Form 3531 Irs

Form 3531 Irs - Form 3115 application for change in accounting method. Web form 3531 correspondence action trailthis figure demonstrates how to edit an action trail when corresponding and sending the return back to the taxpayer. So my problem now is where should i send back this forms? Web addresses for forms beginning with the number 3. Get or renew an individual taxpayer identification number (itin) for federal tax purposes if you are not eligible for a social security number. Shown is a form 3531 and a partially obscured form 1040. Web box 6 on form 3531 says: Web usually form 3531 has an address in the upper left corner to send the form. Web may 3, 2021, i just received form 3531 from irs asking for my spouses signature which was missing. I filed electronically for 2019 and no signature pages were mailed in and not required by program.

Your original signature is required. I received an envelope from the irs with my tax return and a green form 3531 attached. Shown is a form 3531 and a partially obscured form 1040. 0 found this answer helpful | 0 lawyers agree If you are contesting a penalty, i’d spring for the $50 for a copy of your return and if you are right, appeal the first collection notice that grants you appeal rights. You must resubmit the original completed form along with all applicable schedules, forms and attachments. Hope this answers your question. How can i tell if this form is real and not a scam? Web form 3531 correspondence action trailthis figure demonstrates how to edit an action trail when corresponding and sending the return back to the taxpayer. Web where to send form 3531 ?

I received an envelope from the irs with my tax return and a green form 3531 attached. Web posted on jul 24, 2021 if they didn’t stick you with a substantial late filing penalty, i’d just refill the original signed return. Web usually form 3531 has an address in the upper left corner to send the form. Web application for irs individual taxpayer identification number. Web may 3, 2021, i just received form 3531 from irs asking for my spouses signature which was missing. You must resubmit the original completed form along with all applicable schedules, forms and attachments. Form 3520 annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Shown is a form 3531 and a partially obscured form 1040. So my problem now is where should i send back this forms? How can i tell if this form is real and not a scam?

