Form 3853 Instructions

Form 3853 Instructions - Web use form ftb 3853 to determine if you owe an individual shared responsibility penalty or to claim exemptions from the state individual health coverage. Choose either the 3853 or 3849 form (use the. Web the organization should submit form 2553: If the organization adheres to. 2 months and 15 days past the start of the tax year in which the election is to be effective. Web starting in 2020, californians who don't have health insurance and who don't qualify for an exemption are subject to pay an individual shared responsibility penalty, or isr. Part iii your ssn or itin: Web side 1 health coverage exemptions and individual shared responsibility penalty taxable year 2020 california form 3853 attach to your california form. Web up to $40 cash back download the form 3853 pdf and open it in a pdf viewer. Read the instructions at the top of the form and fill out the required fields.

Web share your form with others. Read the instructions at the top of the form and fill out the required fields. If you and/or a member of your applicable household are reporting any coverage or are. Web use form ftb 3853 to determine if you owe an individual shared responsibility penalty or to claim exemptions from the state individual health coverage. Web starting in 2020, californians who don't have health insurance and who don't qualify for an exemption are subject to pay an individual shared responsibility penalty, or isr. Web side 1 your name: Web up to $40 cash back download the form 3853 pdf and open it in a pdf viewer. Web the organization should submit form 2553: Web 2022, 3853, instructions for form 3853, health coverage exemption and individual shared responsibility penalty. 2 months and 15 days past the start of the tax year in which the election is to be effective.

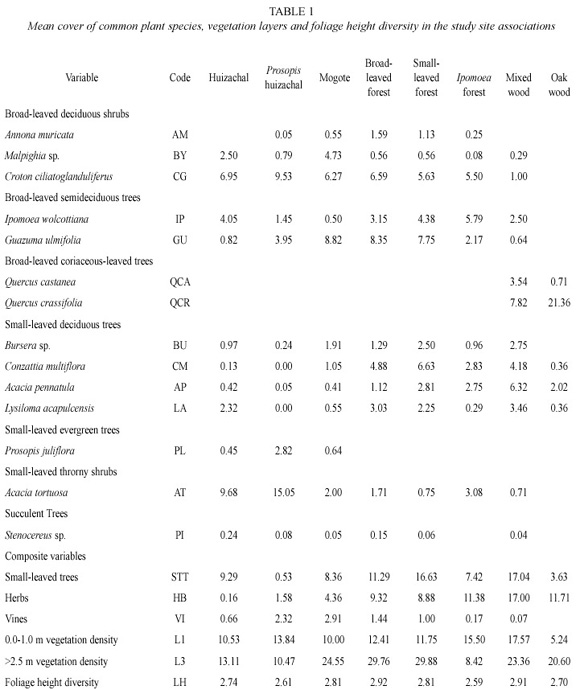

This is only available by request. Web use form ftb 3853 to determine if you owe an individual shared responsibility penalty or to claim exemptions from the state individual health coverage. Web 2022, 3853, instructions for form 3853, health coverage exemption and individual shared responsibility penalty. Web side 1 your name: If you and/or a member of your applicable household are reporting any coverage or are. Web side 1 health coverage exemptions and individual shared responsibility penalty taxable year 2020 california form 3853 attach to your california form. 8/2015 purpose to serve as the primary document to summarize finding of standards compliance monitoring for the community care for the aged and. Web side 1 part iii coverage and exemptions claimed on your tax return for individuals. Choose either the 3853 or 3849 form (use the. Web the california franchise tax board april 1 issued the 2020 instructions for form ftb 3853, health coverage exemptions and individual shared responsibility.

