Form 2210 For 2022

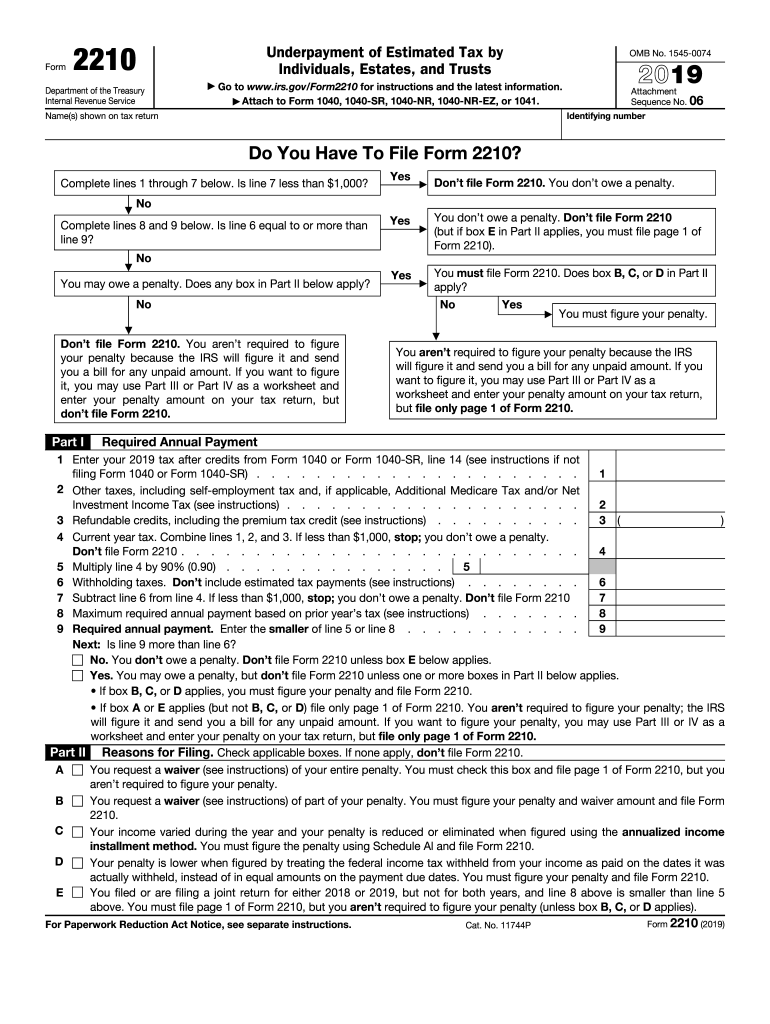

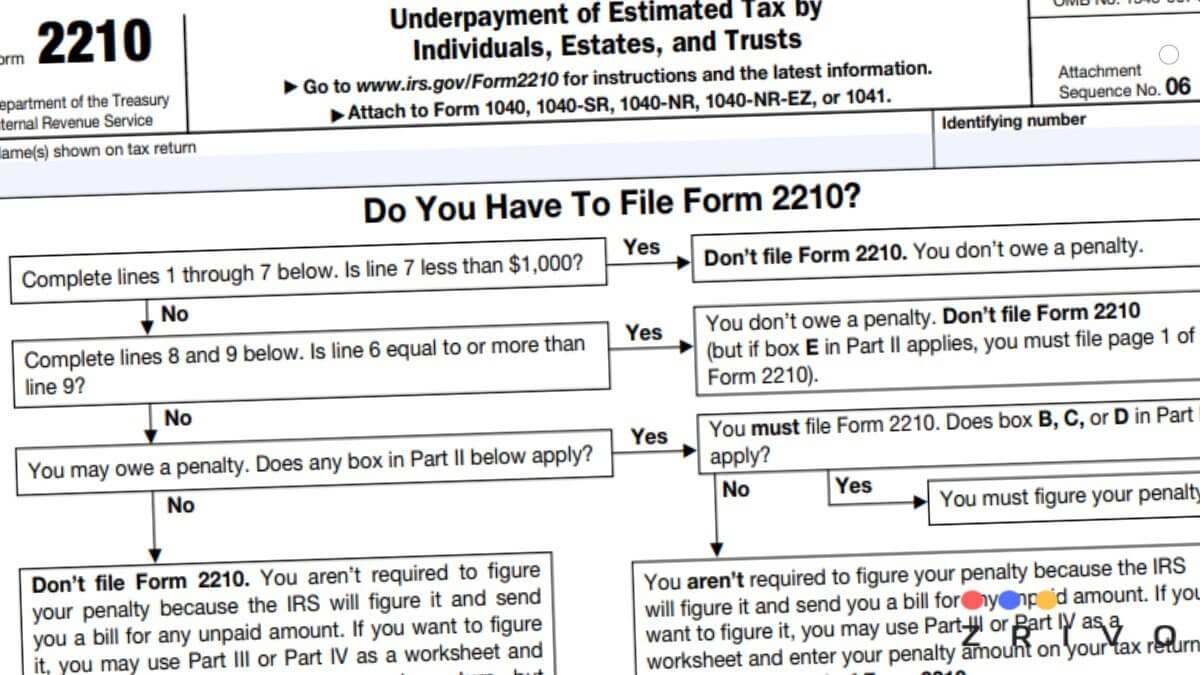

Form 2210 For 2022 - Web see waiver of penalty in instructions for form 2210 pdf. Department of the treasury internal revenue service. Web for 2022, the rates are: 06 name(s) shown on tax return Underpayment of estimated tax by individuals, estates, and trusts. You may use the short method if: The interest rate for underpayments, which is updated by the irs each quarter. Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in december 2022, so this is the latest version of form 2210, fully updated for tax year 2022. All withholding and estimated tax payments were made equally throughout the year. Web form 2210 department of the treasury internal revenue service underpayment of estimated tax by individuals, estates, and trusts go to www.irs.gov/form2210 for instructions and the latest information.

Department of the treasury internal revenue service. Web the quarter that you underpaid. All withholding and estimated tax payments were made equally throughout the year. In the first quarter, you paid only $4,000. Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in december 2022, so this is the latest version of form 2210, fully updated for tax year 2022. You may qualify for the short method to calculate your penalty. You had most of your income tax withheld early in the year instead of spreading it equally through the year. You can use form 2210, underpayment of estimated tax by individuals, estates, and. 06 name(s) shown on tax return The interest rate for underpayments, which is updated by the irs each quarter.

Web 2022 instructions for form 2210 underpayment of estimated tax by individuals, estates, and trusts department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. For instructions and the latest information. The interest rate for underpayments, which is updated by the irs each quarter. Underpayment of estimated tax by individuals, estates, and trusts. 06 name(s) shown on tax return Web see waiver of penalty in instructions for form 2210 pdf. You may qualify for the short method to calculate your penalty. In the first quarter, you paid only $4,000. Massachusetts income tax extension payment worksheet and voucher (english, pdf 283.39 kb) Web for 2022, the rates are:

