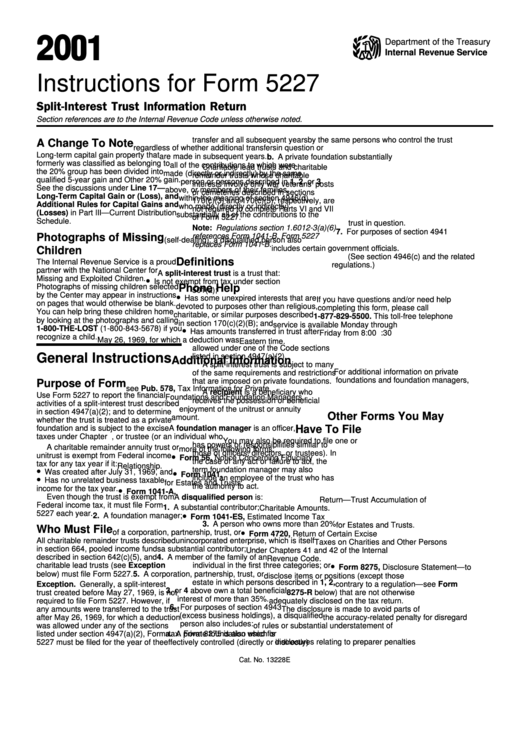

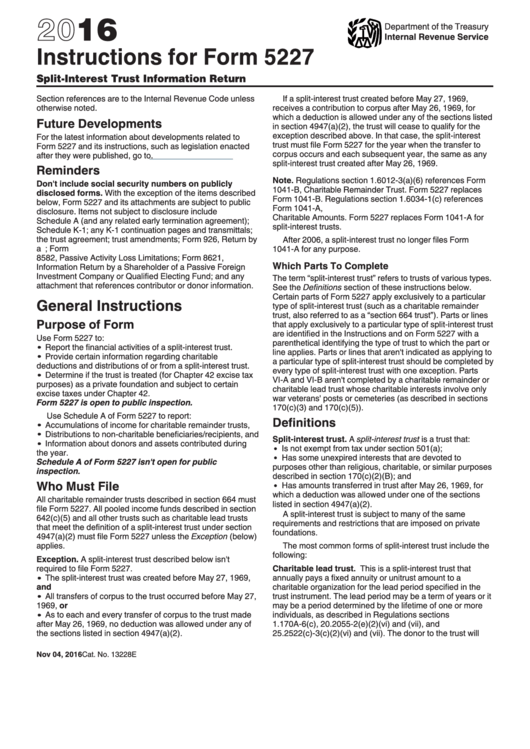

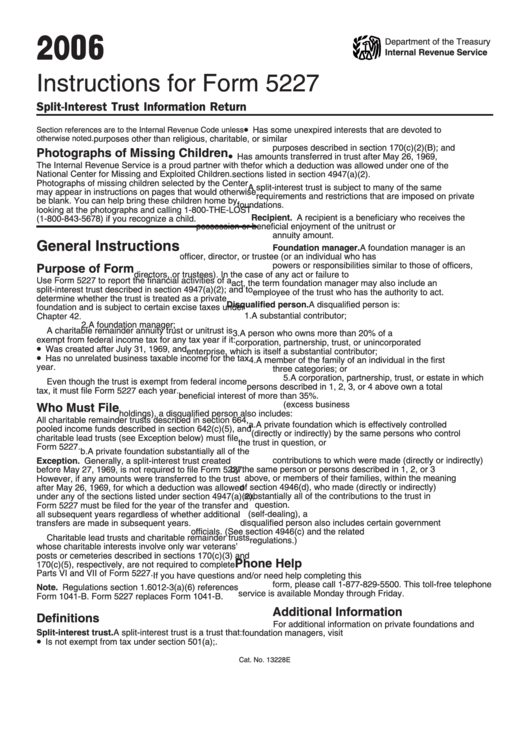

Form 5227 Instructions

Form 5227 Instructions - Web to file form 5227. The tax return has schedules which track various ‘buckets’ or ‘tranches’ of the trust’s income & corpus. All charitable remainder trusts described in section 664 must file form 5227. What’s new electronic filing expected to be available in 2023. For instructions and the latest information. Web form 5227 and its instructions, such as legislation enacted after they were published, go to irs.gov/form5227. , 2020, and ending, 20. All pooled income funds described in section. Determine if the trust is treated as a private foundation and subject to certain excise taxes under chapter 42. Department of the treasury internal revenue service.

