Form 5564 Irs

Form 5564 Irs - The form is known as a notice of deficiency. Instructions for form 1040 form w. Web form 5564 notice of deficiency waiver if the irs believes that you owe more tax than what was reported on your tax return, the irs will send a notice of deficiency. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Use the sign tool to create and add your electronic signature to signnow the ir's form 5564 notice of deficiency. If you are making a. Web here at brotman law we can help respond to the internal revenue service notice of deficiency with either an irs audit appeal, petition, 5564 form, 1040x form, and. Web what is irs form 5564? 5564 notice of deficiency waiver free ebay auction templatesvictoria secret coupons 2012 ×10. Web find out how to save, fill in or print irs forms with adobe reader.

Web irs form 5564 explained if the irs sends you a notice of deficiency stating a discrepancy in your tax return that resulted in an underpayment of taxes, the taxpayer can choose to. The form is known as a notice of deficiency. Contact the third party that furnished the. The notice explains how the amount was calculated, what to do if you agree or disagree,. If you agree with the information on your notice,. This may result in an increase or decrease in your tax. Web what is irs form 5564? Web sign the enclosed form 5564 and mail or fax it to the address or fax number listed on the letter. Web if you are making a payment, include it with the form 5564. Along with notice cp3219a, you should receive form 5564.

Contact the third party that furnished the. Individual tax return form 1040 instructions; Along with notice cp3219a, you should receive form 5564. Web find out how to save, fill in or print irs forms with adobe reader. Web what is irs form 5564? If you pay the amount due now, you will reduce the amount of interest and penalties. Web employer's quarterly federal tax return. Irs form 5564 is included when the federal tax agency sends the irs notice cp3219a. If you disagree you have the right to challenge this determination in u.s. Web this letter is your notice of deficiency, as required by law.

