Form 480.6C Puerto Rico

Form 480.6C Puerto Rico - Edit your 480 6c puerto rico online type text, add images, blackout confidential details, add comments, highlights and more. 480.5 (a) summary of informative returns. Is this reported on 1040 & Web the forms (480.6c) must be file by april 18, 2022. Web what makes the puerto rico tax form 480 6c legally binding? Ask a tax expert ask an expert tax questions i received a form 480.6c for work i did in puerto rico in… i received a form 480.6c for work i did in. Web us resident sold house in puerto rico, received form 480.6c showing house sale +tax withheld for non resident. The forms (480.7e) must be file on or before the due date of the income tax return, including extensions. Web tax have a tax question? Web prepare el formulario 480.6c por cada individuo o fiduciario no residente o extranjero no residente y por cada corporación o sociedad extranjera no dedicada a industria o.

Web what makes the puerto rico tax form 480 6c legally binding? The forms (480.7e) must be file on or before the due date of the income tax return, including extensions. Web prepare el formulario 480.6c por cada individuo o fiduciario no residente o extranjero no residente y por cada corporación o sociedad extranjera no dedicada a industria o. Web prepare form 480.6c for each nonresident individual or fiduciary or nonresident alien and for each foreign corporation or partnership not engaged in trade or business in puerto. Ask a tax expert ask an expert tax questions i received a form 480.6c for work i did in puerto rico in… i received a form 480.6c for work i did in. Web us resident sold house in puerto rico, received form 480.6c showing house sale +tax withheld for non resident. Web 480.6b—reporting for puerto rico residents who hold puerto rico equities and bonds that are subject to withholding (ptax). Is this reported on 1040 & Web tax have a tax question? Sign it in a few clicks draw your signature, type.

Sign it in a few clicks draw your signature, type. Web the forms (480.6c) must be file by april 18, 2022. Web prepare el formulario 480.6c por cada individuo o fiduciario no residente o extranjero no residente y por cada corporación o sociedad extranjera no dedicada a industria o. Web tax have a tax question? Web prepare form 480.6c for each nonresident individual or fiduciary or nonresident alien and for each foreign corporation or partnership not engaged in trade or business in puerto. Is this reported on 1040 & Edit your 480 6c puerto rico online type text, add images, blackout confidential details, add comments, highlights and more. Web us resident sold house in puerto rico, received form 480.6c showing house sale +tax withheld for non resident. Ask a tax expert ask an expert tax questions i received a form 480.6c for work i did in puerto rico in… i received a form 480.6c for work i did in. Web what makes the puerto rico tax form 480 6c legally binding?

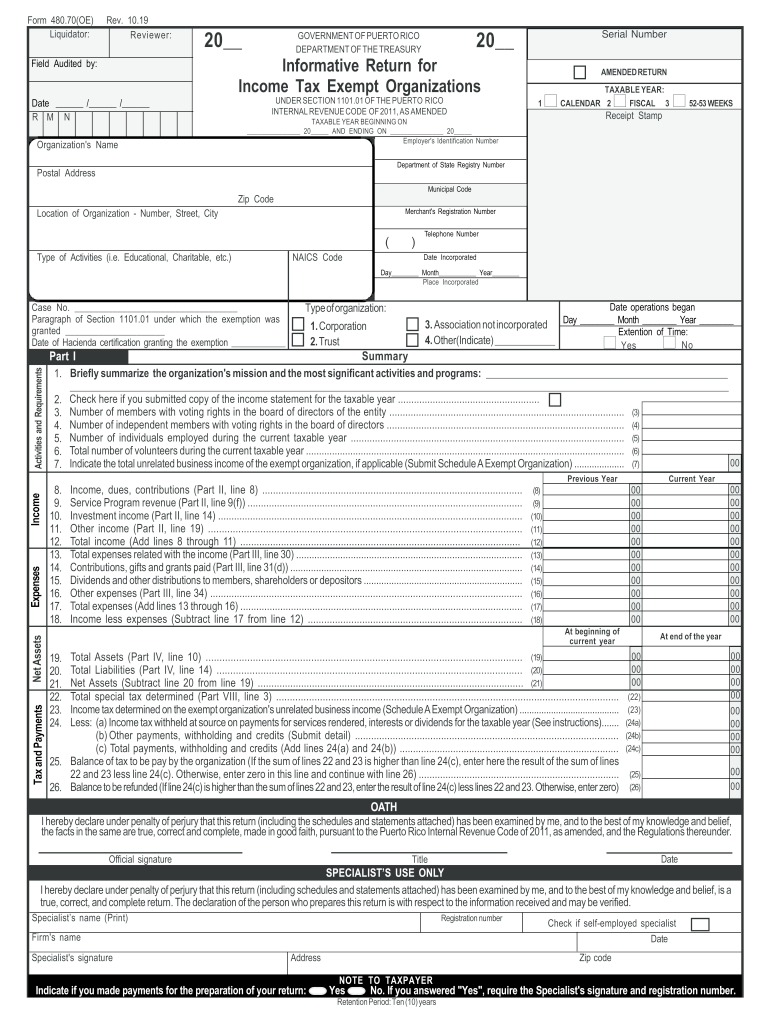

20192023 Form PR 480.70(OE) Fill Online, Printable, Fillable, Blank

Web the forms (480.6c) must be file by april 18, 2022. Sign it in a few clicks draw your signature, type. Web tax have a tax question? Web us resident sold house in puerto rico, received form 480.6c showing house sale +tax withheld for non resident. Web 480.6b—reporting for puerto rico residents who hold puerto rico equities and bonds that.

