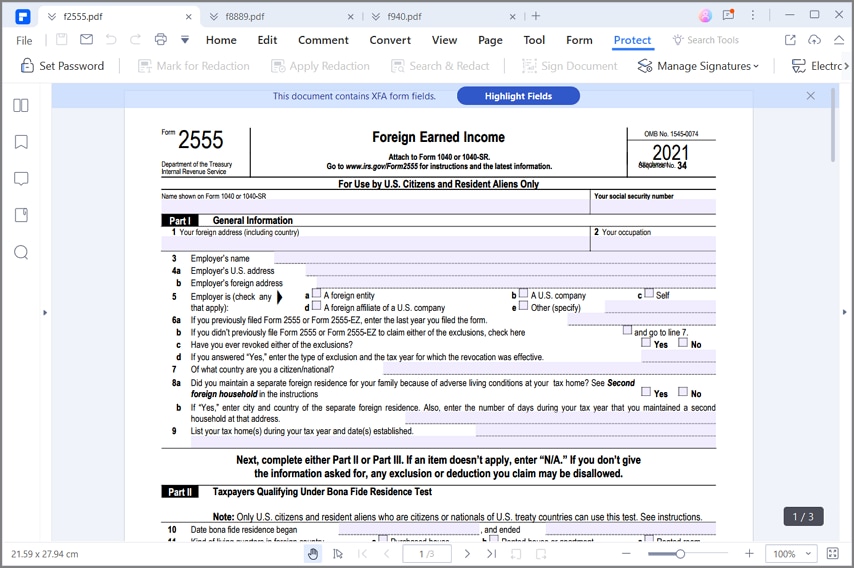

Form 2555 T

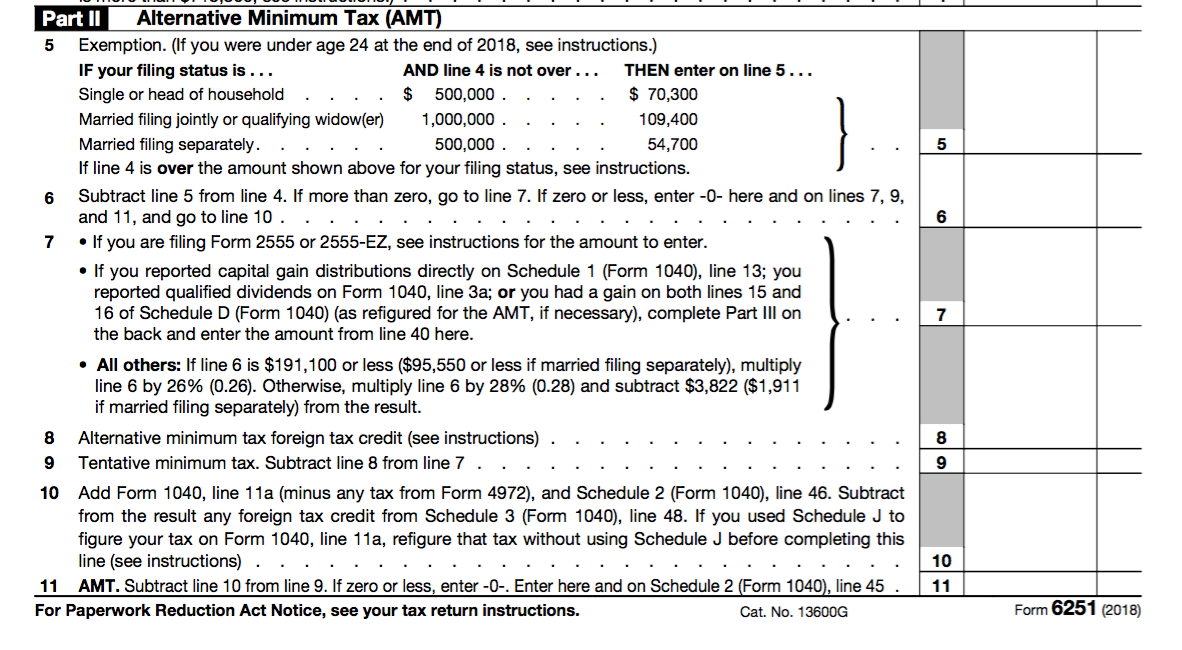

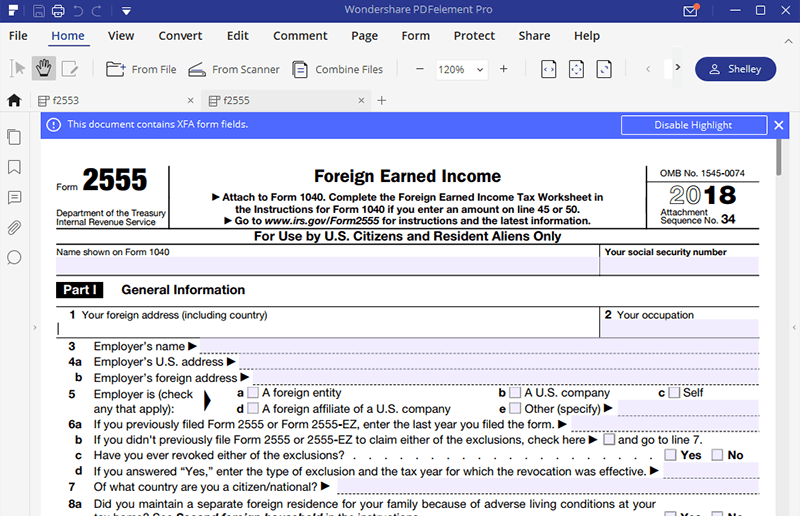

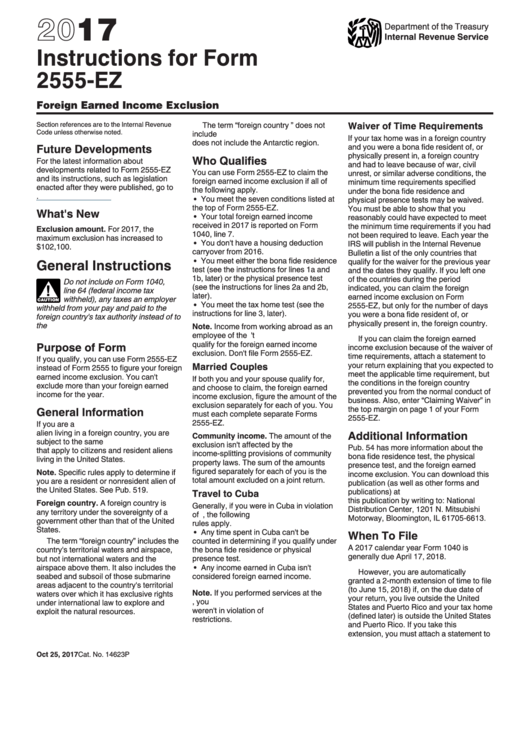

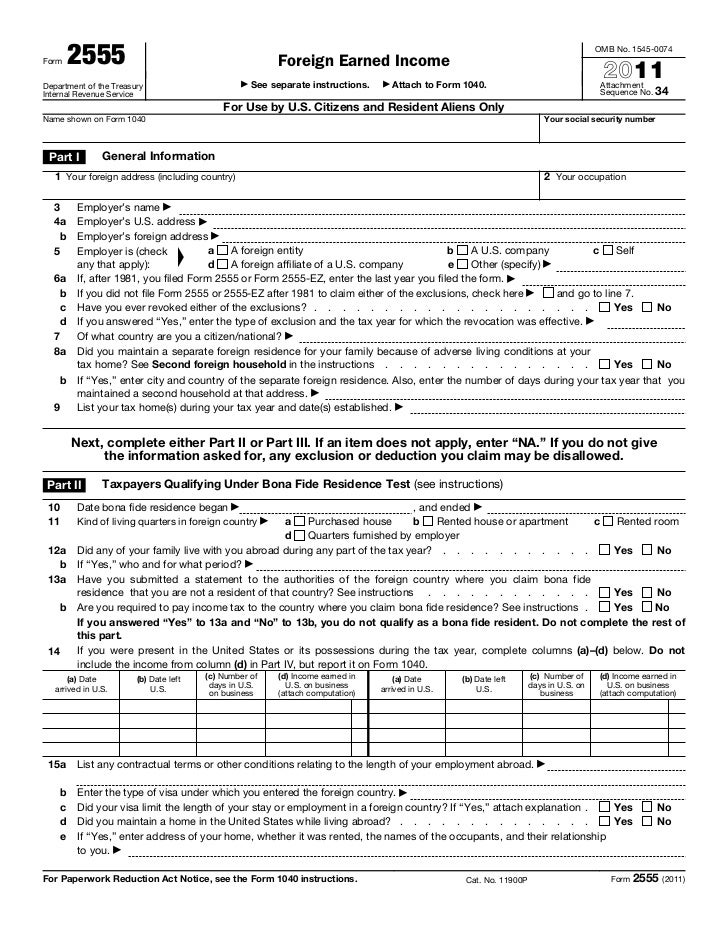

Form 2555 T - Web follow these steps to enter form 2555 for the physical presence test in lacerte: Company e other (specify) 6 a if you previously filed form 2555 or. Company c self any that apply): Go to screen 31, foreign income exclusion (2555). It is used to claim the foreign earned income. Hand off your taxes, get expert help, or. Go to www.irs.gov/form2555 for instructions and the latest. Web key takeaways form 2555 is a tax form that must be filed by nonresident aliens who have earned income from the united states. Locate the general information section. Web foreign earned income exclusion (form 2555) u.s.

Go to screen 31, foreign income exclusion (2555). You cannot exclude or deduct more than the. Form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you can exclude. Go to www.irs.gov/form2555 for instructions and the latest. Efile form 1040 and form 2555 t canada (english) ask questions and learn more about your taxes and finances. Locate the general information section. D a foreign affiliate of a u.s. Company e other (specify) 6 a if you previously filed form 2555 or. Hand off your