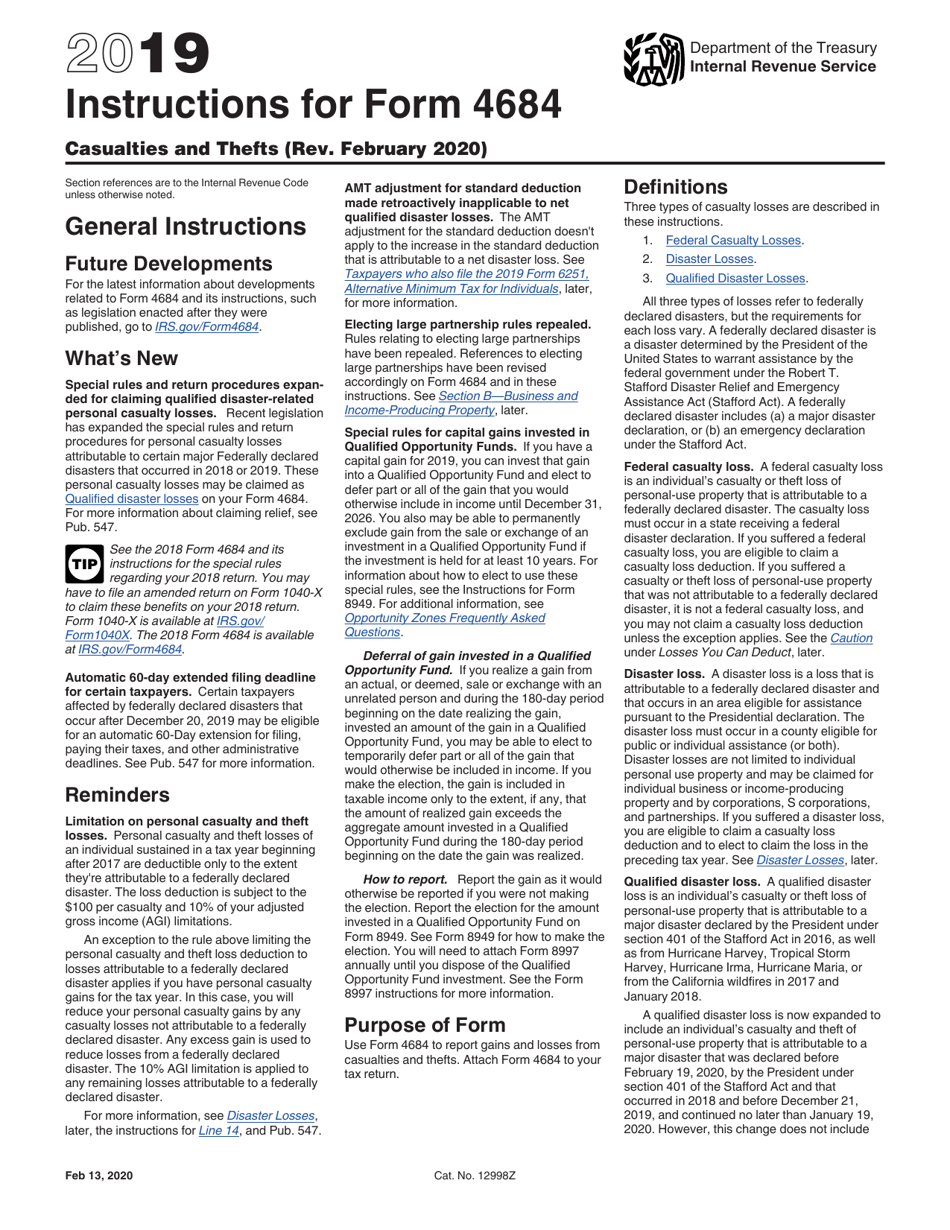

Form 4684 Instructions 2022

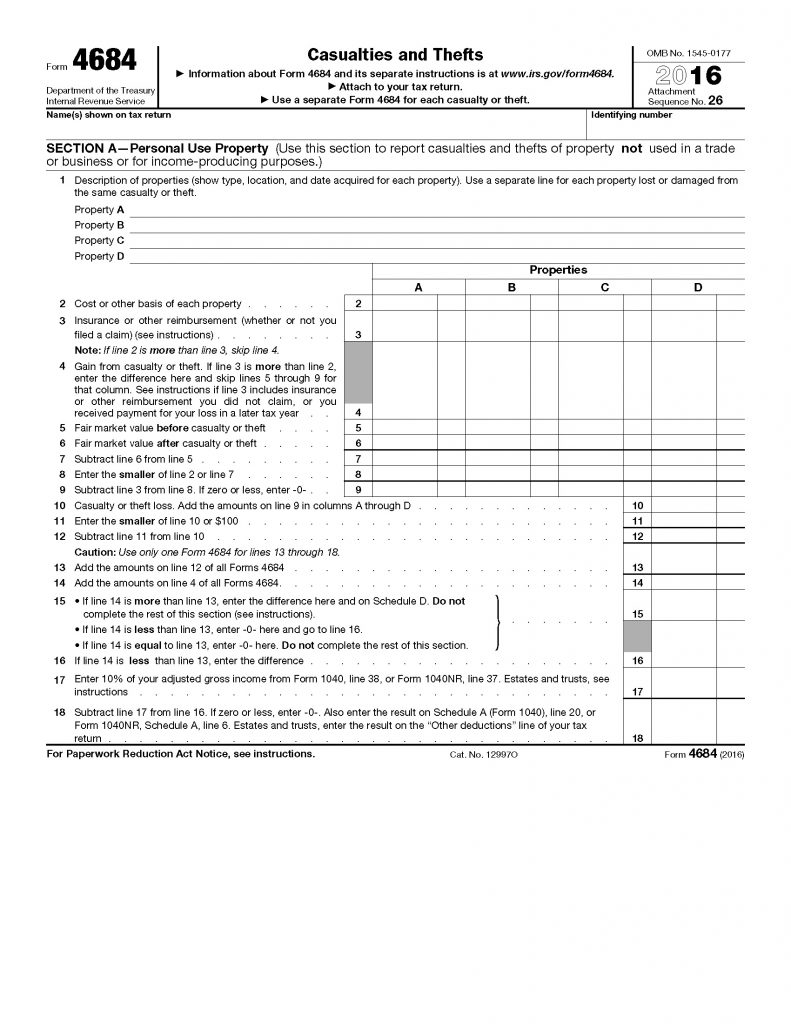

Form 4684 Instructions 2022 - Web updated for tax year 2017 • december 9, 2022 01:02 pm overview you may be eligible to claim a casualty deduction for your property loss if you suffer property. Web general instructions other forms you may have to file use form 461 to figure your excess business loss. Web ryan eichler what is form 4684: Web form 4684 is for a casualty loss. Form 4684 is an internal revenue service (irs) form for reporting gains or losses from casualties and. Want to talk to an expert? Web suggestions for redesign of the form 4684 to make the computation less cumbersome and still follow the law are welcome and may be submitted at the. If there are more than. Web information about form 4684, casualties and thefts, including recent updates, related forms and instructions on how to file. Tax relief for homeowners with corrosive drywall:

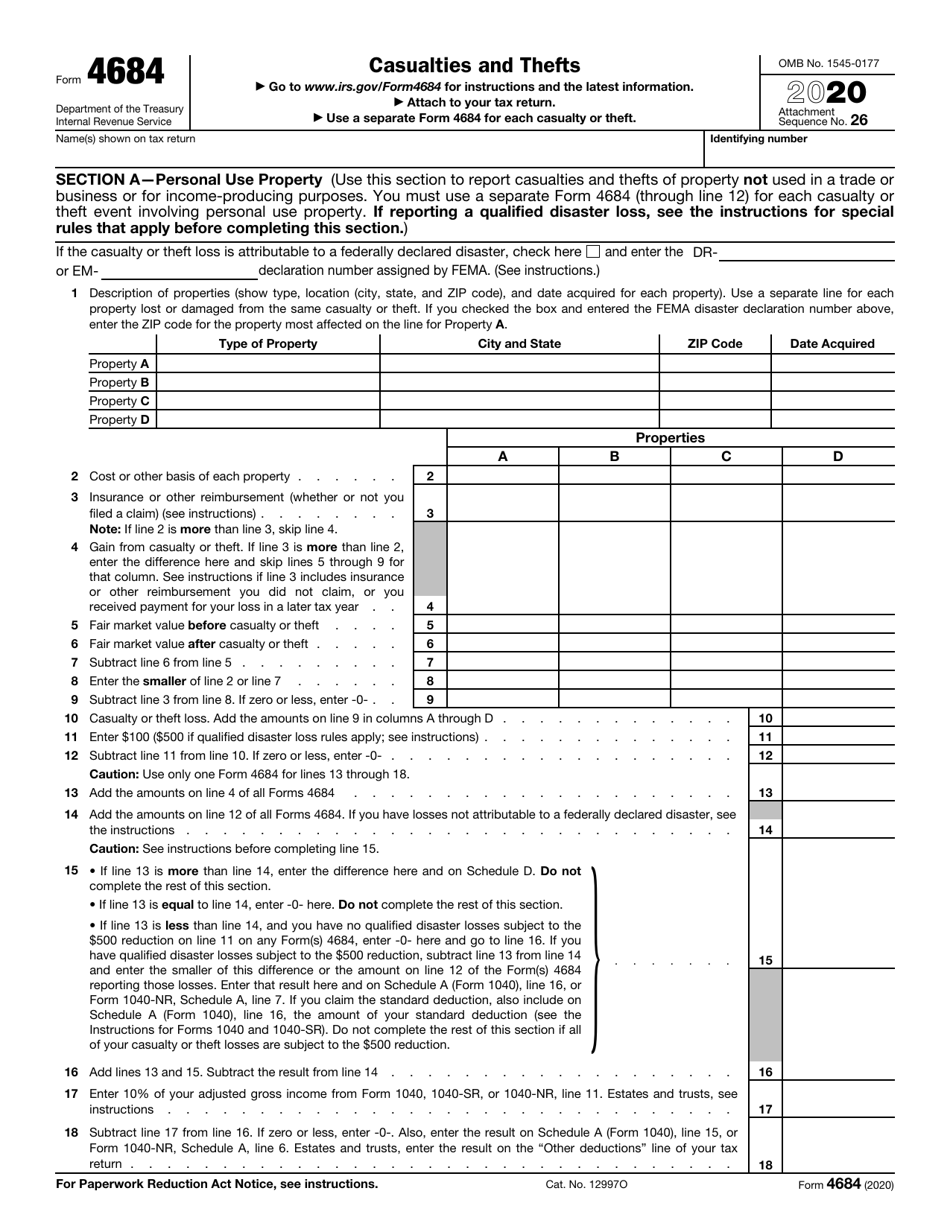

Web use form 4684, casualties and thefts, to report involuntary conversions from casualties and thefts. Use form 8949 to report the sale or exchange of a capital asset. Web use this screen to complete form 4684, section a, casualties and thefts of personal use property. Current revision publication 547 pdf ( html | ebook epub) recent developments. Enter information for each casualty or theft occurrence. Form 4684 is an internal revenue service (irs) form for reporting gains or losses from casualties and. Complete and sign it in seconds from your desktop or mobile device, anytime and anywhere. Get everything done in minutes. Web form 4684 2021 casualties and thefts department of the treasury internal revenue service go to www.irs.gov/form4684 for instructions and the latest information. This article will assist you with entering a casualty or theft for form 4684 in.

Web entering a casualty or theft for form 4684. Please use the link below to download 2022. Web general instructions other forms you may have to file use form 461 to figure your excess business loss. Web generating form 4684 casualty or theft loss for an individual return in lacerte solved • by intuit • 250 • updated september 08, 2022 this article will show you how. Form 4684 is an internal revenue service (irs) form for reporting gains or losses from casualties and. Web use this screen to complete form 4684, section a, casualties and thefts of personal use property. Web form 4684 2021 casualties and thefts department of the treasury internal revenue service go to www.irs.gov/form4684 for instructions and the latest information. Solved•by intuit•updated july 19, 2022. Web ryan eichler what is form 4684: Want to talk to an expert?

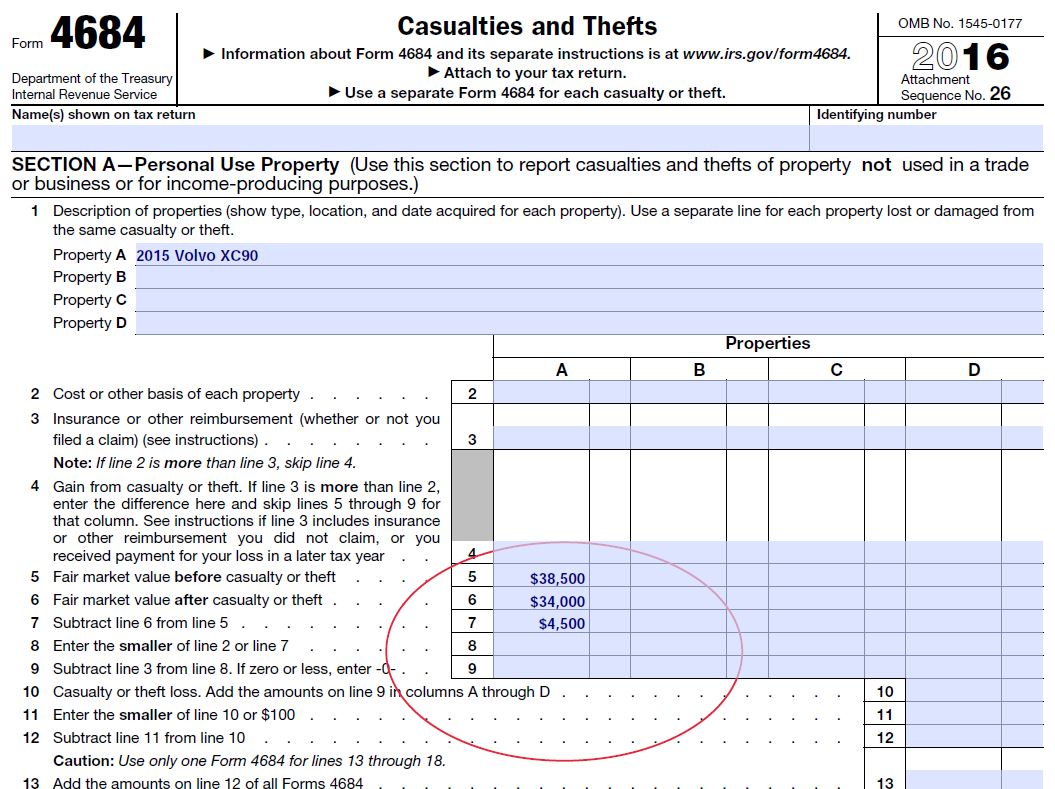

Diminished Value and Taxes, IRS form 4684 Diminished Value of

This year, the casualty losses you can deduct are mainly limited to those caused by federally declared disasters. Web form 4684 is for a casualty loss. Complete and sign it in seconds from your desktop or mobile device, anytime and anywhere. Solved•by intuit•updated july 19, 2022. This article will assist you with entering a casualty or theft for form 4684.

Form 4684 instructions 2018

Attach form 4684 to your tax. Current revision publication 547 pdf ( html | ebook epub) recent developments. Web generating form 4684 casualty or theft loss for an individual return in lacerte solved • by intuit • 250 • updated september 08, 2022 this article will show you how. This year, the casualty losses you can deduct are mainly limited.

Publication 225, Farmer's Tax Guide; Chapter 20 Sample Return

Web entering a casualty or theft for form 4684. If there are more than. Attach form 4684 to your tax. Complete and sign it in seconds from your desktop or mobile device, anytime and anywhere. Want to talk to an expert?

Publication 225, Farmer's Tax Guide; Chapter 20 Sample Return

Web form 4684 is for a casualty loss. Tax relief for homeowners with corrosive drywall: Want to talk to an expert? Web ryan eichler what is form 4684: Web entering a casualty or theft for form 4684.

Diminished Value and Taxes, IRS form 4684 Diminished Value Car Appraisal

Web federal casualties and thefts form 4684 pdf form content report error it appears you don't have a pdf plugin for this browser. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. If there are more than. Use form 8949 to report the sale or exchange of a capital asset..

IRS Form 2553 Instructions How and Where to File This Tax Form

Web federal casualties and thefts form 4684 pdf form content report error it appears you don't have a pdf plugin for this browser. Get everything done in minutes. Web use this screen to complete form 4684, section a, casualties and thefts of personal use property. Form 4684 is an internal revenue service (irs) form for reporting gains or losses from.

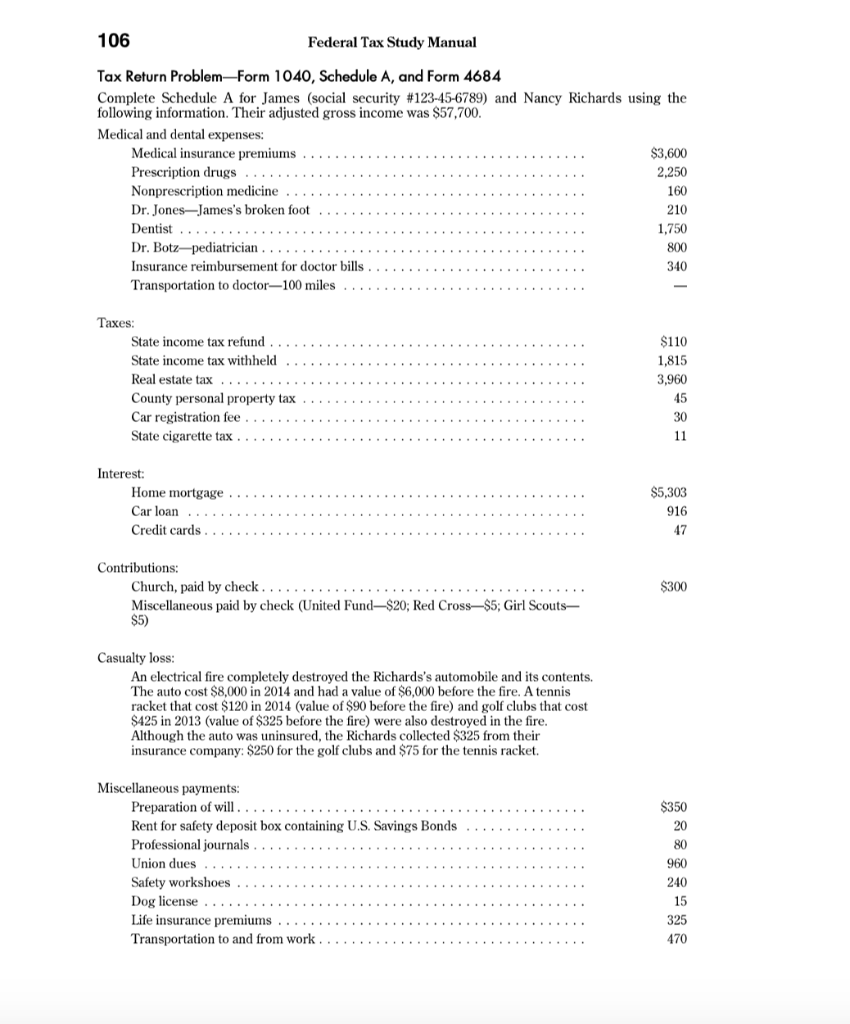

106 Federal Tax Study Manual Tax Return ProblemForm

Get everything done in minutes. Tax relief for homeowners with corrosive drywall: This year, the casualty losses you can deduct are mainly limited to those caused by federally declared disasters. Web use this screen to complete form 4684, section a, casualties and thefts of personal use property. Use form 8949 to report the sale or exchange of a capital asset.

IRS Form 4684 Download Fillable PDF or Fill Online Casualties and

Tax relief for homeowners with corrosive drywall: Web a casualty loss is claimed as an itemized deduction on schedule a of form 1040 and form 4684, casualties and thefts. Web entering a casualty or theft for form 4684. Solved•by intuit•updated july 19, 2022. If there are more than.

File major disaster claims on Form 4684 Don't Mess With Taxes

Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Please use the link below to download 2022. Instructions for form 4684, casualties and thefts 2022 01/12/2023 Form 4684 is an internal revenue service (irs) form for reporting gains or losses from casualties and. Web form 4684 2021 casualties and thefts.

Download Instructions for IRS Form 4684 Casualties and Thefts PDF, 2019

Enter information for each casualty or theft occurrence. Use form 6252, installment sale income, to report the sale of property under. Web use form 4684, casualties and thefts, to report involuntary conversions from casualties and thefts. If there are more than. Please use the link below to download 2022.

Use Form 8949 To Report The Sale Or Exchange Of A Capital Asset.

Web use this screen to complete form 4684, section a, casualties and thefts of personal use property. Web generating form 4684 casualty or theft loss for an individual return in lacerte solved • by intuit • 250 • updated september 08, 2022 this article will show you how. Tax relief for homeowners with corrosive drywall: Web a loss on deposits occurs when your financial institution becomes insolvent or bankrupt.

Use Form 6252, Installment Sale Income, To Report The Sale Of Property Under.

Web information about form 4684, casualties and thefts, including recent updates, related forms and instructions on how to file. Web form 4684 is for a casualty loss. Instructions for form 4684, casualties and thefts 2022 01/12/2023 Web ryan eichler what is form 4684:

Attach Form 4684 To Your Tax.

Get everything done in minutes. Please use the link below to download 2022. Web a casualty loss is claimed as an itemized deduction on schedule a of form 1040 and form 4684, casualties and thefts. Web general instructions future developments for the latest information about developments related to form 4684 and its instructions, such as legislation enacted after they were.

Current Revision Publication 547 Pdf ( Html | Ebook Epub) Recent Developments.

Enter information for each casualty or theft occurrence. Web entering a casualty or theft for form 4684. Solved•by intuit•updated july 19, 2022. Web updated for tax year 2017 • december 9, 2022 01:02 pm overview you may be eligible to claim a casualty deduction for your property loss if you suffer property.