Form 5695 Pdf

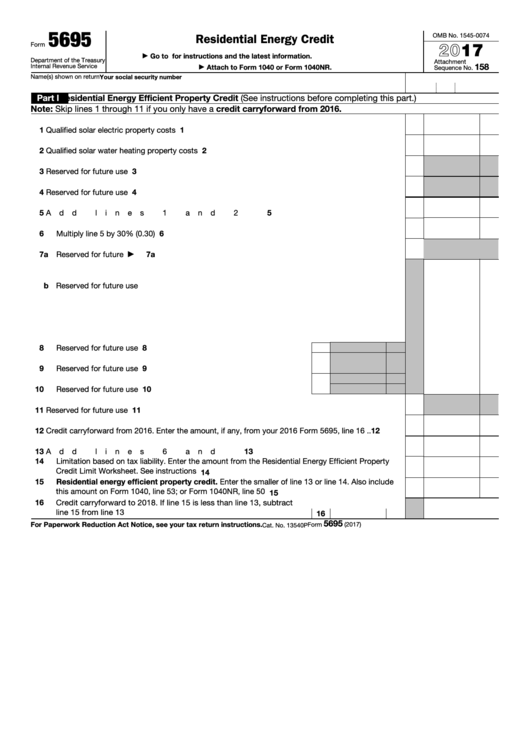

Form 5695 Pdf - Web learn about claiming residential energy credits using form 5695 here. Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2022 • december 1, 2022 09:04 am overview. Web complete form 5695 in just a couple of moments by using the instructions below: Attach to form 1040 or 1040nr. The residential energy credits are: More about the federal form 5695 tax credit we last. Go to www.freetaxusa.com to start your free return today! Web purpose of form use form 5695 to figure and take your residential energy credits. The residential energy credits are: Download this form print this form more about the.

Web form 5695 (redirected from 5695 form ) a form that one files with the irs to claim tax credits for energy efficient products used in a residence, especially one's home. More about the federal form 5695 tax credit we last. Ad register and edit, fill, sign now your irs form 5695 & more fillable forms. Web what is the irs form 5695? Complete, edit or print tax forms instantly. Web residential energy credits go to www.irs.gov/form5695 for instructions and the latest information. Department of the treasury internal revenue service. The residential energy credits are: Web department of the treasury internal revenue service go to www.irs.gov/form5695 for instructions and the latest information. The residential energy credits are:

Web complete form 5695 in just a couple of moments by using the instructions below: The nonbusiness energy property credit. Department of the treasury internal revenue service. The instructions to form 5695. Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2022 • december 1, 2022 09:04 am overview. Download this form print this form more about the. Web purpose of form use form 5695 to figure and take your residential energy credits. Web form 5695 (redirected from 5695 form ) a form that one files with the irs to claim tax credits for energy efficient products used in a residence, especially one's home. Attach to form 1040 or 1040nr. Go to www.freetaxusa.com to start your free return today!

Nonbusiness Energy Credit Form Armando Friend's Template

Department of the treasury internal revenue service. Complete, edit or print tax forms instantly. Download this form print this form more about the. Attach to form 1040 or 1040nr. Web use form 5695 to figure and take the residential energy efficient property credit.

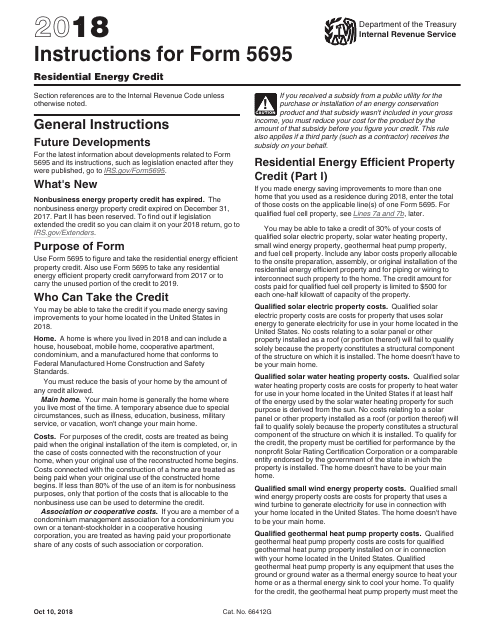

Download Instructions for IRS Form 5695 Residential Energy Credit PDF

More about the federal form 5695 tax credit we last. • the residential energy efficient property credit, and • the. Web get answers to frequently asked questions about entering information from form 5695, residential energy credits, in the individual module of intuit proconnect. Ad register and edit, fill, sign now your irs form 5695 & more fillable forms. Go to.

