Form 4 Sec Filing

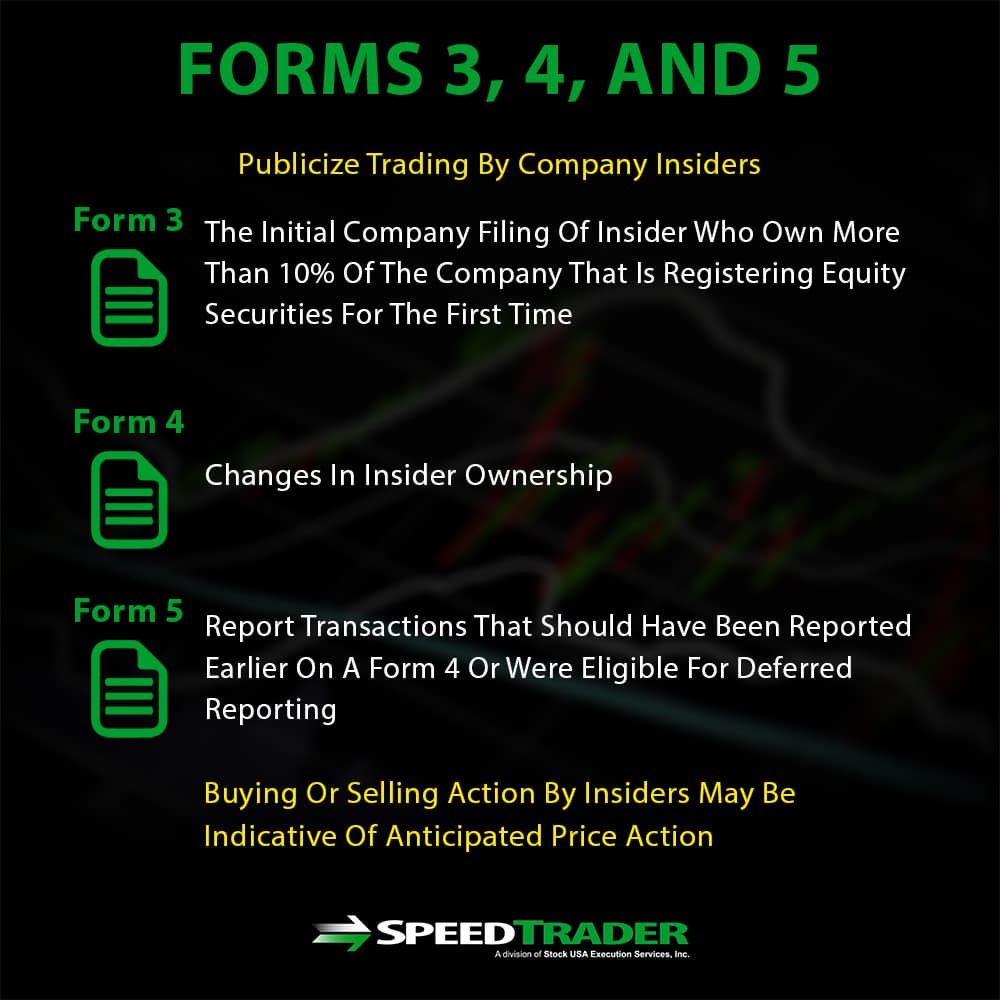

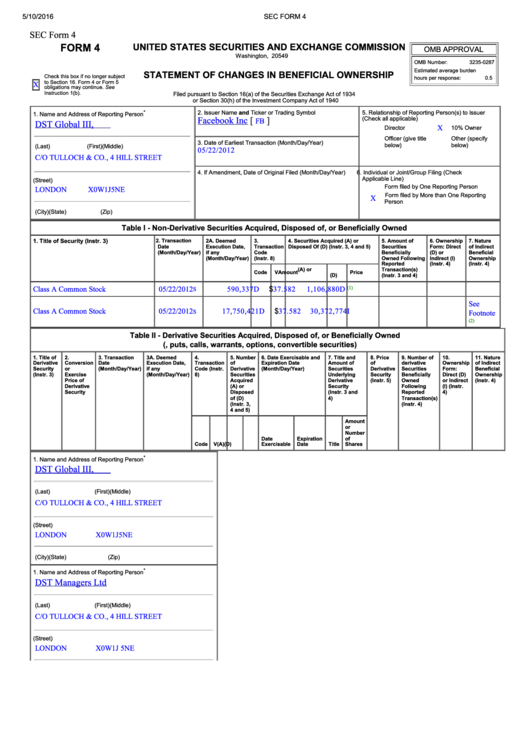

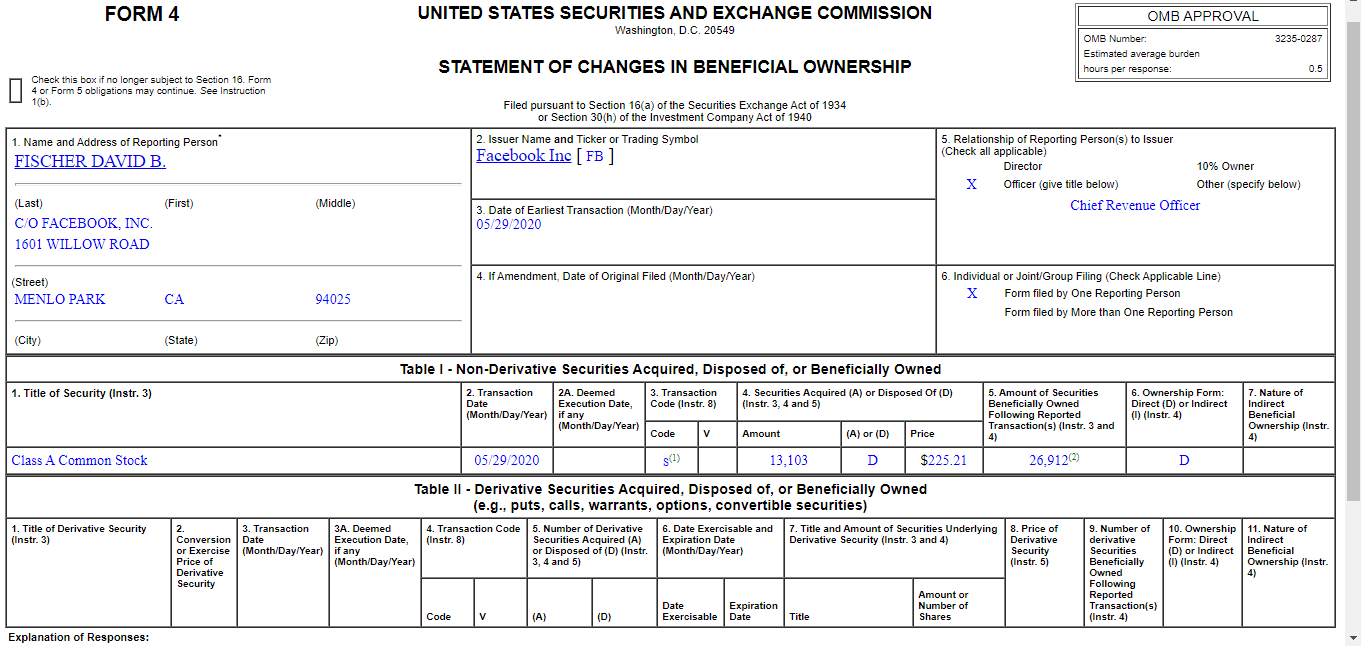

Form 4 Sec Filing - Section 3 contains the transaction date of february 14, 2020. The federal securities laws require certain individuals (such as officers, directors, and those that hold more than 10% of any class of a company’s securities, together we’ll call, “insiders”) to report purchases, sales, and holdings of their company’s securities by filing forms 3, 4, and 5. Or section 30 (h) of the investment company act of 1940. In most cases, when an insider executes a transaction, he or she must file a form 4. United states securities and exchange commission. Search historical executives form 4 filings insider trading transaction data. Section 2 has the company name of tesla inc. Web form 4 is an sec filing used to disclose that an insider transaction has occurred. Anyone can access and download this information for free. Web united states securities and exchange commission omb approvalwashington, d.c.

