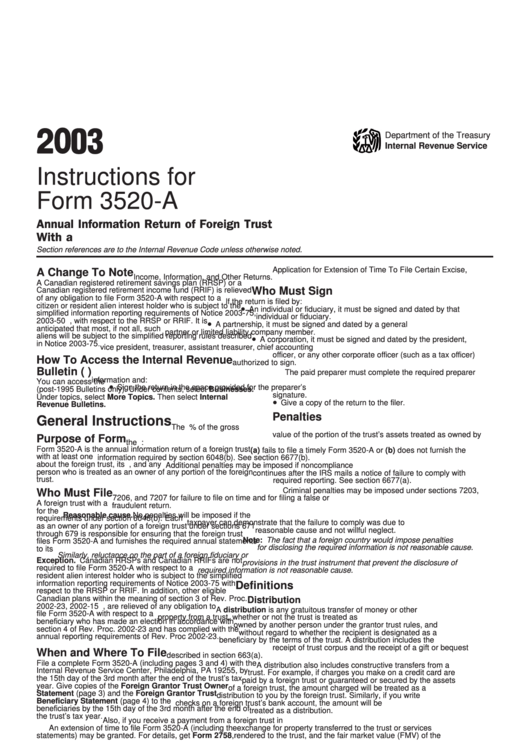

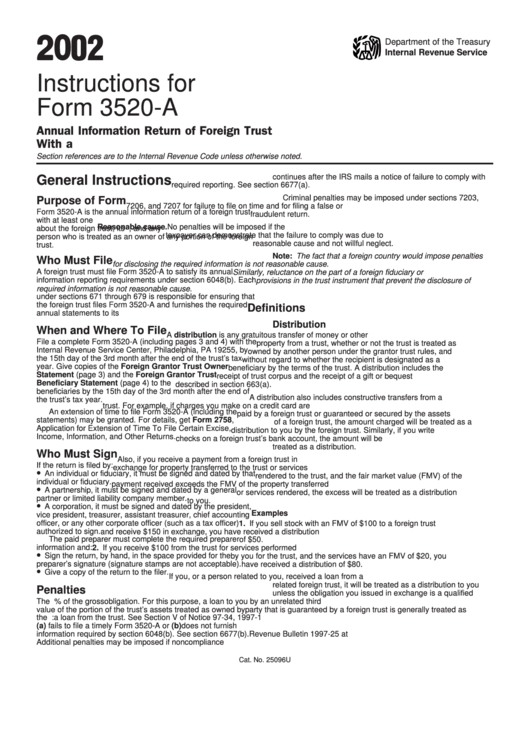

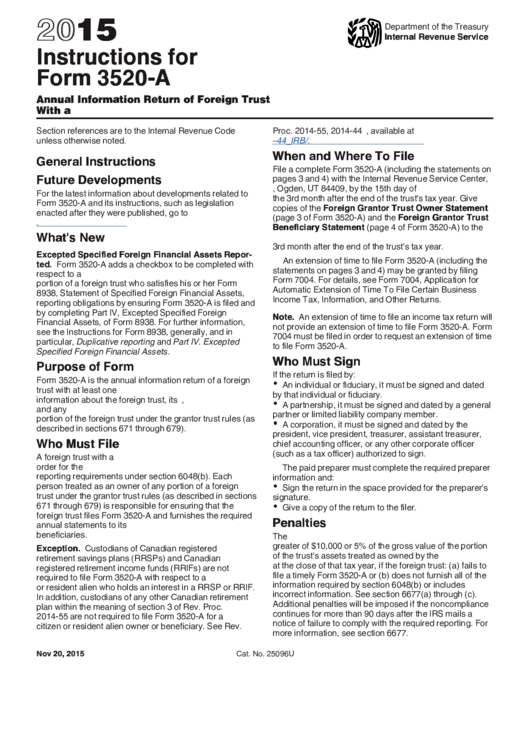

Form 3520-A Instructions

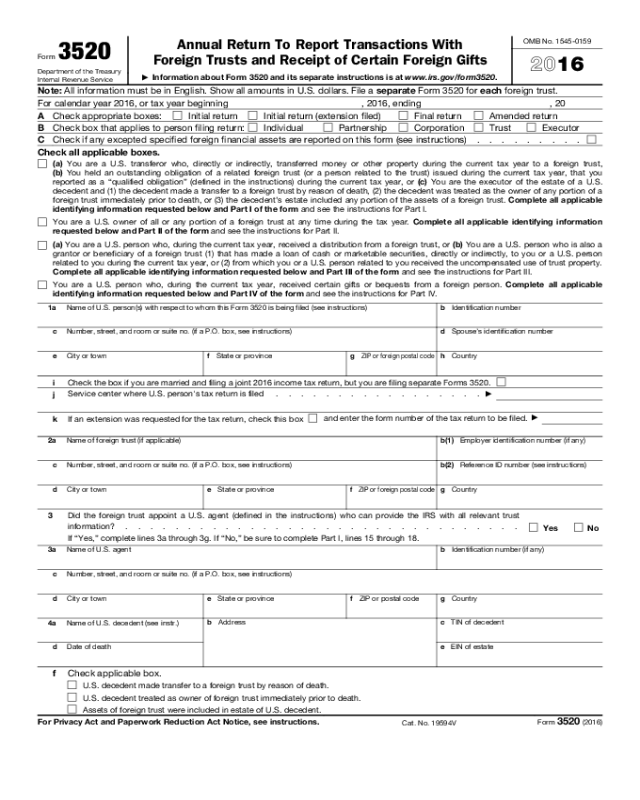

Form 3520-A Instructions - The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Decedents) file form 3520 to report: A valid signature is required. Web form 3520 & instructions: As provided by the irs: Web form instructions businesses business entity or group nonresident power of attorney declaration (ftb 3520 be) form instructions length of poa generally, a poa lasts for. Web all representatives listed on a poa declaration will have the ability to remove another representative from the poa declaration. What is a grantor trust? Certain transactions with foreign trusts. The form 3520 is an informational return used to report certain transactions with foreign trusts, ownership of foreign trusts, or large gifts from certain.

