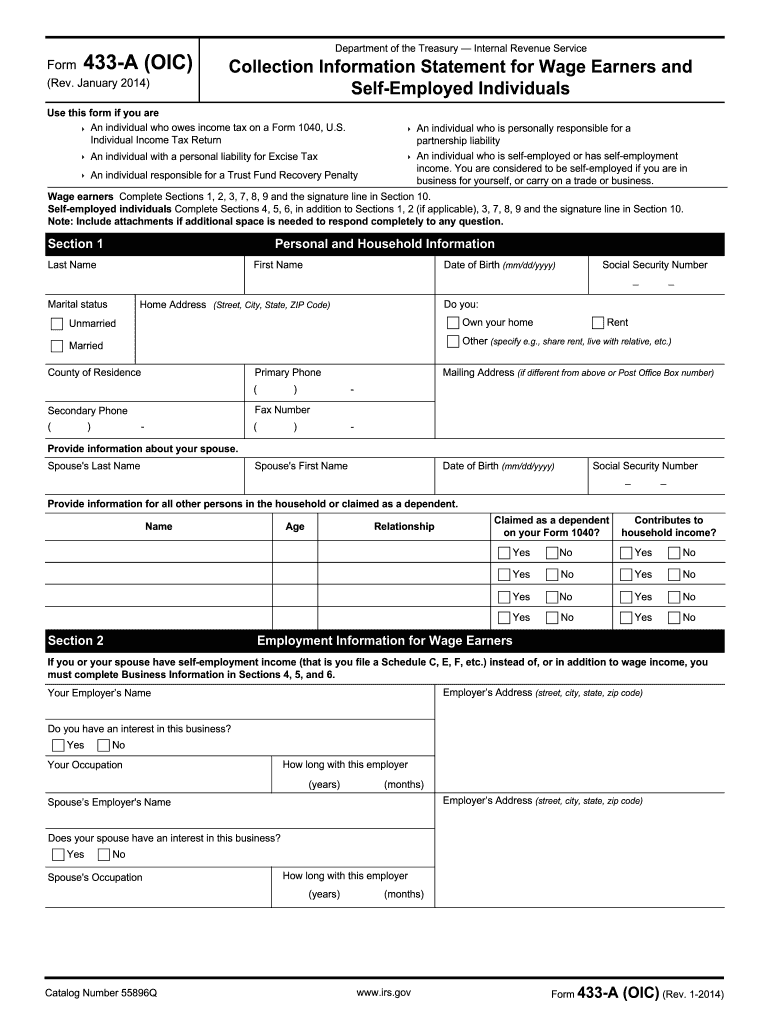

Form 433 Oic

Form 433 Oic - Get ready for tax season deadlines by completing any required tax forms today. Use this form if you are y. This form is also about eight pages long. In order to file for an offer in compromise settlement to. Web to be eligible for an oic, the taxpayer must have filed all tax returns and made all tax payments for the current year. Collection information statement for wage earners. Complete, edit or print tax forms instantly. Web • offer in compromise: This form is also about eight pages long. Web we would like to show you a description here but the site won’t allow us.

Web we would like to show you a description here but the site won’t allow us. Web • offer in compromise: The irs uses this form to determine. Use this form if you are y. Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today. This form is also about eight pages long. In order to file for an offer in compromise settlement to. Complete, edit or print tax forms instantly.

In order to file for an offer in compromise settlement to. Collection information statement for wage earners. Form 433 must be included with the offer in compromise application packet. Web to be eligible for an oic, the taxpayer must have filed all tax returns and made all tax payments for the current year. This form is also about eight pages long. This form is also about eight pages long. Web we would like to show you a description here but the site won’t allow us. Web • offer in compromise: Web up to two forms 656 can calculate for tax liabilities where one taxpayer or spouse are liable for some tax years and the couple is jointly liable for other tax years. Complete, edit or print tax forms instantly.