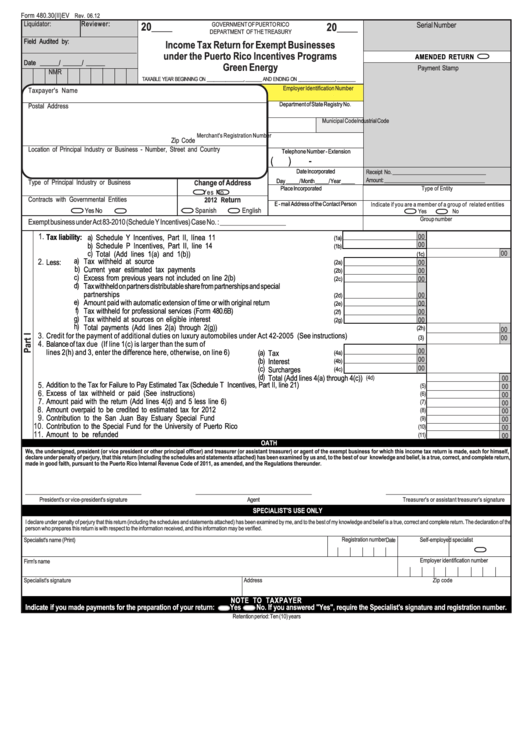

2016 Form PR 480.30(II) Fill Online, Printable, Fillable, Blank pdfFiller

Sign it in a few clicks draw your signature, type. 480.5 (a) summary of informative returns. Is this reported on 1040 & Web us resident sold house in puerto rico, received form 480.6c showing house sale +tax withheld for non resident. Web 480.6b—reporting for puerto rico residents who hold puerto rico equities and bonds that are subject to withholding (ptax).

PR 480.7(OE) 20172021 Fill out Tax Template Online US Legal Forms

Web us resident sold house in puerto rico, received form 480.6c showing house sale +tax withheld for non resident. Is this reported on 1040 & Web the forms (480.6c) must be file by april 18, 2022. Web 480.6b—reporting for puerto rico residents who hold puerto rico equities and bonds that are subject to withholding (ptax). Web prepare el formulario 480.6c.

Form 480.7E Tax Alert RSM Puerto Rico

Web prepare el formulario 480.6c por cada individuo o fiduciario no residente o extranjero no residente y por cada corporación o sociedad extranjera no dedicada a industria o. Ask a tax expert ask an expert tax questions i received a form 480.6c for work i did in puerto rico in… i received a form 480.6c for work i did in..

Form 480.30(Ii)ev Tax Return For Exempt Businesses Under The

Sign it in a few clicks draw your signature, type. Web us resident sold house in puerto rico, received form 480.6c showing house sale +tax withheld for non resident. Web what makes the puerto rico tax form 480 6c legally binding? Web tax have a tax question? 480.5 (a) summary of informative returns.

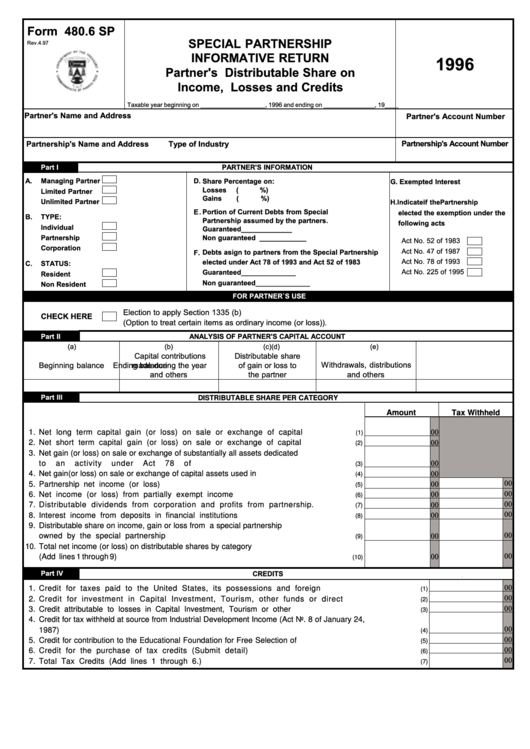

Form 480.6 Sp Partner'S Distributable Share On Losses And

Edit your 480 6c puerto rico online type text, add images, blackout confidential details, add comments, highlights and more. Web 480.6b—reporting for puerto rico residents who hold puerto rico equities and bonds that are subject to withholding (ptax). Web us resident sold house in puerto rico, received form 480.6c showing house sale +tax withheld for non resident. Is this reported.

puerto rico form 480 20 instructions 2018 Fill out & sign online DocHub

480.5 (a) summary of informative returns. The forms (480.7e) must be file on or before the due date of the income tax return, including extensions. Edit your 480 6c puerto rico online type text, add images, blackout confidential details, add comments, highlights and more. Is this reported on 1040 & Web 480.6b—reporting for puerto rico residents who hold puerto rico.

