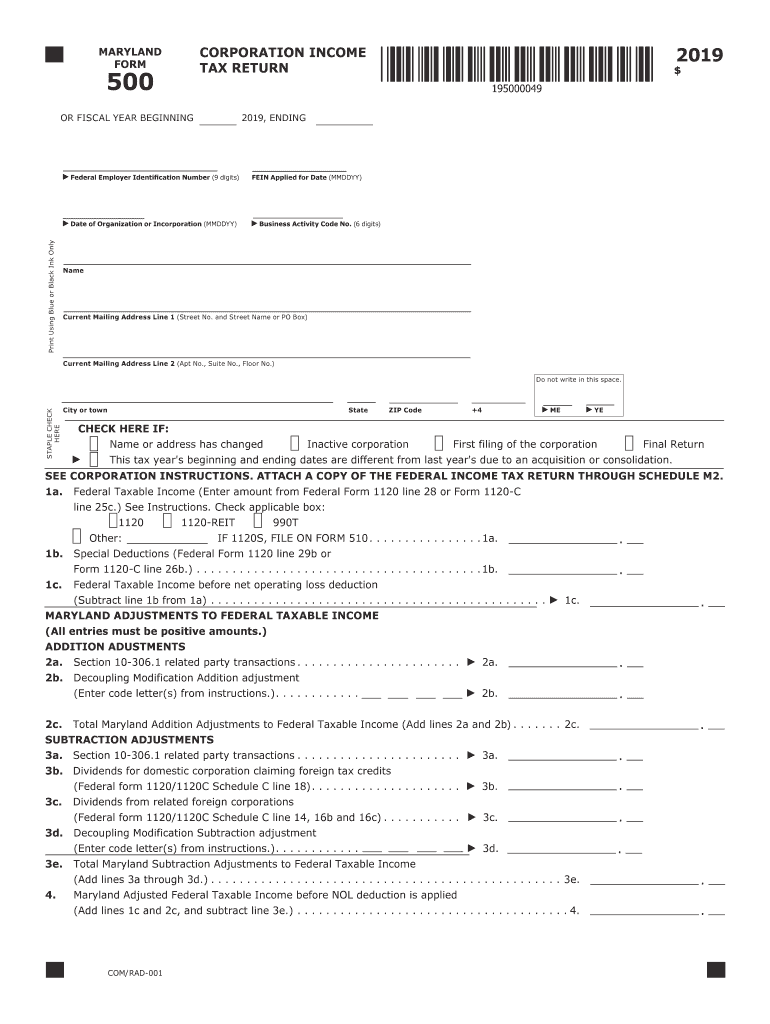

Form 500 Maryland

Form 500 Maryland - This form is for income earned in tax year 2022, with tax returns due in april. Click on the variant to choose if. The fortune 500 list is an annual ranking of the 500 largest. Read pdf viewer and/or browser incompatibility if you cannot open this form. In addition to filing form 500 to calculate and pay the corporation income tax, also file form 510. Web we last updated the maryland corporation income tax return in january 2023, so this is the latest version of form 500, fully updated for tax year 2022. Get ready for tax season deadlines by completing any required tax forms today. Or fiscal year beginning 2021, ending. Web how you can get md form 500 quick and simple: Web 500 (2d) maryland corporation income tax return.

Web if you are a maryland resident, you can file long form 502 and 502b if your federal adjusted gross income is less than $100,000. Get ready for tax season deadlines by completing any required tax forms today. Eligibility requirements include verifying the disability (a. Complete, edit or print tax forms instantly. Or fiscal year beginning 2022, ending. 5 other matters extension of time to file if unable to file. Web every maryland corporation must file a corporation income tax return, using form 500, even if the corporation has no taxable income or is inactive. Web fortune magazine announced the 2021 fortune 500 list this week, which includes six maryland companies. See the outlined fillable lines. Or fiscal year beginning 2021, ending.

Form used by a corporation and certain. If you lived in maryland only part of the year, you. Eligibility requirements include verifying the disability (a. Or fiscal year beginning 2022, ending. Read pdf viewer and/or browser incompatibility if you cannot open this form. Print using blue or black ink only staple. Web if you are a maryland resident, you can file long form 502 and 502b if your federal adjusted gross income is less than $100,000. Web form 500d is a maryland corporate income tax form. Web every maryland corporation must file a corporation income tax return, using form 500, even if the corporation has no taxable income or is inactive. 5 other matters extension of time to file if unable to file.

