Form 502 Ptet

Form 502 Ptet - Eric holcomb signed senate enrolled act 2 into law feb. Web ptet returns (“form 502ptet”) are due by the 15th day of the 4th month following the close of the taxable year. Web ptet instructions, form & faq. Web eligible to claim the refundable ptet credits. Web income tax form being filed: If you are filing form 504, enter the amount from line 6 on line 30 of form. Do not attach form pv or check/money order to form 502. Web publication 502 explains the itemized deduction for medical and dental expenses that you claim on schedule a (form 1040), including: Filing basis calendar fiscal short. Line 2, part cc of form 502cr (forms 502 or 505);

How to make the election? Eric holcomb signed senate enrolled act 2 into law feb. (2) during tax year 2023 and thereafter, making an estimated payment of ptet for the. Place form pv with attached. Web am trying to complete a virginia form 502 ptet return and having two issues: Web (1) during tax year 2022, filing form 502v and submitting a payment of ptet; Web income tax form being filed: Return payment estimated payment extension payment. Or line 1, part ddd of form 500cr (corporation and pte returns). For calendar year filers, that means april 15.

Return payment estimated payment extension payment. Eric holcomb signed senate enrolled act 2 into law feb. Web income tax form being filed: How to make the election? Or line 1, part ddd of form 500cr (corporation and pte returns). Web eligible to claim the refundable ptet credits. The form for the 2022 virginia ptet payment is form. Web publication 502 explains the itemized deduction for medical and dental expenses that you claim on schedule a (form 1040), including: Web am trying to complete a virginia form 502 ptet return and having two issues: Web money order to form pv.

