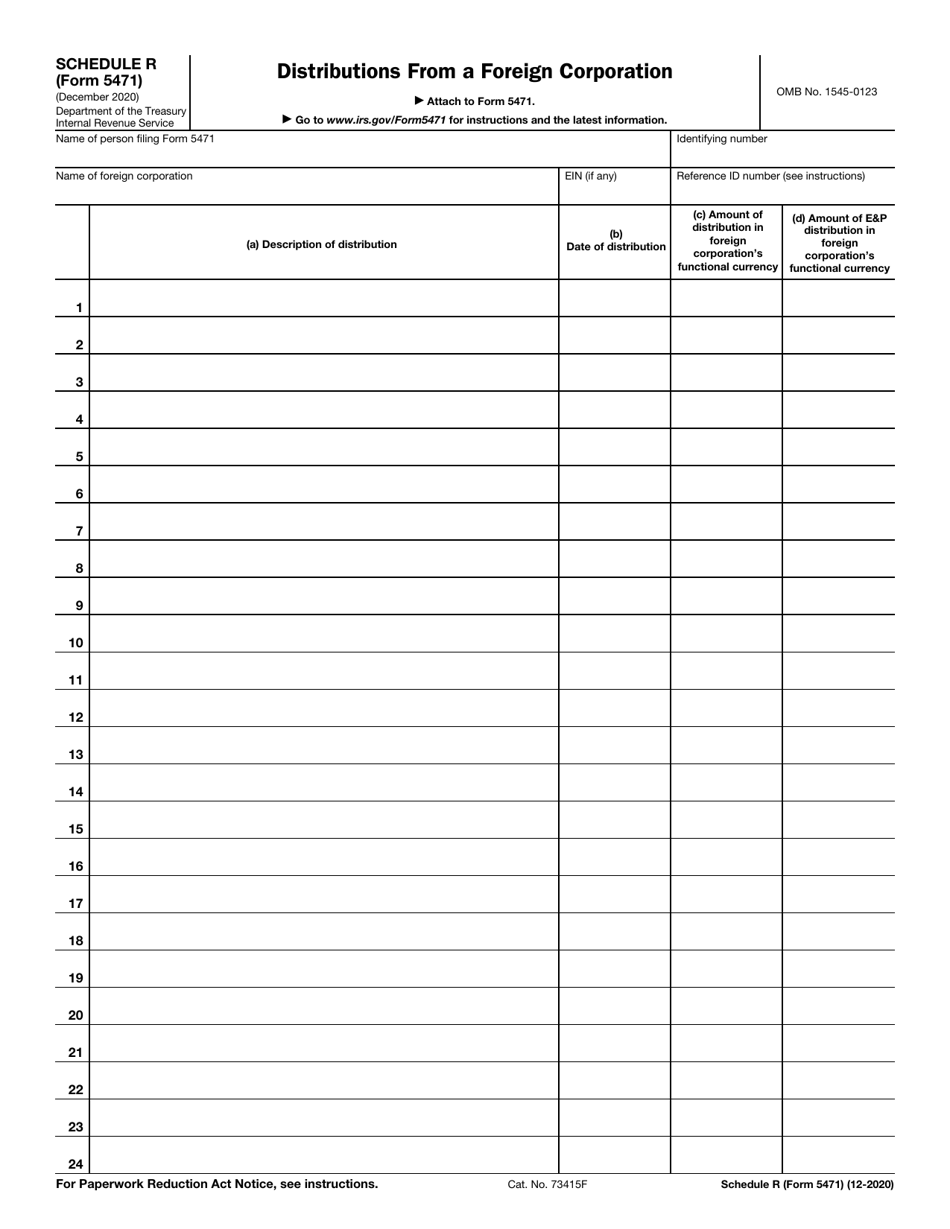

Form 5471 Schedule R

Form 5471 Schedule R - Web form 5471 and schedule j. Form 5471 schedule j applies to category one, four, and five. Follow these steps to check schedule r, part i, boxes 2, 4, 5, 6, or 9: Web use the links below to find more information on how to produce form 5471. Complicated form 5471 filing requirements simplified for dormant foreign corporations. Citizens and residents who are officers, directors, or shareholders in certain foreign corporations. Web this article is designed to provide a basic overview of the internal revenue service (“irs”) form 5471, schedule m. Web i have linked to the form 5471, schedule p and also indicate the activity number (which just so happens to be the name of the cfc.) sill getting the error. Ad get ready for tax season deadlines by completing any required tax forms today. Web conveniently schedule online today with our online scheduler and questionnaire.

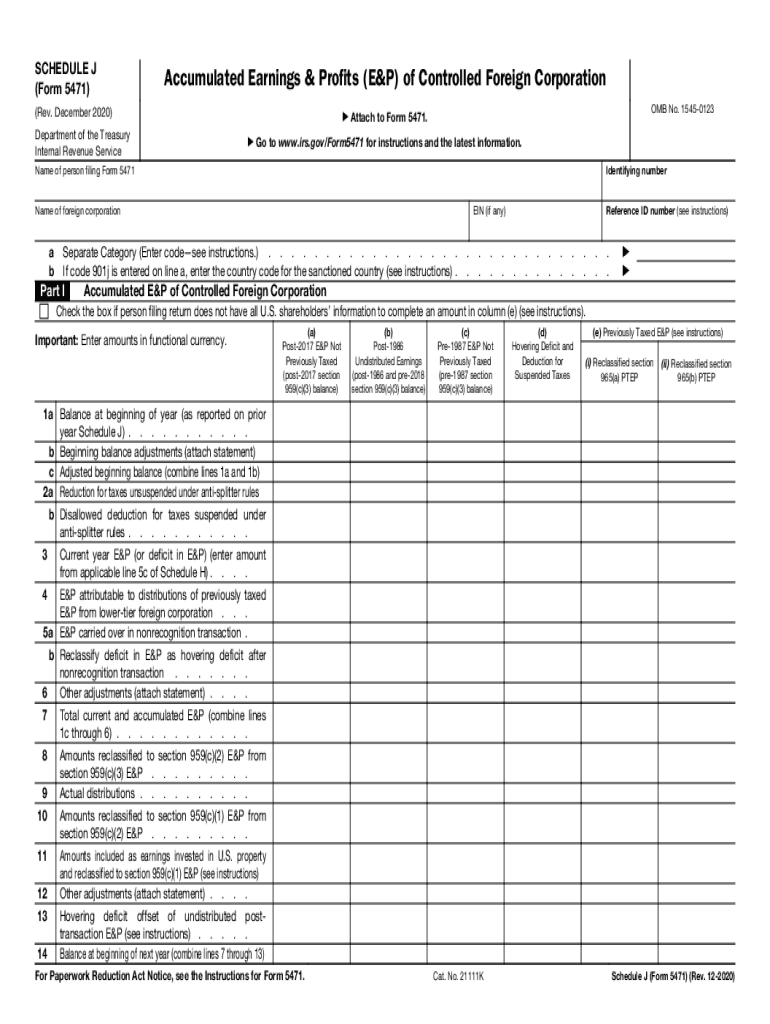

This is because it revolves around accumulated earnings and profits for. Web form 5471 and schedule j. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; According to the instructions for schedule r, the information reported on. The december 2021 revision of separate. Web schedule r (form 5471) (december 2020) department of the treasury internal revenue service. 36 part ii of separate schedule o (form 5471). Try it for free now! 34 schedule b of form 5471. Who must complete schedule m.

Web i have linked to the form 5471, schedule p and also indicate the activity number (which just so happens to be the name of the cfc.) sill getting the error. The december 2021 revision of separate. Citizens and residents who are officers, directors, or shareholders in certain foreign corporations. Web form 5471, information return of u.s. Web schedule r will be used to report basic information pertaining to distributions from foreign corporations. According to the instructions for schedule r, the information reported on. Follow these steps to check schedule r, part i, boxes 2, 4, 5, 6, or 9: Who must complete schedule m. Recent legislation enacted a florida sales and use tax exemption for oral hygiene products. Complicated form 5471 filing requirements simplified for dormant foreign corporations.

IRS Issues Updated New Form 5471 What's New?

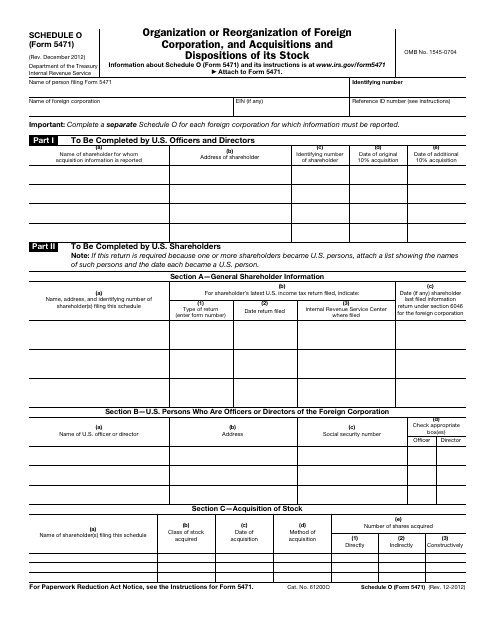

I feel kind of stupid for asking this, but can't seem to think this through properly. 36 part ii of separate schedule o (form 5471). January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Web instructions for form 5471(rev. 37 schedule c and schedule f.

A Brief Introduction to the Brand New Schedule Q and Schedule R for IRS

36 part ii of separate schedule o (form 5471). Recent legislation enacted a florida sales and use tax exemption for oral hygiene products. I'll even send cookies if anyone. Web form 5471, information return of u.s. According to the instructions for schedule r, the.