500 Form Maryland Fill Out and Sign Printable PDF Template signNow

Web how you can get md form 500 quick and simple: Web we last updated maryland form 500 in january 2023 from the maryland comptroller of maryland. 5 other matters extension of time to file if unable to file. Maryland corporation income tax return: Or fiscal year beginning 2022, ending.

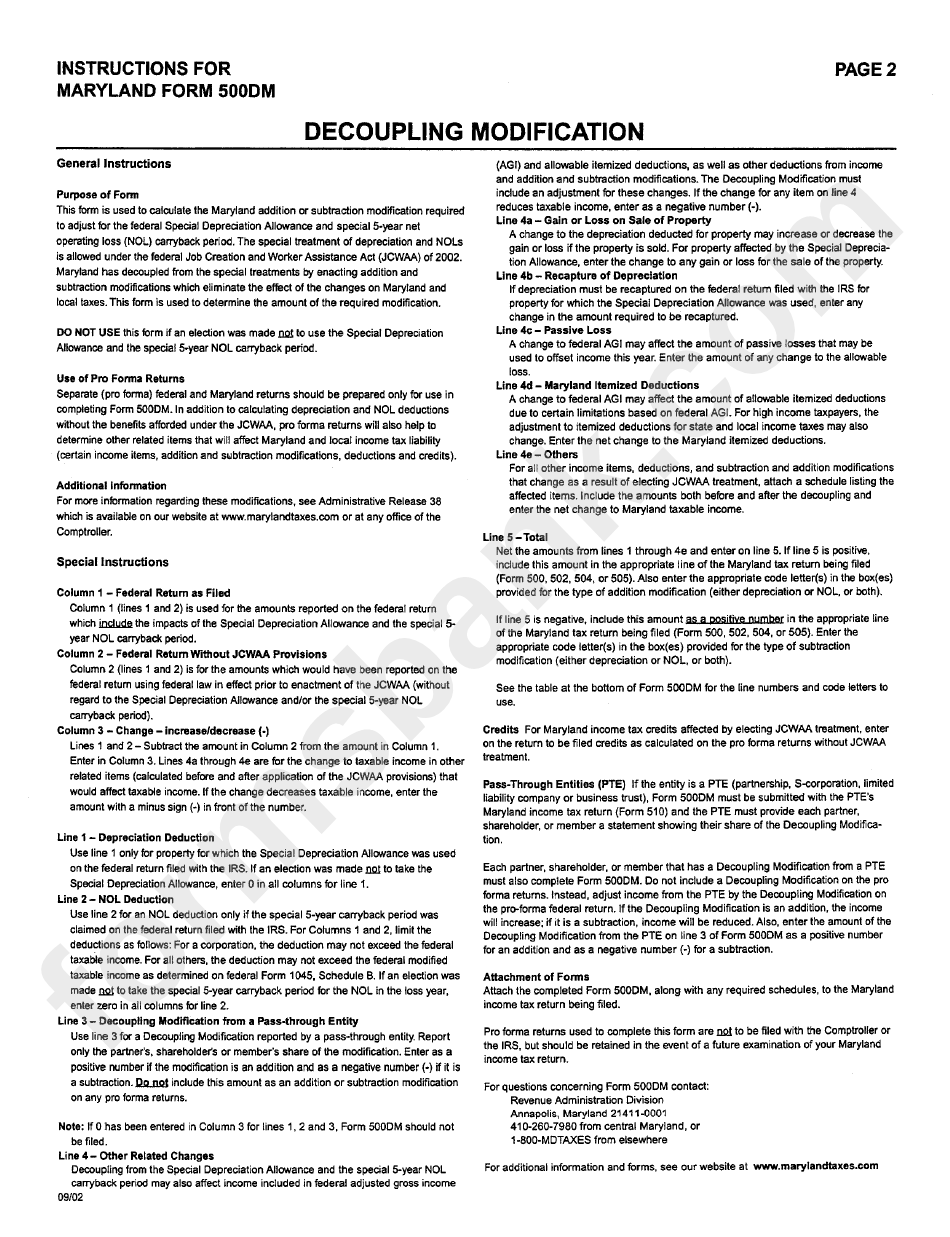

Instructions For Maryland Form 500dm printable pdf download

Print using blue or black ink only staple check. Web we last updated the maryland corporation income tax return in january 2023, so this is the latest version of form 500, fully updated for tax year 2022. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn. 5 other matters extension of time.