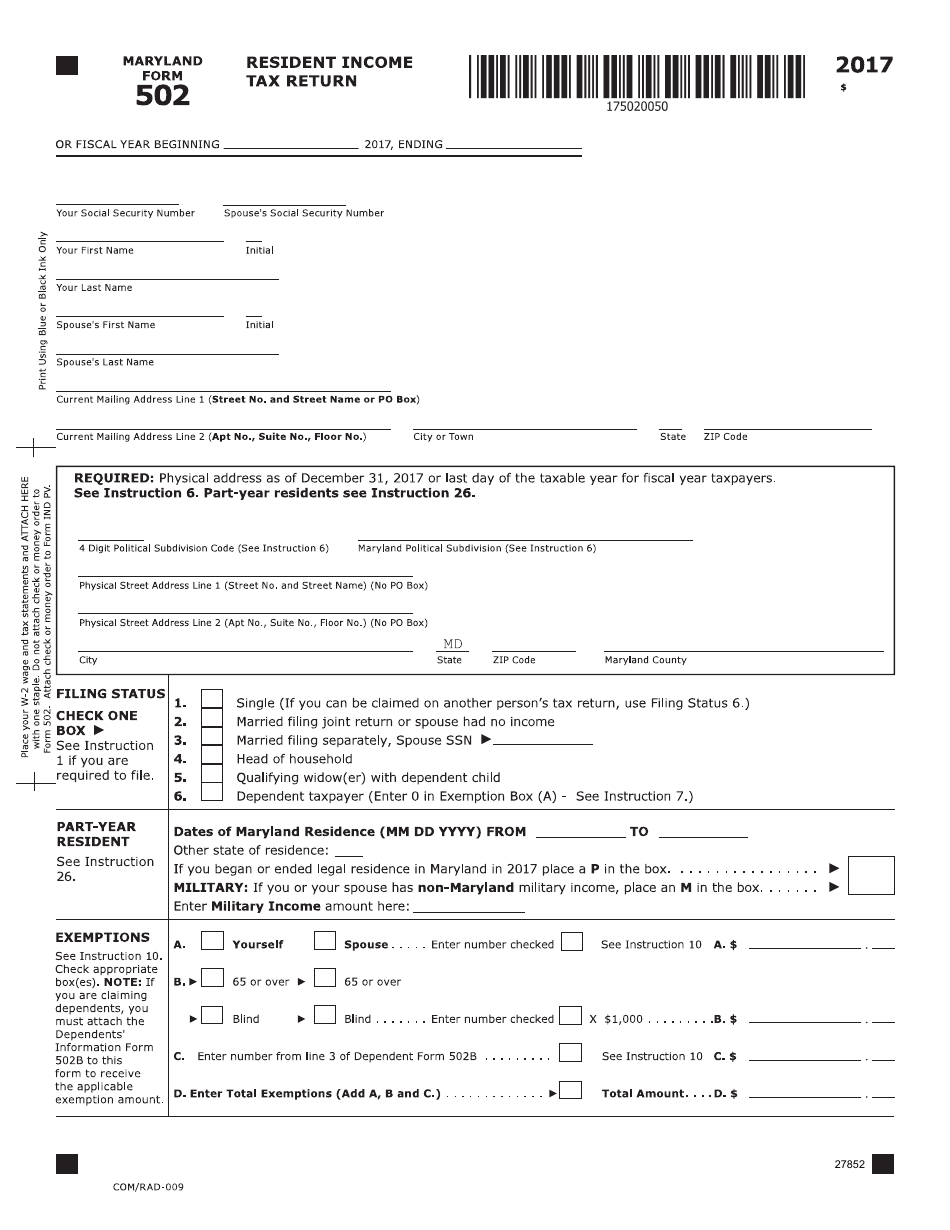

Form 502 Download Printable PDF or Fill Online Writ of Execution

Web publication 502 explains the itemized deduction for medical and dental expenses that you claim on schedule a (form 1040), including: Web s corporations, partnerships, and limited liability companies. Web ptet instructions, form & faq. Web if you are filing form 502 or form 505, enter the amount from line 6 on line 2, part cc of form 502cr. Select.

Rajasthan PTET Application Form 2021 PTET 2021 Apply Online

Web income tax form being filed: How to make the election? Select the type of payment you are making: Web am trying to complete a virginia form 502 ptet return and having two issues: For calendar year filers, that means april 15.