IRS Form 5471 Schedule R Download Fillable PDF or Fill Online

Who must complete schedule m. Web form 5471 is used by certain u.s. Web instructions for form 5471(rev. Citizens and residents who are officers, directors, or shareholders in certain foreign corporations. Try it for free now!

2018 Form IRS 5471 Fill Online, Printable, Fillable, Blank PDFfiller

Web form 5471 schedule j. All assistance is greatly appreciated. Web this article is designed to provide a basic overview of the internal revenue service (“irs”) form 5471, schedule m. Web changes to separate schedule e (form 5471). This is because it revolves around accumulated earnings and profits for.

A Dive into the New Form 5471 Categories of Filers and the Schedule R

Web this article is designed to provide a basic overview of the internal revenue service (“irs”) form 5471, schedule m. All assistance is greatly appreciated. Web schedule r will be used to report basic information pertaining to distributions from foreign corporations. To complete 5471 page 3. Web form 5471 schedule j.

Form 5471, Page 1 YouTube

To complete 5471 page 3. Web use the links below to find more information on how to produce form 5471. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Web schedule r will be used to report basic information pertaining to distributions from foreign corporations. Follow these steps to check schedule r, part i,.

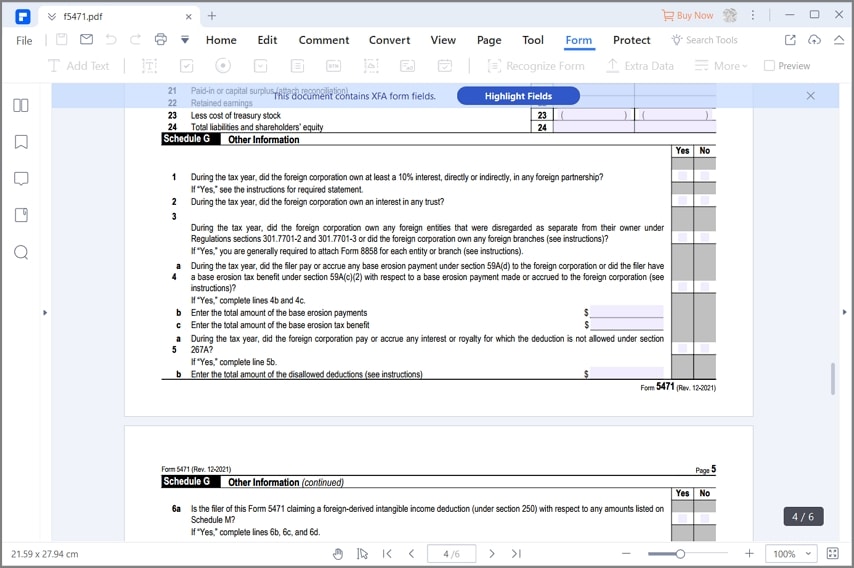

Demystifying the Form 5471 Part 9. Schedule G SF Tax Counsel

Ad get ready for tax season deadlines by completing any required tax forms today. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; 35 schedule e of form 5471. I'll even send cookies if anyone. All assistance is greatly appreciated.

IRS Form 5471 Schedule O Download Fillable PDF or Fill Online

35 schedule e of form 5471. Web conveniently schedule online today with our online scheduler and questionnaire. Persons with respect to certain foreign corporations, is one of the most comprehensive and complex forms required of. All assistance is greatly appreciated. 36 part ii of separate schedule o (form 5471).

How to Fill out IRS Form 5471 (2020 Tax Season)

Web instructions for form 5471(rev. Recent legislation enacted a florida sales and use tax exemption for oral hygiene products. Web conveniently schedule online today with our online scheduler and questionnaire. To complete 5471 page 1 click here. Upload, modify or create forms.

Form 5471 Fill Out and Sign Printable PDF Template signNow

According to the instructions for schedule r, the. Web schedule r (form 5471) (december 2020) department of the treasury internal revenue service. Web changes to separate schedule e (form 5471). 34 schedule b of form 5471. To complete 5471 page 3.

Persons With Respect To Certain Foreign Corporations, Is One Of The Most Comprehensive And Complex Forms Required Of.

Recent legislation enacted a florida sales and use tax exemption for oral hygiene products. Try it for free now! Web form 5471 and schedule j. Distributions from a foreign corporation.

January 2023) (Use With The December 2022 Revision Of Form 5471 And Separate Schedule Q;

Citizens and residents who are officers, directors, or shareholders in certain foreign corporations. 37 schedule c and schedule f. According to the instructions for schedule r, the information reported on. Web schedule r (form 5471) (december 2020) department of the treasury internal revenue service.

Web Form 5471 Schedule J.

Web form 5471 is used by certain u.s. Web schedule r will be used to report basic information pertaining to distributions from foreign corporations. All assistance is greatly appreciated. To complete 5471 page 3.

Web Form 5471, Information Return Of U.s.

Ad get ready for tax season deadlines by completing any required tax forms today. According to the instructions for schedule r, the. 35 schedule e of form 5471. 34 schedule b of form 5471.