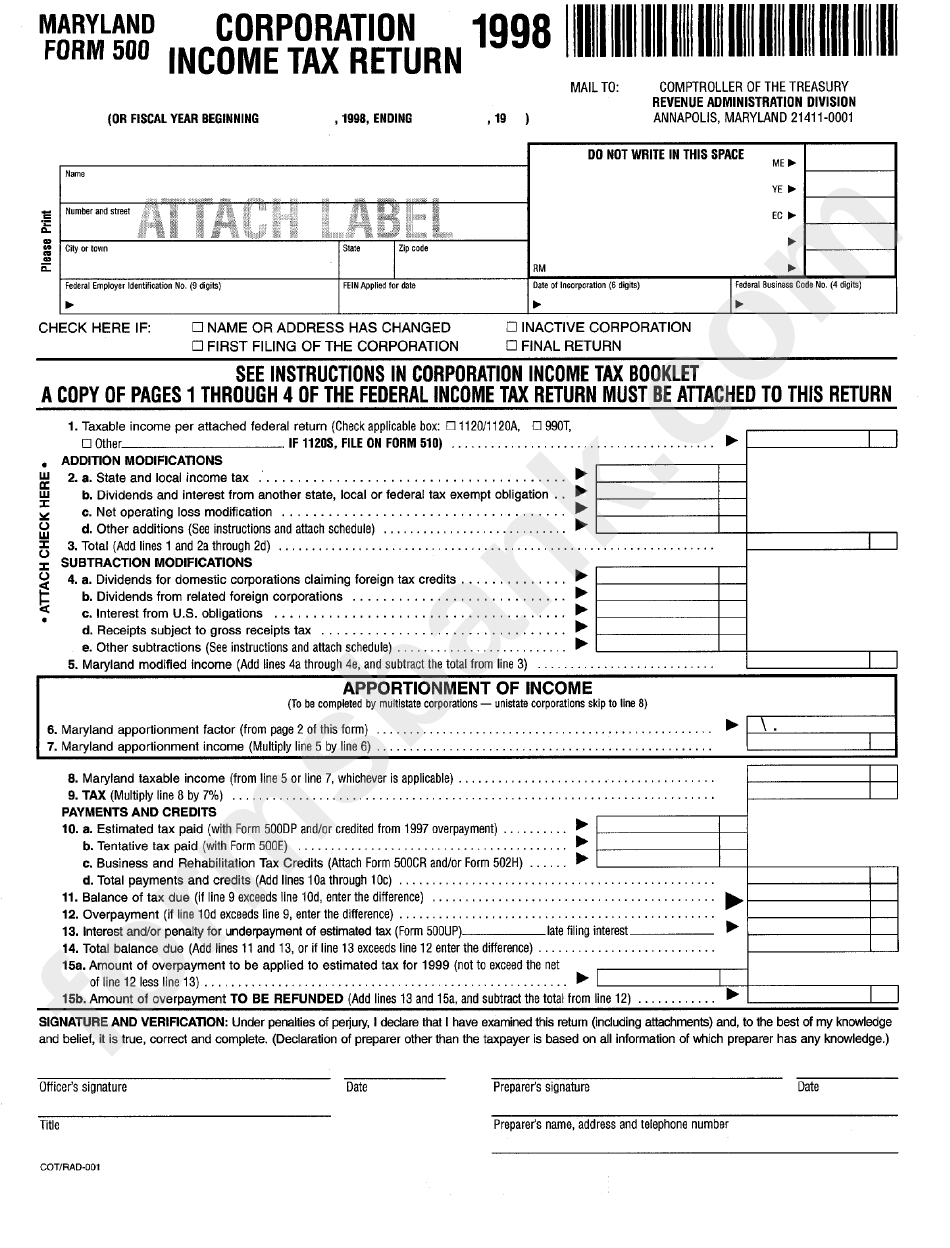

Fillable Form 500 Corporation Tax Return Maryland 1998

See the outlined fillable lines. Form used by a corporation and certain other organizations to file an income tax return for a specific tax year or period. This form is for income earned in tax year 2022, with tax returns due in april. Click on the variant to choose if. 5 other matters extension of time to file if unable.