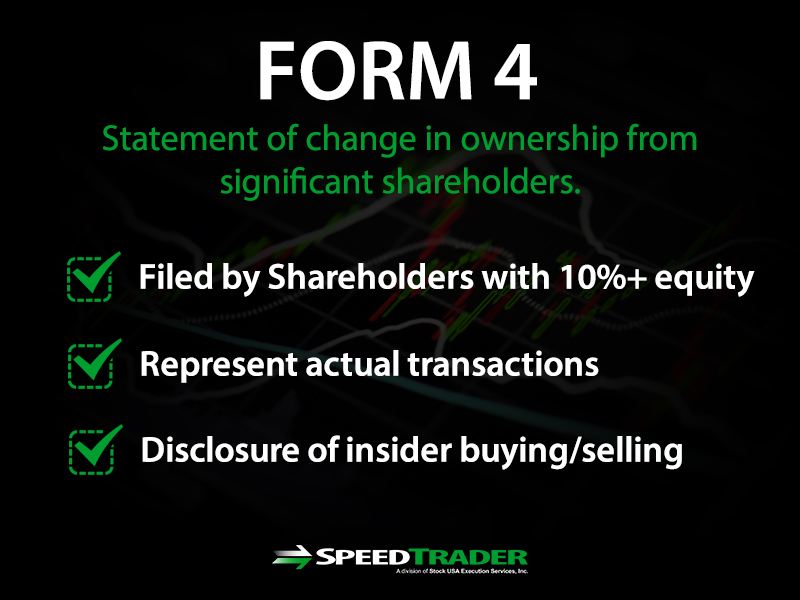

In most cases, when an insider executes a transaction, he or she must file a form 4. With this form filing, the public is made aware of the insider’s various transactions in company securities, including the amount purchased or. Anyone can access and download this information for free. Web filings & forms. United states securities and exchange commission. The federal securities laws require certain individuals (such as officers, directors, and those that hold more than 10% of any class of a company’s securities, together we’ll call, “insiders”) to report purchases, sales, and holdings of their company’s securities by filing forms 3, 4, and 5. Web united states securities and exchange commission omb approvalwashington, d.c. It also provides details about transaction date, size, and price of the shares. Filed pursuant to section 16 (a) of the securities exchange act of 1934. Web forms 3, 4 and 5.

It also provides details about transaction date, size, and price of the shares. Web form 4 is an sec filing used to disclose that an insider transaction has occurred. In most cases, when an insider executes a transaction, he or she must file a form 4. Section 5 contains the details of. Web filings & forms. Web form 4 statement of changes of beneficial ownership of securities the commission is authorized to solicit the information required by this form pursuant to sections 16(a) and 23(a) of the securities exchange act of 1934, and sections 30(h) and 38 of the investment company act of 1940, and the rules and regulations. The federal securities laws require certain individuals (such as officers, directors, and those that hold more than 10% of any class of a company’s securities, together we’ll call, “insiders”) to report purchases, sales, and holdings of their company’s securities by filing forms 3, 4, and 5. Web forms 3, 4 and 5. Section 3 contains the transaction date of february 14, 2020. In this case, it was elon musk.

OXY Form 4 SEC Filing Explained 29 March 2021 YouTube

Web forms 3, 4 and 5. With this form filing, the public is made aware of the insider’s various transactions in company securities, including the amount purchased or. All companies, foreign and domestic, are required to file registration statements, periodic reports, and other forms electronically through edgar. Web united states securities and exchange commission omb approvalwashington, d.c. United states securities.

What Is SEC Form 4 and How Do You Read Form 4 Filings?

Or section 30 (h) of the investment company act of 1940. Anyone can access and download this information for free. Web how to read a form 4 filing section 1 contains the details of the insider that made the transaction. Section 2 has the company name of tesla inc. United states securities and exchange commission.