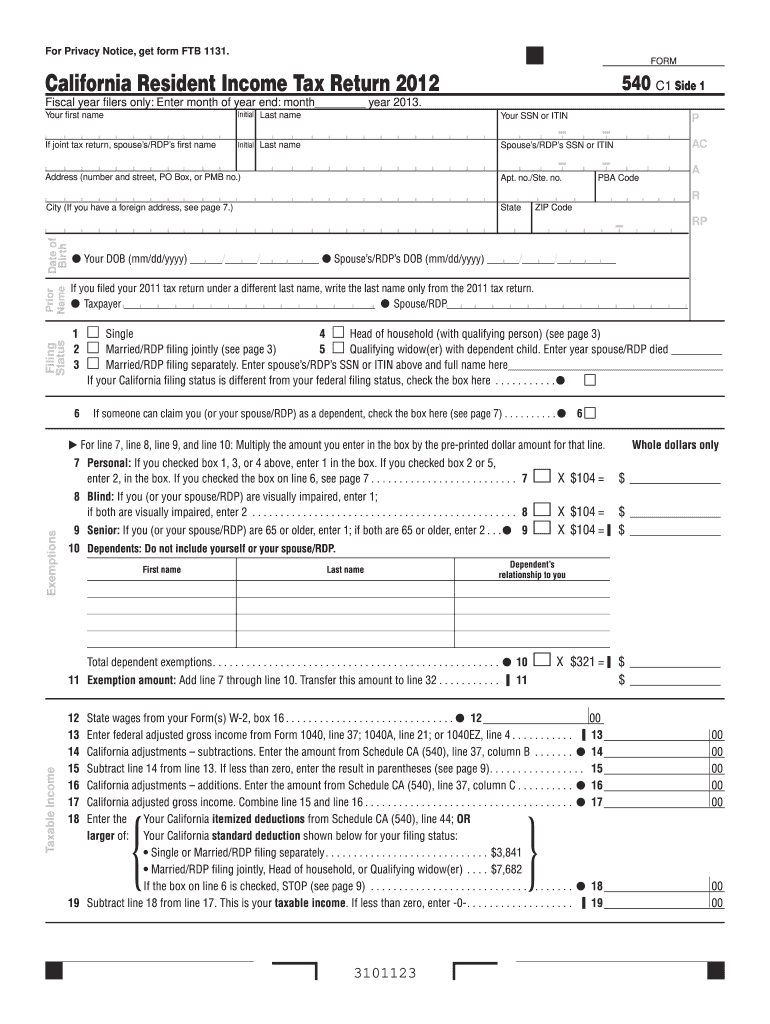

Ca Ftb 540 Instructions Fill and Sign Printable Template Online US

Web starting in 2020, californians who don't have health insurance and who don't qualify for an exemption are subject to pay an individual shared responsibility penalty, or isr. Choose either the 3853 or 3849 form (use the. Web 2022, 3853, instructions for form 3853, health coverage exemption and individual shared responsibility penalty. Web side 1 part iii coverage and exemptions.