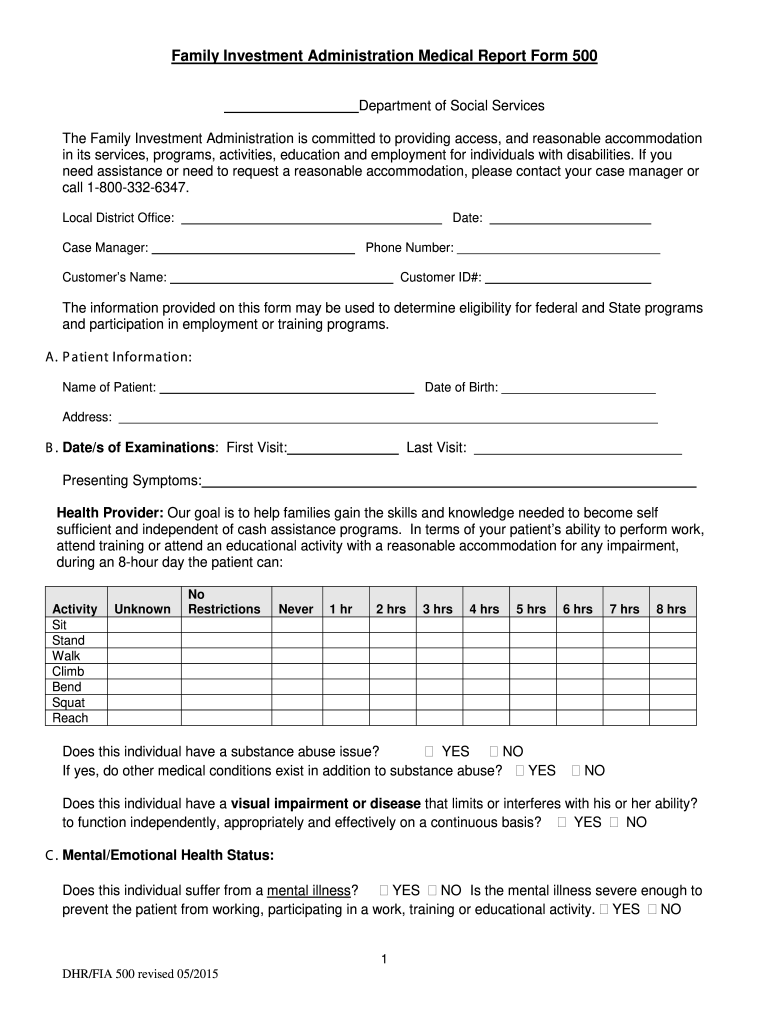

Medical 500 form Fill out & sign online DocHub

Eligibility requirements include verifying the disability (a. Complete, edit or print tax forms instantly. Open up the pdf blank in the editor. Web download or print the 2022 maryland form 500x (amended corporation income tax return) for free from the maryland comptroller of maryland. Or fiscal year beginning 2022, ending.