taxes, get expert help, or. Web when a taxpayer meets the requirements to qualify for foreign income exclusion using form 2555 — they are able to exclude upwards of $107,600 of their foreign earned income.

Locate the general information section. Form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you can exclude. Web foreign earned income exclusion (form 2555) u.s. Web key takeaways form 2555 is a tax form that must be filed by nonresident aliens who have earned income from the united states. Go to screen 31, foreign income exclusion (2555). Go to www.irs.gov/form2555 for instructions and the latest. Company e other (specify) 6 a if you previously filed form 2555 or. Web follow these steps to enter form 2555 for the physical presence test in lacerte: Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. D a foreign affiliate of a u.s.

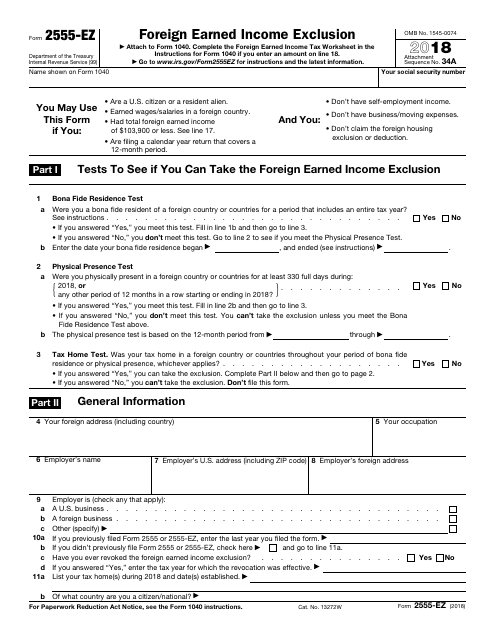

Ssurvivor Form 2555 Ez Instructions 2018

Web 5 employer is (check a a foreign entity b a u.s. Company e other (specify) 6 a if you previously filed form 2555 or. Go to www.irs.gov/form2555 for instructions and the latest. Hand off your taxes, get expert help, or. Go to screen 31, foreign income exclusion (2555).

Breanna Sample Form 2555