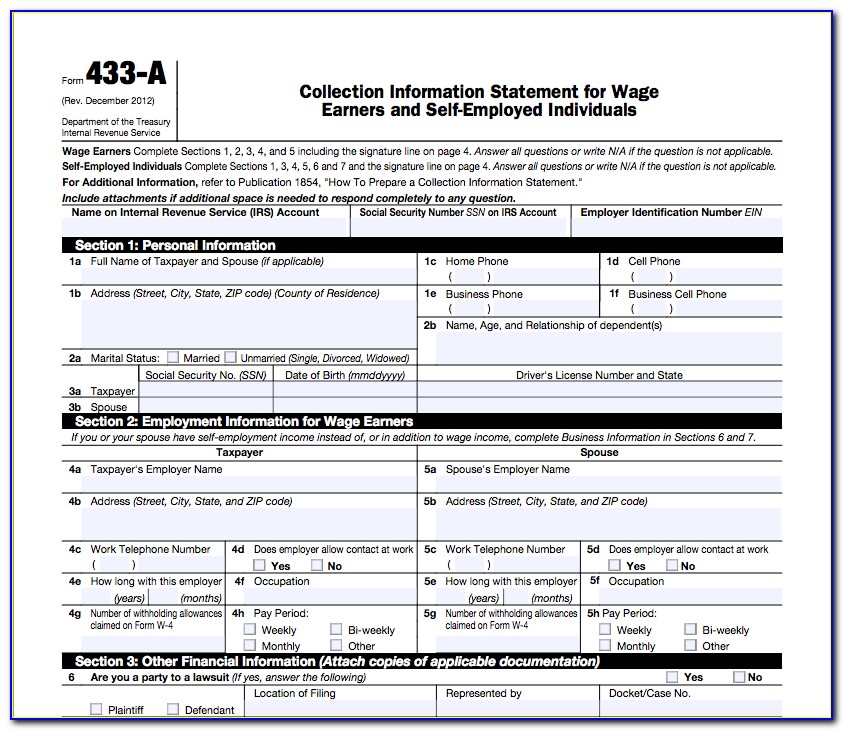

IRS Form 433A (OIC) 2018 2019 Fill out and Edit Online PDF Template

Use this form if you are y. Get ready for tax season deadlines by completing any required tax forms today. Web to be eligible for an oic, the taxpayer must have filed all tax returns and made all tax payments for the current year. The irs uses this form to determine. This form is also about eight pages long.

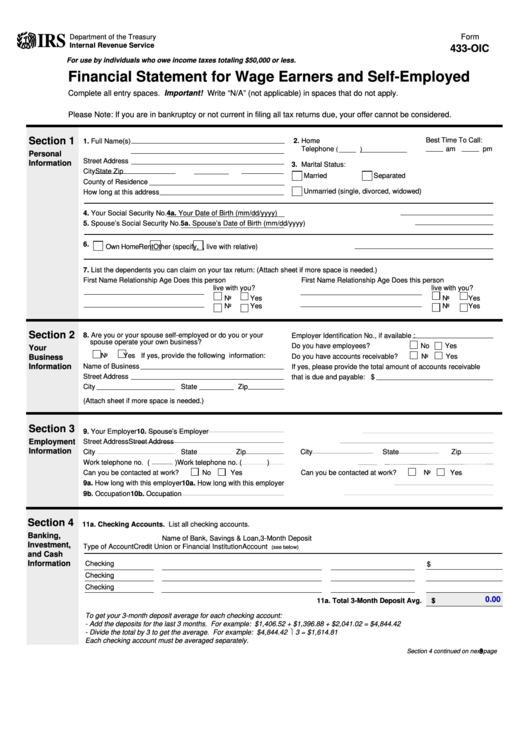

Form 433Oic Financial Statement For Wage Earners And SelfEmployed

Ad access irs tax forms. Use this form if you are y. In order to file for an offer in compromise settlement to. Web to be eligible for an oic, the taxpayer must have filed all tax returns and made all tax payments for the current year. Web up to two forms 656 can calculate for tax liabilities where one.