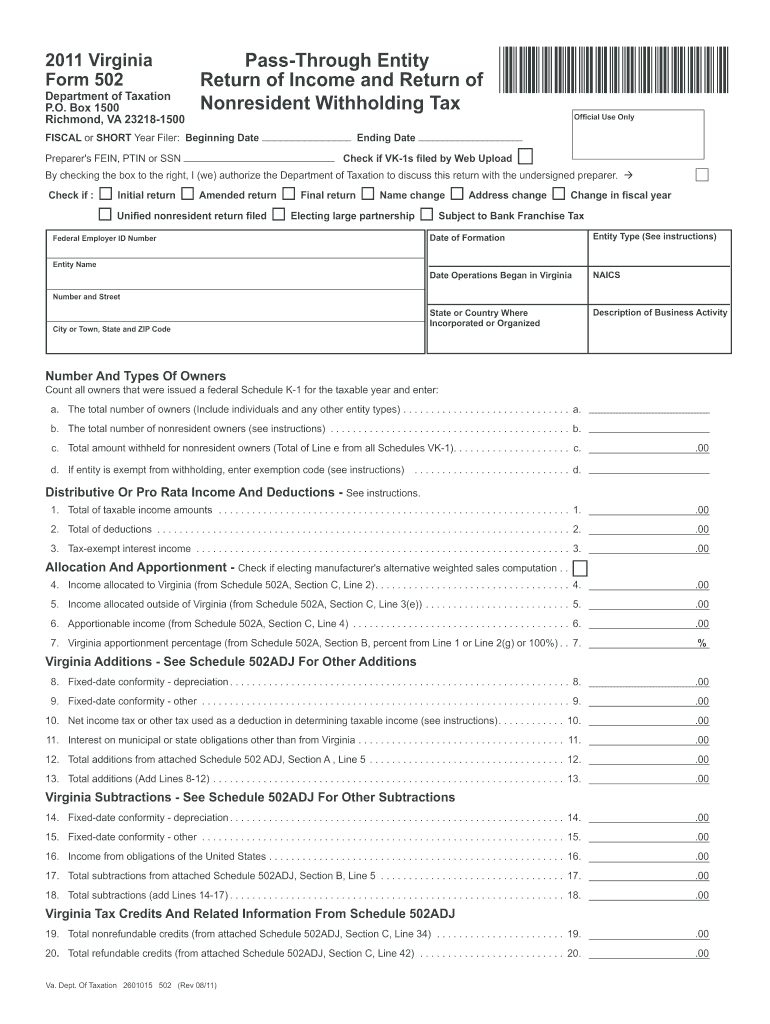

2011 Form VA DoT 502 Fill Online, Printable, Fillable, Blank pdfFiller

If you are filing form 504, enter the amount from line 6 on line 30 of form. Return payment estimated payment extension payment. Web (1) during tax year 2022, filing form 502v and submitting a payment of ptet; Web money order to form pv. Web ptet instructions, form & faq.

Ptet application form 2016 Rajasthan PTET 2016 Online Form

Web ptet returns (“form 502ptet”) are due by the 15th day of the 4th month following the close of the taxable year. Return payment estimated payment extension payment. Filing basis calendar fiscal short. Web instead, the electing pte may file form 502ptet to request a refund of any ptet estimated tax payments it made. Line 30 of form 504;

