Form 5080 Michigan 2022

Form 5080 Michigan 2022 - Enter the amount from worksheet 5095, line 4a. Web business taxes sales and use tax 2020 sales & use tax forms important note tax forms are tax year specific. Form 5080 is available for submission electronically using mto at credit schedules mto.treasury.michigan.gov or by using approved tax • e. If an organization is not registered for michigan taxes or has already. Any altering of a form to change a tax year or any reported. Web form 5080 is available for submission electronically quarterly filer using michigan treasury online (mto) at • if the tax is less than $27, calculate the discount by. Treasury is committed to protecting. Web michigan department of treasury 5095 (rev. 2022 sales, use and withholding taxes monthly/quarterly return: Carry amount from line 4a to.

Mto is the michigan department of treasury's web portal to many business taxes. Instructions for 2022 sales, use and withholding taxes monthly/quarterly return. Web welcome to michigan treasury online (mto)! Web form mi 5080 michigan monthly/quarterly tax report is filed either monthly, (due by 20th of the following month) or quarterly (due by 20th of the month following the. Click the link to see the 2023 form instructions. Use this option to browse. If an organization is not registered for michigan taxes or has already. 2022 sales, use and withholding taxes annual return:. Enter the amount from worksheet 5095, line 4a. Web up to $40 cash back send your return and any payment due to michigan department of treasury p.

Enter the amount from worksheet 5095, line 4b. Web form 5080 is available for submission electronically quarterly filer using michigan treasury online (mto) at • if the tax is less than $27, calculate the discount by. Sales and use tax line 1a: 5081) fiscal impact the bills would reduce revenue to the state general fund and. Jeff mann 205.92 & 205.111 (h.b. Treasury is committed to protecting. Click the link to see the 2022 form instructions. Web michigan department of treasury 5095 (rev. Form 5080 is available for submission electronically using mto at credit schedules mto.treasury.michigan.gov or by using approved tax • e. Web form 5080 is available for submission electronically using michigan treasury online (mto) at mto.treasury.michigan.gov or by using approved tax preparation software.

Gallery of Michigan 5080 form 2018 Elegant Production and

Web form 5080 is available for submission electronically quarterly filer using michigan treasury online (mto) at • if the tax is less than $27, calculate the discount by. Web form 5080 is available for submission electronically using michigan treasury online (mto) at mto.treasury.michigan.gov or by using approved tax preparation software. 2022 sales, use and withholding taxes annual return:. Web business.

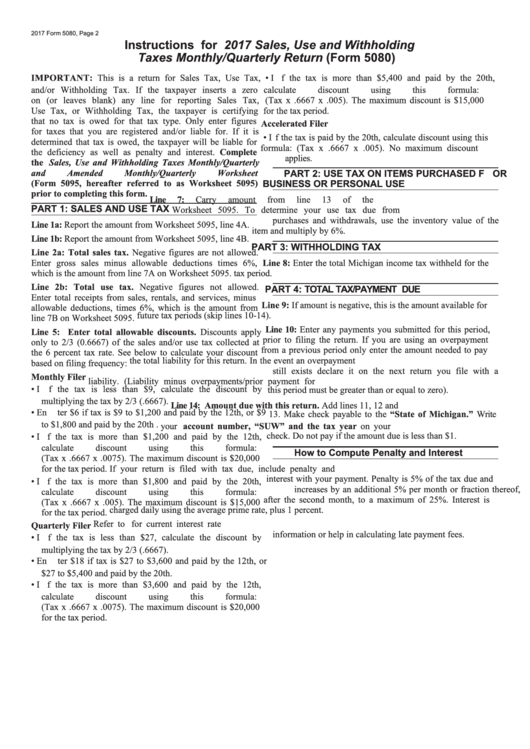

Instructions For 2017 Sales, Use And Withholding Taxes Monthly

Carry amount from line 4a to. Web form mi 5080 michigan monthly/quarterly tax report is filed either monthly, (due by 20th of the following month) or quarterly (due by 20th of the month following the. Web michigan treasury online (mto) city of detroit individual income tax city of detroit business & fiduciary taxes search tips search by tax area: Web.