Form 4 The key to profiting from insider filings WhaleWisdom Alpha

In this case, it was elon musk. It also provides details about transaction date, size, and price of the shares. Section 2 has the company name of tesla inc. Statement of changes in beneficial ownership. December 31, 2024 check this box if no longerstatement of changes in beneficial ownership estimated average burdensubject to section 16.

Get that Form 4 Filed! Andrew Abramowitz, PLLC

Statement of changes in beneficial ownership. Web united states securities and exchange commission omb approvalwashington, d.c. Anyone can access and download this information for free. Web form 4 is an sec filing used to disclose that an insider transaction has occurred. Web what’s a form 4?

Sec Form 4 Statement Of Changes In Beneficial Ownership printable pdf

Web form 4 statement of changes of beneficial ownership of securities the commission is authorized to solicit the information required by this form pursuant to sections 16(a) and 23(a) of the securities exchange act of 1934, and sections 30(h) and 38 of the investment company act of 1940, and the rules and regulations. December 31, 2024 check this box if.

SEC Filings Explained What You Need to Know

Section 2 has the company name of tesla inc. Anyone can access and download this information for free. Web form 4 statement of changes of beneficial ownership of securities the commission is authorized to solicit the information required by this form pursuant to sections 16(a) and 23(a) of the securities exchange act of 1934, and sections 30(h) and 38 of.

SEC Form 4 Explained for Beginners Watching the Actions of Management

Web how to read a form 4 filing section 1 contains the details of the insider that made the transaction. Web forms 3, 4 and 5. Statement of changes in beneficial ownership. Anyone can access and download this information for free. Search historical executives form 4 filings insider trading transaction data.

SEC Form 4 Definition

Web what’s a form 4? It also provides details about transaction date, size, and price of the shares. Statement of changes in beneficial ownership. Section 5 contains the details of. Web filings & forms.

Stock Market Finance

Web form 4 is an sec filing used to disclose that an insider transaction has occurred. Search historical executives form 4 filings insider trading transaction data. In this case, it was elon musk. Section 2 has the company name of tesla inc. Web forms 3, 4 and 5.

SEC Filings Introduction What You Need to Know

The federal securities laws require certain individuals (such as officers, directors, and those that hold more than 10% of any class of a company’s securities, together we’ll call, “insiders”) to report purchases, sales, and holdings of their company’s securities by filing forms 3, 4, and 5. Web form 4 statement of changes of beneficial ownership of securities the commission is.

In Most Cases, When An Insider Executes A Transaction, He Or She Must File A Form 4.

All companies, foreign and domestic, are required to file registration statements, periodic reports, and other forms electronically through edgar. It also provides details about transaction date, size, and price of the shares. Web what’s a form 4? United states securities and exchange commission.

Web Form 4 Statement Of Changes Of Beneficial Ownership Of Securities The Commission Is Authorized To Solicit The Information Required By This Form Pursuant To Sections 16(A) And 23(A) Of The Securities Exchange Act Of 1934, And Sections 30(H) And 38 Of The Investment Company Act Of 1940, And The Rules And Regulations.

Anyone can access and download this information for free. Web filings & forms. In this case, it was elon musk. Web form 4 is an sec filing used to disclose that an insider transaction has occurred.

Filed Pursuant To Section 16 (A) Of The Securities Exchange Act Of 1934.

With this form filing, the public is made aware of the insider’s various transactions in company securities, including the amount purchased or. Web united states securities and exchange commission omb approvalwashington, d.c. Web forms 3, 4 and 5. Section 5 contains the details of.

Section 3 Contains The Transaction Date Of February 14, 2020.

Section 2 has the company name of tesla inc. Web how to read a form 4 filing section 1 contains the details of the insider that made the transaction. The federal securities laws require certain individuals (such as officers, directors, and those that hold more than 10% of any class of a company’s securities, together we’ll call, “insiders”) to report purchases, sales, and holdings of their company’s securities by filing forms 3, 4, and 5. Or section 30 (h) of the investment company act of 1940.

:max_bytes(150000):strip_icc()/SECFORM4TeslaElonfromEDGAR-67a4f1b6d1534283880be38d30515214.jpg)