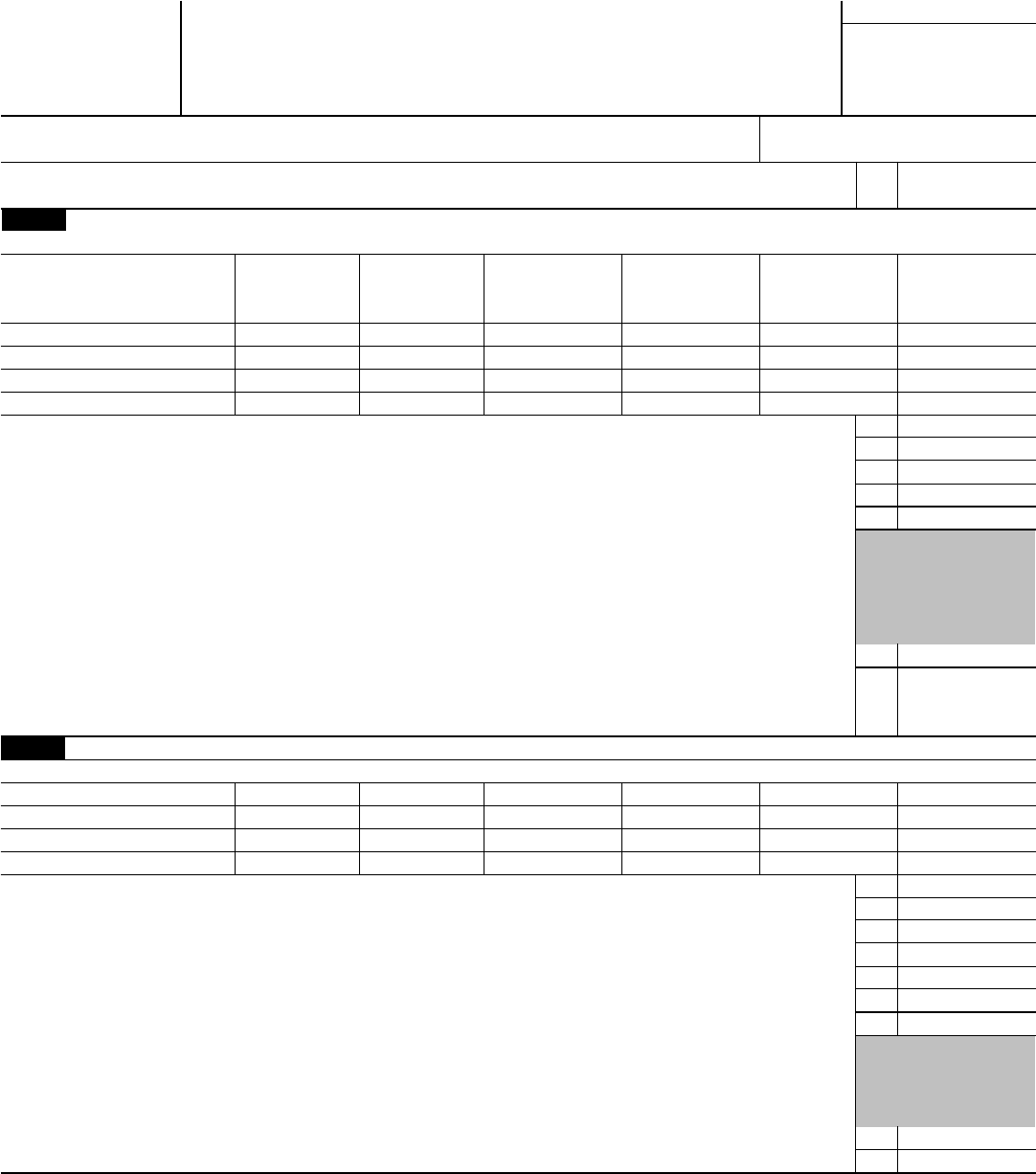

Tax Form 5564 Fill Online, Printable, Fillable, Blank pdfFiller

Department of health and human services centers for medicare & medicaid services form approved omb no. You should determine if you agree with the proposed changes or wish to file a petition with. Web here's the address: Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. Web sign and return form.