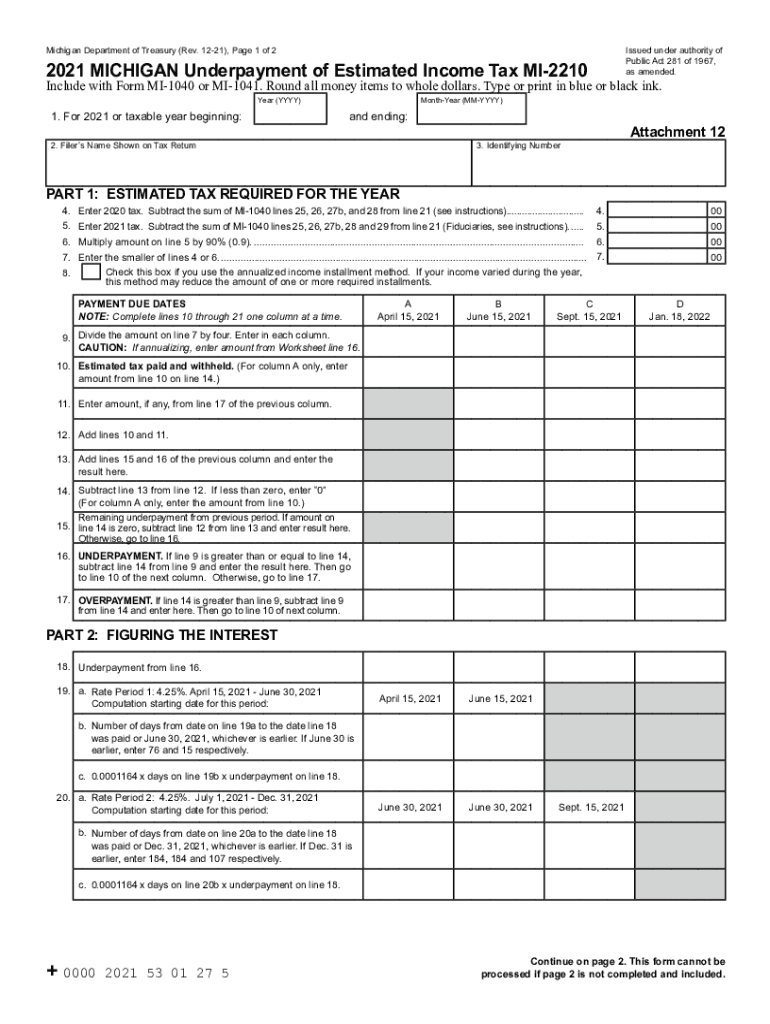

Mi 2210 Fill Out and Sign Printable PDF Template signNow

Web welcome to michigan treasury online (mto)! Treasury is committed to protecting. Instructions for 2022 sales, use and. Web form 5080 is available for submission electronically using michigan treasury online (mto) at mto.treasury.michigan.gov or by using approved tax preparation software. Use this option to browse.

Fill Michigan

2022 sales, use and withholding taxes monthly/quarterly return: Mto is the michigan department of treasury's web portal to many business taxes. Click the link to see the 2023 form instructions. Web 2022 mto form instructions. Click the link to see the 2022 form instructions.

Michigan Sales Tax form 5081 Inspirational Pdf Countervailing Duty

Use this option to browse. 2022 sales, use and withholding taxes monthly/quarterly return: Web form number form name; Enter the amount from worksheet 5095, line 4a. Web michigan department of treasury 5095 (rev.

IMG 5080 YouTube

Web 5095) prior to completing this form. Web welcome to michigan treasury online (mto)! 2022 sales, use and withholding taxes monthly/quarterly return: Web form mi 5080 michigan monthly/quarterly tax report is filed either monthly, (due by 20th of the following month) or quarterly (due by 20th of the month following the. Web form 5080 is available for submission electronically using.