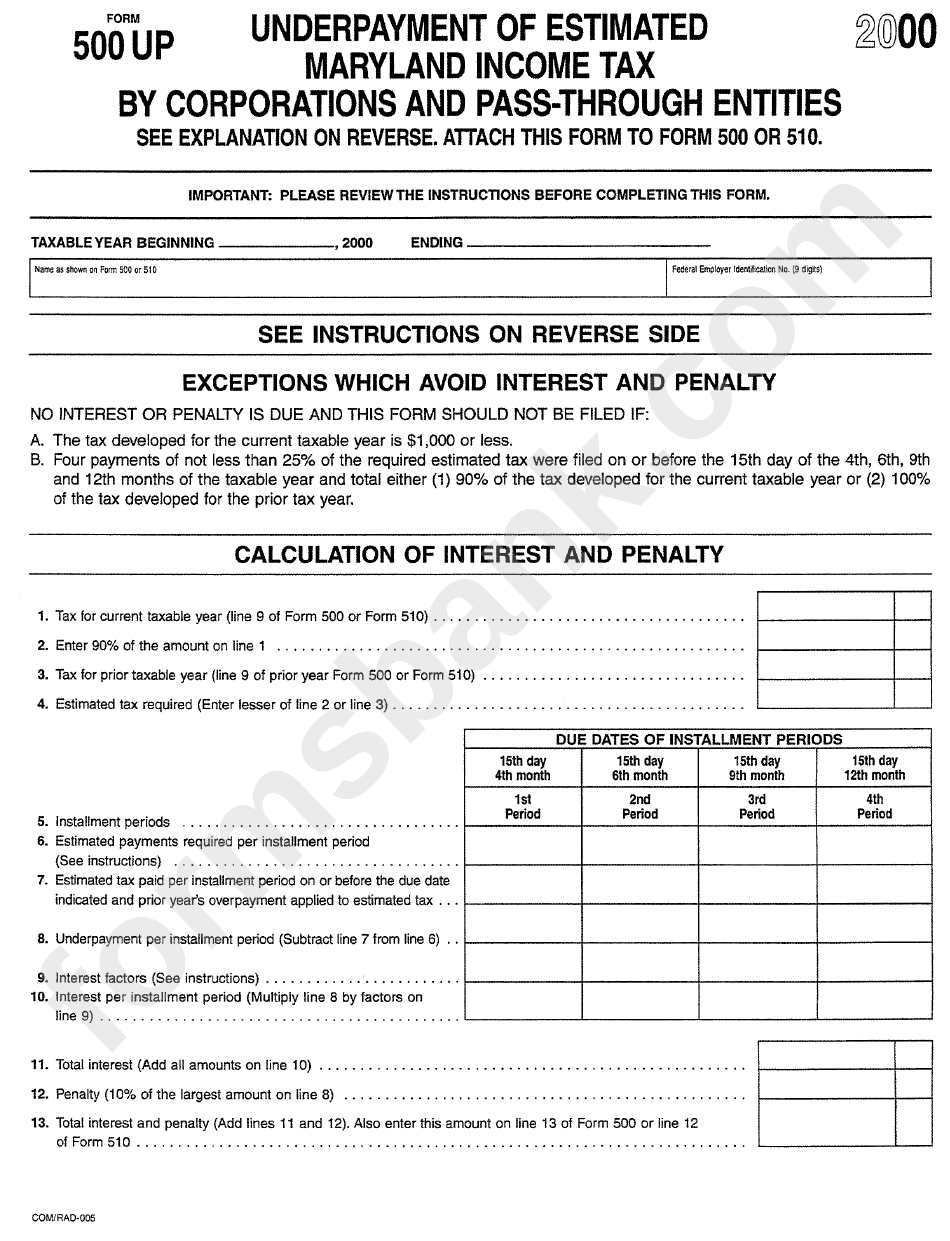

Form 500 Up Underpayment Of Estimated Maryland Tax By

Or fiscal year beginning 2021, ending. Web download or print the 2022 maryland form 500x (amended corporation income tax return) for free from the maryland comptroller of maryland. Form used by a corporation and certain. Web if you are a maryland resident, you can file long form 502 and 502b if your federal adjusted gross income is less than $100,000..

500 Maryland Dr, Hope, AR 71801 Trulia

Print using blue or black ink only staple. Print using blue or black ink only staple check. Eligibility requirements include verifying the disability (a. Maryland corporation income tax return: Web we last updated the maryland corporation income tax return in january 2023, so this is the latest version of form 500, fully updated for tax year 2022.