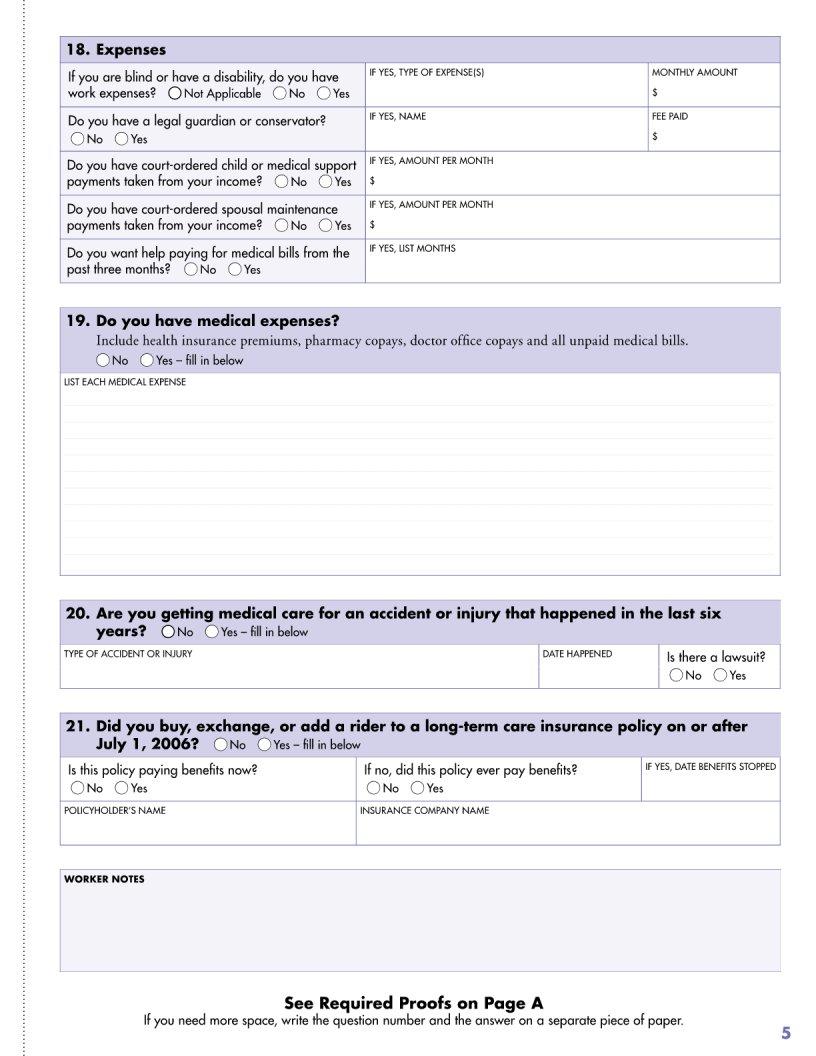

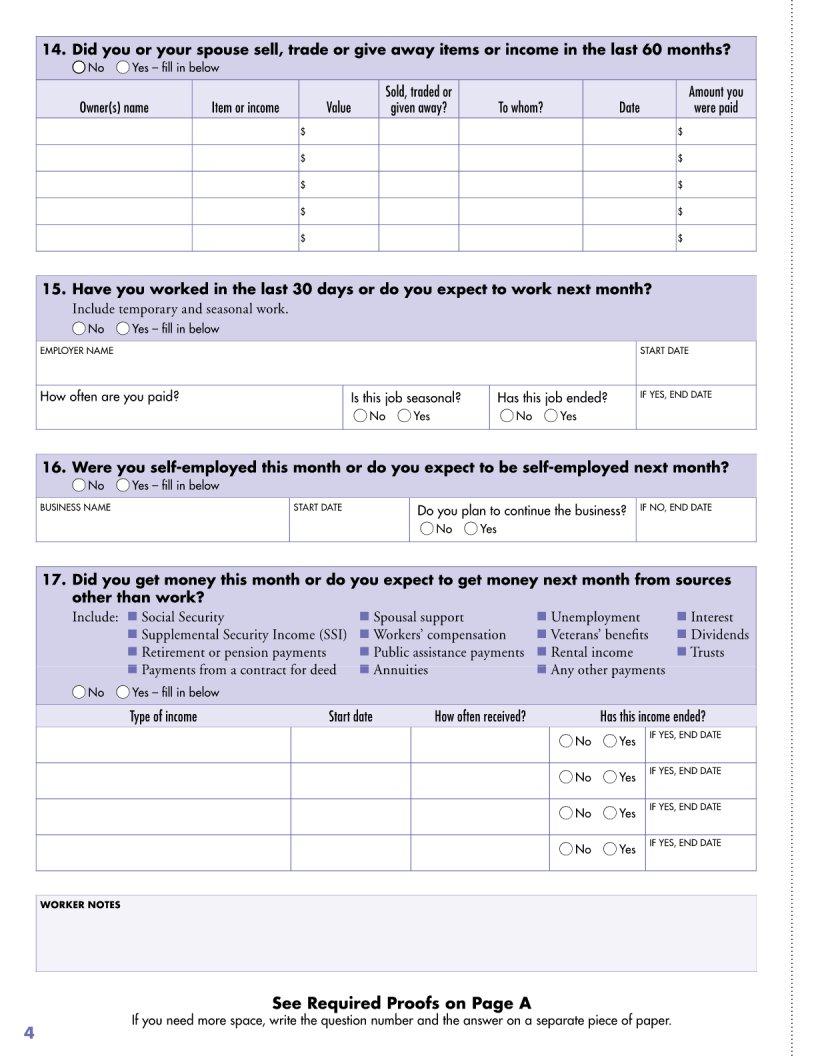

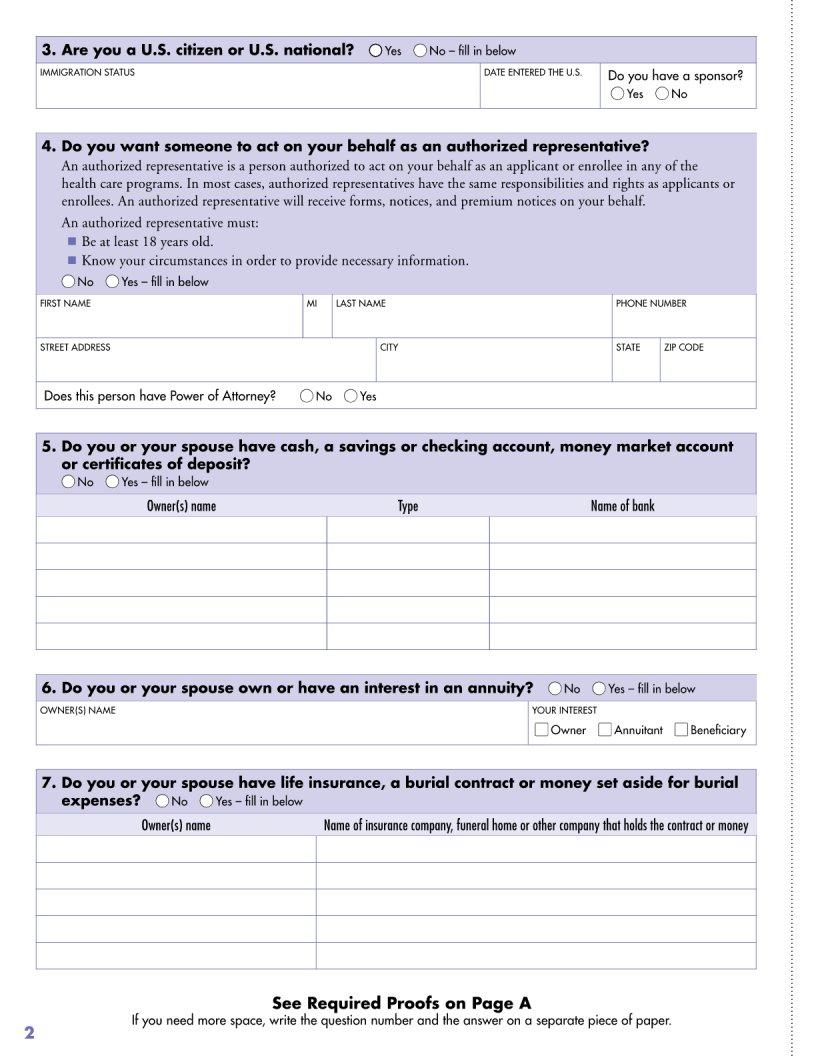

Dhs 3531 Form ≡ Fill Out Printable PDF Forms Online

How can i tell if this form is real and not a scam? I do not understand how they. Your form 1040/a/ez/sr is blank, illegible, missing or damaged and we can't process it. You must resubmit the original completed form along with all applicable schedules, forms and attachments. Web may 3, 2021, i just received form 3531 from irs asking.

Dhs 3531 Form ≡ Fill Out Printable PDF Forms Online

Web addresses for forms beginning with the number 3. If you are contesting a penalty, i’d spring for the $50 for a copy of your return and if you are right, appeal the first collection notice that grants you appeal rights. I do not understand how they. Web posted on jul 24, 2021 if they didn’t stick you with a.

IRS Audit Letter 3531 Sample 1