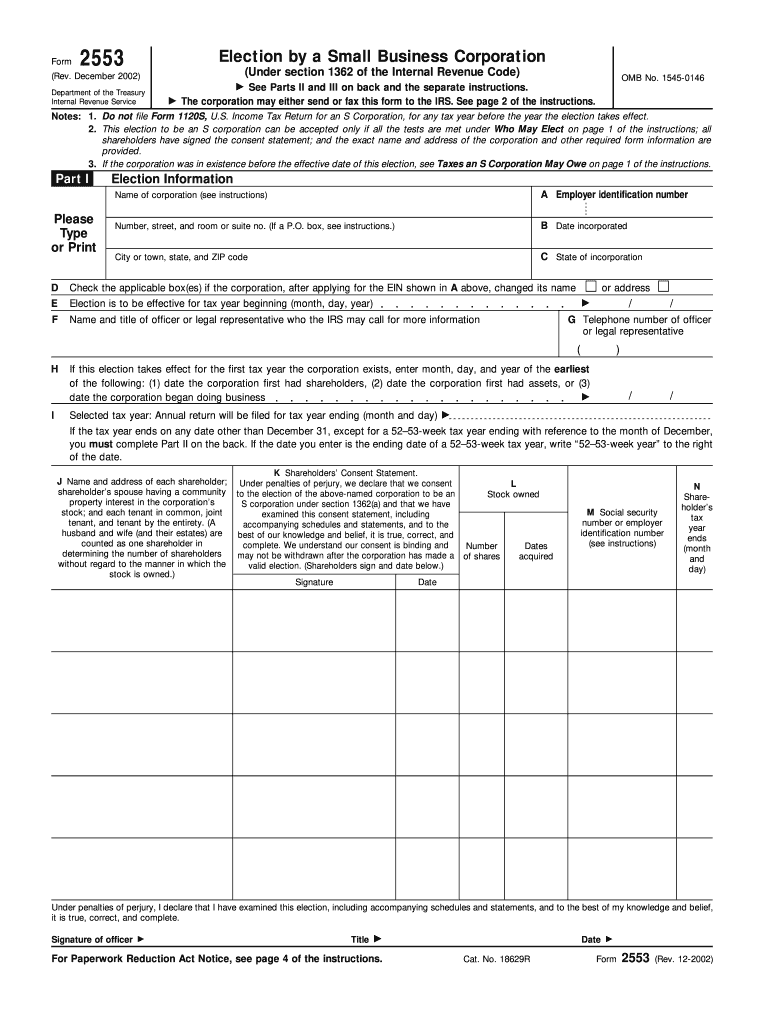

Irs Form 2553 Fill in Fill Out and Sign Printable PDF Template signNow

Web find out how to save, fill in or print irs forms with adobe reader. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay. 5564 notice of deficiency waiver free ebay auction templatesvictoria secret coupons 2012 ×10. Web you should review the complete audit report enclosed with your letter. If you.

4.8.9 Statutory Notices of Deficiency Internal Revenue Service

Web the notice of deficiency waiver is the form you’ll use to notify the irs that you’re in agreement with the extra tax amount proposed. Web what is irs form 5564? The notice explains how the amount was calculated, what to do if you agree or disagree,. Web here at brotman law we can help respond to the internal revenue.

irs form 656 Fill Online, Printable, Fillable Blank

Along with notice cp3219a, you should receive form 5564. The notice explains how the amount was calculated, what to do if you agree or disagree,. Web find out how to save, fill in or print irs forms with adobe reader. Use the sign tool to create and add your electronic signature to signnow the ir's form 5564 notice of deficiency..

Custom Bath Estimate Form Printing

Web irs form 5564 explained if the irs sends you a notice of deficiency stating a discrepancy in your tax return that resulted in an underpayment of taxes, the taxpayer can choose to. Web this letter is your notice of deficiency, as required by law. If you agree with the information on your notice,. Web double check all the fillable.

IRS Audit Letter CP3219A Sample 1

Web up to $40 cash back get the free irs form 5564 pdf. Department of health and human services centers for medicare & medicaid services form approved omb no. Web here's the address: This may result in an increase or decrease in your tax. If you are making a.

4.8.9 Statutory Notices of Deficiency Internal Revenue Service

United states (english) united states (spanish) canada (english) canada (french) tax refund. 5564 notice of deficiency waiver free ebay auction templatesvictoria secret coupons 2012 ×10. Web here's the address: Web up to $40 cash back get the free irs form 5564 pdf. Web sign and return form 5564, certified with a return receipt requested, as soon as possible to limit.