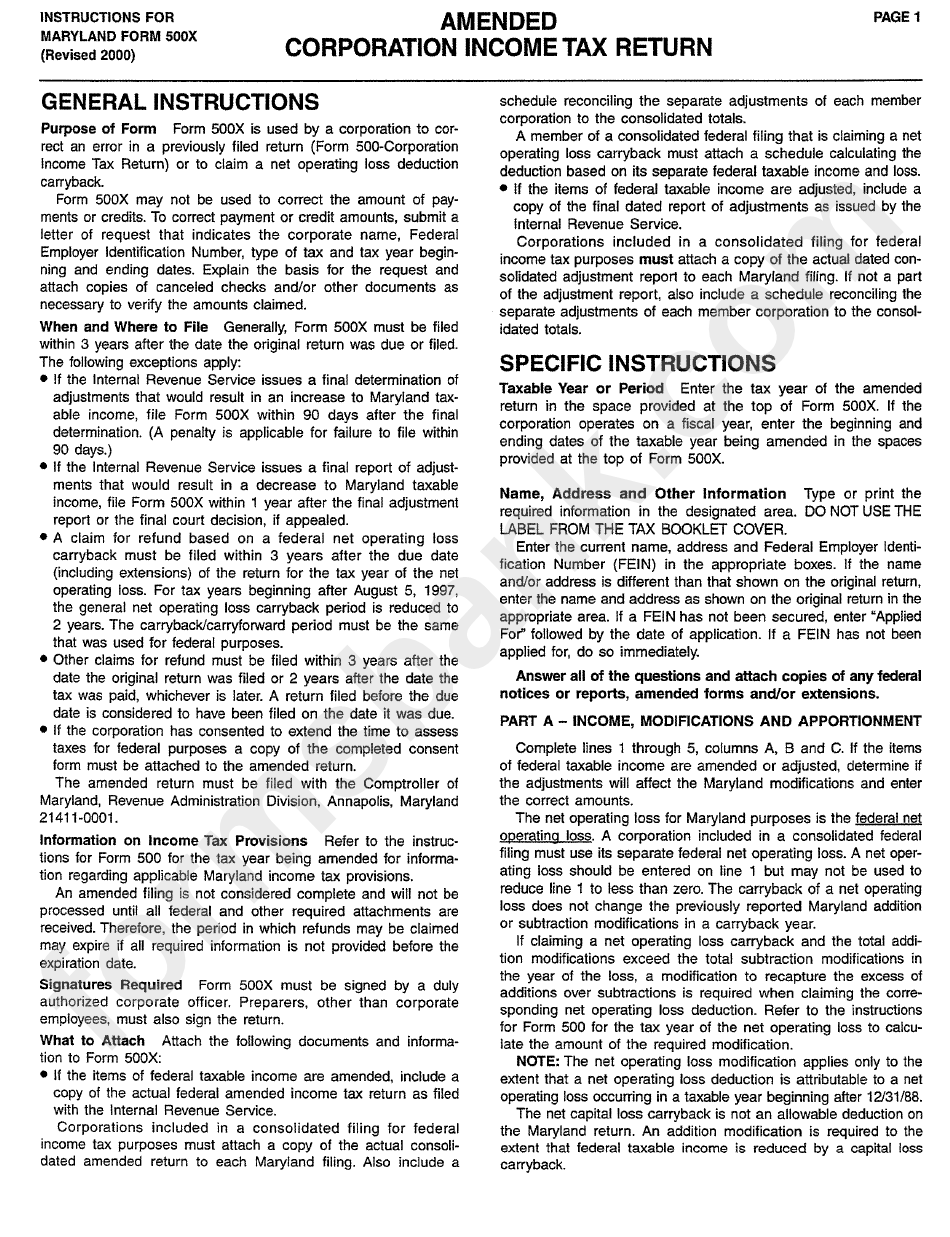

Instructions For Maryland Form 500x Amended Tax Return

Web how you can get md form 500 quick and simple: Form used by a corporation and certain other organizations to file an income tax return for a specific tax year or period. Web front of form 500. Read pdf viewer and/or browser incompatibility if you cannot open this form. In addition to filing form 500 to calculate and pay.