So today we received a mail from the irs containing our form 1040 (with a missing sign) and form 3531. I used turbo tax for the 1st time this year to file. Web form 3531 or scam? Web where to send form 3531 ? 0 found this answer helpful | 0 lawyers agree

3.11.3 Individual Tax Returns Internal Revenue Service

Shown is a form 3531 and a partially obscured form 1040. Web form 3531 or scam? Web addresses for forms beginning with the number 3. I filed electronically for 2019 and no signature pages were mailed in and not required by program. You must resubmit the original completed form along with all applicable schedules, forms and attachments.

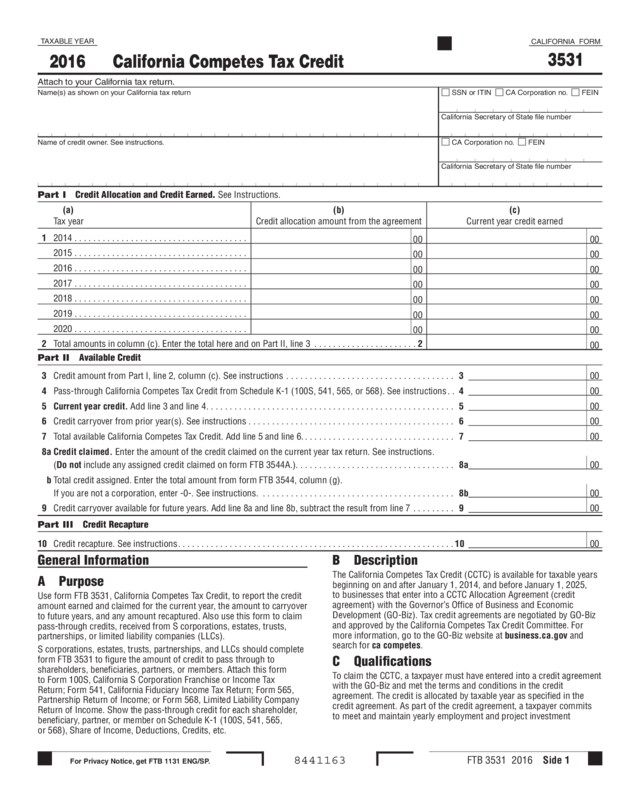

Form FTB3531 Download Fillable PDF or Fill Online California Competes

How can i tell if this form is real and not a scam? Form 3115 application for change in accounting method. There was no letter included. So today we received a mail from the irs containing our form 1040 (with a missing sign) and form 3531. I do not understand how they.