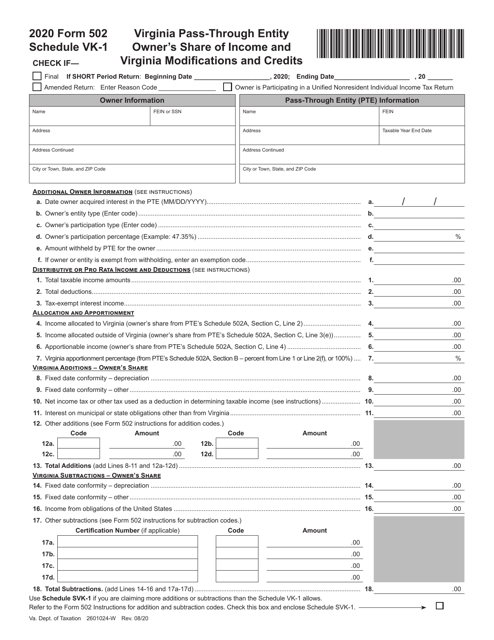

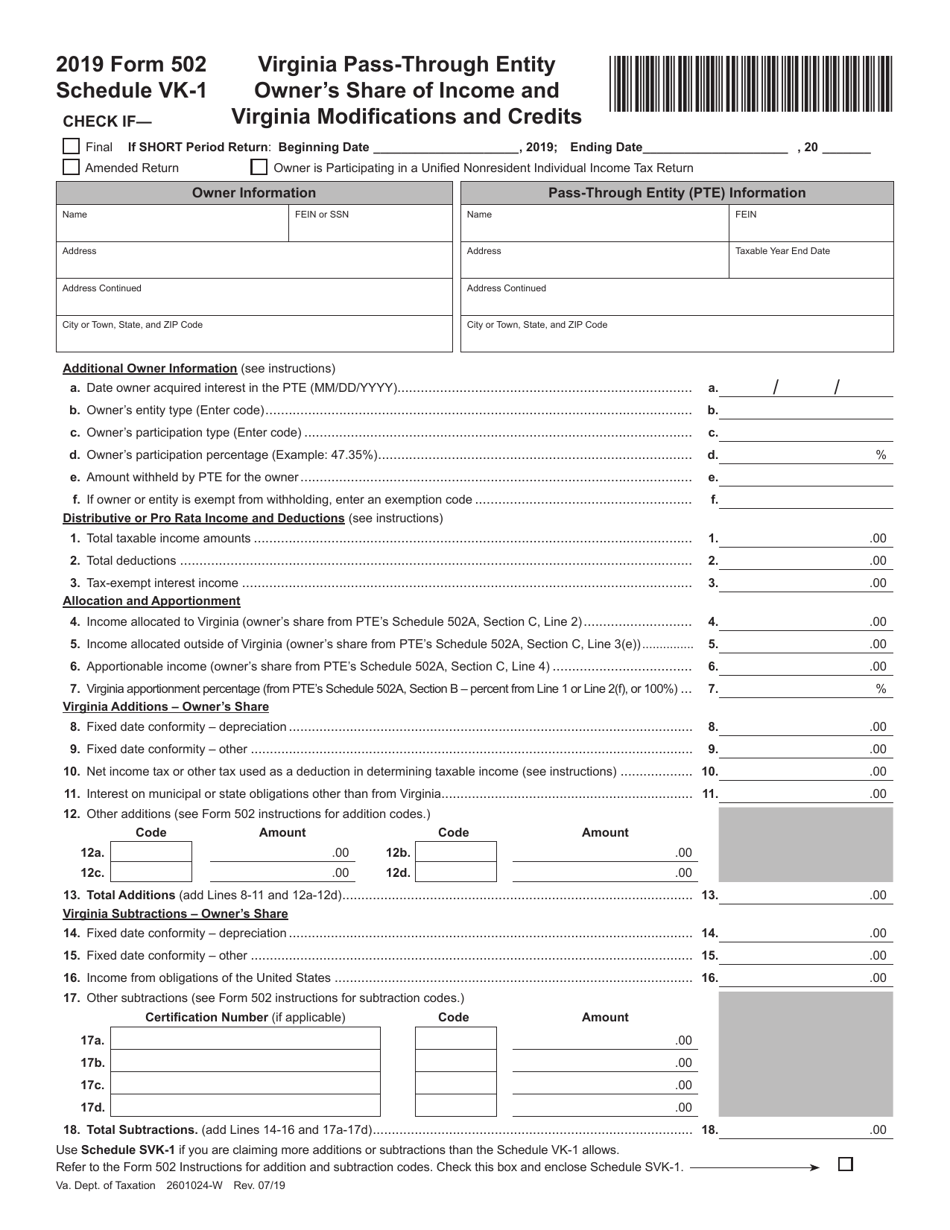

Form 502 Schedule VK1 Download Fillable PDF or Fill Online Virginia

Select the type of payment you are making: Web money order to form pv. How to make the election? Web ptet returns (“form 502ptet”) are due by the 15th day of the 4th month following the close of the taxable year. Web if you are filing form 502 or form 505, enter the amount from line 6 on line 2,.

Fill Free fillable Form 502General Information (Application for

Do not attach form pv or check/money order to form 502. Web ptet returns (“form 502ptet”) are due by the 15th day of the 4th month following the close of the taxable year. Web they can make the va ptet election for 2022 by filing va form 502 ptet in 2023 by the original due date and paying the tax.