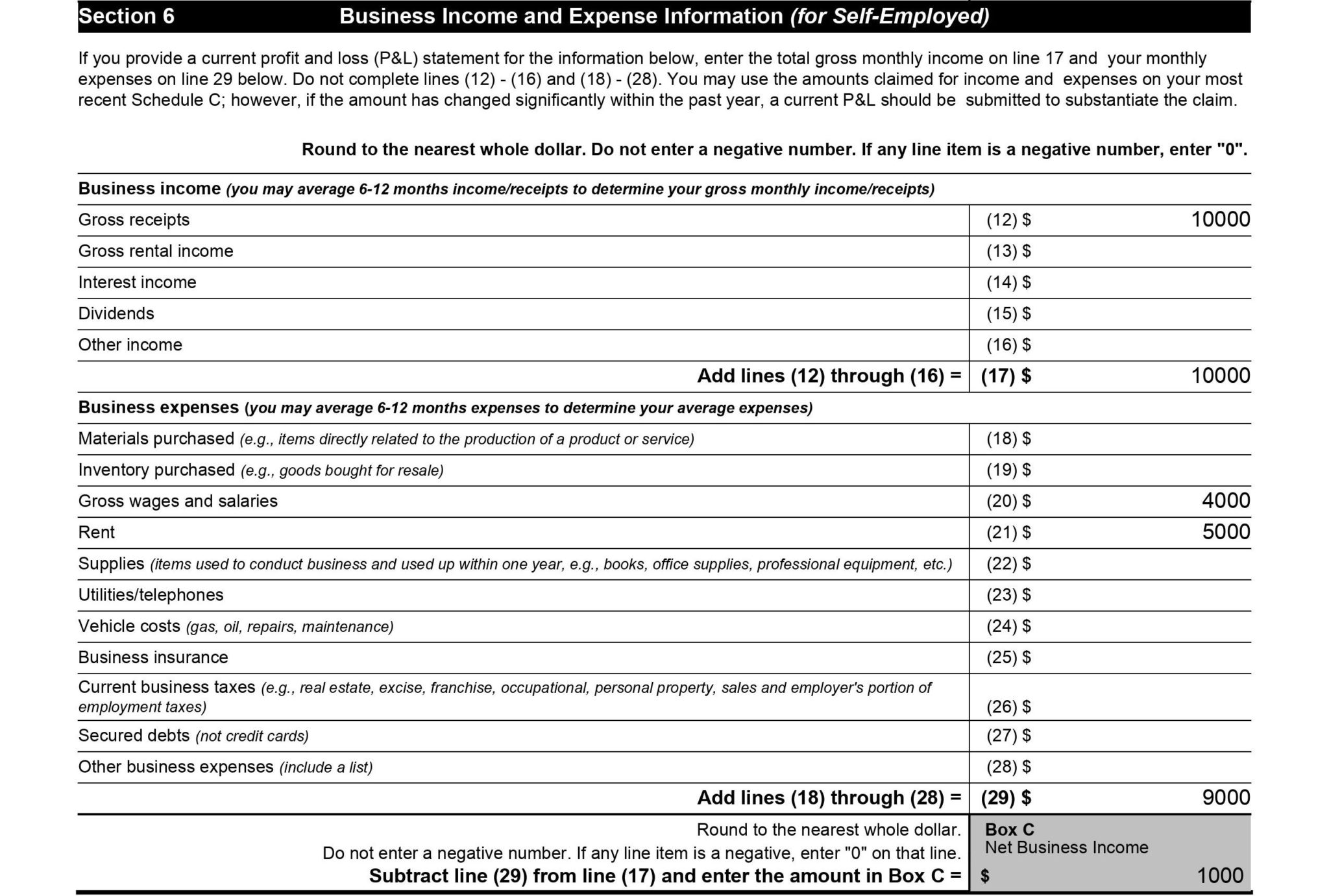

How To Fill Out Form 433A (OIC) (2019 Version), Detailed Instructions

This form is also about eight pages long. In order to file for an offer in compromise settlement to. Web • offer in compromise: An individual who owes income. Web up to two forms 656 can calculate for tax liabilities where one taxpayer or spouse are liable for some tax years and the couple is jointly liable for other tax.