Web foreign earned income exclusion (form 2555) u.s. Web key takeaways form 2555 is a tax form that must be filed by nonresident aliens who have earned income from the united states. Go to www.irs.gov/form2555 for instructions and the latest. Web follow these steps to enter form 2555 for the physical presence test in lacerte: Hand off your taxes, get.

Top 16 Form 2555ez Templates free to download in PDF format

Go to screen 31, foreign income exclusion (2555). Web 5 employer is (check a a foreign entity b a u.s. Locate the general information section. Hand off your taxes, get expert help, or. Web when a taxpayer meets the requirements to qualify for foreign income exclusion using form 2555 — they are able to exclude upwards of $107,600 of their.

US Tax Abroad Expatriate Form 2555

Company e other (specify) 6 a if you previously filed form 2555 or. D a foreign affiliate of a u.s. Efile form 1040 and form 2555 t canada (english) ask questions and learn more about your taxes and finances. It is used to claim the foreign earned income. Company c self any that apply):

IRS Form 2555 Fill out with Smart Form Filler

Efile form 1040 and form 2555 t canada (english) ask questions and learn more about your taxes and finances. Hand off your taxes, get expert help, or. Citizens and resident aliens who live and work abroad may be able to exclude all or part of their foreign salary or wages from. D a foreign affiliate of a u.s. Web if.