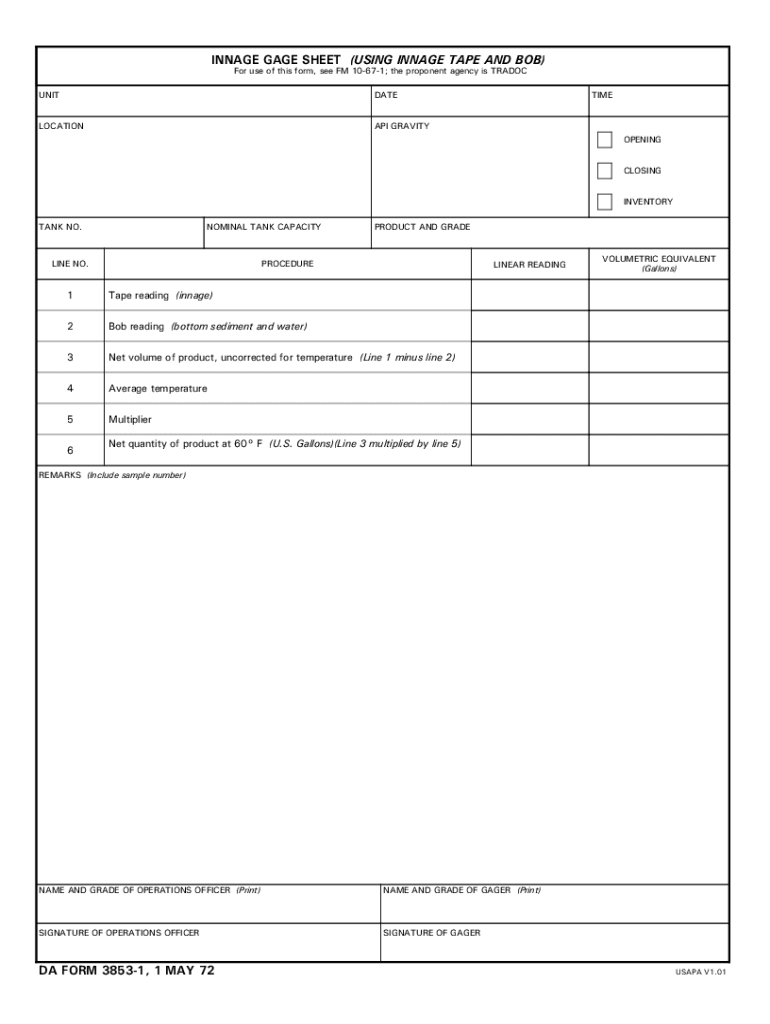

Da Form 3853 1 20202022 Fill and Sign Printable Template Online US

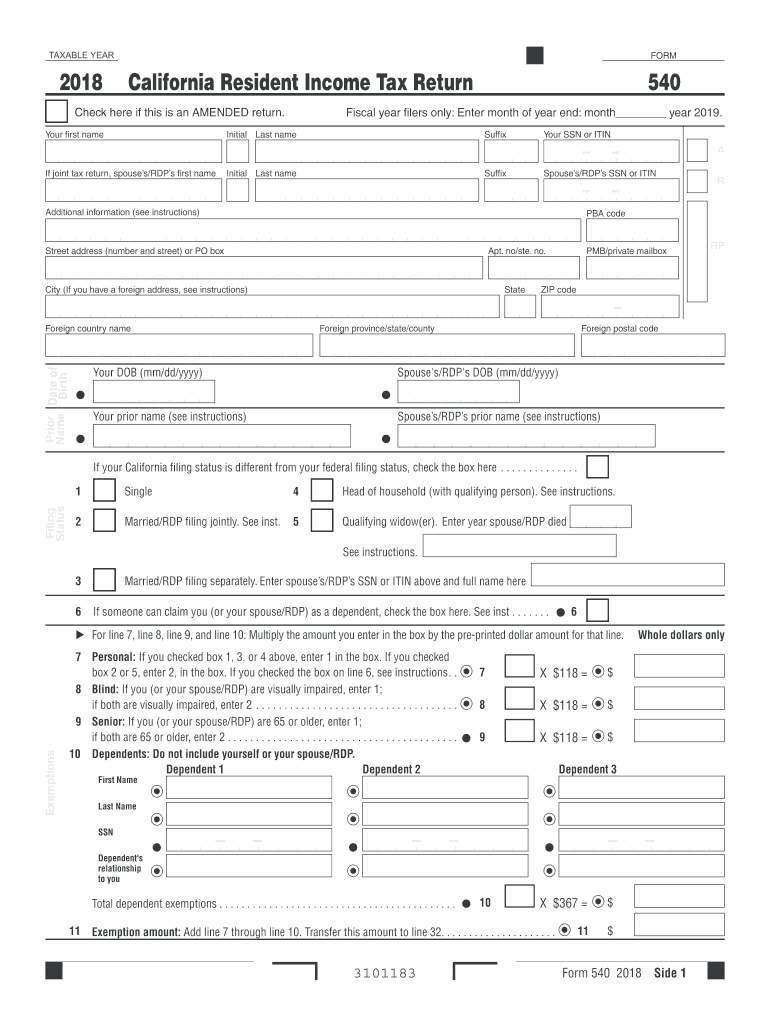

Web california resident income tax return. If the organization adheres to. If you and/or a member of your applicable household are reporting any coverage or are. In the “name of claimant”. Web residents of california must provide this documentation by completing form ftb 3853, a tax form that must be enclosed with your form 540, california resident income tax.

Form 3853 1 ezvgqrk

Choose either the 3853 or 3849 form (use the. Edit your form 3853 online. You can also download it, export it or print it out. Indicate the date to the sample with the date function. Click on the sign icon and create a digital signature.

1997 california tax form 540 Fill out & sign online DocHub

Coverage and exemptions claimed on your tax return for individuals. You can also download it, export it or print it out. This is only available by request. Web the california franchise tax board april 1 issued the 2020 instructions for form ftb 3853, health coverage exemptions and individual shared responsibility. Click on the sign icon and create a digital signature.

3853 Form Fill Online, Printable, Fillable, Blank pdfFiller

Web starting in 2020, californians who don't have health insurance and who don't qualify for an exemption are subject to pay an individual shared responsibility penalty, or isr. Web side 1 your name: You can also download it, export it or print it out. Web side 1 part iii coverage and exemptions claimed on your tax return for individuals. 2.