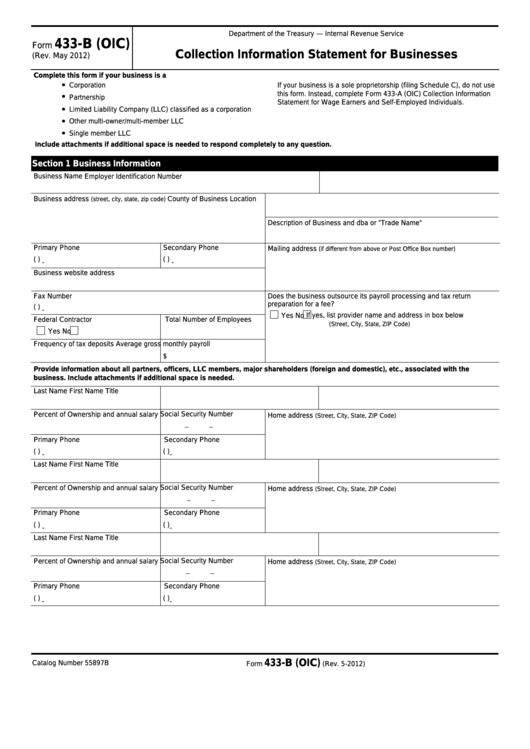

Fillable Form 433B (Oic) Collection Information Statement For

Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. Web to be eligible for an oic, the taxpayer must have filed all tax returns and made all tax payments for the current year. The irs uses this form to determine. Get ready for tax season deadlines by completing any required tax.

How To Fill Out Form 433A (OIC) (2019 Version), Detailed Instructions

Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Ad access irs tax forms. The irs uses this form to determine. This form is also about eight pages long.

IRS Form 433B (OIC) 2018 2019 Printable & Fillable Sample in PDF

Web • offer in compromise: Web we would like to show you a description here but the site won’t allow us. Ad access irs tax forms. This form is also about eight pages long. The irs uses this form to determine.

New Eeo 1 Form 2017 Form Resume Examples aZDYGa3O79

Get ready for tax season deadlines by completing any required tax forms today. Use this form if you are y. Web up to two forms 656 can calculate for tax liabilities where one taxpayer or spouse are liable for some tax years and the couple is jointly liable for other tax years. Ad access irs tax forms. Get ready for.

How to complete IRS form 433A OIC YouTube

This form is also about eight pages long. Get ready for tax season deadlines by completing any required tax forms today. Web to be eligible for an oic, the taxpayer must have filed all tax returns and made all tax payments for the current year. Web up to two forms 656 can calculate for tax liabilities where one taxpayer or.

2014 Form IRS 433A (OIC) Fill Online, Printable, Fillable, Blank

An individual who owes income. This form is also about eight pages long. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. In order to file for an offer in compromise settlement to.

IRS Form 433B (OIC) 2018 Version Instructions Business Offer In

Complete, edit or print tax forms instantly. This form is also about eight pages long. Form 433 must be included with the offer in compromise application packet. An individual who owes income. In order to file for an offer in compromise settlement to.

An Individual Who Owes Income.

Get ready for tax season deadlines by completing any required tax forms today. Form 433 must be included with the offer in compromise application packet. Ad access irs tax forms. In order to file for an offer in compromise settlement to.

Web • Offer In Compromise:

Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Web we would like to show you a description here but the site won’t allow us. Use this form if you are y.

Collection Information Statement For Wage Earners.

This form is also about eight pages long. Web up to two forms 656 can calculate for tax liabilities where one taxpayer or spouse are liable for some tax years and the couple is jointly liable for other tax years. This form is also about eight pages long. The irs uses this form to determine.