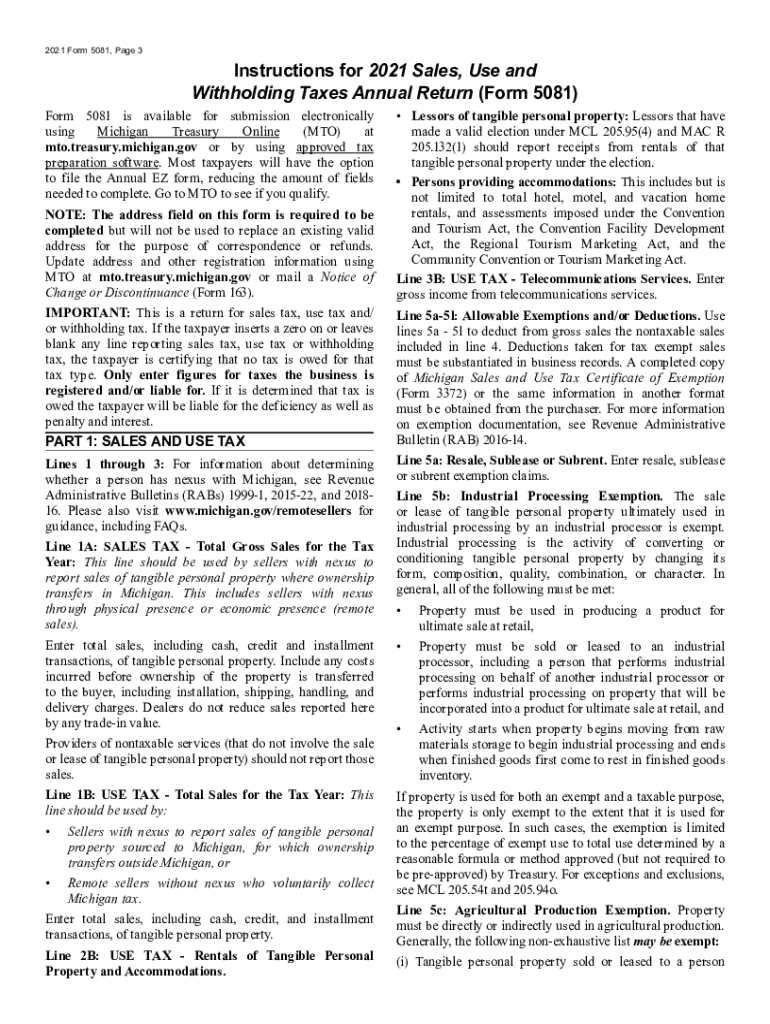

2021 Form MI 5081 Instruction Fill Online, Printable, Fillable, Blank

If an organization is not registered for michigan taxes or has already. Web 2022 mto form instructions. Web welcome to michigan treasury online (mto)! Enter the amount from worksheet 5095, line 4b. Web michigan department of treasury 5095 (rev.

Form 5080 michigan 2019 Fill out & sign online DocHub

Form 5080 is available for submission electronically using mto at credit schedules mto.treasury.michigan.gov or by using approved tax • e. Sales and use tax line 1a: Treasury is committed to protecting. Mto is the michigan department of treasury's web portal to many business taxes. Web form number form name;

Form I508 Edit, Fill, Sign Online Handypdf

Web form 5080 is available for submission electronically using michigan treasury online (mto) at mto.treasury.michigan.gov or by using approved tax preparation software. Enter the amount from worksheet 5095, line 4b. Web up to $40 cash back send your return and any payment due to michigan department of treasury p. Sales and use tax line 1a: Carry amount from line 4a.

Form 5081 Fill Out and Sign Printable PDF Template signNow

2022 sales, use and withholding taxes monthly/quarterly return: Mto is the michigan department of treasury's web portal to many business taxes. Web 2022 mto form instructions. Web form 5080 is available for submission electronically using michigan treasury online (mto) at mto.treasury.michigan.gov or by using approved tax preparation software. Instructions for 2022 sales, use and.

