 199 instructions online.