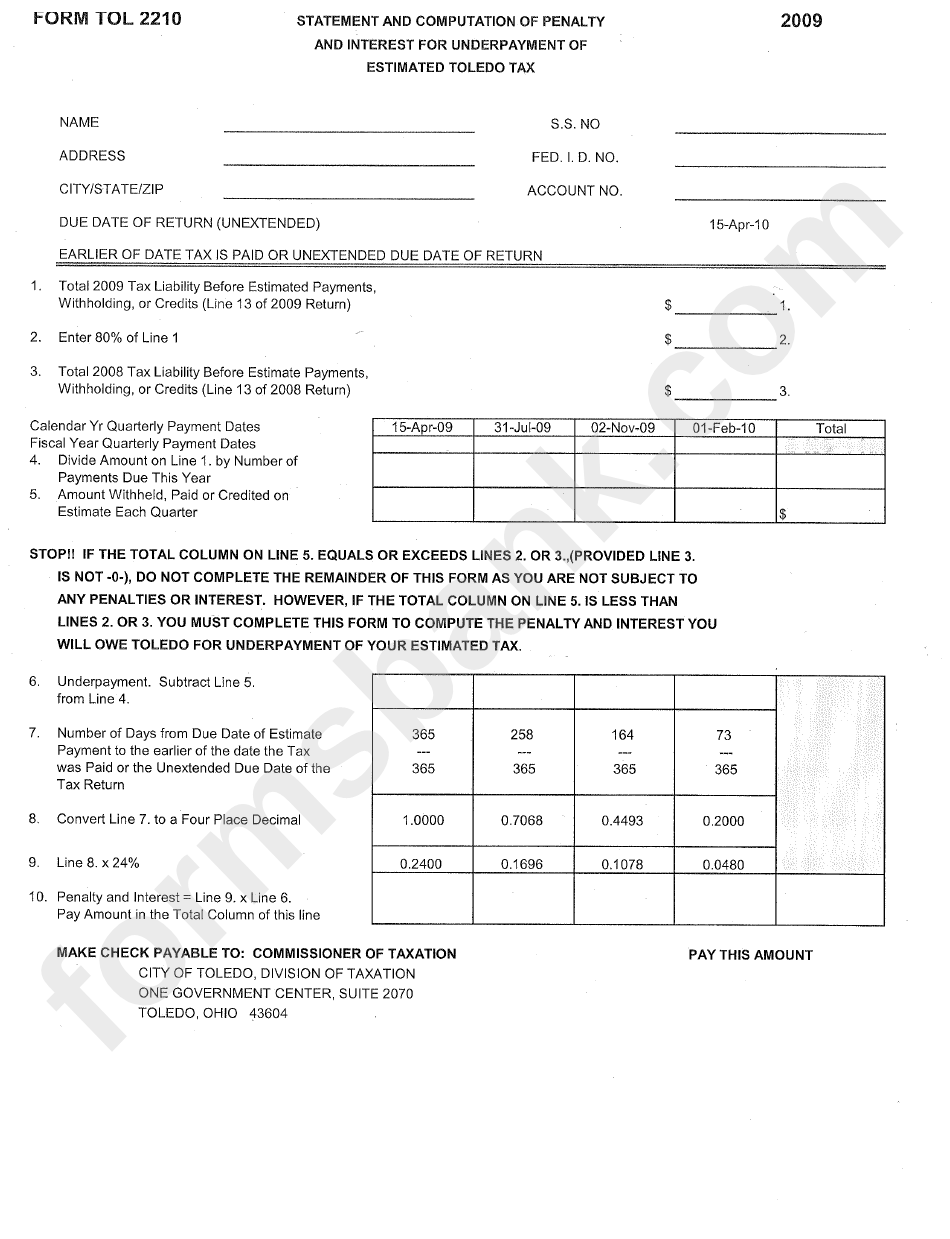

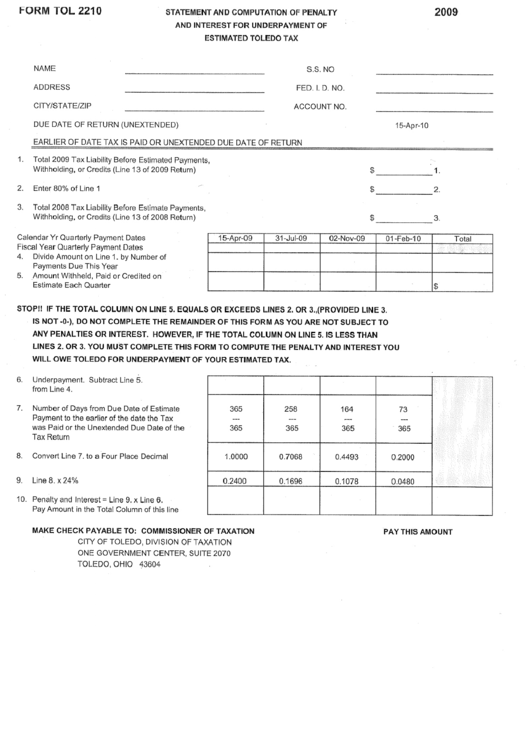

Form Tol 2210 Statement And Computation Of Penalty And Interest

All withholding and estimated tax payments were made equally throughout the year. Web form 2210 department of the treasury internal revenue service underpayment of estimated tax by individuals, estates, and trusts go to www.irs.gov/form2210 for instructions and the latest information. Web irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers.