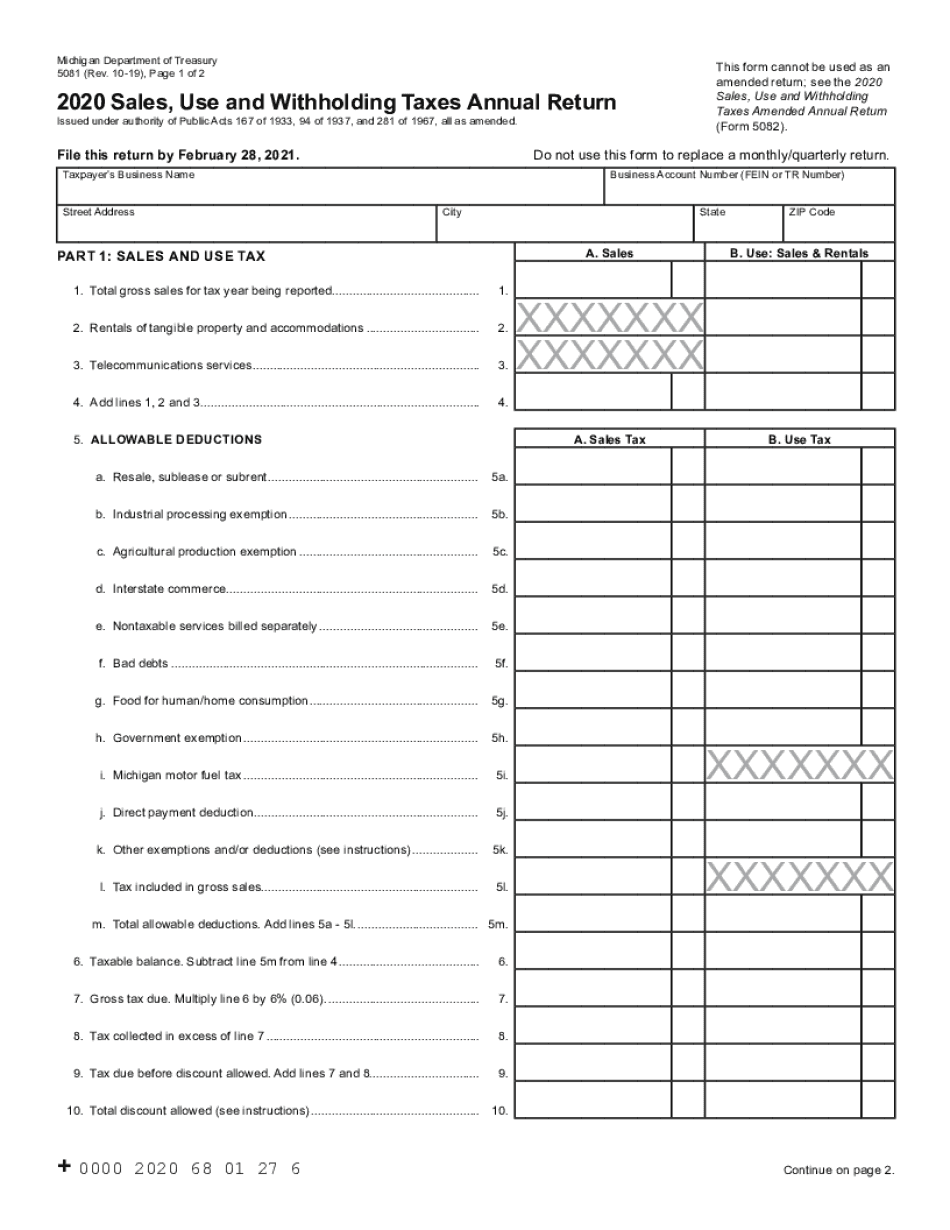

5080, 2022 Sales, Use And Withholding Taxes.

Web michigan department of treasury 5095 (rev. Web 5095) prior to completing this form. Web form 5080 is available for submission electronically quarterly filer using michigan treasury online (mto) at • if the tax is less than $27, calculate the discount by. Web welcome to michigan treasury online (mto)!

Web Form Number Form Name;

2022 sales, use and withholding taxes annual return:. Web form 5080 is available for submission electronically using michigan treasury online (mto) at mto.treasury.michigan.gov or by using approved tax preparation software. Carry amount from line 4a to. Sales and use tax line 1a:

Enter The Amount From Worksheet 5095, Line 4B.

Web michigan treasury online (mto) city of detroit individual income tax city of detroit business & fiduciary taxes search tips search by tax area: Web form number form name; Web form 5080 is available for submission electronically using michigan treasury online (mto) at mto.treasury.michigan.gov or by using approved tax preparation software. Web business taxes sales and use tax 2020 sales & use tax forms important note tax forms are tax year specific.

5081) Fiscal Impact The Bills Would Reduce Revenue To The State General Fund And.

Form 5080 is available for submission electronically using mto at credit schedules mto.treasury.michigan.gov or by using approved tax • e. Click the link to see the 2022 form instructions. Web up to $40 cash back send your return and any payment due to michigan department of treasury p. Instructions for 2022 sales, use and.