Form 2106 Ez

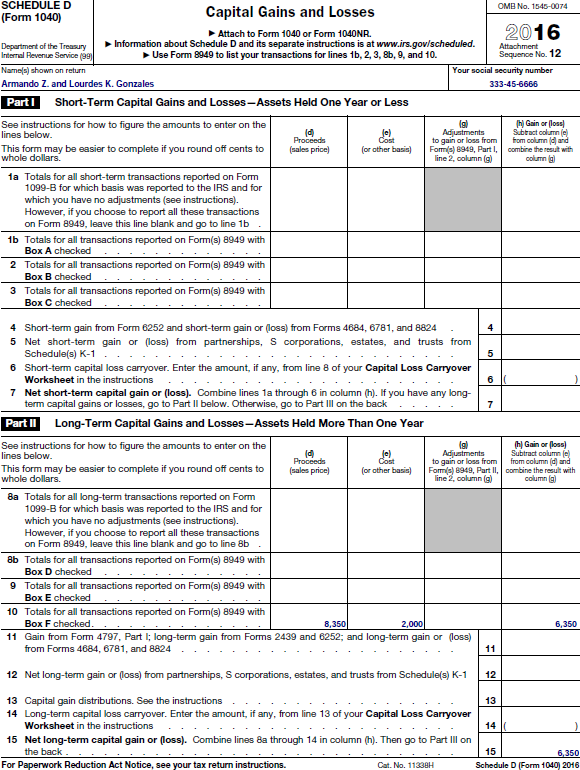

Form 2106 Ez - Web what is the irs form 2106? Complete, edit or print tax forms instantly. Unreimbursed employee business expenses is a simplified version of irs form 2106, used by employees to deduct ordinary and necessary expenses related to. Get ready for tax season deadlines by completing any required tax forms today. If you plan to deduct actual. Ad access irs tax forms. What’s new standard mileage rate. Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2017 • december 1, 2022 09:45 am overview. Unreimbursed employee business expenses was a simplified version and was used by employees claiming a tax deduction because of. The 2016 rate for business use of your vehicle is 54 cents.

Employees file this form to. Web what is the irs form 2106? Complete, edit or print tax forms instantly. Ad do your 2016, 2017 all the way back to 2000 easy, fast, secure & free to try! Web up to $40 cash back form2106ezomb no. Web step 1 enter your expenses column a other than meals column b meals vehicle expense from line 22 or line 29. Purpose of form you can use form. Get ready for tax season deadlines by completing any required tax forms today. The 2013 rate for business use of your vehicle is 56½ cents a mile. Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2017 • december 1, 2022 09:45 am overview.

Purpose of form you can use form. Complete, edit or print tax forms instantly. Unreimbursed employee business expenses is a simplified version of irs form 2106, used by employees to deduct ordinary and necessary expenses related to. This form is for income earned in tax year 2022, with tax returns due in. Web what is the irs form 2106? Get ready for tax season deadlines by completing any required tax forms today. Unreimbursed employee business expenses was a simplified version and was used by employees claiming a tax deduction because of. Web information about form 2106, employee business expenses, including recent updates, related forms and instructions on how to file. A form that an employee files with the irs to claim a tax deduction for unreimbursed expenses that the employee has incurred in the ordinary course of his/her. The 2013 rate for business use of your vehicle is 56½ cents a mile.

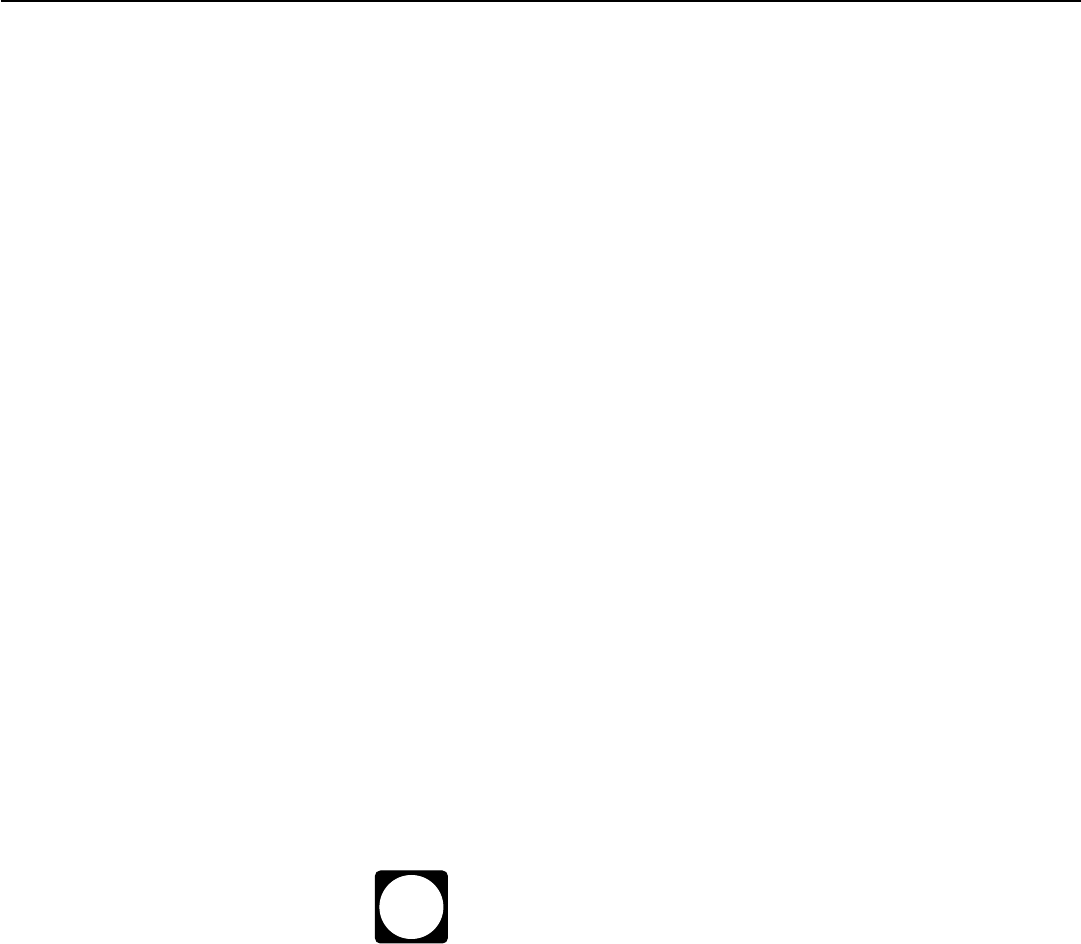

irs form 2106 ez for 2018 Fill Online, Printable, Fillable Blank

Purpose of form you can use form. Web step 1 enter your expenses column a other than meals column b meals vehicle expense from line 22 or line 29. Ad access irs tax forms. A form that an employee files with the irs to claim a tax deduction for unreimbursed expenses that the employee has incurred in the ordinary course.

Irs Form 2106 For 2012 Universal Network

Unreimbursed employee business expenses was a simplified version and was used by employees claiming a tax deduction because of. The 2016 rate for business use of your vehicle is 54 cents. A form that an employee files with the irs to claim a tax deduction for unreimbursed expenses that the employee has incurred in the ordinary course of his/her. Web.

Find Out 30+ List On Form 2106 Ez They Missed to Let You in! Beaston79779

Unreimbursed employee business expenses was a simplified version and was used by employees claiming a tax deduction because of. Ad do your 2016, 2017 all the way back to 2000 easy, fast, secure & free to try! Complete, edit or print tax forms instantly. A form that an employee files with the irs to claim a tax deduction for unreimbursed.

Publication 508 Tax Benefits for WorkRelated Education; Tax Benefits

Complete, edit or print tax forms instantly. Unreimbursed employee business expenses was a simplified version and was used by employees claiming a tax deduction because of. Web information about form 2106, employee business expenses, including recent updates, related forms and instructions on how to file. What’s new standard mileage rate. Purpose of form you can use form.

Form 2106EZ Edit, Fill, Sign Online Handypdf

A form that an employee files with the irs to claim a tax deduction for unreimbursed expenses that the employee has incurred in the ordinary course of his/her. Web what is the irs form 2106? What’s new standard mileage rate. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service.

Fill Free fillable IRS PDF forms

Ad do your 2016, 2017 all the way back to 2000 easy, fast, secure & free to try! This form is for income earned in tax year 2022, with tax returns due in. If you plan to deduct actual. Web up to $40 cash back form2106ezomb no. Purpose of form you can use form.

Election Out of Qualified Economic Stimulus PropertyTax...

Web up to $40 cash back form2106ezomb no. Ad access irs tax forms. The 2016 rate for business use of your vehicle is 54 cents. Web information about form 2106, employee business expenses, including recent updates, related forms and instructions on how to file. Employees file this form to.

Fillable Form 2106Ez Unreimbursed Employee Business Expenses 2012

Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2017 • december 1, 2022 09:45 am overview. Purpose of form you can use form. A form that an employee files with the irs to claim a tax deduction for unreimbursed expenses that the employee has incurred in the ordinary course of his/her. Web up.

Ssurvivor Form 2106 Instructions 2019

Ad access irs tax forms. Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2017 • december 1, 2022 09:45 am overview. A form that an employee files with the irs to claim a tax deduction for unreimbursed expenses that the employee has incurred in the ordinary course of his/her. The 2013 rate for.

The 2013 Rate For Business Use Of Your Vehicle Is 56½ Cents A Mile.

If you plan to deduct actual. Purpose of form you can use form. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. The 2016 rate for business use of your vehicle is 54 cents.

Written By A Turbotax Expert • Reviewed By A Turbotax Cpa Updated For Tax Year 2017 • December 1, 2022 09:45 Am Overview.

Web what is the irs form 2106? Web up to $40 cash back form2106ezomb no. What’s new standard mileage rate. 15450074unreimbursed employee business expensesdepartment of the treasury internal revenue service (99) your name2017attach to.

Web Step 1 Enter Your Expenses Column A Other Than Meals Column B Meals Vehicle Expense From Line 22 Or Line 29.

Ad access irs tax forms. Employees file this form to. Get ready for tax season deadlines by completing any required tax forms today. Ad do your 2016, 2017 all the way back to 2000 easy, fast, secure & free to try!

A Form That An Employee Files With The Irs To Claim A Tax Deduction For Unreimbursed Expenses That The Employee Has Incurred In The Ordinary Course Of His/Her.

Web information about form 2106, employee business expenses, including recent updates, related forms and instructions on how to file. Complete, edit or print tax forms instantly. This form is for income earned in tax year 2022, with tax returns due in. Unreimbursed employee business expenses is a simplified version of irs form 2106, used by employees to deduct ordinary and necessary expenses related to.