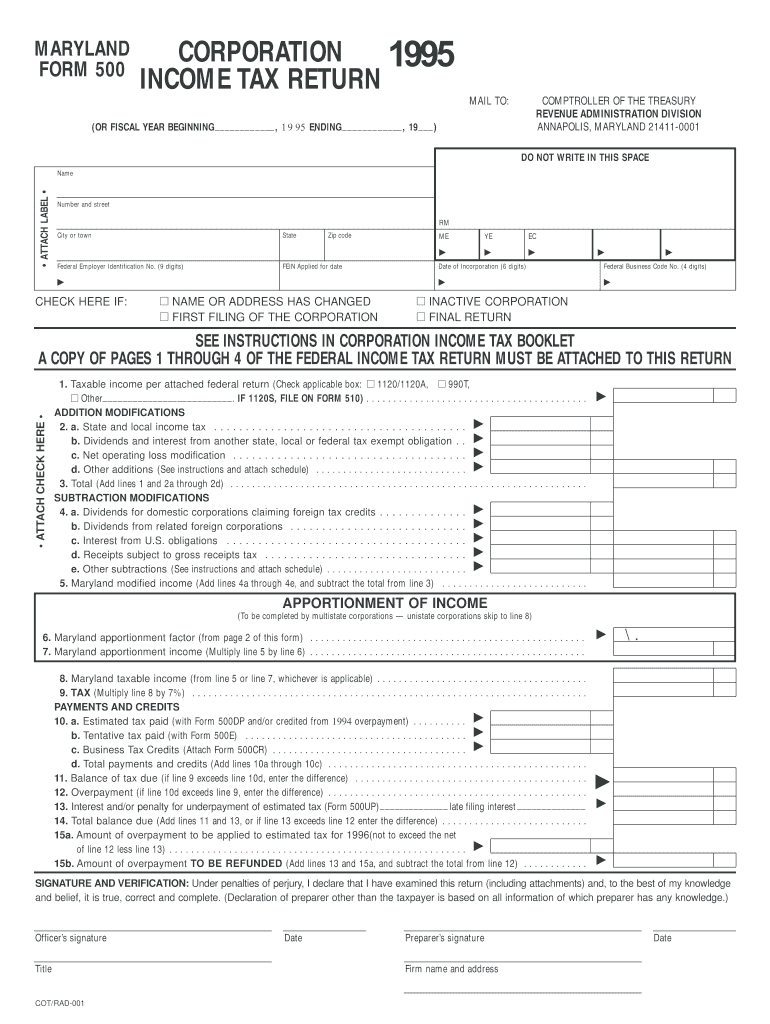

1995 MD Form 500 Fill Online, Printable, Fillable, Blank pdfFiller

Web form 500d is a maryland corporate income tax form. I certify that i am a legal resident of thestate of and am not subject to maryland withholding because i meet the requirements set forth under the servicemembers civil. If you lived in maryland only part of the year, you. Click on the variant to choose if. Web how you.