Electronic filing of form 5227 is expected to be available in 2023, and the irs will announce the specific date of availability when the programming comes online. Do not enter social security numbers on this form (except on schedule a) as it may be made public. The tax return has schedules which track various ‘buckets’ or ‘tranches’ of the trust’s income & corpus. Web to file form 5227. See the instructions pdf for more information about when and where to file these returns, and how to obtain an extension of time to file. Do not enter social security numbers on this form (except on schedule a) as it may be made public. Web form 5227 and its instructions, such as legislation enacted after they were published, go to irs.gov/form5227. Web use form 5227 to: For instructions and the latest information. For the calendar year 2020 or tax year beginning.

Do not enter social security numbers on this form (except on schedule a) as it may be made public. For the calendar year 2020 or tax year beginning. All pooled income funds described in section. Web form 5227 and its instructions, such as legislation enacted after they were published, go to irs.gov/form5227. Web use form 5227 to: What’s new electronic filing expected to be available in 2023. See the instructions pdf for more information about when and where to file these returns, and how to obtain an extension of time to file. For instructions and the latest information. Department of the treasury internal revenue service. The tax return has schedules which track various ‘buckets’ or ‘tranches’ of the trust’s income & corpus.

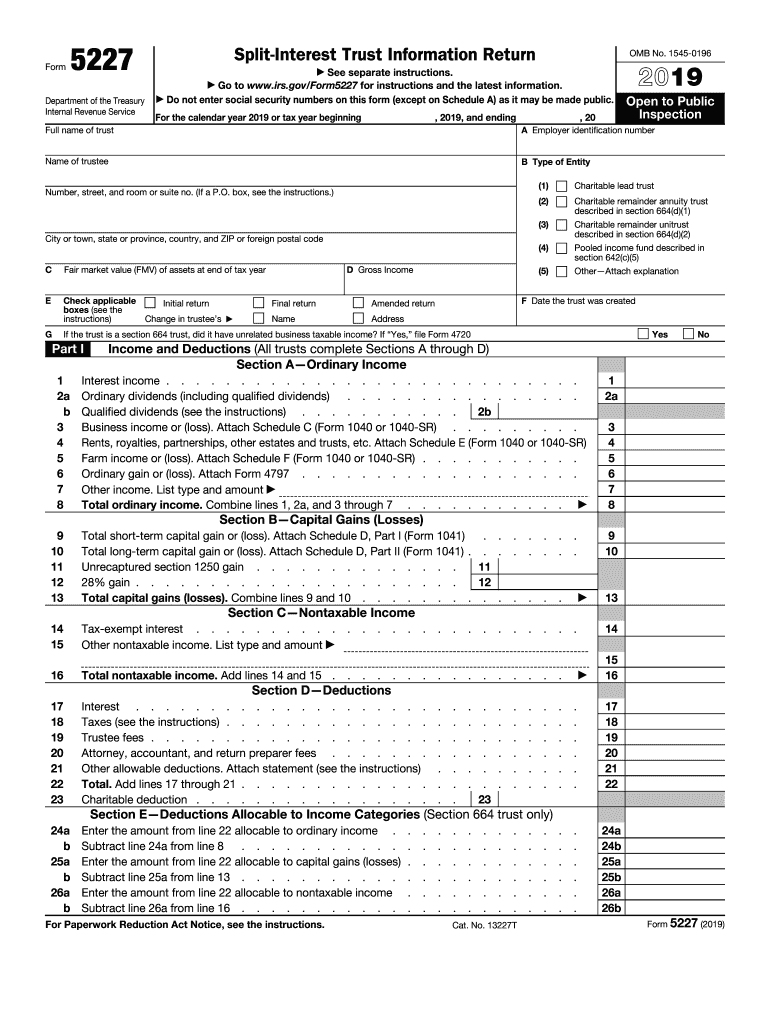

Form 5227 SplitInterest Trust Information Return (2014) Free Download

Web to file form 5227. Do not enter social security numbers on this form (except on schedule a) as it may be made public. , 2020, and ending, 20. What’s new electronic filing expected to be available in 2023. Web use form 5227 to:

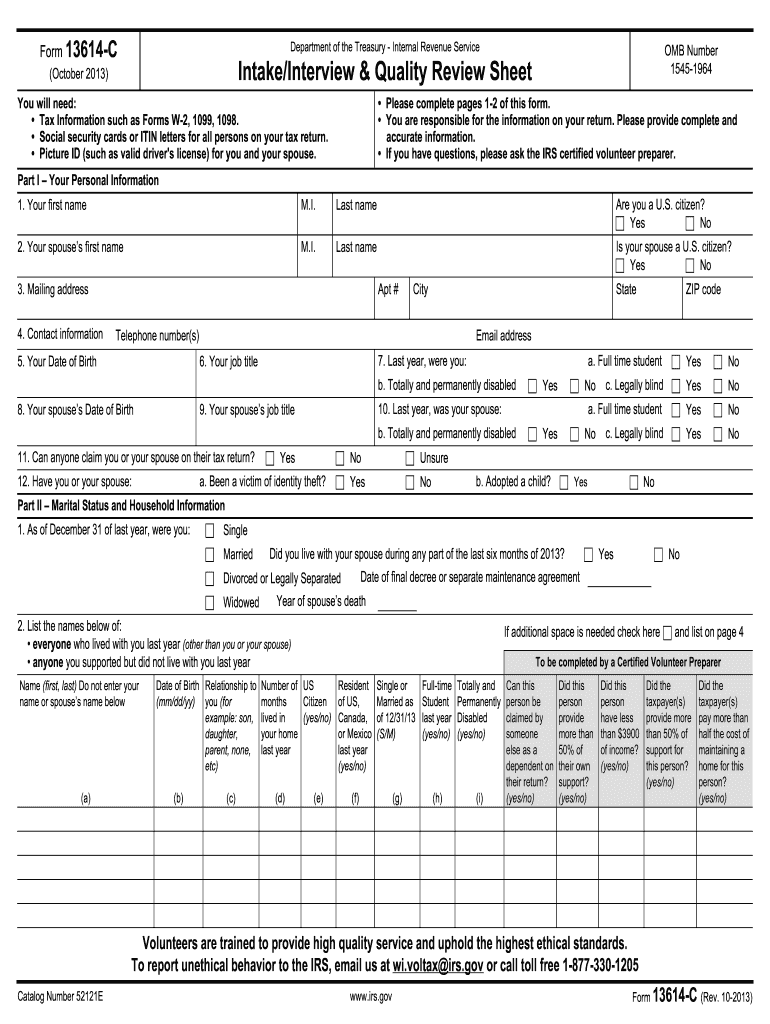

2013 Form IRS 13614C Fill Online, Printable, Fillable, Blank PDFfiller

The tax return has schedules which track various ‘buckets’ or ‘tranches’ of the trust’s income & corpus. Do not enter social security numbers on this form (except on schedule a) as it may be made public. Department of the treasury internal revenue service. Determine if the trust is treated as a private foundation and subject to certain excise taxes under.

Form 5227 SplitInterest Trust Information Return (2014) Free Download

Web to file form 5227. Web latest version of form 4970, tax on accumulation distribution of trusts (attachment with beneficiary’s return), posted on the irs website dec. See the instructions pdf for more information about when and where to file these returns, and how to obtain an extension of time to file. For instructions and the latest information. For the.

5227 Instructions Form Fill Out and Sign Printable PDF Template signNow

Web the trustee will file form 5227 for the crt (crat or crut) using a calendar tax year. Do not enter social security numbers on this form (except on schedule a) as it may be made public. Web form 5227 and its instructions, such as legislation enacted after they were published, go to irs.gov/form5227. Web latest version of form 4970,.

Instructions For Form 5227 printable pdf download

See the instructions pdf for more information about when and where to file these returns, and how to obtain an extension of time to file. Web use form 5227 to: For instructions and the latest information. The tax return has schedules which track various ‘buckets’ or ‘tranches’ of the trust’s income & corpus. Web the trustee will file form 5227.

Instructions for Form 5227 Internal Revenue Service Fill Out and Sign

Do not enter social security numbers on this form (except on schedule a) as it may be made public. Determine if the trust is treated as a private foundation and subject to certain excise taxes under chapter 42. What’s new electronic filing expected to be available in 2023. See the instructions pdf for more information about when and where to.

Instructions For Form 5227 2016 printable pdf download

Department of the treasury internal revenue service. Electronic filing of form 5227 is expected to be available in 2023, and the irs will announce the specific date of availability when the programming comes online. Web form 5227 and its instructions, such as legislation enacted after they were published, go to irs.gov/form5227. , 2020, and ending, 20. See the instructions pdf.