Ownership of foreign trusts under the rules of sections. A grantor trust is any trust to the extent that. It does not have to be a. Certain transactions with foreign trusts, ownership of foreign trusts under the. As provided by the irs: Certain transactions with foreign trusts. Web all representatives listed on a poa declaration will have the ability to remove another representative from the poa declaration. For a trust with a calendar year, the due date is march 15th. However, the trust can request. A foreign trust with at least one u.s.

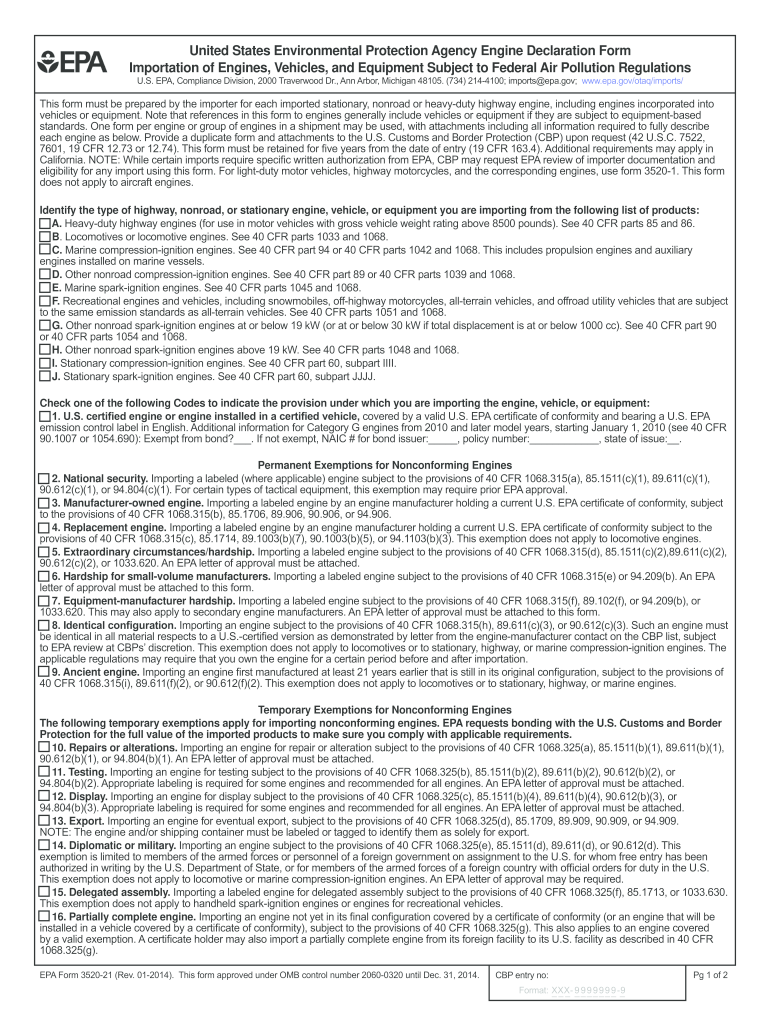

It does not have to be a. What is a grantor trust? Ownership of foreign trusts under the rules of sections. However, the trust can request. Decedents) file form 3520 to report: A foreign trust with at least one u.s. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. The form 3520 is an informational return used to report certain transactions with foreign trusts, ownership of foreign trusts, or large gifts from certain. A grantor trust is any trust to the extent that. Read the detailed procedures for importing vehicles and.