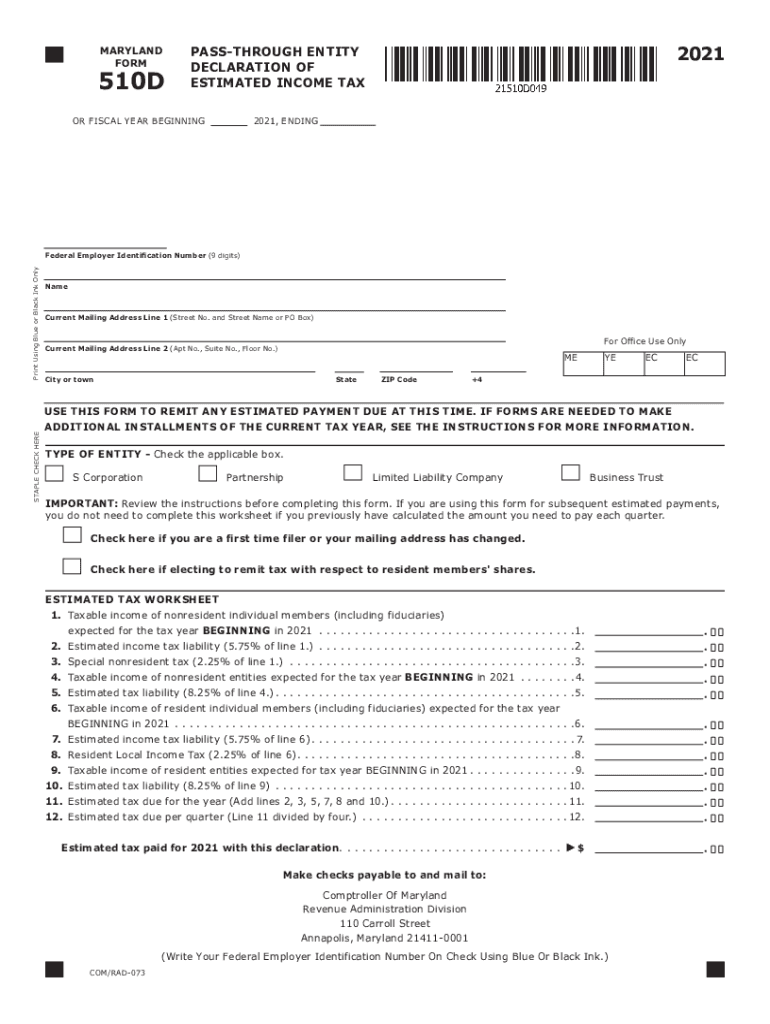

Md 510D Fill Out and Sign Printable PDF Template signNow

While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn. Here you can put in your data. Or fiscal year beginning 2021, ending. Read pdf viewer and/or browser incompatibility if you cannot open this form. Ad register and subscribe now to work on your md form 500 & more fillable forms.

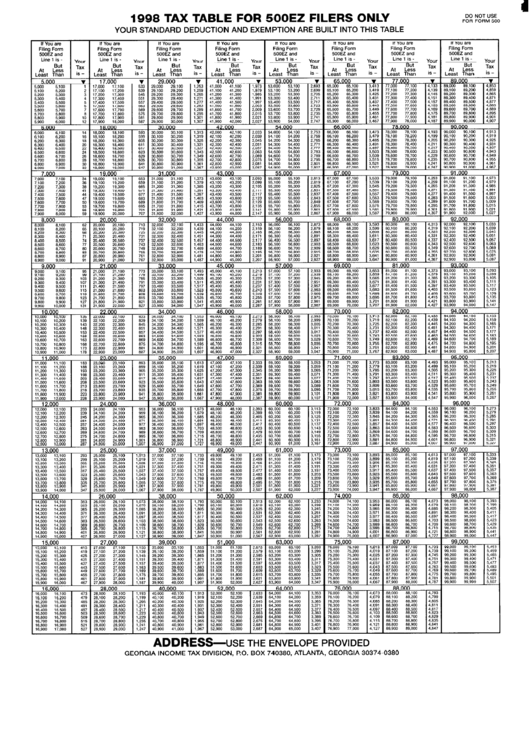

Form 500ez Tax Table 1998 printable pdf download

In addition to filing form 500 to calculate and pay the corporation income tax, also file form 510. Click on the variant to choose if. Print using blue or black ink only staple. Print using blue or black ink only staple check. Maryland corporation income tax return:

I Certify That I Am A Legal Resident Of Thestate Of And Am Not Subject To Maryland Withholding Because I Meet The Requirements Set Forth Under The Servicemembers Civil.

Web we last updated maryland form 500 in january 2023 from the maryland comptroller of maryland. Ad register and subscribe now to work on your md form 500 & more fillable forms. Web download or print the 2022 maryland form 500x (amended corporation income tax return) for free from the maryland comptroller of maryland. Web how you can get md form 500 quick and simple:

See The Outlined Fillable Lines.

Web every maryland corporation must file a corporation income tax return, using form 500, even if the corporation has no taxable income or is inactive. Web 500 (2d) maryland corporation income tax return. Maryland corporation income tax return: This form is for income earned in tax year 2022, with tax returns due in april.

The Fortune 500 List Is An Annual Ranking Of The 500 Largest.

Web form 500d is a maryland corporate income tax form. Form used by a corporation and certain. Eligibility requirements include verifying the disability (a. Complete, edit or print tax forms instantly.

Web Fortune Magazine Announced The 2021 Fortune 500 List This Week, Which Includes Six Maryland Companies.

Print using blue or black ink only staple. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn. In addition to filing form 500 to calculate and pay the corporation income tax, also file form 510. Open up the pdf blank in the editor.