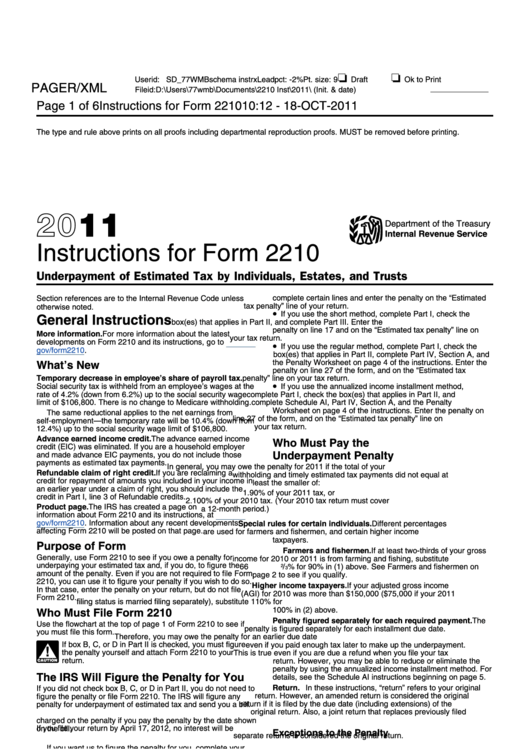

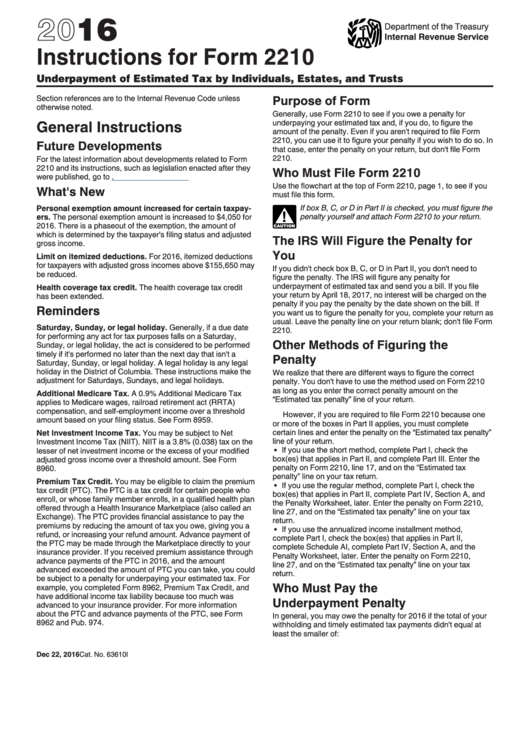

Instructions for IRS Form 2210 Underpayment of Estimated Tax by

Web the quarter that you underpaid. Web irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers are required to file to determine if they owe a penalty for the underpayment of their estimated tax liability. The interest rate for underpayments, which is updated by the irs each quarter. Web 2022.

About Form 2210, Underpayment of Estimated Tax by Fill Out and Sign

All withholding and estimated tax payments were made equally throughout the year. You may use the short method if: Web irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers are required to file to determine if they owe a penalty for the underpayment of their estimated tax liability. Web see.

2210 Form 2022 2023

In the first quarter, you paid only $4,000. Department of the treasury internal revenue service. General instructions future developments for the latest information about developments related to form 2210 and Web see waiver of penalty in instructions for form 2210 pdf. Your income varies during the year.

Form Tol 2210 Statement And Computation Of Penalty And Interest

Web 2022 underpayment of estimated. Massachusetts income tax extension payment worksheet and voucher (english, pdf 283.39 kb) Department of the treasury internal revenue service. Underpayment of estimated tax by individuals, estates, and trusts. You can use form 2210, underpayment of estimated tax by individuals, estates, and.

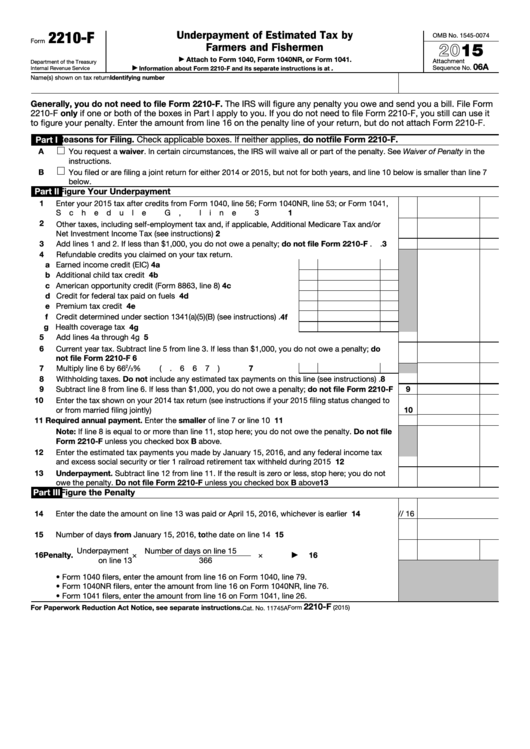

Fillable Form 2210F Underpayment Of Estimated Tax By Farmers And

Web 2022 instructions for form 2210 underpayment of estimated tax by individuals, estates, and trusts department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Web irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers are required to file to determine if.

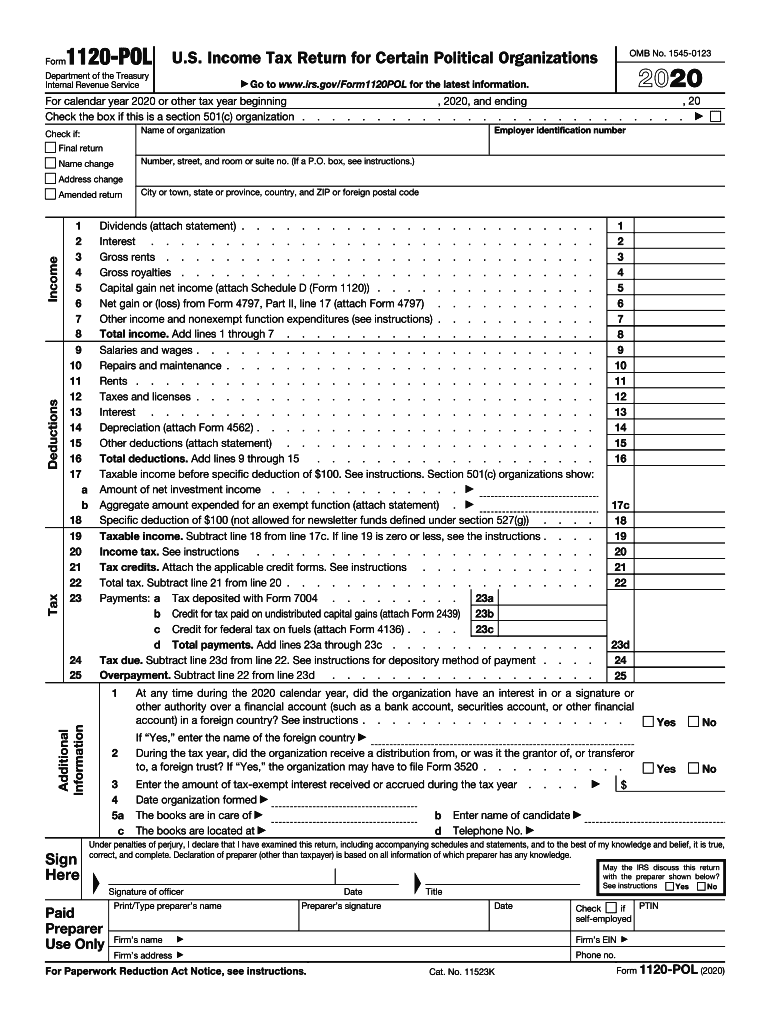

IRS 1120POL 20202021 Fill out Tax Template Online US Legal Forms

Underpayment of estimated tax by individuals, estates, and trusts. You had most of your income tax withheld early in the year instead of spreading it equally through the year. For instructions and the latest information. 06 name(s) shown on tax return Your income varies during the year.

Instructions For Form 2210 Underpayment Of Estimated Tax By

You can use form 2210, underpayment of estimated tax by individuals, estates, and. You may qualify for the short method to calculate your penalty. Complete form 2210, underpayment of estimated tax by individuals, estates, and trusts pdf. Your income varies during the year. Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in december 2022,.

Instructions For Form 2210 Underpayment Of Estimated Tax By

Web irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers are required to file to determine if they owe a penalty for the underpayment of their estimated tax liability. Web 2022 underpayment of estimated. You had most of your income tax withheld early in the year instead of spreading it.

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in december 2022, so this is the latest version of form 2210, fully updated for tax year 2022. Web for 2022, the rates are: All withholding and estimated tax payments were made equally throughout the year. Web the quarter that you underpaid. Web irs form 2210,.

You Had Most Of Your Income Tax Withheld Early In The Year Instead Of Spreading It Equally Through The Year.

Department of the treasury internal revenue service. In the first quarter, you paid only $4,000. All withholding and estimated tax payments were made equally throughout the year. Web 2022 underpayment of estimated.

Web Irs Form 2210, Underpayment Of Estimated Tax By Individuals, Estates, And Trusts, Is A Tax Document That Some Taxpayers Are Required To File To Determine If They Owe A Penalty For The Underpayment Of Their Estimated Tax Liability.

Complete form 2210, underpayment of estimated tax by individuals, estates, and trusts pdf. General instructions future developments for the latest information about developments related to form 2210 and Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in december 2022, so this is the latest version of form 2210, fully updated for tax year 2022. Web for 2022, the rates are:

Web The Quarter That You Underpaid.

06 name(s) shown on tax return Massachusetts income tax extension payment worksheet and voucher (english, pdf 283.39 kb) Underpayment of estimated tax by individuals, estates, and trusts. Web see waiver of penalty in instructions for form 2210 pdf.

You May Qualify For The Short Method To Calculate Your Penalty.

For instructions and the latest information. You may use the short method if: Web 2022 instructions for form 2210 underpayment of estimated tax by individuals, estates, and trusts department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. You can use form 2210, underpayment of estimated tax by individuals, estates, and.