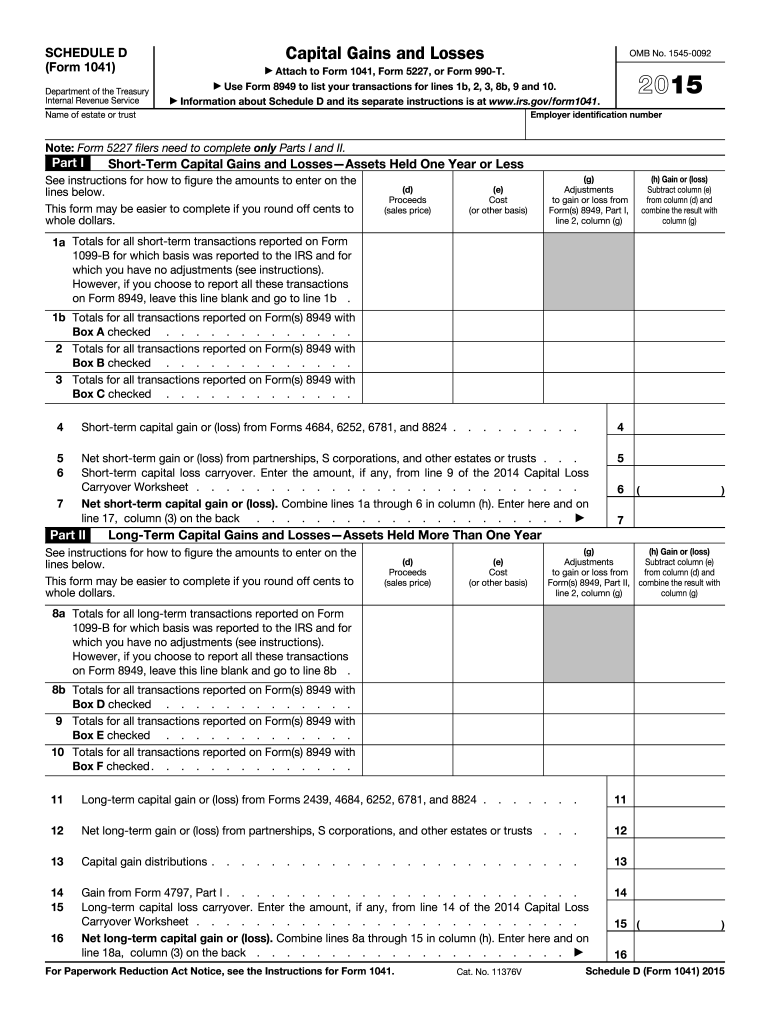

2015 Form IRS 1041 Schedule D Fill Online, Printable, Fillable, Blank

Department of the treasury internal revenue service. For instructions and the latest information. See the instructions pdf for more information about when and where to file these returns, and how to obtain an extension of time to file. Web to file form 5227. Web use form 5227 to:

Instructions For Form 5227 printable pdf download

All charitable remainder trusts described in section 664 must file form 5227. Web to file form 5227. Web form 5227 and its instructions, such as legislation enacted after they were published, go to irs.gov/form5227. Web use form 5227 to: Do not enter social security numbers on this form (except on schedule a) as it may be made public.

Form 5227 SplitInterest Trust Information Return (2014) Free Download

Web latest version of form 4970, tax on accumulation distribution of trusts (attachment with beneficiary’s return), posted on the irs website dec. Do not enter social security numbers on this form (except on schedule a) as it may be made public. For instructions and the latest information. For instructions and the latest information. For the calendar year 2020 or tax.

For Instructions And The Latest Information.

The tax return has schedules which track various ‘buckets’ or ‘tranches’ of the trust’s income & corpus. What’s new electronic filing expected to be available in 2023. For instructions and the latest information. See the instructions pdf for more information about when and where to file these returns, and how to obtain an extension of time to file.

Web Latest Version Of Form 4970, Tax On Accumulation Distribution Of Trusts (Attachment With Beneficiary’s Return), Posted On The Irs Website Dec.

All charitable remainder trusts described in section 664 must file form 5227. Electronic filing of form 5227 is expected to be available in 2023, and the irs will announce the specific date of availability when the programming comes online. , 2020, and ending, 20. All pooled income funds described in section.

Do Not Enter Social Security Numbers On This Form (Except On Schedule A) As It May Be Made Public.

For the calendar year 2020 or tax year beginning. Web use form 5227 to: Department of the treasury internal revenue service. Web form 5227 and its instructions, such as legislation enacted after they were published, go to irs.gov/form5227.

Web The Trustee Will File Form 5227 For The Crt (Crat Or Crut) Using A Calendar Tax Year.

Determine if the trust is treated as a private foundation and subject to certain excise taxes under chapter 42. Web to file form 5227. Do not enter social security numbers on this form (except on schedule a) as it may be made public.