Form 4549 Refund

Form 4549 Refund - However, thereafter, as a result of the other audit, irs assessed additional tax based on cancellation of indebtedness income, and the refund that it sent the taxpayers was less than the amount. When did you receive the notice? Have you received notices like. Form 4666, summary of employment tax. Refund claims must be made during the calendar year in which the return was prepared. What type of notice did you receive? Web if you discover an h&r block error on your return that entitles you to a larger refund (or smaller tax liability), we’ll refund the tax prep fee for that return and file an amended return at no additional charge. Web the irs form 4549 is the income tax examination changes letter. Web i received a 4549 letter today does that mean i owe that balance or is that the refund i’ll be getting back? This form means the irs is questioning your tax return.

Refund claims must be made during the calendar year in which the return was prepared. Form 4666, summary of employment tax. Web the irs form 4549 is the income tax examination changes letter. Web following an audit, the irs will communicate with you about the results. Web if you discover an h&r block error on your return that entitles you to a larger refund (or smaller tax liability), we’ll refund the tax prep fee for that return and file an amended return at no additional charge. Web i received a 4549 letter today does that mean i owe that balance or is that the refund i’ll be getting back? What type of notice did you receive? However, thereafter, as a result of the other audit, irs assessed additional tax based on cancellation of indebtedness income, and the refund that it sent the taxpayers was less than the amount. Web form 4549 is an irs form that is sent to taxpayers whose returns have been audited. This form means the irs is questioning your tax return.

The accountant can help you figure out what to do about the notice you received. This form means the irs is questioning your tax return. Web form 4549 is an irs form that is sent to taxpayers whose returns have been audited. However, thereafter, as a result of the other audit, irs assessed additional tax based on cancellation of indebtedness income, and the refund that it sent the taxpayers was less than the amount. It will include information, including: Web examiners must prepare and issue form 4549 showing the adjustments to the tax and/or penalties, and complete the other information section as follows: Refund claims must be made during the calendar year in which the return was prepared. Web the irs form 4549 is the income tax examination changes letter. Web i received a 4549 letter today does that mean i owe that balance or is that the refund i’ll be getting back? Web after the field examiner’s review, the taxpayers’ representative signed a form 4549 that showed a refund due principally to a loss on a sale.

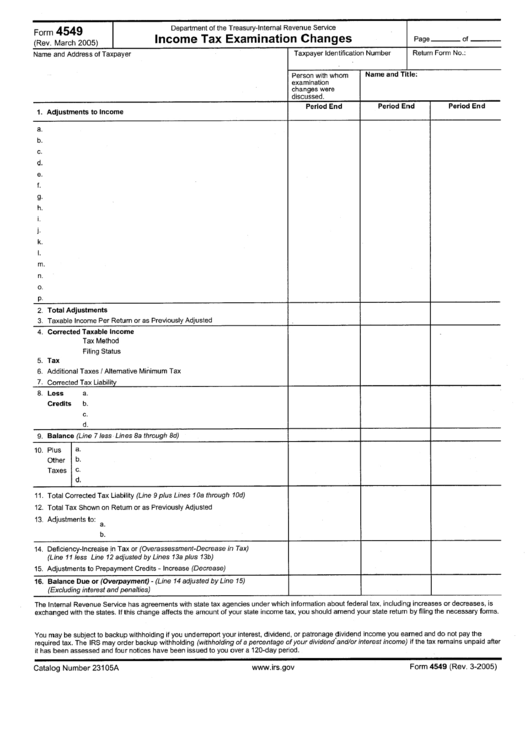

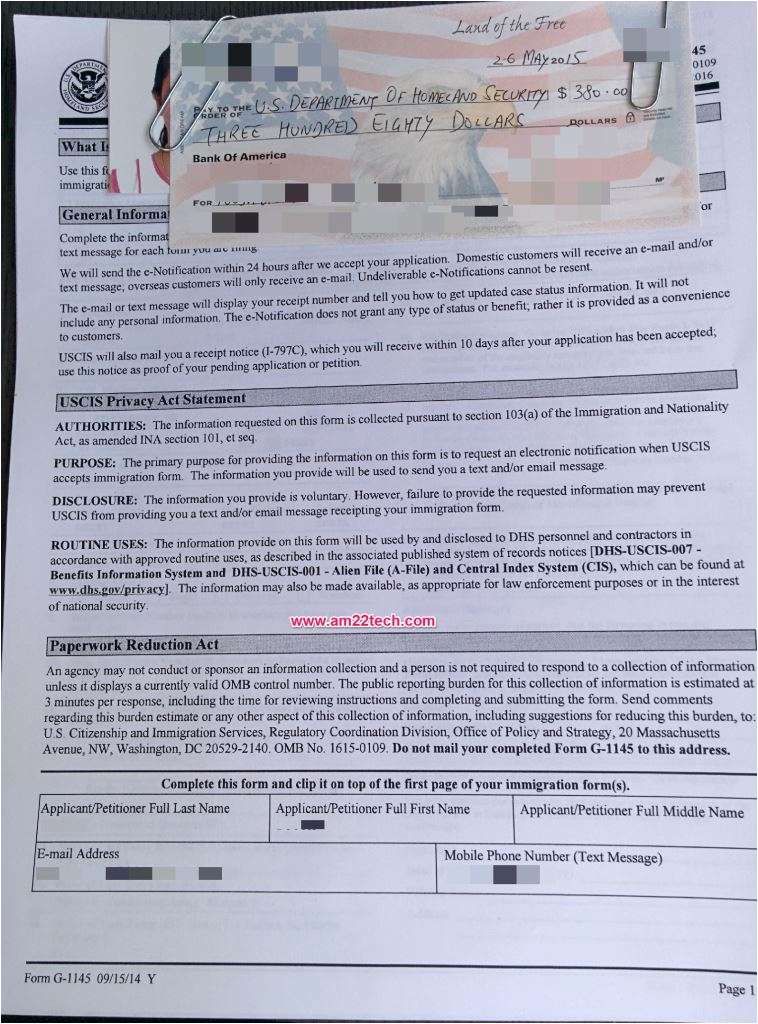

Form 4549 Tax Examination Changes March 2005 printable pdf

On (date) you filed a claim using form (843, 1040x, 1120x) for a refund of $ (amount) for (year). The form will include a summary of the proposed changes to the tax return, penalties, and interest determined as an outcome of the audit. The accountant can help you figure out what to do about the notice you received. Web i.

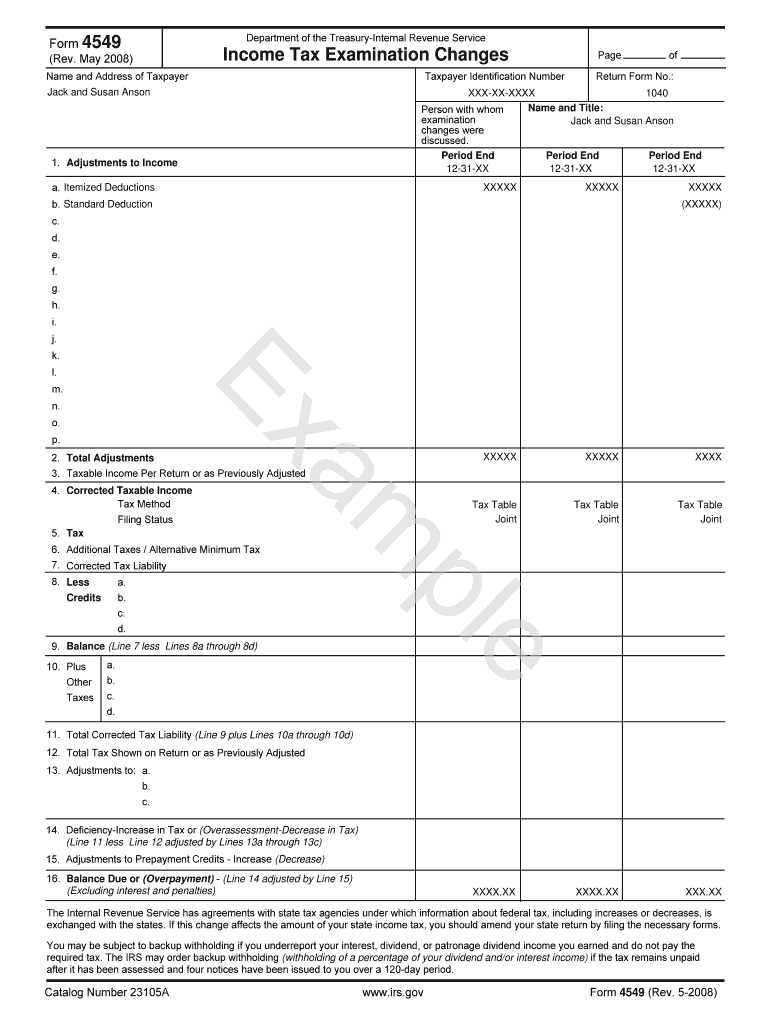

Irs form 4549 Fill out & sign online DocHub

Web the irs form 4549 is the income tax examination changes letter. The agency may think you failed to report some income, took too many deductions, or didn't pay enough taxes. This form means the irs is questioning your tax return. The irs form 4549 also called the income tax examination letter informs the taxpayer about the proposed changes to.

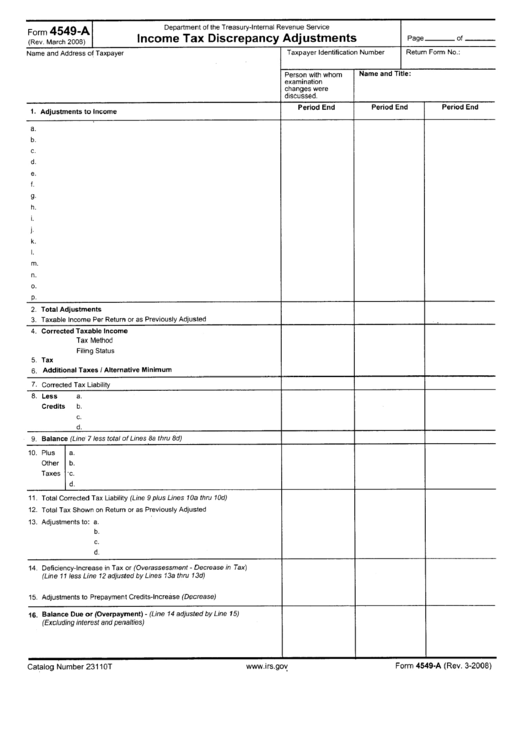

Form 4549A Tax Discrepancy Adjustments printable pdf download

Web i received a 4549 letter today does that mean i owe that balance or is that the refund i’ll be getting back? Web examiners must prepare and issue form 4549 showing the adjustments to the tax and/or penalties, and complete the other information section as follows: The irs form 4549 also called the income tax examination letter informs the.

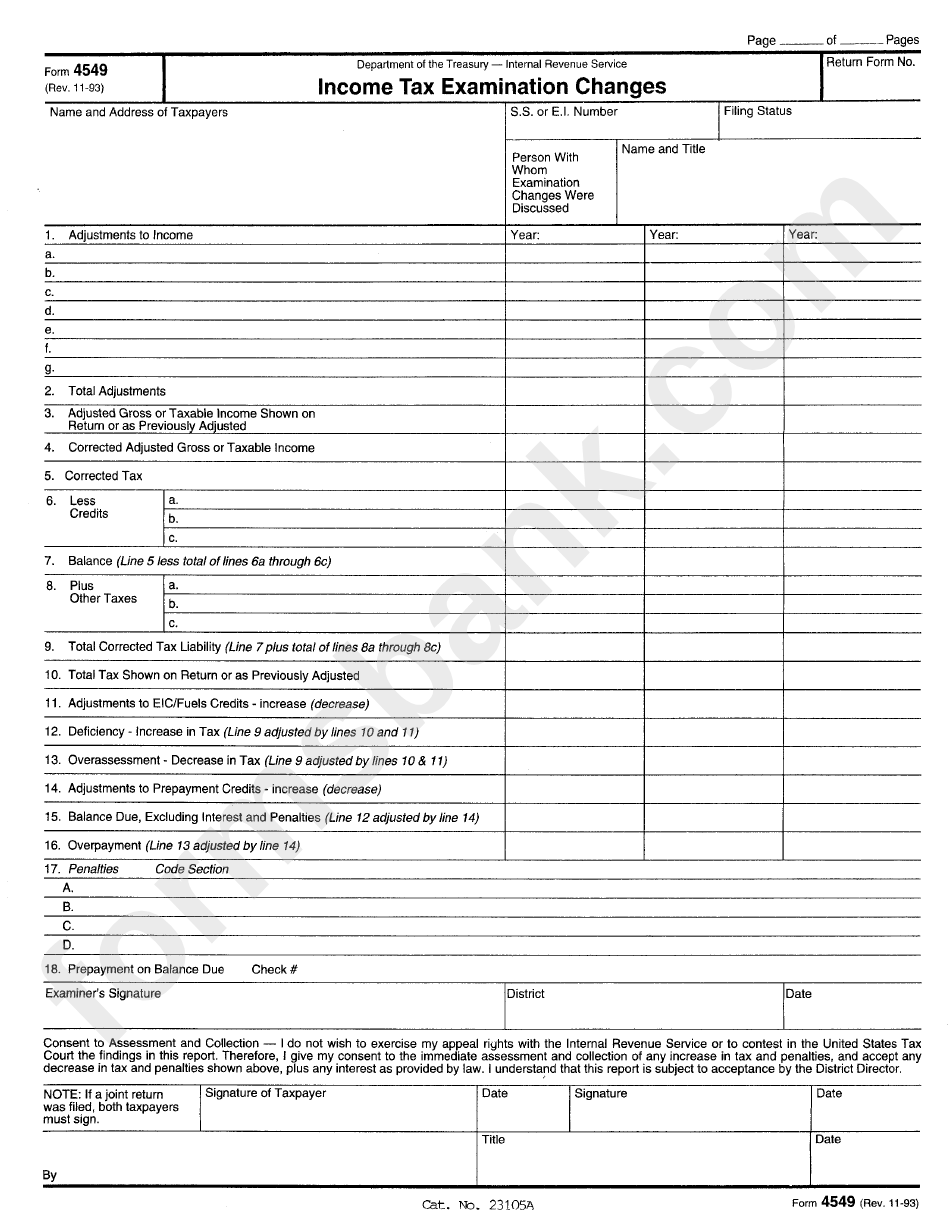

RA's Report Was Initial Determination For Penalty Assessment Purposes

The agency may think you failed to report some income, took too many deductions, or didn't pay enough taxes. The form will include a summary of the proposed changes to the tax return, penalties, and interest determined as an outcome of the audit. Web the irs form 4549 is the income tax examination changes letter. Web chief counsel advice 201921013.

Form 4549 Tax Examination Changes Department Of The Treasury

The irs form 4549 also called the income tax examination letter informs the taxpayer about the proposed changes to the tax return, penalties, and interest as a result of the audit. Web form 4549 is an irs form that is sent to taxpayers whose returns have been audited. Web i received a 4549 letter today does that mean i owe.

Irs form 4549 Sample Glendale Community

Web after the field examiner’s review, the taxpayers’ representative signed a form 4549 that showed a refund due principally to a loss on a sale. On (date) you filed a claim using form (843, 1040x, 1120x) for a refund of $ (amount) for (year). When did you receive the notice? Web examiners must prepare and issue form 4549 showing the.

Irs Form 4549 ≡ Fill Out Printable PDF Forms Online

Web chief counsel advice 201921013 in chief counsel advice (cca), irs shall held that print 4549, income tax examination changed, i.e.,. What type of notice did you receive? On (date) you filed a claim using form (843, 1040x, 1120x) for a refund of $ (amount) for (year). Form 4666, summary of employment tax. The agency may think you failed to.

Irs Form 4549 ≡ Fill Out Printable PDF Forms Online

Web following an audit, the irs will communicate with you about the results. The agency may think you failed to report some income, took too many deductions, or didn't pay enough taxes. It will include information, including: Form 4666, summary of employment tax. When did you receive the notice?

US Tax Relief Group

Web the irs form 4549 is the income tax examination changes letter. Web i received a 4549 letter today does that mean i owe that balance or is that the refund i’ll be getting back? This form means the irs is questioning your tax return. Web after the field examiner’s review, the taxpayers’ representative signed a form 4549 that showed.

Irs form 4549 Sample Glendale Community

The form will include a summary of the proposed changes to the tax return, penalties, and interest determined as an outcome of the audit. This form means the irs is questioning your tax return. Web examiners must prepare and issue form 4549 showing the adjustments to the tax and/or penalties, and complete the other information section as follows: Web form.

The Form Will Include A Summary Of The Proposed Changes To The Tax Return, Penalties, And Interest Determined As An Outcome Of The Audit.

Have you received notices like. Web i received a 4549 letter today does that mean i owe that balance or is that the refund i’ll be getting back? It will include information, including: The irs form 4549 also called the income tax examination letter informs the taxpayer about the proposed changes to the tax return, penalties, and interest as a result of the audit.

Web Examiners Must Prepare And Issue Form 4549 Showing The Adjustments To The Tax And/Or Penalties, And Complete The Other Information Section As Follows:

Web the irs form 4549 is the income tax examination changes letter. Web if you discover an h&r block error on your return that entitles you to a larger refund (or smaller tax liability), we’ll refund the tax prep fee for that return and file an amended return at no additional charge. Web following an audit, the irs will communicate with you about the results. Web after the field examiner’s review, the taxpayers’ representative signed a form 4549 that showed a refund due principally to a loss on a sale.

This Form Means The Irs Is Questioning Your Tax Return.

Web chief counsel advice 201921013 in chief counsel advice (cca), irs shall held that print 4549, income tax examination changed, i.e.,. Form 4666, summary of employment tax. Refund claims must be made during the calendar year in which the return was prepared. The agency may think you failed to report some income, took too many deductions, or didn't pay enough taxes.

The Accountant Can Help You Figure Out What To Do About The Notice You Received.

On (date) you filed a claim using form (843, 1040x, 1120x) for a refund of $ (amount) for (year). However, thereafter, as a result of the other audit, irs assessed additional tax based on cancellation of indebtedness income, and the refund that it sent the taxpayers was less than the amount. What type of notice did you receive? Web form 4549 is an irs form that is sent to taxpayers whose returns have been audited.