Dhs 3531 Form ≡ Fill Out Printable PDF Forms Online

0 found this answer helpful | 0 lawyers agree I filed electronically for 2019 and no signature pages were mailed in and not required by program. Your original signature is required. I used turbo tax for the 1st time this year to file. So my problem now is where should i send back this forms?

EDGAR Filing Documents for 000079298715000015

Your form 1040/a/ez/sr is blank, illegible, missing or damaged and we can't process it. I tried to call the irs. I do not understand how they. You must resubmit the original completed form along with all applicable schedules, forms and attachments. Web box 6 on form 3531 says:

2016 Form 3531 California Competes Tax Credit Edit, Fill, Sign

I do not understand how they. Web box 6 on form 3531 says: Web form 3531 or scam? Web may 3, 2021, i just received form 3531 from irs asking for my spouses signature which was missing. Form 3520 annual return to report transactions with foreign trusts and receipt of certain foreign gifts.

IRS Audit Letter 3531 Sample 1

Your form 1040/a/ez/sr is blank, illegible, missing or damaged and we can't process it. Form 3115 application for change in accounting method. Web usually form 3531 has an address in the upper left corner to send the form. Web form 3531 or scam? 0 found this answer helpful | 0 lawyers agree

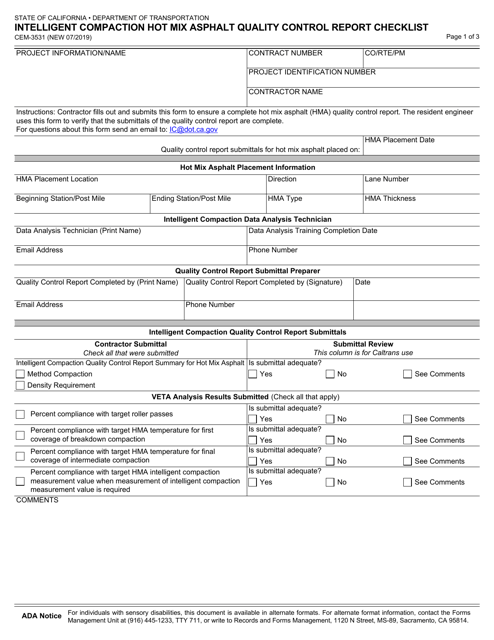

Form CEM3531 Download Fillable PDF or Fill Online Intelligent

Form 3115 application for change in accounting method. So my problem now is where should i send back this forms? Form 3520 annual return to report transactions with foreign trusts and receipt of certain foreign gifts. 0 found this answer helpful | 0 lawyers agree Web form 3531 or scam?

I Do Not Understand How They.

Web box 6 on form 3531 says: Your form 1040/a/ez/sr is blank, illegible, missing or damaged and we can't process it. I received an envelope from the irs with my tax return and a green form 3531 attached. Web posted on jul 24, 2021 if they didn’t stick you with a substantial late filing penalty, i’d just refill the original signed return.

So My Problem Now Is Where Should I Send Back This Forms?

Hope this answers your question. Web may 3, 2021, i just received form 3531 from irs asking for my spouses signature which was missing. Web application for irs individual taxpayer identification number. 0 found this answer helpful | 0 lawyers agree

Web Addresses For Forms Beginning With The Number 3.

Web form 3531 or scam? I used turbo tax for the 1st time this year to file. There was no letter included. How can i tell if this form is real and not a scam?

Form 3115 Application For Change In Accounting Method.

Web form 3531 correspondence action trailthis figure demonstrates how to edit an action trail when corresponding and sending the return back to the taxpayer. Get or renew an individual taxpayer identification number (itin) for federal tax purposes if you are not eligible for a social security number. ( for a copy of a form, instruction or publication) address to mail form to irs: So today we received a mail from the irs containing our form 1040 (with a missing sign) and form 3531.