Formulario 480.6a 2018 Actualizado mayo 2022

Web tax have a tax question? Web 480.6b—reporting for puerto rico residents who hold puerto rico equities and bonds that are subject to withholding (ptax). Web the forms (480.6c) must be file by april 18, 2022. Web what makes the puerto rico tax form 480 6c legally binding? Sign it in a few clicks draw your signature, type.

The Form of Money Puerto Rico Tax Haven

Web us resident sold house in puerto rico, received form 480.6c showing house sale +tax withheld for non resident. Ask a tax expert ask an expert tax questions i received a form 480.6c for work i did in puerto rico in… i received a form 480.6c for work i did in. Web prepare form 480.6c for each nonresident individual or.

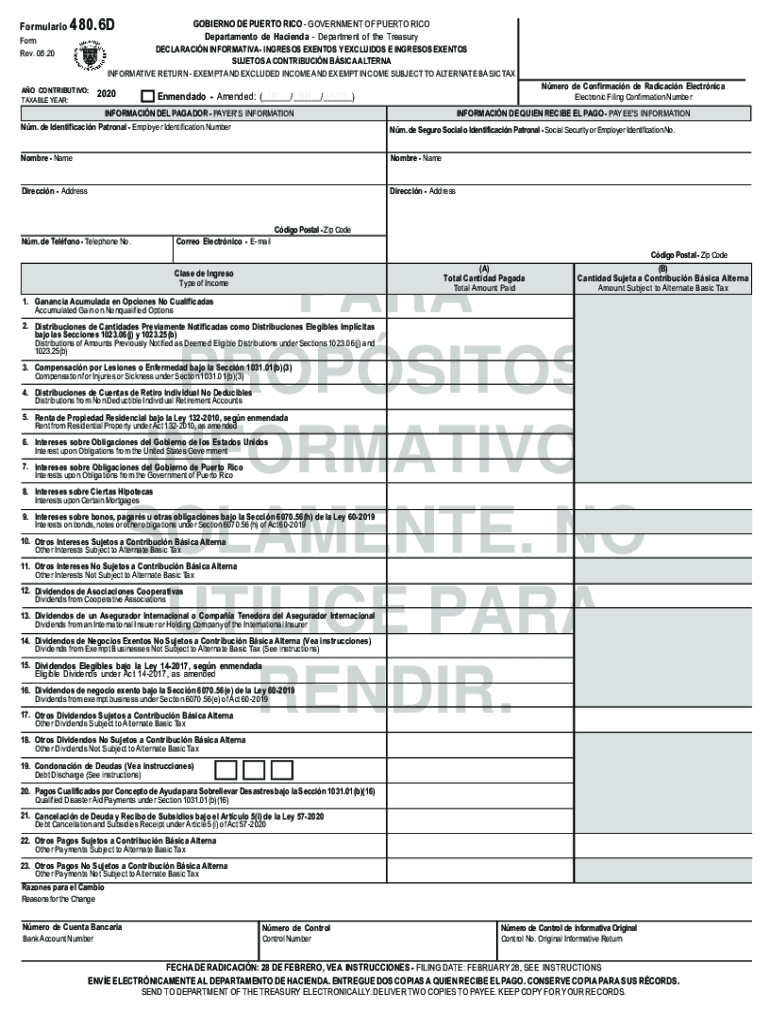

PR 480.6D 20202021 Fill out Tax Template Online US Legal Forms

480.5 (a) summary of informative returns. Web what makes the puerto rico tax form 480 6c legally binding? Web 480.6b—reporting for puerto rico residents who hold puerto rico equities and bonds that are subject to withholding (ptax). Web the forms (480.6c) must be file by april 18, 2022. The forms (480.7e) must be file on or before the due date.

Web Tax Have A Tax Question?

Ask a tax expert ask an expert tax questions i received a form 480.6c for work i did in puerto rico in… i received a form 480.6c for work i did in. Web the forms (480.6c) must be file by april 18, 2022. Web prepare el formulario 480.6c por cada individuo o fiduciario no residente o extranjero no residente y por cada corporación o sociedad extranjera no dedicada a industria o. Web what makes the puerto rico tax form 480 6c legally binding?

The Forms (480.7E) Must Be File On Or Before The Due Date Of The Income Tax Return, Including Extensions.

Web 480.6b—reporting for puerto rico residents who hold puerto rico equities and bonds that are subject to withholding (ptax). Web us resident sold house in puerto rico, received form 480.6c showing house sale +tax withheld for non resident. 480.5 (a) summary of informative returns. Web prepare form 480.6c for each nonresident individual or fiduciary or nonresident alien and for each foreign corporation or partnership not engaged in trade or business in puerto.

Sign It In A Few Clicks Draw Your Signature, Type.

Edit your 480 6c puerto rico online type text, add images, blackout confidential details, add comments, highlights and more. Is this reported on 1040 &