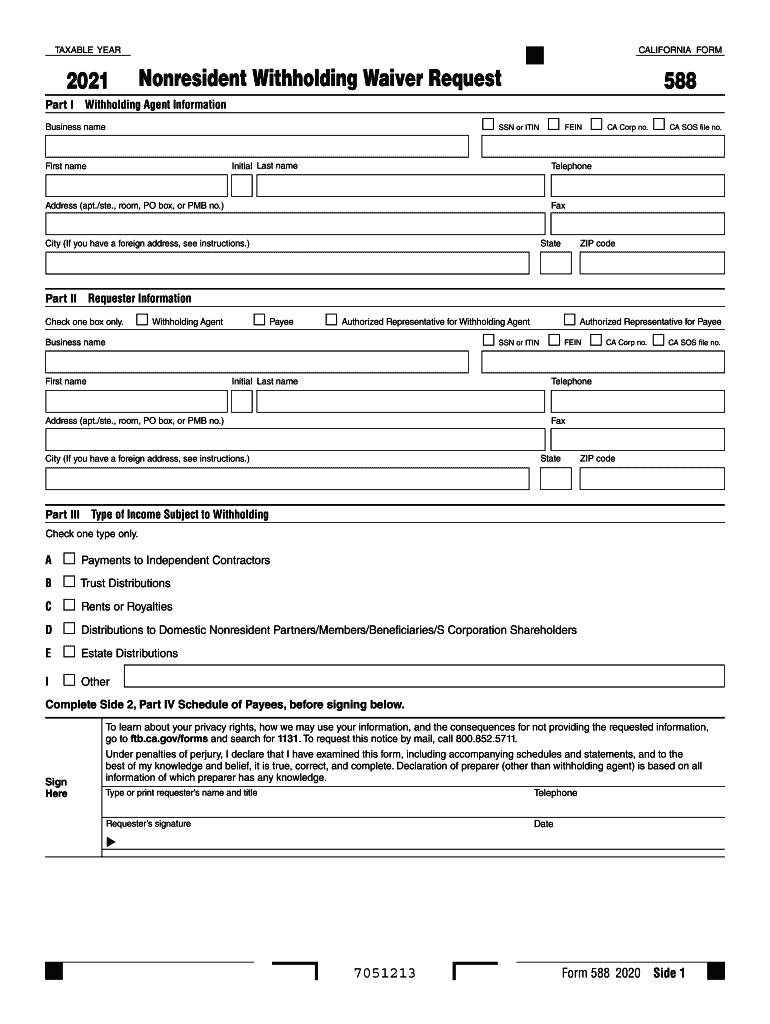

ftb ca 588 Fill out & sign online DocHub

Web be sure the data you fill in form 3853 is updated and accurate. Web this number is needed on form ftb 3853, health coverage exemptions and individual shared responsibility penalty, to prove that covered california granted you an. Web 2022, 3853, instructions for form 3853, health coverage exemption and individual shared responsibility penalty. Web up to $40 cash back.