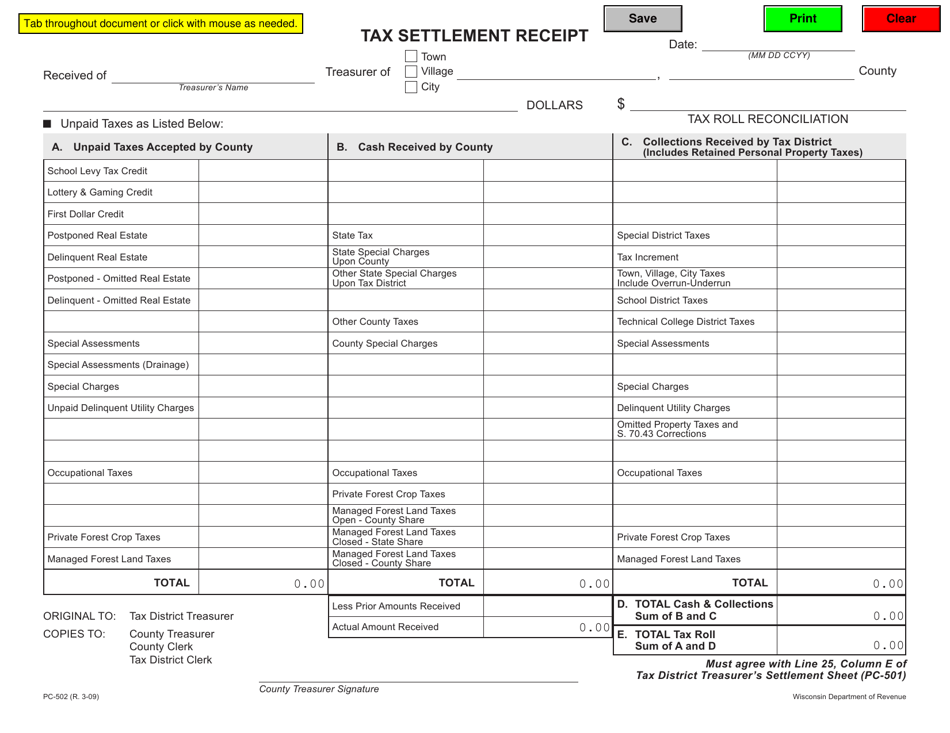

Form PC502 Download Fillable PDF or Fill Online Tax Settlement Receipt

Web s corporations, partnerships, and limited liability companies. Web income tax form being filed: Eric holcomb signed senate enrolled act 2 into law feb. Line 30 of form 504; Web they can make the va ptet election for 2022 by filing va form 502 ptet in 2023 by the original due date and paying the tax or making an extension.

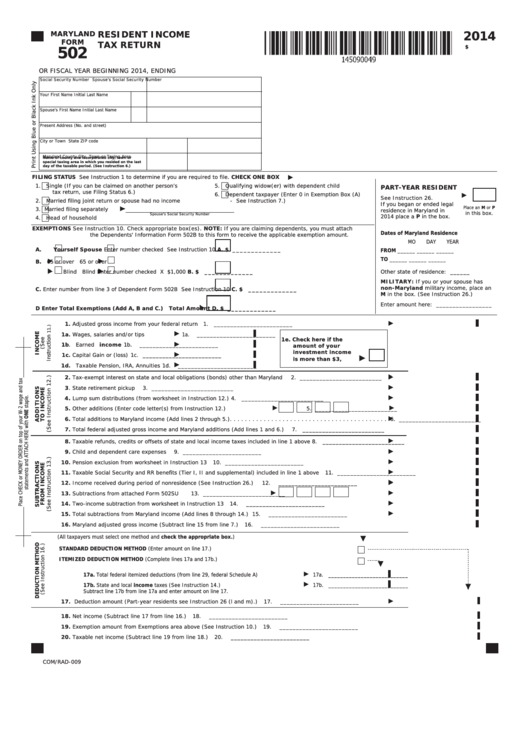

Fillable Form 502 Maryland Resident Tax Return 2014

Web if you are filing form 502 or form 505, enter the amount from line 6 on line 2, part cc of form 502cr. How to make the election? Return payment estimated payment extension payment. Web (1) during tax year 2022, filing form 502v and submitting a payment of ptet; Web how to enter virginia pte in proseries.

Form 502 Schedule VK1 Download Fillable PDF or Fill Online Virginia

Web eligible to claim the refundable ptet credits. How to make the election? Web if you are filing form 502 or form 505, enter the amount from line 6 on line 2, part cc of form 502cr. Select the type of payment you are making: Web money order to form pv.

How To Make The Election?

The ptet is an optional tax that partnerships or new. Web publication 502 explains the itemized deduction for medical and dental expenses that you claim on schedule a (form 1040), including: Web how to enter virginia pte in proseries. Web instead, the electing pte may file form 502ptet to request a refund of any ptet estimated tax payments it made.

Return Payment Estimated Payment Extension Payment.

Web s corporations, partnerships, and limited liability companies. Or line 1, part ddd of form 500cr (corporation and pte returns). (2) during tax year 2023 and thereafter, making an estimated payment of ptet for the. Web am trying to complete a virginia form 502 ptet return and having two issues:

Web They Can Make The Va Ptet Election For 2022 By Filing Va Form 502 Ptet In 2023 By The Original Due Date And Paying The Tax Or Making An Extension Payment.

For calendar year filers, that means april 15. Web money order to form pv. Web ptet returns (“form 502ptet”) are due by the 15th day of the 4th month following the close of the taxable year. Web (1) during tax year 2022, filing form 502v and submitting a payment of ptet;

Filing Basis Calendar Fiscal Short.

The form for the 2022 virginia ptet payment is form. Select the type of payment you are making: Web if you are filing form 502 or form 505, enter the amount from line 6 on line 2, part cc of form 502cr. If you are filing form 504, enter the amount from line 6 on line 30 of form.