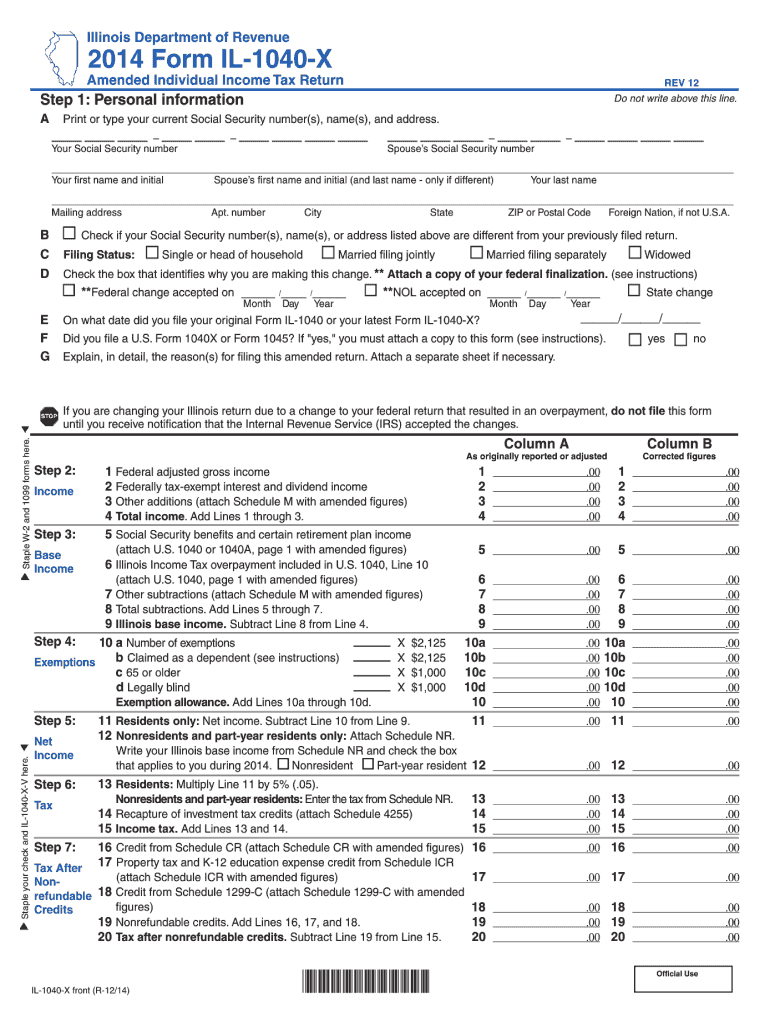

1040X Instructions 2014 Fill Out and Sign Printable PDF Template

Irs form 5564 is included when the federal tax agency sends the irs notice cp3219a. Web here's the address: You should determine if you agree with the proposed changes or wish to file a petition with. Instructions for form 1040 form w. Web sign and return form 5564, certified with a return receipt requested, as soon as possible to limit.

Form 4797 Edit, Fill, Sign Online Handypdf

If you are making a. Web sign the enclosed form 5564 and mail or fax it to the address or fax number listed on the letter. If you disagree you have the right to challenge this determination in u.s. Web up to $40 cash back get the free irs form 5564 pdf. Web you should review the complete audit report.

FIA Historic Database

Web mail or fax form 5564 back to the address on the notice by the deadline along with the new information you feel disputes the notice. If you are making a. You should determine if you agree with the proposed changes or wish to file a petition with. Web if you are making a payment, include it with the form.

The Form Is Known As A Notice Of Deficiency.

Web employer's quarterly federal tax return. Web here at brotman law we can help respond to the internal revenue service notice of deficiency with either an irs audit appeal, petition, 5564 form, 1040x form, and. Web the notice of deficiency waiver is the form you’ll use to notify the irs that you’re in agreement with the extra tax amount proposed. Web sign and return form 5564, certified with a return receipt requested, as soon as possible to limit the amount of interest that accrues on the balance due.

This May Result In An Increase Or Decrease In Your Tax.

Web here's the address: We received information that is different from what you reported on your tax return. Instructions for form 1040 form w. Web mail or fax form 5564 back to the address on the notice by the deadline along with the new information you feel disputes the notice.

Web This Letter Is Your Notice Of Deficiency, As Required By Law.

Get access to thousands of forms. If you disagree you have the right to challenge this determination in u.s. Contact the third party that furnished the. Along with notice cp3219a, you should receive form 5564.

Web Sign The Enclosed Form 5564 And Mail Or Fax It To The Address Or Fax Number Listed On The Letter.

You should determine if you agree with the proposed changes or wish to file a petition with. Web irs form 5564 explained if the irs sends you a notice of deficiency stating a discrepancy in your tax return that resulted in an underpayment of taxes, the taxpayer can choose to. Use the sign tool to create and add your electronic signature to signnow the ir's form 5564 notice of deficiency. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay.