Form 211 Irs

Form 211 Irs - There is no question that the. Gather specific and credible evidence 2.3. Submit a whistleblower claim 3. Web the form 211 is the path for submitting information (and requesting an award) to the irs about individuals and businesses that are failing to pay federal tax. The irs whistleblower’s office stresses that a completed form must contain: Web form 211 is submitted to the irs by a “whistleblower” who seeks to claim a reward for providing information about tax evasion to the u.s. Read the instructions before completing this form. There may be other more appropriate forms specific to your. How to report tax fraud 2.1. Web what is irs form 211?

How long does the process take? Individuals must then mail the form 211 with supporting documentation to: A description of the alleged tax noncompliance, including a written narrative explaining the issue(s). Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Form 211 rewards can be. Submit a whistleblower claim 3. The irs whistleblower’s office stresses that a completed form must contain: Web the whistleblower's original signature on the declaration under penalty of perjury (a representative cannot sign form 211 for the whistleblower) and the date of signature. Instructions for form 941 pdf M/s 4110 ogden, ut 84404

How long does the process take? Web what is irs form 211? Web a claimant must file a formal claim for award by completing and sending form 211, application for award for original information, to be considered for the whistleblower program. Web the form 211 is the path for submitting information (and requesting an award) to the irs about individuals and businesses that are failing to pay federal tax. Read the instructions before completing this form. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. There may be other more appropriate forms specific to your. The irs whistleblower’s office stresses that a completed form must contain: Send completed form along with any supporting information to: Hire an irs whistleblower attorney 2.2.

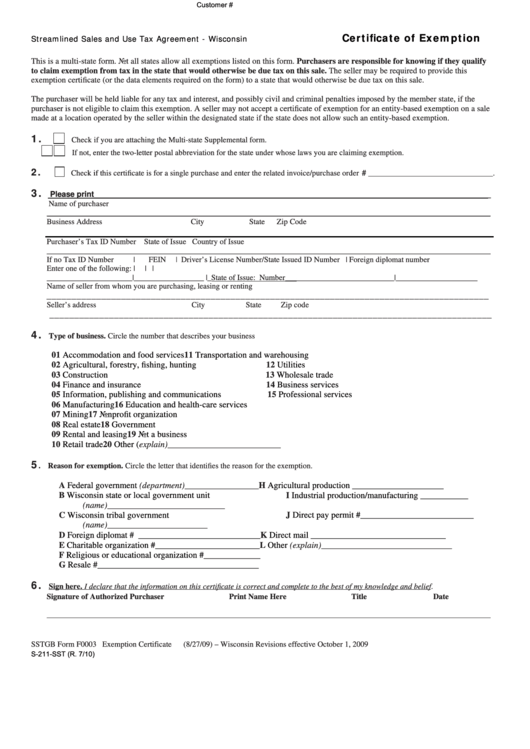

Fillable Form S211Sst Wisconsin Streamlined Sales And Use Tax

There is no question that the. Web the whistleblower's original signature on the declaration under penalty of perjury (a representative cannot sign form 211 for the whistleblower) and the date of signature. The irs whistleblower’s office stresses that a completed form must contain: There may be other more appropriate forms specific to your. Read the instructions before completing this form.

Turning in U.S. tax cheats and getting paid for it Don't Mess With Taxes

Submit a whistleblower claim 3. There is no question that the. Web the whistleblower's original signature on the declaration under penalty of perjury (a representative cannot sign form 211 for the whistleblower) and the date of signature. Hire an irs whistleblower attorney 2.2. M/s 4110 ogden, ut 84404

IRS Form 211 Ausfüllhilfe und Erläuterung Wiensworld

Web whistleblowers must use irs form 211, application for award for original information, and ensure that it contains the following: Form 211 rewards can be. Hire an irs whistleblower attorney 2.2. Web a claimant must file a formal claim for award by completing and sending form 211, application for award for original information, to be considered for the whistleblower program..

irs form 3949a 2022 Fill Online, Printable, Fillable Blank form

Hire an irs whistleblower attorney 2.2. Web the whistleblower's original signature on the declaration under penalty of perjury (a representative cannot sign form 211 for the whistleblower) and the date of signature. Instructions for form 941 pdf Web what is irs form 211? Web employer's quarterly federal tax return.

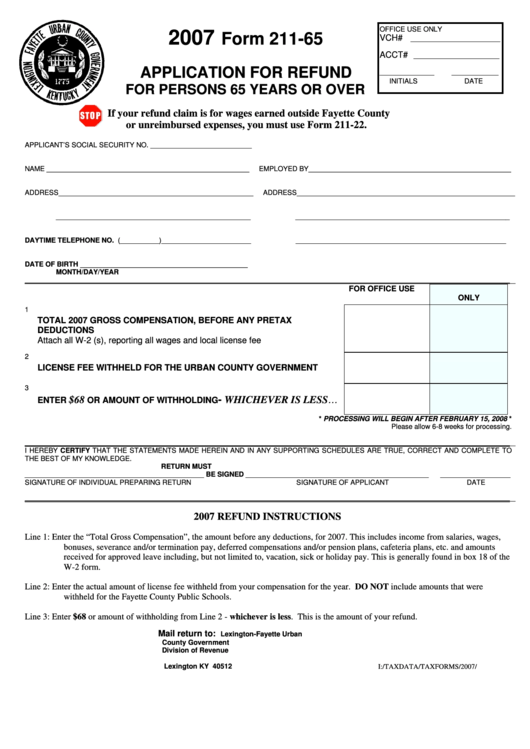

Form 21165 Application For Refund For Persons 65 Years Or Over

How to report tax fraud 2.1. Submit a whistleblower claim 3. There is no question that the. Web form 211 is submitted to the irs by a “whistleblower” who seeks to claim a reward for providing information about tax evasion to the u.s. How long does the process take?

Form 211

There may be other more appropriate forms specific to your. The irs whistleblower’s office stresses that a completed form must contain: Web the whistleblower's original signature on the declaration under penalty of perjury (a representative cannot sign form 211 for the whistleblower) and the date of signature. Submit a whistleblower claim 3. Hire an irs whistleblower attorney 2.2.

IRS Whistleblower Program ‹ Get a Reward for Reporting Tax Fraud

Web employer's quarterly federal tax return. Web what is irs form 211? Instructions for form 941 pdf Web form 211 is submitted to the irs by a “whistleblower” who seeks to claim a reward for providing information about tax evasion to the u.s. A description of the alleged tax noncompliance, including a written narrative explaining the issue(s).

Tax Whistleblower — The Dos And Don'ts Of Filing A Form 211 Tax

Form 211 rewards can be. M/s 4110 ogden, ut 84404 Web the form 211 is the path for submitting information (and requesting an award) to the irs about individuals and businesses that are failing to pay federal tax. Examples of tax frauds or tax avoidance to report 6. Web whistleblowers must use irs form 211, application for award for original.

Form 211 Application for Award for Original Information (2014) Free

There is no question that the. Web the form 211 is the path for submitting information (and requesting an award) to the irs about individuals and businesses that are failing to pay federal tax. M/s 4110 ogden, ut 84404 There may be other more appropriate forms specific to your. Gather specific and credible evidence 2.3.

Child Support IRS Form 211 Whistleblower Award Issued YouTube

Instructions for form 941 pdf Web the form 211 is the path for submitting information (and requesting an award) to the irs about individuals and businesses that are failing to pay federal tax. The irs whistleblower’s office stresses that a completed form must contain: Examples of tax frauds or tax avoidance to report 6. A description of the alleged tax.

Hire An Irs Whistleblower Attorney 2.2.

Examples of tax frauds or tax avoidance to report 6. The irs whistleblower’s office stresses that a completed form must contain: Web the form 211 is the path for submitting information (and requesting an award) to the irs about individuals and businesses that are failing to pay federal tax. Web the whistleblower's original signature on the declaration under penalty of perjury (a representative cannot sign form 211 for the whistleblower) and the date of signature.

Send Completed Form Along With Any Supporting Information To:

Submit a whistleblower claim 3. Form 211 rewards can be. A description of the alleged tax noncompliance, including a written narrative explaining the issue(s). Web whistleblowers must use irs form 211, application for award for original information, and ensure that it contains the following:

How To Report Tax Fraud 2.1.

Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. M/s 4110 ogden, ut 84404 Read the instructions before completing this form. There is no question that the.

Individuals Must Then Mail The Form 211 With Supporting Documentation To:

Web a claimant must file a formal claim for award by completing and sending form 211, application for award for original information, to be considered for the whistleblower program. How long does the process take? Web what is irs form 211? Gather specific and credible evidence 2.3.