Form 3520A Annual Information Return of Foreign Trust with a U.S

Ownership of foreign trusts under the rules of sections. Certain transactions with foreign trusts. Decedent made transfer to a foreign trust by reason of death. Persons (and executors of estates of u.s. However, the trust can request.

Instructions For Form 3520A Annual Information Return Of Foreign

Persons (and executors of estates of u.s. Decedents) file form 3520 with the irs to report: Web having ownership in a foreign trust and/or receiving a distribution from a foreign trust may require that the u.s. Owner is required to file in order to report to the irs, and to the u.s. Decedent made transfer to a foreign trust by.

Form 7004 Instructions 2021 2022 IRS Forms TaxUni

There may be additional filing requirements. Web this document provides a summary of epa requirements for imported vehicles and engines. Certain transactions with foreign trusts. Certain transactions with foreign trusts, ownership of foreign trusts under the. It does not have to be a.

Form 3520 Fill out & sign online DocHub

There may be additional filing requirements. The form 3520 is an informational return used to report certain transactions with foreign trusts, ownership of foreign trusts, or large gifts from certain. Web the following persons are required to file form 3520 to report certain distributions (or deemed distributions) during the tax year from foreign trusts: As provided by the irs: Decedents).

20142020 Form EPA 352021 Fill Online, Printable, Fillable, Blank

Persons (and executors of estates of u.s. Read the detailed procedures for importing vehicles and. Web this document provides a summary of epa requirements for imported vehicles and engines. Web form instructions businesses business entity or group nonresident power of attorney declaration (ftb 3520 be) form instructions length of poa generally, a poa lasts for. Decedent made transfer to a.

Instructions For Form 3520A Annual Information Return Of Foreign

A grantor trust is any trust to the extent that. Persons (and executors of estates of u.s. Web this document provides a summary of epa requirements for imported vehicles and engines. The form 3520 is an informational return used to report certain transactions with foreign trusts, ownership of foreign trusts, or large gifts from certain. The irs f orm 3520.

form 3520a instructions 2019 2020 Fill Online, Printable, Fillable

A foreign trust with at least one u.s. Web this document provides a summary of epa requirements for imported vehicles and engines. Decedents) file form 3520 to report: It does not have to be a. Owner files this form annually to provide information.

Form 3520 (2020) Instructions for Foreign Gifts & Inheritance

Owner files this form annually to provide information. Persons (and executors of estates of u.s. It does not have to be a. Owner is required to file in order to report to the irs, and to the u.s. Decedent treated as owner of foreign trust immediately prior to death.assets of foreign trust were included in.

Steuererklärung dienstreisen Form 3520

Web having ownership in a foreign trust and/or receiving a distribution from a foreign trust may require that the u.s. A valid signature is required. It does not have to be a. Web all representatives listed on a poa declaration will have the ability to remove another representative from the poa declaration. Read the detailed procedures for importing vehicles and.

Instructions For Form 3520A Annual Information Return Of Foreign

It does not have to be a. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Certain transactions with foreign trusts, ownership of foreign trusts under the. The form 3520 is an informational return used to report certain transactions with foreign trusts, ownership of foreign trusts, or large gifts.

However, The Trust Can Request.

As provided by the irs: Certain transactions with foreign trusts, ownership of foreign trusts under the. Read the detailed procedures for importing vehicles and. A grantor trust is any trust to the extent that.

A Foreign Trust With At Least One U.s.

Web having ownership in a foreign trust and/or receiving a distribution from a foreign trust may require that the u.s. Ownership of foreign trusts under the rules of sections. Decedent treated as owner of foreign trust immediately prior to death.assets of foreign trust were included in. Persons (and executors of estates of u.s.

Web The Following Persons Are Required To File Form 3520 To Report Certain Distributions (Or Deemed Distributions) During The Tax Year From Foreign Trusts:

Decedents) file form 3520 to report: Persons (and executors of estates of u.s. Decedents) file form 3520 with the irs to report: Owner files this form annually to provide information.

The Irs F Orm 3520 Is Used To Report A Foreign Gift, Inheritance Or Trust Distribution From A Foreign Person.

There may be additional filing requirements. It does not have to be a. Web this document provides a summary of epa requirements for imported vehicles and engines. Owner is required to file in order to report to the irs, and to the u.s.