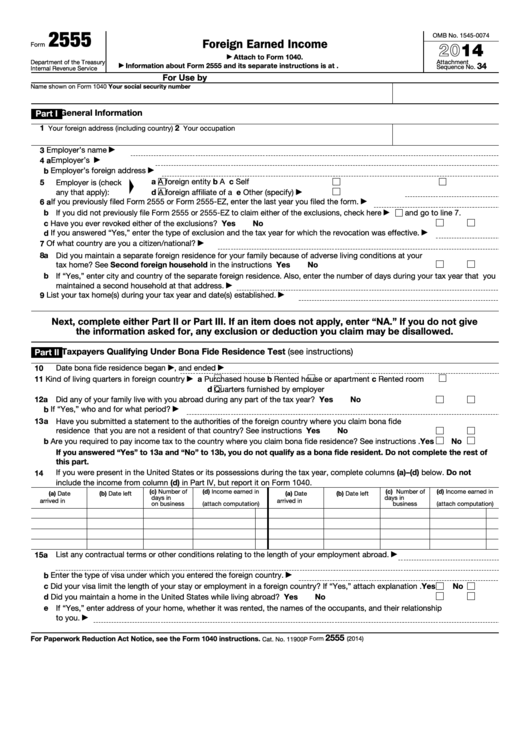

Fillable Form 2555 Foreign Earned 2014 printable pdf download

Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Go to screen 31, foreign income exclusion (2555). Locate the general information section. Web foreign earned income exclusion (form 2555) u.s. D a foreign affiliate of a u.s.

IRS Form 2555EZ Download Fillable PDF or Fill Online Foreign Earned

Go to screen 31, foreign income exclusion (2555). D a foreign affiliate of a u.s. You cannot exclude or deduct more than the. Web 5 employer is (check a a foreign entity b a u.s. Web when a taxpayer meets the requirements to qualify for foreign income exclusion using form 2555 — they are able to exclude upwards of $107,600.

Form 2555 How to fill out StepbyStep Instructions Claim Foreign

Company e other (specify) 6 a if you previously filed form 2555 or. Form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you can exclude. Delete both also, try the following: Go to www.irs.gov/form2555 for instructions and the latest. Citizens and resident aliens who live and work abroad may be able to exclude.

Ssurvivor Form 2555 Ez Instructions 2018

Locate the general information section. Go to www.irs.gov/form2555 for instructions and the latest. Web follow these steps to enter form 2555 for the physical presence test in lacerte: Web key takeaways form 2555 is a tax form that must be filed by nonresident aliens who have earned income from the united states. Efile form 1040 and form 2555 t canada.

Ssurvivor Completed Form 2555 Example

D a foreign affiliate of a u.s. Web when a taxpayer meets the requirements to qualify for foreign income exclusion using form 2555 — they are able to exclude upwards of $107,600 of their foreign earned income. Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Delete.

Web 5 Employer Is (Check A A Foreign Entity B A U.s.

Company c self any that apply): Form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you can exclude. Web follow these steps to enter form 2555 for the physical presence test in lacerte: Citizens and resident aliens who live and work abroad may be able to exclude all or part of their foreign salary or wages from.

Web If You Qualify, You Can Use Form 2555 To Figure Your Foreign Earned Income Exclusion And Your Housing Exclusion Or Deduction.

Efile form 1040 and form 2555 t canada (english) ask questions and learn more about your taxes and finances. Go to screen 31, foreign income exclusion (2555). Web when a taxpayer meets the requirements to qualify for foreign income exclusion using form 2555 — they are able to exclude upwards of $107,600 of their foreign earned income. D a foreign affiliate of a u.s.

Company E Other (Specify) 6 A If You Previously Filed Form 2555 Or.

Delete both also, try the following: Locate the general information section. You cannot exclude or deduct more than the. Web key takeaways form 2555 is a tax form that must be filed by nonresident aliens who have earned income from the united states.

Go To Www.irs.gov/Form2555 For Instructions And The Latest.

Web foreign earned income exclusion (form 2555) u.s. It is used to claim the foreign earned income. Hand off your taxes, get expert help, or.