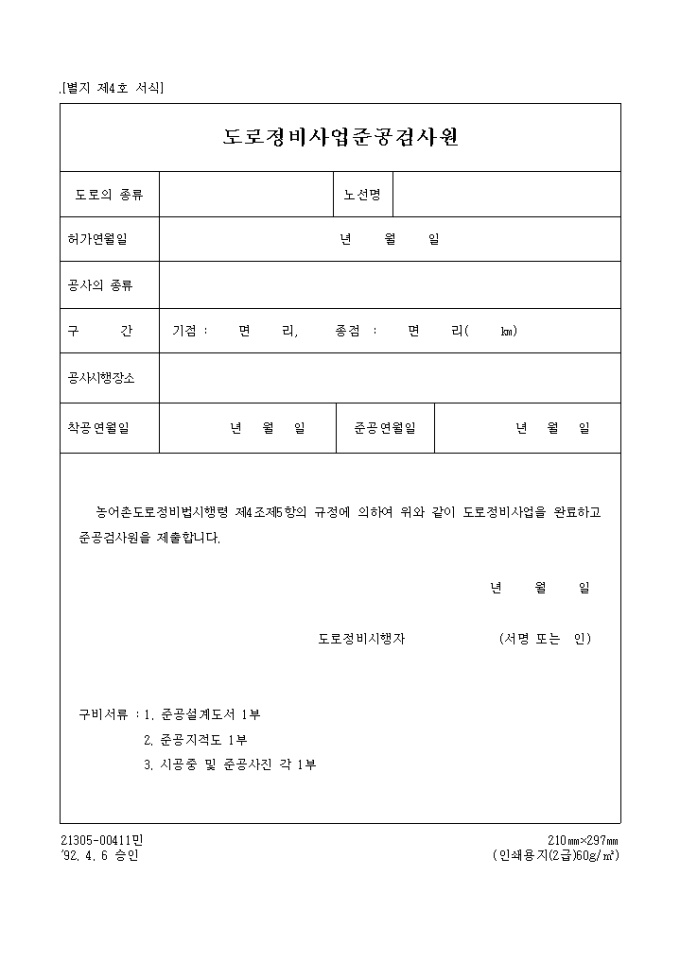

도로정비사업 준공검사원 샘플, 양식 다운로드

Coverage and exemptions claimed on your tax return for individuals. 8/2015 purpose to serve as the primary document to summarize finding of standards compliance monitoring for the community care for the aged and. Web residents of california must provide this documentation by completing form ftb 3853, a tax form that must be enclosed with your form 540, california resident income.

CA FTB 540X 20162022 Fill out Tax Template Online US Legal Forms

If you and/or a member of your applicable household are. Web be sure the data you fill in form 3853 is updated and accurate. Coverage and exemptions claimed on your tax return for individuals. This is only available by request. If you and/or a member of your applicable household are reporting any coverage or are.

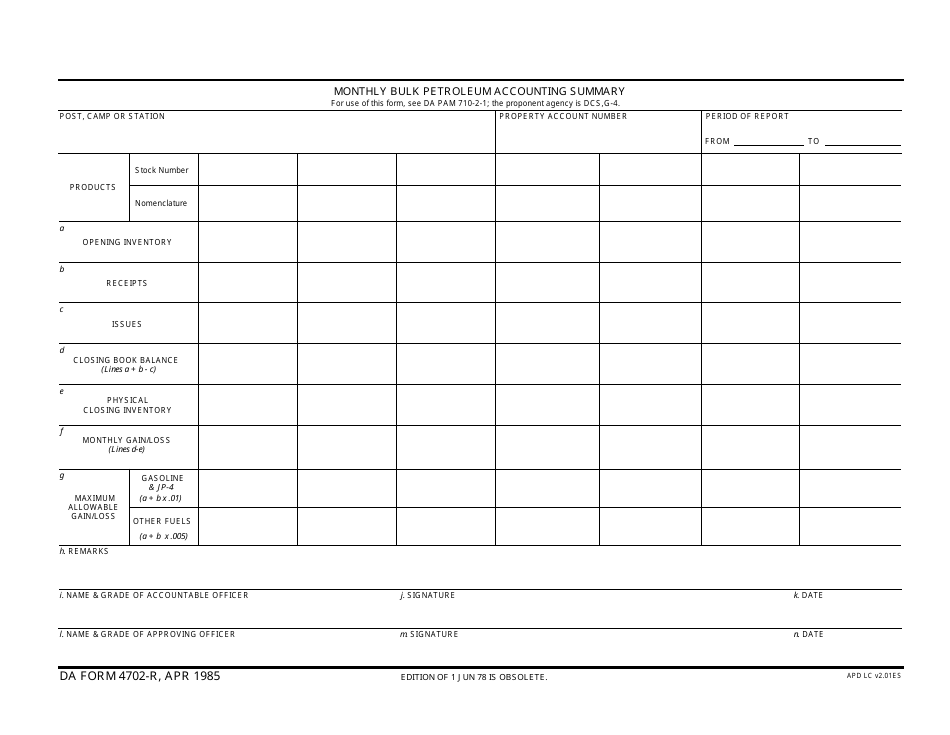

DA Form 4702R Download Fillable PDF or Fill Online Monthly Bulk

Web this number is needed on form ftb 3853, health coverage exemptions and individual shared responsibility penalty, to prove that covered california granted you an. Edit your form 3853 online. Web side 1 part iii coverage and exemptions claimed on your tax return for individuals. Web california resident income tax return. Web 2022, 3853, instructions for form 3853, health coverage.