How to file for the solar tax credit IRS Form 5695 instructions (2023)

The residential energy credits are: More about the federal form 5695 tax credit we last. Web complete form 5695 in just a couple of moments by using the instructions below: Web purpose of form use form 5695 to figure and take your residential energy credits. Attach to form 1040 or 1040nr.

Fillable Form 5695 Residential Energy Credits 2016 printable pdf

Download this form print this form more about the. Find the document template you will need from the library of legal form samples. Web form 5695 (redirected from 5695 form ) a form that one files with the irs to claim tax credits for energy efficient products used in a residence, especially one's home. The instructions to form 5695. Web.

5695 form Fill out & sign online DocHub

Department of the treasury internal revenue service. Web form 5695 (redirected from 5695 form ) a form that one files with the irs to claim tax credits for energy efficient products used in a residence, especially one's home. Web use form 5695 to figure and take the residential energy efficient property credit. The residential energy credits are: Web learn about.

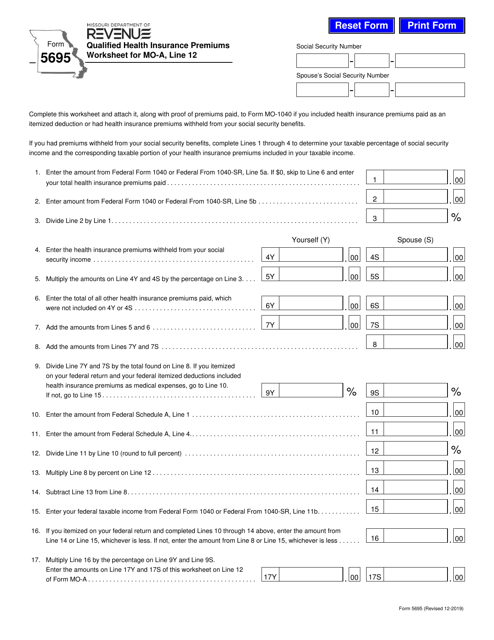

Form 5695 Download Fillable PDF or Fill Online Qualified Health

Attach to form 1040 or 1040nr. Department of the treasury internal revenue service. Web get answers to frequently asked questions about entering information from form 5695, residential energy credits, in the individual module of intuit proconnect. Web complete form 5695 in just a couple of moments by using the instructions below: Web form 5695 department of the treasury internal revenue.

Nonbusiness Energy Credit Form Armando Friend's Template

Department of the treasury internal revenue service. Ad register and edit, fill, sign now your irs form 5695 & more fillable forms. The residential energy credits are: Web complete form 5695 in just a couple of moments by using the instructions below: Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2022 • december.

Form 5695 2021 2022 IRS Forms TaxUni

Complete, edit or print tax forms instantly. The residential energy credits are: Attach to form 1040 or 1040nr. Go to www.freetaxusa.com to start your free return today! The instructions to form 5695.

How to File IRS Form 5695 To Claim Your Renewable Energy Credits

Complete, edit or print tax forms instantly. Download this form print this form more about the. The instructions to form 5695. The residential energy credits are: The nonbusiness energy property credit.

Filing For The Solar Tax Credit Wells Solar

Web get answers to frequently asked questions about entering information from form 5695, residential energy credits, in the individual module of intuit proconnect. Department of the treasury internal revenue service. More about the federal form 5695 tax credit we last. Web purpose of form use form 5695 to figure and take your residential energy credits. Web form 5695 (redirected from.

Web Purpose Of Form Use Form 5695 To Figure And Take Your Residential Energy Credits.

Department of the treasury internal revenue service. • the residential energy efficient property credit, and • the. Web department of the treasury internal revenue service go to www.irs.gov/form5695 for instructions and the latest information. Web form 5695 (redirected from 5695 form ) a form that one files with the irs to claim tax credits for energy efficient products used in a residence, especially one's home.

•The Residential Energy Efficient Property Credit, And •The.

Complete, edit or print tax forms instantly. More about the federal form 5695 tax credit we last. Ad register and edit, fill, sign now your irs form 5695 & more fillable forms. The residential energy credits are:

Download This Form Print This Form More About The.

Attach to form 1040 or 1040nr. Web complete form 5695 in just a couple of moments by using the instructions below: Web residential energy credits go to www.irs.gov/form5695 for instructions and the latest information. The residential energy credits are:

Web What Is The Irs Form 5695?

Web learn about claiming residential energy credits using form 5695 here. The instructions to form 5695. Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2022 • december 1, 2022 09:04 am overview. Go to www.freetaxusa.com to start your free return today!