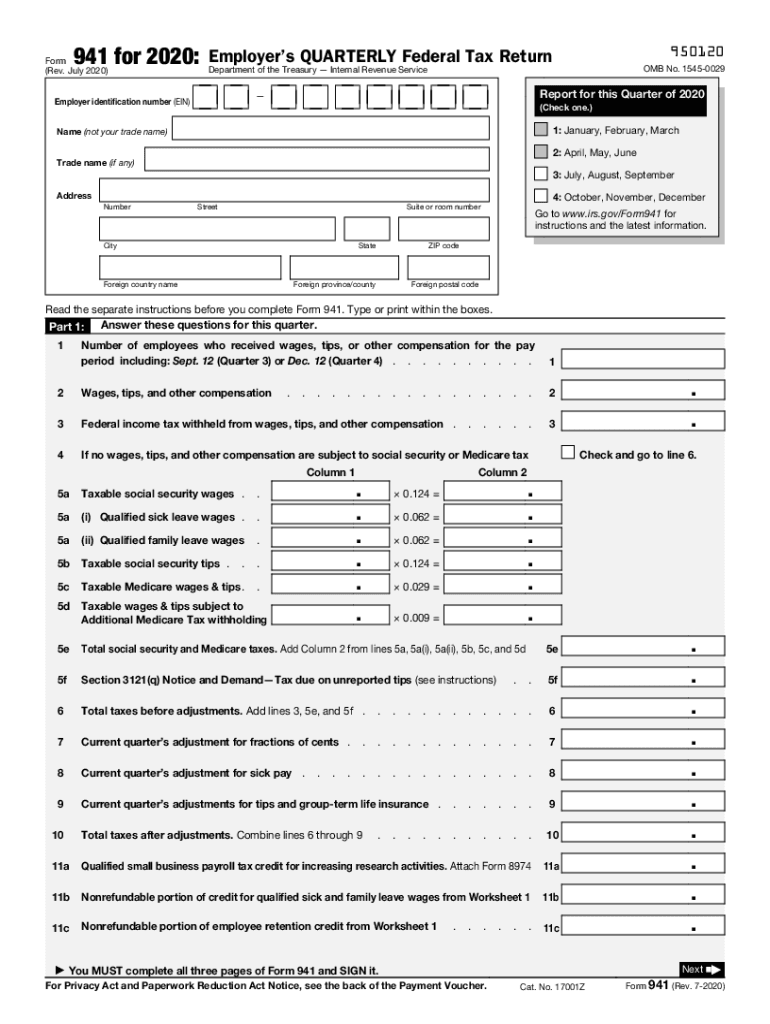

2020 Form IRS 941 Fill Online, Printable, Fillable, Blank pdfFiller

Web side 1 part iii coverage and exemptions claimed on your tax return for individuals. Web use form ftb 3853 to determine if you owe an individual shared responsibility penalty or to claim exemptions from the state individual health coverage. 8/2015 purpose to serve as the primary document to summarize finding of standards compliance monitoring for the community care for.

Web 2022, 3853, Instructions For Form 3853, Health Coverage Exemption And Individual Shared Responsibility Penalty.

Web this number is needed on form ftb 3853, health coverage exemptions and individual shared responsibility penalty, to prove that covered california granted you an. If you and/or a member of your applicable household are reporting any coverage or are. Send california form 3853 via email, link, or fax. Web side 1 health coverage exemptions and individual shared responsibility penalty taxable year 2020 california form 3853 attach to your california form.

Coverage And Exemptions Claimed On Your Tax Return For Individuals.

Web starting in 2020, californians who don't have health insurance and who don't qualify for an exemption are subject to pay an individual shared responsibility penalty, or isr. Web california resident income tax return. 8/2015 purpose to serve as the primary document to summarize finding of standards compliance monitoring for the community care for the aged and. This is only available by request.

If You And/Or A Member Of Your Applicable Household Are Reporting Any Coverage Or Are.

Below, you will find detailed instructions and a sample of completed sides 1 and 3 of form 540 and a sample of side 1 and side 2 of. Part iii your ssn or itin: If you and/or a member of your applicable household are. Web the organization should submit form 2553:

Web To Complete Form 3853 Or Form 3849, Follow This Navigation Path:

Click on the sign icon and create a digital signature. Read the instructions at the top of the form and fill out the required fields. Web side 1 part iii coverage and exemptions claimed on your tax return for individuals. 2 months and 15 days past the start of the tax year in which the election is to be effective.